November 20, 2023

Heavy Rare Earths Limited (“HRE” or “the Company”) is pleased to report an addition to its existing rare earth project portfolio of Cowalinya and Merino (WA), and Duke (NT).

- New Perenjori project adds to HRE’s rare earth exploration portfolio in Western Australia’s Mid West region

- 100 per cent-owned project targeted for ion-adsorption type rare earth deposits

- Cursory historic exploration and none for rare earths

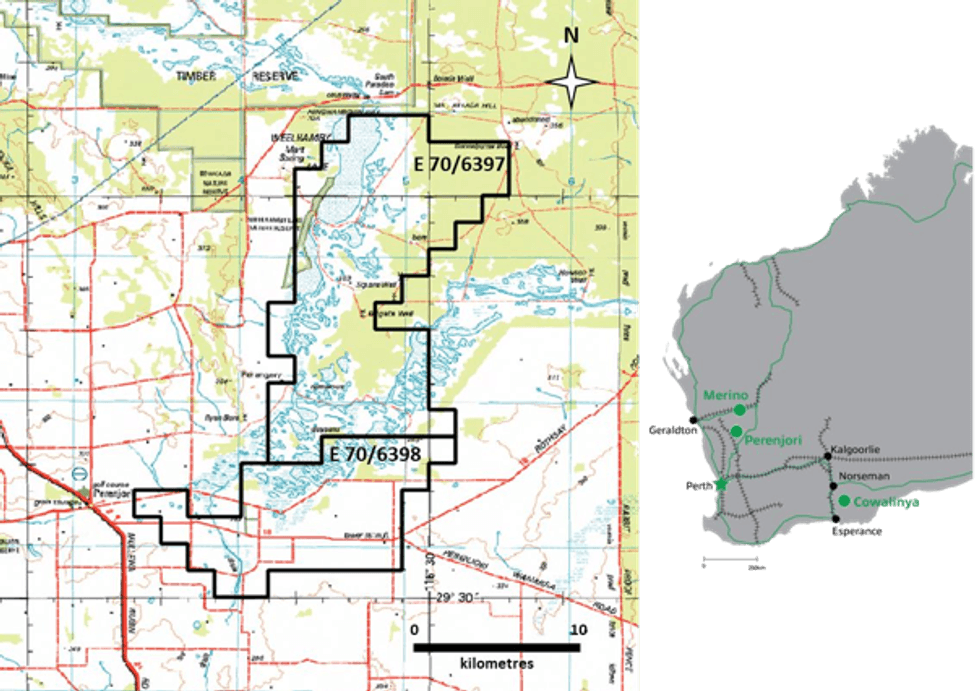

The Company’s 100 per cent-owned Perenjori rare earth project is located in the Mid West region of Western Australia approximately 185 kilometres ESE of the port city of Geraldton (Figure 1). It covers an area of 329 km2 in two adjacent exploration licences E70/6397 and E70/6398 that were recently granted by the Department of Mines, Industry Regulation and Safety. The underlying tenure to the project is (from N to S) unallocated Crown land, general lease (for grazing purposes) and private farm land.

Native Title rights over the region is held by the Yamatji Nation.

The exploration model being investigated by HRE is heavy rare earths (HREE)-enriched ion- adsorption clay-hosted deposits similar to those found in southern China and Myanmar which supply most of the world’s HREEs. The Perenjori and nearby Merino area (refer to ASX announcement 1 September 2023) both ranked very highly in an internal study targeting this style of mineralisation in Western Australia’s palaeochannels.

Geology and Previous Exploration

The geology of the Perenjori area is dominated by Quaternary lacustrine sediments of ephemeral salt lakes (playas) as well as calcrete and laterite. Laterite is associated with sparse outcrops of Archaean granitoids which locally exhibit extreme weathering. Minor outcrops of fresh granitoids range from hornblende and biotite-bearing granite and granodiorite to undifferentiated varieties. Chemical analysis by the Geological Survey of Western Australia shows that granitic intrusions immediately north of the project contain between 363 and 889 ppm TREE (total rare earths). No samples were analysed within HRE’s tenements.

Palaeochannels are inferred to occur beneath most of the project area, but owing to the complete absence of exploration drilling on HRE’s tenements the precise location and depth of these palaeochannels remains uncertain.

Planned Exploration by HRE

The Company has agreed to the terms of the Yamatji Nation Indigenous Land Use Agreement’s Standard Heritage Agreement (SHA) and final execution of the SHA is imminent. This allows the commencement of on-ground exploration at both Perenjori and nearby Merino.

HRE plans to complete a first-pass sweep of the Perenjori project, comprising soil and rock sampling, during Year 1 of exploration. Drilling in Year 2 of the program will be subject to the results of Year 1 activities.

The proposed budget for Years 1 and 2 of exploration on the Perenjori project is summarized in Table 1. The statutory minimum annual expenditure commitment on the project is the same for each year at $109,000.

Click here for the full ASX Release

This article includes content from Heavy Rare Earths, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

HRE:AU

The Conversation (0)

06 September 2022

Heavy Rare Earths

Rare Earth Elements in Western Australia and the Northern Territory

Rare Earth Elements in Western Australia and the Northern Territory Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00