- WORLD EDITIONAustraliaNorth AmericaWorld

June 05, 2022

Anson Resources Limited (“Anson” or “the Company”) is pleased to provide the following update to the development strategy of the Paradox Lithium Project (“the Paradox Project”) in Utah, in the USA.

Highlights:

- Anson confirms plans for a major increase in planned production capacity of its core asset, the Paradox Lithium Project in Utah, USA.

- Project’s Detailed Feasibility Study (“DFS”) to target Stage 1 production capacity of 10,000 tonnes per annum of battery grade lithium carbonate.

- This represents a 275% increase in production capacity from the 2,674tpa published in the Project’s Updated Preliminary Economic Assessment (1 September 2021).

- Anson’s decision to increase lithium production capacity is driven by;

- Anticipated significant JORC resource increase at the Project;

- Growing lithium demand and higher lithium prices; and

- Enhanced lithium recoveries and superior performance of Anson’s 99.95% purity lithium carbonate.

- Bromine production capacity at the Paradox Project is to be added progressively, to align with forecast substantial demand growth for zincbromine batteries (for renewable energy storage) and other bromine derivative products.

- Development of the Paradox Project is progressing rapidly, with the DFS being undertaken by leading engineering company Worley well advanced, and a major Resource expansion program ongoing.

- Battery Grade Lithium Carbonate is currently selling for around US$79,550/t1.

Substantial developments in the lithium market, combined with the unique attributes of the Paradox Project, have allowed Anson to pursue a major expansion of the planned Stage 1 Lithium Carbonate production capacity to 10,000 tonnes per annum.

This represents an increase in planned production capacity of 275% on the 2,674 tonnes per annum target previously reported in the Paradox Project’s Updated Preliminary Economic Assessment (ASX announcement, 1 September 2021).

This strategic expansion will be incorporated into the Paradox Project’s Detailed Feasibility Study (“DFS”), which is being undertaken by global engineering firm, Worley.

This major expansion in planned production capacity is driven by:

- Anticipated JORC Resource upgrade and increase to be delivered from the ongoing Resource Expansion Program, and increased project area (refer ASX announcements 17 January 2022, 2 February 2022, 28 March 2022, 23 May 2022 and 1 June 2022);

- Higher lithium recoveries achieved from Anson’s Direct Lithium Extraction (“DLE”) test work; 91.5% recoveries against previously estimated 80% (refer ASX announcement 13 August 2021);

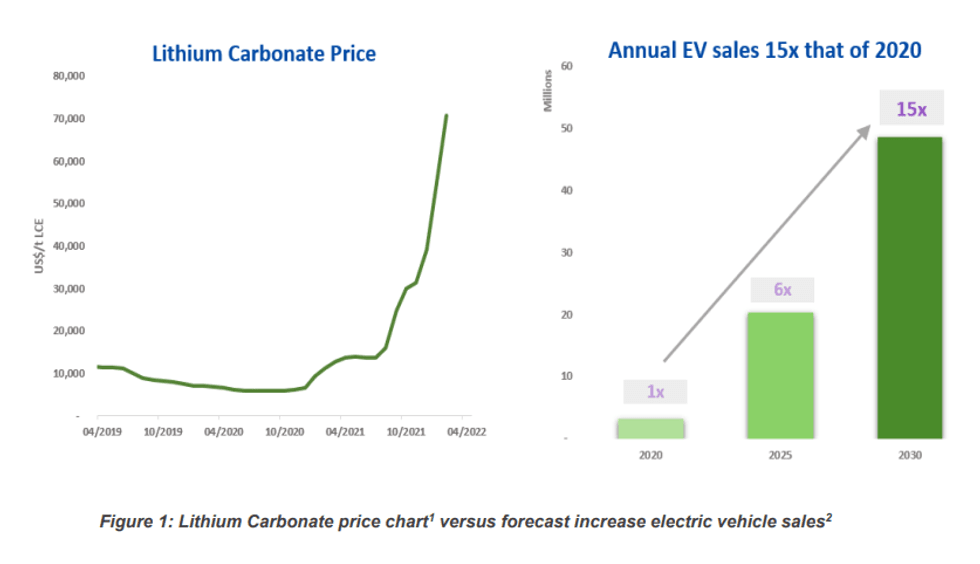

- In excess of 1,000% increase in the Lithium Carbonate price over the past 24 months driven by forecast demand growth, stemming from the global electric vehicle revolution (see Figure 1 below);

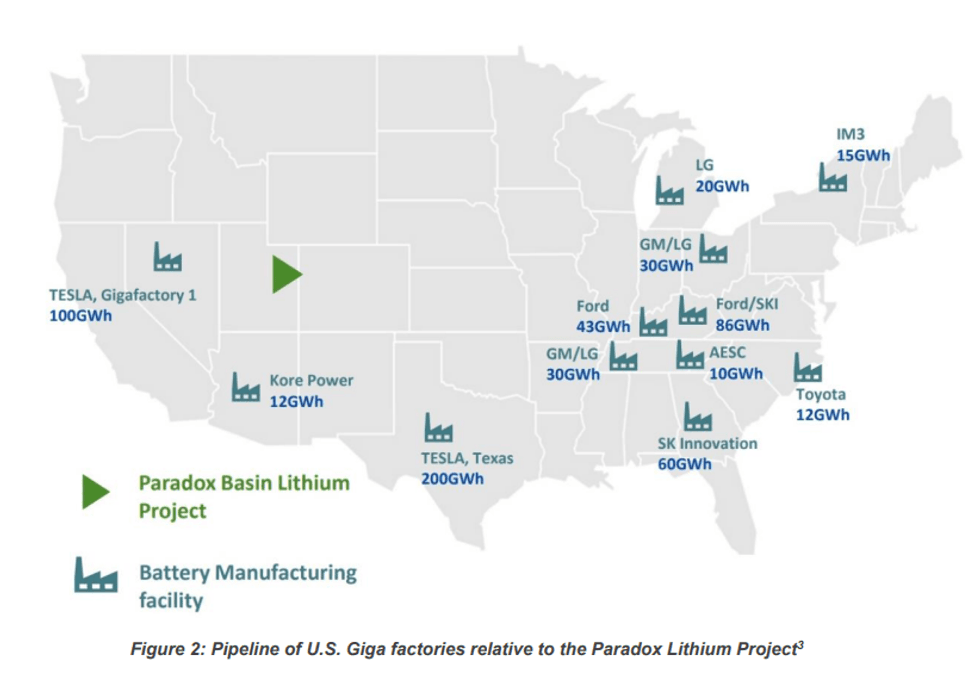

- Rapid expansion in private sector investment in lithium-ion battery manufacturing facilities in the United States (see Figure 2 below) and increased offtake activity for sustainably produced Lithium Carbonate;

- The superior performance of Anson’s 99.95% purity Lithium Carbonate relative to commercially available battery-grade Lithium Carbonate in lithium-ion battery cells, indicating a longer battery lifespan (refer ASX announcement 9 September 2021);

- The designation by the US Government of lithium as a critical mineral, with domestic production being in the national interest; and

- The allocation of approximately US$20 billion in low interest loans by the US Government to support the transition from fossil fuels to an alternative energy economy, including the development of a domestic lithium supply chain.

Click here for the full ASX Release

This article includes content from Anson Resources Limited , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.From Your Site Articles

ASN:AU

The Conversation (0)

08 June 2022

Anson Resources

Developing a Near-Term Clean Energy Project in Utah

Developing a Near-Term Clean Energy Project in Utah Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00