HIGHLIGHTS

- 5,983 m of infill drilling completed (3,704 m of new results) on 10-m drill spacing in 62 drill holes from August 2025, representing ~44% of the total planned 13,000-m infill program

- Highlights include: 8.56 g/t Au over 8.5m from 60.5m depth, 16.95 g/t Au over 4.0m from 80m depth (including 130.32 g/t Au over 0.5m from 83.5m depth), and 9.32 g/t Au over 6.0m from 58m depth

- Results to date continue to be broadly consistent with modelled reserve stopes, indicate potential for upside mineralization in new areas, and provide key spatial controls that will inform an updated local block model and refine future production stope designs

- An aggregate total of 10,000 m (~72%) of total planned drill meters have been completed to date, with full assays and QA/QC pending for the remaining holes not reported

- Infill program on track to wrap up in Q1 2026

Osisko Development Corp. (NYSE: ODV, TSXV: ODV) (" Osisko Development " or the " Company ") is pleased to announce new infill drilling results from its ongoing 13,000-meter program on 10 meter drill spacing that commenced in August 2025 in the Lowhee Zone of the Company's permitted, 100%-owned Cariboo Gold Project (" Cariboo " or the " Project "), located in central British Columbia (" B.C. "), Canada. The six drill hole fans reported herein comprise an additional ~3,704 meters (" m ") of underground infill drilling, bringing the total tally of drilling with full results to 5,983 m, or ~44% of the planned total.

In total, an aggregate of approximately 10,000 meters, representing ~72% of the total planned drill meters, has now been completed. Full assay results and associated quality assurance and quality control reviews are pending for the remaining holes not reported herein.

Chris Lodder, President, stated , "We continue to see good alignment of ongoing infill drilling results with our modelled vein corridors and planned stope shapes, along with occurrences of upside mineralized zones outside current reserve outlines. This tighter drill spacing sharpens our understanding of vein corridor spatial geometries and local variability, while reinforcing the importance of infill drilling in underexplored zones. As this work concludes in the first quarter of 2026, the resulting information is expected to help refine production designs and sequencing."

DRILL ASSAY HIGHLIGHTS

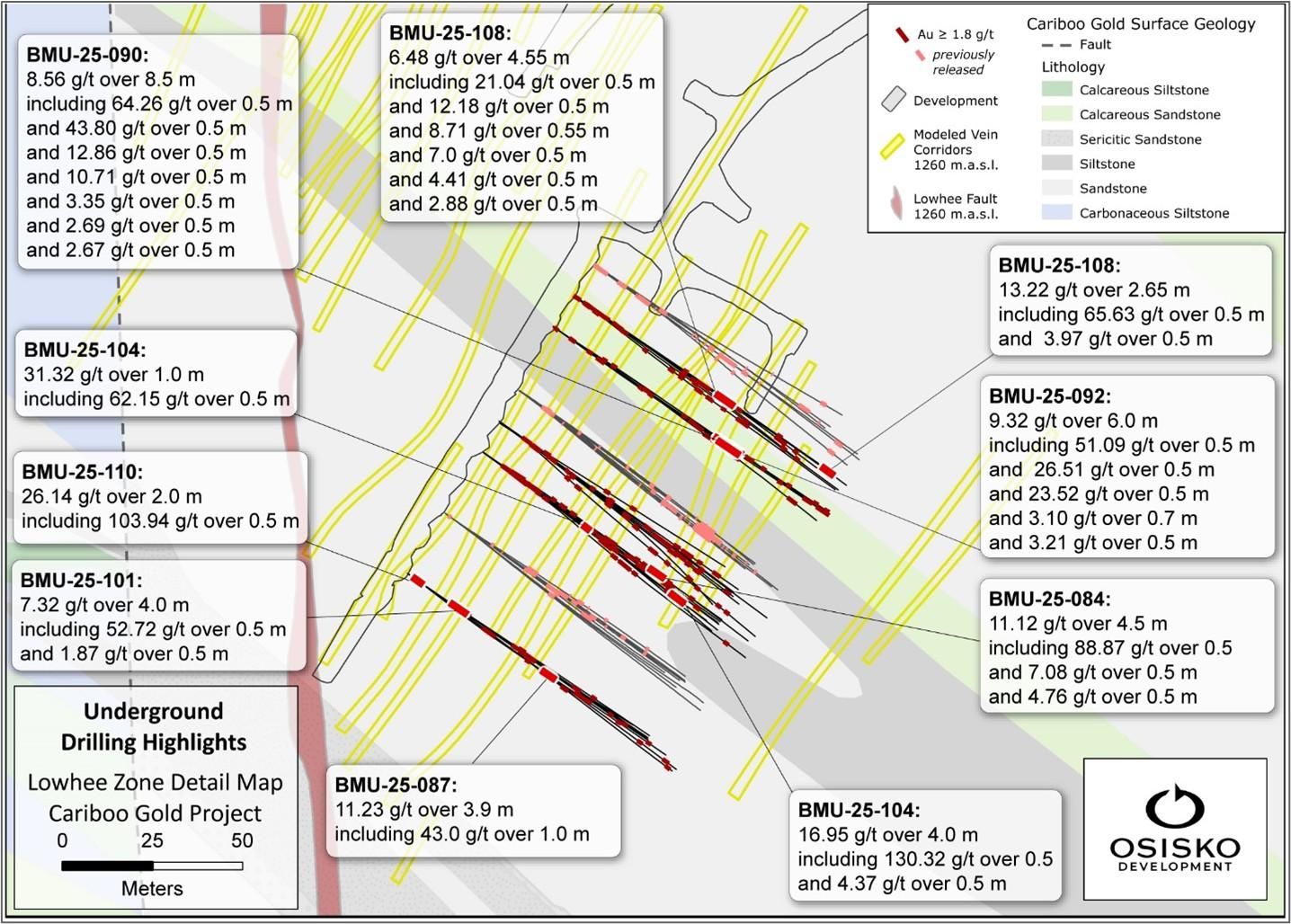

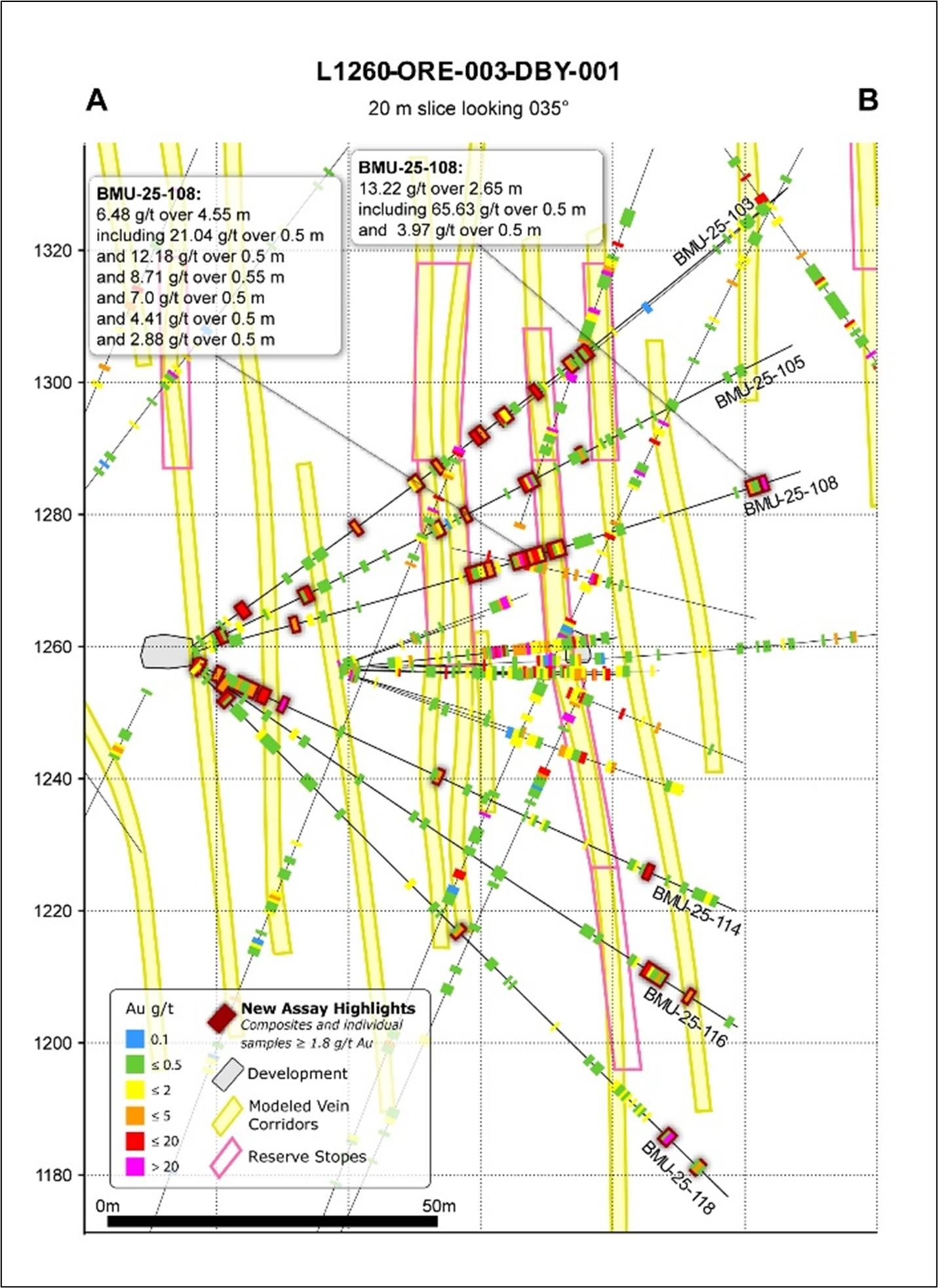

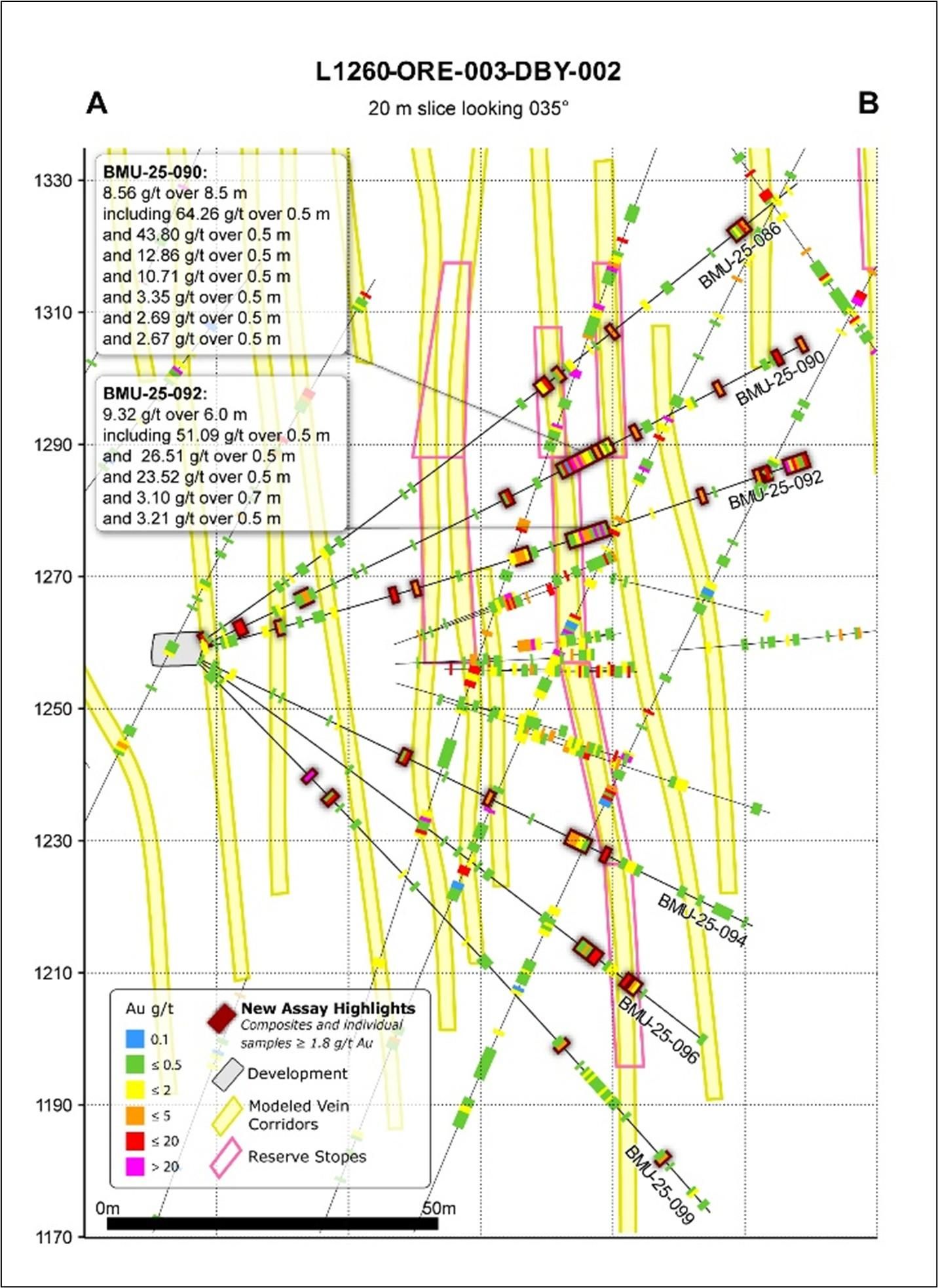

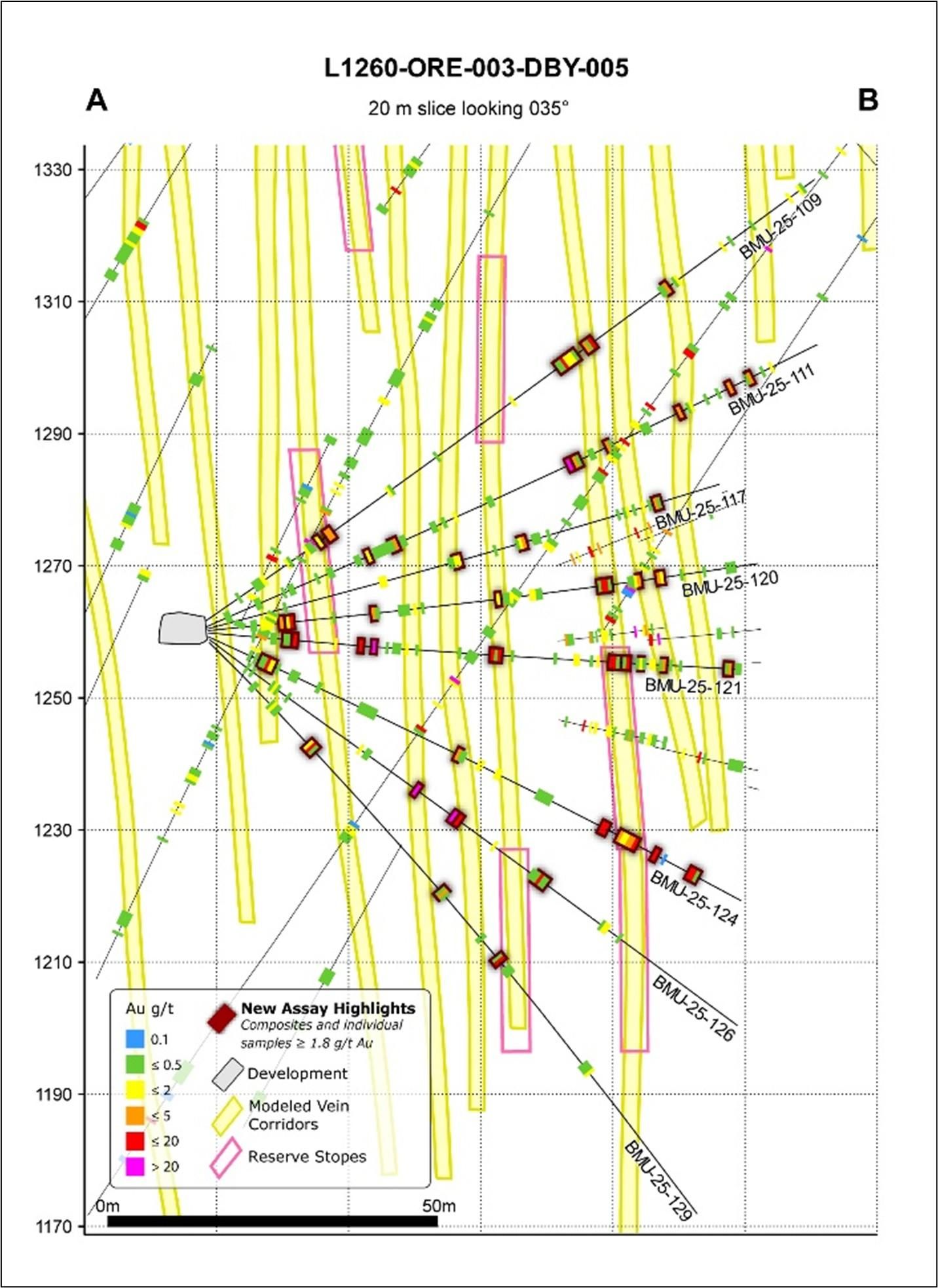

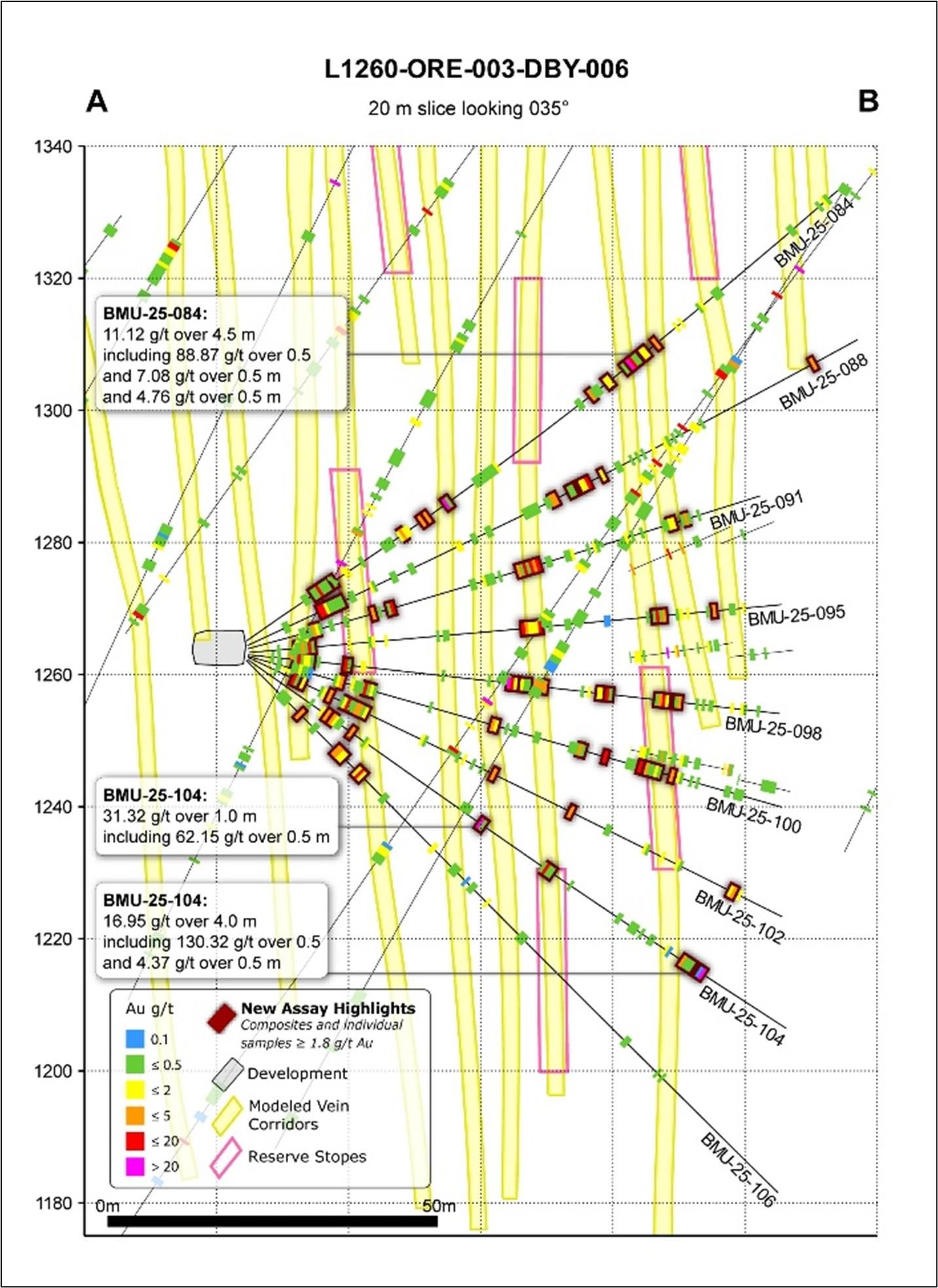

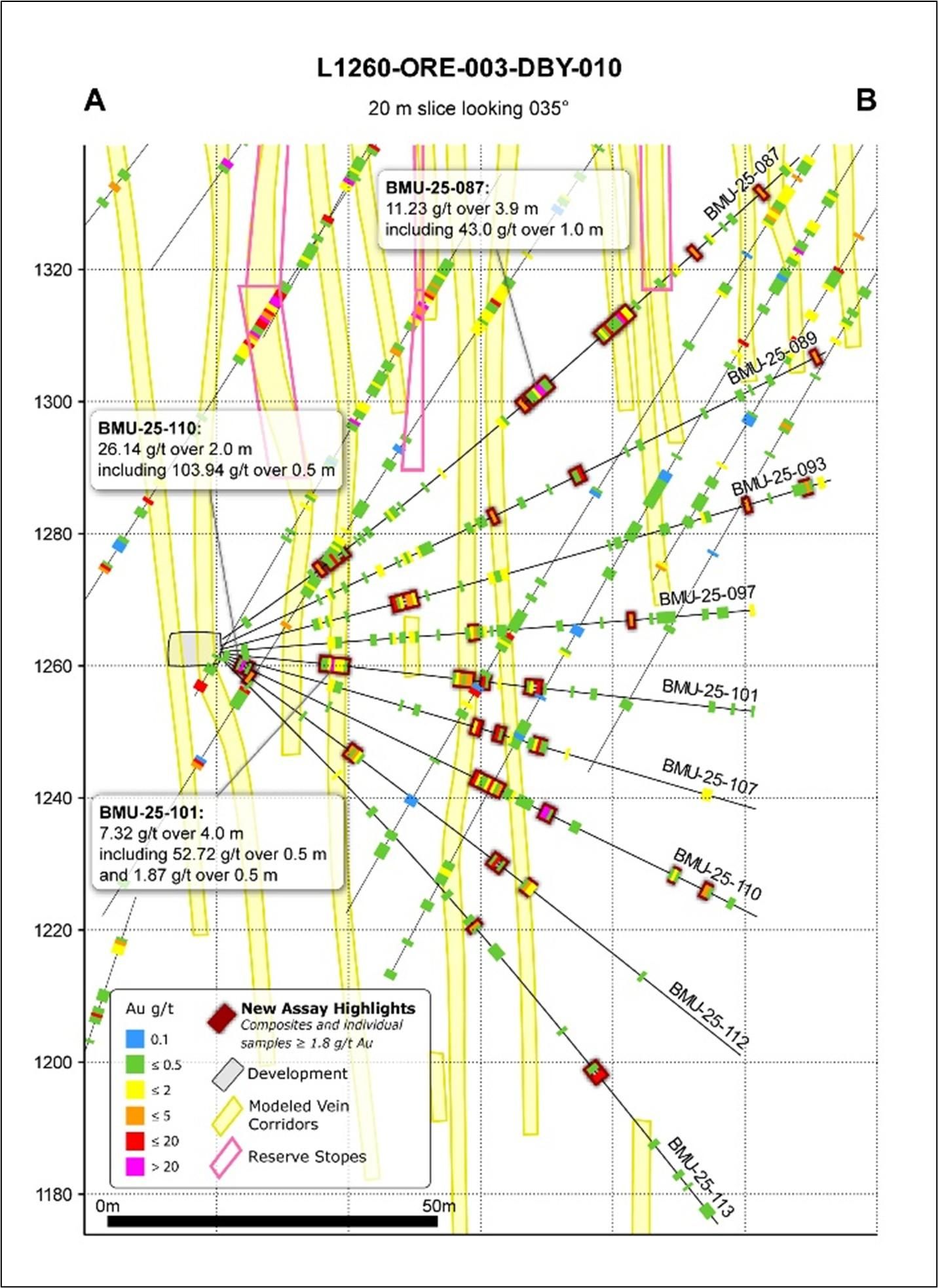

This news release includes assays from thirty-eight (38) underground infill HQ diamond drill (" DD ") holes (63.5-millimeter diameter) totaling ~3,704 m with depths ranging from 81 to 114 m completed between September 2025 and early November 2025 (see Table 1 ). Assays for five (5) complete drill fans were received by November 27, 2025 ( Figure 2 ). Select photon assay highlights include:

- 8.56 grams per tonne ("g/t") gold ("Au") over 8.5 m from 60.5 m depth in hole BMU-25-090, including:

- 64.26 g/t over 0.5 m from 63.5 m depth, and

- 43.80 g/t over 0.5 m from 62.5 m depth, and

- 12.86 g/t over 0.5 m from 62 m depth, and

- 10.71 g/t over 0.5 m from 61 m depth, and

- 3.35 g/t over 0.5 m from 66.5 m depth, and

- 2.69 g/t over 0.5 m from 63 m depth, and

- 2.67 g/t over 0.5 m from 64 m depth

- 16.95 g/t over 4.0 m from 80 m depth in BMU-25-104, including:

- 130.32 g/t over 0.5 m from 83.5 m depth, and

- 4.37 g/t over 0.5 m from 80 m depth

- 9.32 g/t over 6.0 m from 58 m depth in BMU-25-092, including:

- 51.09 g/t over 0.5 m from 63 m depth, and

- 26.51 g/t over 0.5 m from 62 m depth, and

- 23.52 g/t over 0.5 m from 59.7 m depth, and

- 3.10 g/t over 0.7 m from 60.2 m depth, and

- 3.21 g/t over 0.5 m from 60.9 m depth

- 13.22 g/t over 2.65 m from 87.85 m depth in BMU-25-108, including:

- 65.63 g/t over 0.5 m from 90 m depth, and

- 3.97 g/t over 0.5 m from 87.85 m depth

- 26.14 g/t over 2.0 m from 2.5 m depth in BMU-25-110, including:

- 103.94 g/t over 0.5 m from 3 m depth

- 11.12 g/t over 4.5 m from 70.5 m depth in BMU-25-084, including:

- 88.87 g/t over 0.5 m from 71.5 m depth, and

- 7.08 g/t over 0.5 m from 72 m depth, and

- 4.76 g/t over 0.5 m from 76.5 m depth

- 11.23 g/t over 3.9 m from 59.1 m depth in BMU-25-087, including:

- 43.0 g/t over 1.0 m from 60.8 m depth

- 7.32 g/t over 4.0 m from 15 m depth in BMU-25-101, including:

- 57.72 g/t over 0.5 m from 16.5 m depth, and

- 1.87 g/t over 0.5 m from 17.5 m depth

- 31.32 g/t over 1.0 m from 42.9 m depth in BMU-25-104, including:

- 62.15 g/t over 0.5 m from 42.9 m depth

- 6.48 g/t over 4.55 m from 50.45 m depth in BMU-25-108, including:

- 21.04 g/t over 0.5 m from 51.45 m depth, and

- 12.18 g/t over 0.5 m from 51.95 m depth, and

- 8.71 g/t over 0.55 m from 53.45 m depth, and

- 7.0 g/t over 0.5 m from 54 m depth, and

- 4.41 g/t over 0.5 m from 50.95 m depth, and

- 2.88 g/t over 0.5 m from 52.95 m depth

Complete assay highlights, including true width estimates, are presented in Table 1 and drill hole locations and orientations are listed in Table 2. Intervals not recovered by drilling were assigned zero grade. Top cuts have not been applied to high grade assays.

DISCUSSION OF RESULTS

- Based on the results observed to date, there is a positive correlation between the above cut-off assay composites and the modelled reserve stopes. Individual intercepts are not expected to align precisely with the modelled areas, and a degree of variability within the vein corridors is both anticipated and acceptable as tighter spaced infill drilling informs a refinement of the local reserve model. This work is one of the key objectives of the ongoing program.

- Occurrences of above cut-off assay are also being observed in areas not previously included in the reserve model, suggesting potential for upside mineralization. These intervals will be incorporated in the planned remodelling and mineral resource calculation process to determine their implications on the updated local block model and any potential adjustments to planned reserve stopes. In certain areas, this may support the addition of new planned reserve stopes, subject to the final estimation process outcome.

- A spatial offset of certain intercepts when compared to the modelled vein corridors and mineral reserve stope shapes is evident in the cross sections. This reflects, in part, the lower spatial accuracy of the surface-based drill hole data compared to underground drilling, which carries higher survey precision, as well as the more oblique angles of intercepts that the surface-based drill holes have with the vein planes. These factors will be accounted for in the vein corridor remodelling process to be undertaken upon conclusion of this program, and will serve as an important operational template for future infill drilling used in production stope design.

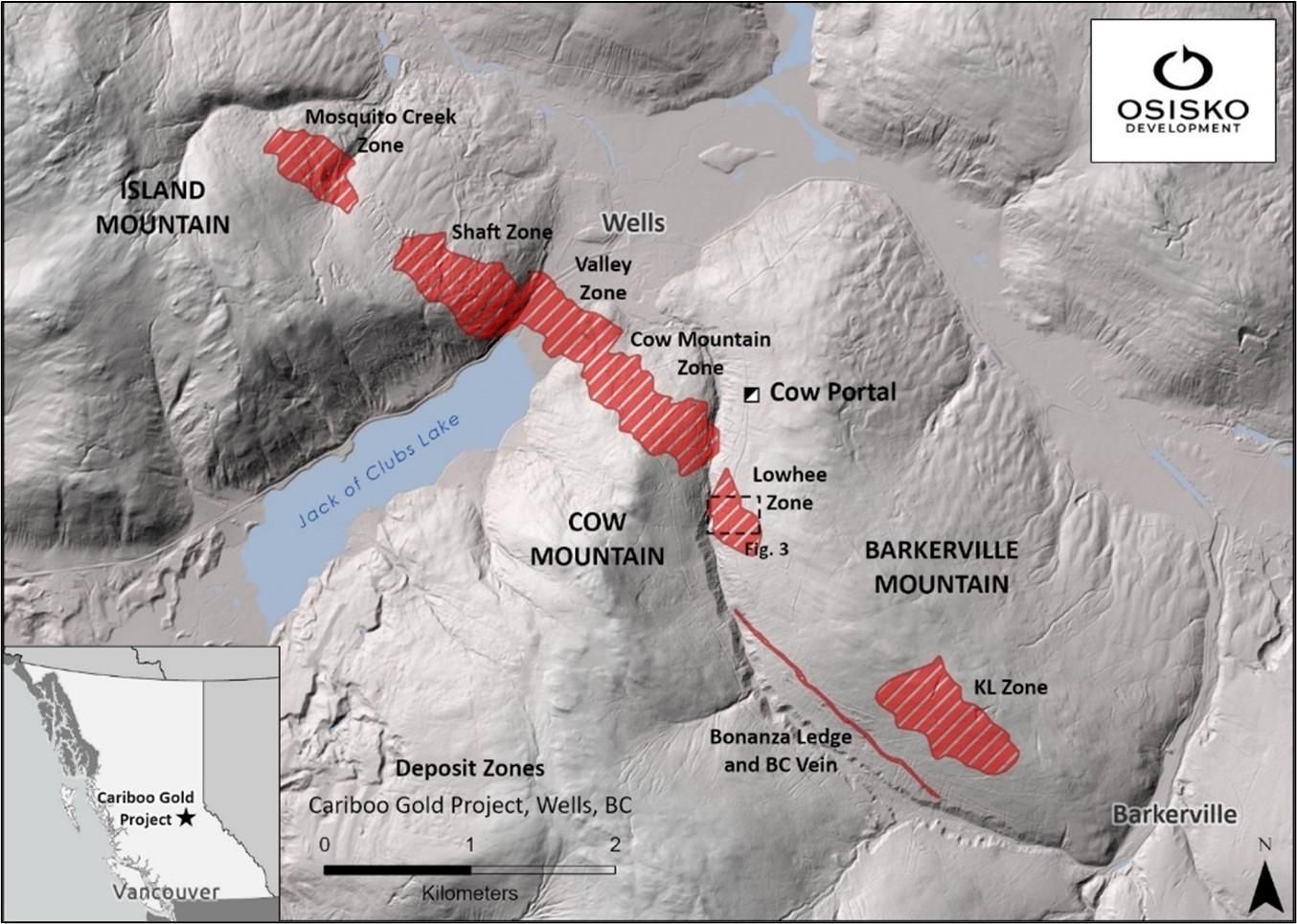

Figure 1: Cariboo Gold Project deposit map with Location of Lowhee Zone and Cow Portal underground access.

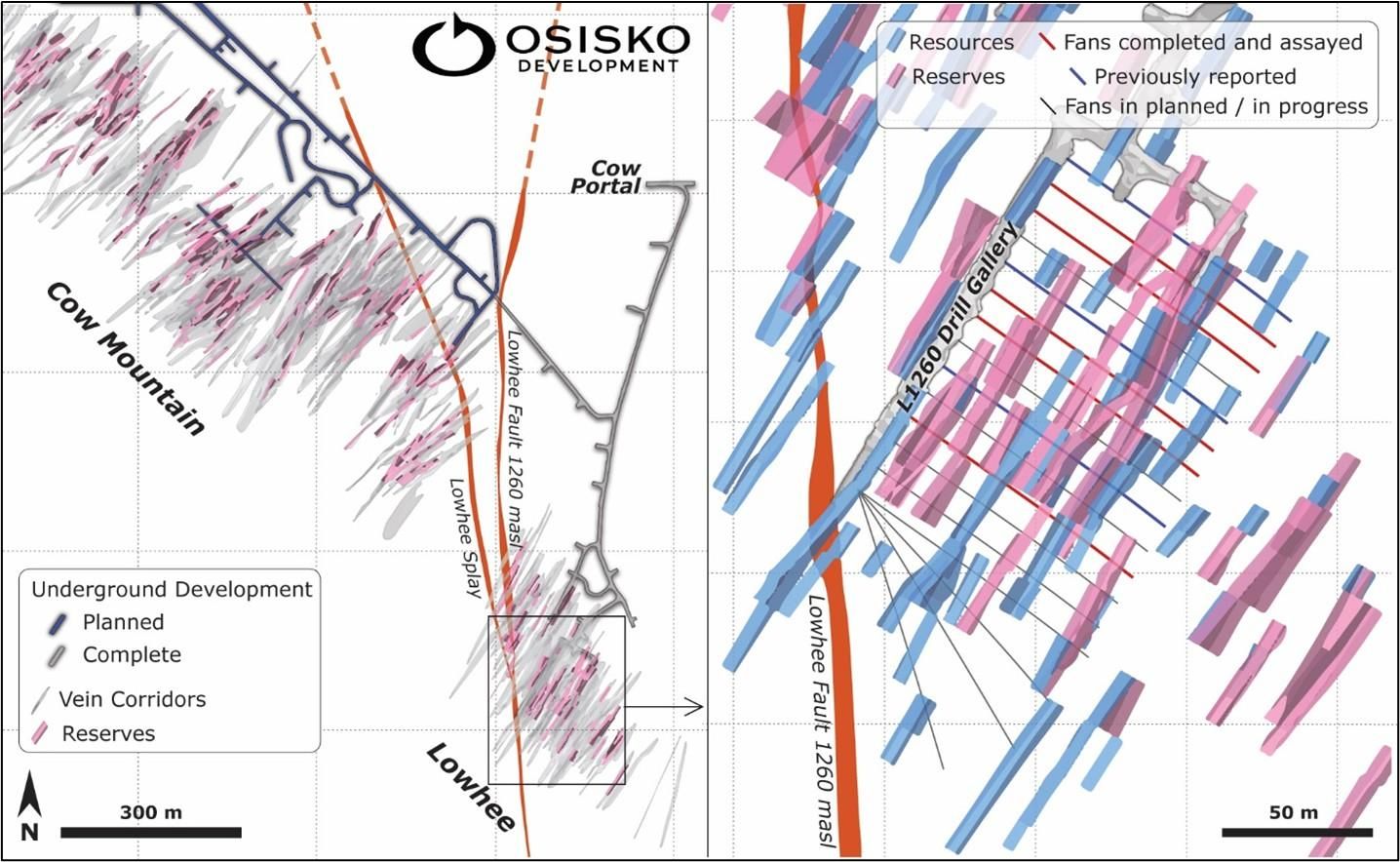

Figure 2: Location and overview of the ongoing 13,000-meter infill drilling campaign.

Figure 3: Lowhee Zone infill select underground drilling highlights (plan view).

Figure 4: Lowhee Zone infill select underground drill assay highlights (this release) with previously released surface and underground diamond drilling results in cross section by fan.

Table 1: Length weighted assay composites and individual samples>=1.8 g/t for Lowhee Zone underground DD.

| Drillhole ID | From (m) | To (m) | Length (m) | Au (g/t) | Est. True Width (m) | |

| BMU-25-084 | 12.25 | 16.25 | 4 | 2.28 | 2.83 | |

| Including | 13.25 | 13.75 | 0.5 | 16.62 | ||

| 28.5 | 29 | 0.5 | 2.20 | 0.36 | ||

| 32 | 32.5 | 0.5 | 2.23 | 0.41 | ||

| 33 | 33.5 | 0.5 | 2.80 | 0.43 | ||

| 36.5 | 37.5 | 1 | 13.52 | 0.71 | ||

| Including | 36.5 | 37 | 0.5 | 26.84 | ||

| 64 | 64.5 | 0.5 | 2.27 | 0.35 | ||

| 67 | 68 | 1 | 1.92 | 0.82 | ||

| 70.5 | 75 | 4.5 | 11.12 | 4.08 | ||

| Including | 71.5 | 72 | 0.5 | 88.87 | 0.45 | |

| and | 72 | 72.5 | 0.5 | 7.08 | ||

| 76.5 | 77 | 0.5 | 4.76 | 0.32 | ||

| BMU-25-086 | 0.4 | 0.9 | 0.5 | 5.40 | 0.49 | |

| 64 | 65.6 | 1.6 | 3.11 | 1.18 | ||

| Including | 65 | 65.6 | 0.6 | 5.63 | ||

| 67.5 | 68 | 0.5 | 3.44 | 0.45 | ||

| 77.8 | 78.3 | 0.5 | 4.79 | 0.37 | ||

| 101.5 | 104 | 2.5 | 2.03 | 1.77 | ||

| Including | 103 | 103.5 | 0.5 | 5.71 | ||

| and | 103.5 | 104 | 0.5 | 2.40 | ||

| BMU-25-087 | 18 | 18.5 | 0.5 | 3.76 | 0.41 | |

| 19.6 | 23 | 3.4 | 2.26 | 2.79 | ||

| Including | 20.6 | 21.1 | 0.5 | 14.50 | ||

| 57.5 | 58.1 | 0.6 | 2.68 | 0.34 | ||

| 59.1 | 63 | 3.9 | 11.23 | 2.76 | ||

| Including | 60.8 | 61.8 | 1 | 43.00 | 0.82 | |

| 73.3 | 79.3 | 6 | 4.56 | 5.25 | ||

| Including | 74.8 | 75.3 | 0.5 | 6.90 | 0.32 | |

| and | 77.3 | 77.8 | 0.5 | 28.19 | 0.50 | |

| and | 77.8 | 78.3 | 0.5 | 15.00 | 0.40 | |

| 92.3 | 92.8 | 0.5 | 3.76 | 0.40 | ||

| 105.9 | 106.4 | 0.5 | 3.72 | 0.41 | ||

| BMU-25-088 | 12 | 16 | 4 | 3.60 | 3.76 | |

| Including | 12 | 12.5 | 0.5 | 12.85 | 0.43 | |

| and | 12.5 | 13 | 0.5 | 13.14 | 0.49 | |

| 51 | 52 | 1 | 2.34 | 0.91 | ||

| Including | 51 | 51.5 | 0.5 | 2.40 | 0.45 | |

| and | 51.5 | 52 | 0.5 | 2.27 | 0.45 | |

| 54 | 57.5 | 3.5 | 2.84 | 3.17 | ||

| Including | 57 | 57.5 | 0.5 | 17.00 | ||

| 59.5 | 60 | 0.5 | 1.86 | 0.43 | ||

| 95.6 | 96.1 | 0.5 | 4.58 | 0.49 | ||

| BMU-25-089 | 45.5 | 46 | 0.5 | 2.56 | 0.43 | |

| 59.3 | 60.7 | 1.4 | 5.64 | 1.25 | ||

| Including | 60.2 | 60.7 | 0.5 | 15.58 | 0.43 | |

| 100 | 100.5 | 0.5 | 4.20 | 0.49 | ||

| BMU-25-090 | 6 | 7 | 1 | 13.34 | 0.71 | |

| 16.3 | 18 | 1.7 | 1.98 | 1.54 | ||

| Including | 17 | 18 | 1 | 3.13 | ||

| 50.9 | 51.9 | 1 | 3.09 | 0.79 | ||

| Including | 51.4 | 51.9 | 0.5 | 5.98 | ||

| 60.5 | 69 | 8.5 | 8.56 | 7.51 | ||

| Including | 61 | 61.5 | 0.5 | 10.71 | 0.41 | |

| and | 62 | 62.5 | 0.5 | 12.86 | ||

| and | 62.5 | 63 | 0.5 | 43.80 | 0.45 | |

| and | 63 | 63.5 | 0.5 | 2.69 | 0.45 | |

| and | 63.5 | 64 | 0.5 | 64.26 | 0.43 | |

| and | 64 | 64.5 | 0.5 | 2.67 | ||

| and | 66.5 | 67 | 0.5 | 3.35 | 0.45 | |

| 73 | 73.5 | 0.5 | 2.38 | 0.38 | ||

| 87.25 | 87.75 | 0.5 | 2.29 | 0.41 | ||

| 97.35 | 97.85 | 0.5 | 8.30 | 0.41 | ||

| 101.5 | 102 | 0.5 | 2.74 | 0.45 | ||

| BMU-25-091 | 10.15 | 11.15 | 1 | 1.93 | 0.50 | |

| Including | 10.15 | 10.65 | 0.5 | 2.76 | ||

| 19.5 | 20 | 0.5 | 2.18 | 0.49 | ||

| 22 | 23 | 1 | 3.85 | 0.97 | ||

| Including | 22.5 | 23 | 0.5 | 7.29 | ||

| 42.5 | 46 | 3.5 | 4.93 | 3.17 | ||

| Including | 42.5 | 43 | 0.5 | 2.53 | 0.43 | |

| and | 43.5 | 44 | 0.5 | 8.03 | 0.49 | |

| and | 44.5 | 45 | 0.5 | 13.94 | 0.43 | |

| and | 45 | 45.5 | 0.5 | 2.36 | ||

| and | 45.5 | 46 | 0.5 | 6.95 | ||

| 66.5 | 67.5 | 1 | 1.82 | 0.64 | ||

| 69 | 69.5 | 0.5 | 2.66 | 0.45 | ||

| BMU-25-092 | 11.95 | 12.45 | 0.5 | 3.46 | 0.48 | |

| 30 | 30.5 | 0.5 | 6.15 | 0.47 | ||

| 33.5 | 34 | 0.5 | 2.51 | 0.48 | ||

| 49.5 | 51.5 | 2 | 1.99 | 1.88 | ||

| Including | 49.5 | 50.5 | 1 | 2.33 | 0.97 | |

| and | 50.5 | 51 | 0.5 | 2.01 | 0.48 | |

| 58 | 64 | 6 | 9.32 | 5.64 | ||

| Including | 59.7 | 60.2 | 0.5 | 23.52 | ||

| and | 60.2 | 60.9 | 0.7 | 3.10 | 0.63 | |

| and | 60.9 | 61.4 | 0.5 | 3.21 | ||

| and | 62 | 62.5 | 0.5 | 26.51 | ||

| and | 63 | 63.5 | 0.5 | 51.09 | ||

| 79 | 79.5 | 0.5 | 4.80 | 0.35 | ||

| 88 | 90 | 2 | 3.31 | 1.93 | ||

| Including | 88 | 88.5 | 0.5 | 2.40 | ||

| and | 89.5 | 90 | 0.5 | 10.82 | 0.48 | |

| 92.75 | 96 | 3.25 | 7.91 | 3.09 | ||

| Including | 92.75 | 93.25 | 0.5 | 20.81 | 0.48 | |

| and | 93.25 | 93.75 | 0.5 | 1.83 | 0.45 | |

| and | 93.75 | 94.25 | 0.5 | 6.20 | 0.43 | |

| and | 94.25 | 94.75 | 0.5 | 3.39 | 0.49 | |

| and | 95.5 | 96 | 0.5 | 18.58 | 0.49 | |

| BMU-25-093 | 27.15 | 30.65 | 3.5 | 2.29 | 3.45 | |

| Including | 27.15 | 27.65 | 0.5 | 7.31 | 0.49 | |

| and | 29.15 | 30.15 | 1 | 3.45 | 0.98 | |

| 82.5 | 83 | 0.5 | 2.08 | 0.47 | ||

| 91.6 | 92.6 | 1 | 2.53 | 0.94 | ||

| Including | 92.1 | 92.6 | 0.5 | 4.65 | ||

| BMU-25-094 | 33.9 | 34.9 | 1 | 3.23 | 0.83 | |

| Including | 34.4 | 34.9 | 0.5 | 6.28 | 0.45 | |

| 48.4 | 48.9 | 0.5 | 4.60 | 0.47 | ||

| 62.1 | 65.25 | 3.15 | 2.29 | 2.94 | ||

| Including | 62.1 | 62.6 | 0.5 | 4.90 | 0.48 | |

| and | 62.6 | 63.1 | 0.5 | 2.38 | 0.45 | |

| and | 63.1 | 63.6 | 0.5 | 3.62 | 0.43 | |

| and | 63.6 | 64.5 | 0.9 | 1.86 | 0.87 | |

| 68 | 68.5 | 0.5 | 17.63 | 0.48 | ||

| BMU-25-095 | 7 | 10 | 3 | 1.83 | 2.90 | |

| Including | 8 | 8.5 | 0.5 | 3.11 | 0.48 | |

| and | 9 | 9.5 | 0.5 | 7.18 | 0.47 | |

| 41.5 | 44.5 | 3 | 3.51 | 2.92 | ||

| Including | 41.5 | 42 | 0.5 | 9.54 | 0.49 | |

| and | 42 | 42.5 | 0.5 | 2.80 | 0.49 | |

| and | 44 | 44.5 | 0.5 | 6.39 | 0.47 | |

| 61.4 | 63.4 | 2 | 2.39 | 1.95 | ||

| Including | 61.9 | 62.4 | 0.5 | 6.26 | 0.50 | |

| and | 62.9 | 63.4 | 0.5 | 2.63 | 0.47 | |

| 70.5 | 71 | 0.5 | 2.19 | 0.50 | ||

| BMU-25-096 | 72 | 75.5 | 3.5 | 3.89 | 3.29 | |

| Including | 73 | 73.5 | 0.5 | 3.49 | 0.47 | |

| and | 74.5 | 75 | 0.5 | 14.78 | 0.47 | |

| and | 75 | 75.5 | 0.5 | 8.14 | ||

| 80.75 | 83 | 2.25 | 3.93 | 1.87 | ||

| Including | 80.75 | 81.25 | 0.5 | 14.54 | 0.33 | |

| and | 82 | 82.5 | 0.5 | 2.12 | 0.47 | |

| BMU-25-097 | 37.8 | 38.8 | 1 | 2.50 | 0.94 | |

| Including | 38.3 | 38.8 | 0.5 | 4.49 | 0.47 | |

| 62 | 62.5 | 0.5 | 3.72 | 0.48 | ||

| BMU-25-098 | 7 | 10 | 3 | 2.76 | 2.72 | |

| Including | 7.5 | 8 | 0.5 | 14.84 | 0.47 | |

| 14.65 | 15.65 | 1 | 3.65 | 0.94 | ||

| Including | 14.65 | 15.15 | 0.5 | 7.05 | 0.47 | |

| 39.5 | 43 | 3.5 | 6.28 | 3.23 | ||

| Including | 39.5 | 40 | 0.5 | 30.60 | 0.46 | |

| and | 40 | 40.5 | 0.5 | 11.88 | 0.45 | |

| 45 | 45.5 | 0.5 | 3.85 | 0.48 | ||

| 53.2 | 55.5 | 2.3 | 2.78 | 1.63 | ||

| Including | 54.5 | 55 | 0.5 | 11.64 | 0.41 | |

| 62.05 | 66 | 3.95 | 2.27 | 3.71 | ||

| Including | 62.55 | 63.1 | 0.55 | 4.33 | 0.52 | |

| and | 63.1 | 63.6 | 0.5 | 8.03 | ||

| and | 65.5 | 66 | 0.5 | 4.16 | 0.47 | |

| BMU-25-099 | 24.1 | 24.6 | 0.5 | 23.97 | 0.45 | |

| 28.4 | 29.4 | 1 | 5.13 | 0.71 | ||

| Including | 28.9 | 29.4 | 0.5 | 10.10 | 0.35 | |

| 80 | 80.5 | 0.5 | 2.33 | 0.43 | ||

| 103 | 103.5 | 0.5 | 2.17 | 0.35 | ||

| BMU-25-100 | 14.5 | 15 | 0.5 | 2.16 | 0.43 | |

| 18.25 | 19.75 | 1.5 | 2.23 | 1.41 | ||

| Including | 18.25 | 18.75 | 0.5 | 5.68 | 0.47 | |

| 38.3 | 39.3 | 1 | 1.96 | 0.77 | ||

| Including | 38.3 | 38.8 | 0.5 | 2.82 | 0.38 | |

| 52 | 53 | 1 | 2.05 | 0.91 | ||

| Including | 52 | 52.5 | 0.5 | 3.72 | 0.45 | |

| 56 | 56.5 | 0.5 | 11.11 | 0.50 | ||

| 61.5 | 65 | 3.5 | 2.17 | 3.42 | ||

| Including | 61.5 | 62 | 0.5 | 10.44 | 0.47 | |

| and | 62.5 | 63 | 0.5 | 2.11 | 0.50 | |

| 66.5 | 67 | 0.5 | 4.01 | 0.50 | ||

| BMU-25-101 | 15 | 19 | 4 | 7.32 | 3.94 | |

| Including | 16.5 | 17 | 0.5 | 52.72 | 0.50 | |

| and | 17.5 | 18 | 0.5 | 1.87 | 0.47 | |

| 35.5 | 38 | 2.5 | 2.34 | 2.47 | ||

| Including | 36 | 36.5 | 0.5 | 4.83 | 0.50 | |

| and | 37 | 37.5 | 0.5 | 2.64 | 0.49 | |

| and | 37.5 | 38 | 0.5 | 2.52 | 0.49 | |

| 39.5 | 40.5 | 1 | 3.97 | 0.97 | ||

| Including | 39.5 | 40 | 0.5 | 7.62 | 0.48 | |

| 46.3 | 48.35 | 2.05 | 3.14 | 2.03 | ||

| Including | 46.8 | 47.3 | 0.5 | 1.88 | 0.49 | |

| and | 47.85 | 48.35 | 0.5 | 10.74 | 0.50 | |

| BMU-25-102 | 7.5 | 9.5 | 2 | 4.67 | 1.98 | |

| Including | 7.5 | 8 | 0.5 | 16.90 | 0.50 | |

| and | 13.5 | 14 | 0.5 | 2.21 | 0.48 | |

| 16 | 20 | 4 | 1.83 | 3.94 | ||

| Including | 16.5 | 17 | 0.5 | 5.27 | 0.50 | |

| and | 18 | 18.5 | 0.5 | 3.84 | ||

| and | 18.5 | 19 | 0.5 | 2.79 | 0.49 | |

| 41 | 41.5 | 0.5 | 2.75 | 0.45 | ||

| 54 | 54.5 | 0.5 | 3.52 | 0.49 | ||

| 81 | 82 | 1 | 2.85 | 0.94 | ||

| Including | 81.5 | 82 | 0.5 | 4.80 | 0.47 | |

| BMU-25-103 | 9 | 10 | 1 | 5.86 | 0.94 | |

| 30.5 | 31 | 0.5 | 4.69 | 0.47 | ||

| 41.6 | 42.6 | 1 | 1.88 | 0.94 | ||

| Including | 41.6 | 42.1 | 0.5 | 2.22 | 0.43 | |

| 46 | 46.5 | 0.5 | 2.46 | 0.41 | ||

| 53.25 | 54.85 | 1.6 | 7.00 | 1.56 | ||

| Including | 53.25 | 53.75 | 0.5 | 18.84 | 0.50 | |

| and | 54.35 | 54.85 | 0.5 | 3.58 | 0.47 | |

| 58 | 59.5 | 1.5 | 2.71 | 1.23 | ||

| Including | 58 | 58.5 | 0.5 | 5.77 | 0.41 | |

| 64.65 | 65.15 | 0.5 | 9.39 | 0.38 | ||

| 71.1 | 72.25 | 1.15 | 1.96 | 1.00 | ||

| Including | 71.1 | 71.75 | 0.65 | 3.28 | 0.56 | |

| 73.75 | 75 | 1.25 | 2.81 | 1.08 | ||

| Including | 74.5 | 75 | 0.5 | 6.35 | 0.43 | |

| BMU-25-104 | 14.5 | 16 | 1.5 | 2.22 | 1.36 | |

| Including | 14.5 | 15 | 0.5 | 2.63 | 0.49 | |

| and | 15.5 | 16 | 0.5 | 3.41 | 0.38 | |

| 19 | 19.5 | 0.5 | 2.60 | 0.41 | ||

| 42.9 | 43.9 | 1 | 31.32 | 0.91 | ||

| Including | 42.9 | 43.4 | 0.5 | 62.15 | 0.47 | |

| 55 | 56.5 | 1.5 | 1.91 | 1.41 | ||

| Including | 55 | 55.5 | 0.5 | 5.16 | 0.43 | |

| 80 | 84 | 4 | 16.95 | 3.67 | ||

| Including | 80 | 80.5 | 0.5 | 4.37 | 0.47 | |

| and | 83.5 | 84 | 0.5 | 130.32 | 0.43 | |

| BMU-25-105 | 4.5 | 5.5 | 1 | 3.21 | 0.98 | |

| Including | 4.5 | 5 | 0.5 | 5.96 | 0.49 | |

| 18.5 | 19.8 | 1.3 | 4.29 | 1.30 | ||

| Including | 19.1 | 19.8 | 0.7 | 7.86 | 0.70 | |

| 41 | 42 | 1 | 2.58 | 0.97 | ||

| Including | 41 | 41.5 | 0.5 | 3.52 | ||

| 46 | 46.5 | 0.5 | 4.89 | 0.45 | ||

| 56 | 58 | 2 | 9.16 | 1.81 | ||

| Including | 56 | 56.5 | 0.5 | 9.90 | 0.47 | |

| and | 57 | 57.5 | 0.5 | 24.96 | 0.47 | |

| 65.75 | 66.25 | 0.5 | 2.05 | 0.47 | ||

| BMU-25-106 | 11.25 | 11.75 | 0.5 | 3.77 | 0.43 | |

| 19 | 21 | 2 | 1.96 | 1.53 | ||

| Including | 19 | 20 | 1 | 2.55 | 0.77 | |

| 23.5 | 25 | 1.5 | 3.84 | 1.30 | ||

| Including | 24 | 24.5 | 0.5 | 10.36 | 0.43 | |

| BMU-25-107 | 39.45 | 40.45 | 1 | 9.46 | 0.82 | |

| Including | 39.95 | 40.45 | 0.5 | 17.46 | 0.38 | |

| 43 | 44 | 1 | 8.02 | 0.95 | ||

| Including | 43 | 43.5 | 0.5 | 15.88 | 0.48 | |

| 49 | 50.5 | 1.5 | 2.17 | 1.45 | ||

| Including | 49.5 | 50 | 0.5 | 5.53 | 0.48 | |

| BMU-25-108 | 15.7 | 16.35 | 0.65 | 3.85 | 0.59 | |

| 43.4 | 47.05 | 3.65 | 1.83 | 3.59 | ||

| Including | 43.4 | 43.9 | 0.5 | 7.61 | 0.49 | |

| and | 46.35 | 47.05 | 0.7 | 2.09 | ||

| 50.45 | 55 | 4.55 | 6.48 | 4.22 | ||

| Including | 50.95 | 51.45 | 0.5 | 4.41 | 0.47 | |

| and | 51.45 | 51.95 | 0.5 | 21.04 | 0.43 | |

| and | 51.95 | 52.45 | 0.5 | 12.18 | 0.48 | |

| and | 52.95 | 53.45 | 0.5 | 2.88 | ||

| and | 53.45 | 54 | 0.55 | 8.71 | 0.52 | |

| and | 54 | 54.5 | 0.5 | 7.00 | 0.45 | |

| 56.25 | 58.25 | 2 | 3.37 | 1.81 | ||

| Including | 56.25 | 56.75 | 0.5 | 8.54 | 0.45 | |

| and | 57.75 | 58.25 | 0.5 | 3.42 | 0.45 | |

| 87.85 | 90.5 | 2.65 | 13.22 | 2.25 | ||

| Including | 87.85 | 88.35 | 0.5 | 3.97 | 0.40 | |

| and | 90 | 90.5 | 0.5 | 65.63 | 0.43 | |

| BMU-25-109 | 20.8 | 21.3 | 0.5 | 1.92 | 0.43 | |

| 22.5 | 23.5 | 1 | 2.91 | 0.87 | ||

| 65.75 | 69.25 | 3.5 | 2.36 | 3.03 | ||

| Including | 66.75 | 67.25 | 0.5 | 13.57 | 0.43 | |

| 70.9 | 72.4 | 1.5 | 4.28 | 1.30 | ||

| Including | 70.9 | 71.4 | 0.5 | 2.10 | 0.43 | |

| and | 71.9 | 72.4 | 0.5 | 10.54 | ||

| 86 | 86.5 | 0.5 | 3.34 | 0.41 | ||

| BMU-25-110 | 2.5 | 4.5 | 2 | 26.14 | 1.81 | |

| Including | 3 | 3.5 | 0.5 | 103.94 | 0.45 | |

| 42.25 | 46.75 | 4.5 | 2.12 | 4.08 | ||

| Including | 42.25 | 42.75 | 0.5 | 5.64 | 0.47 | |

| and | 44.75 | 45.25 | 0.5 | 6.13 | 0.45 | |

| and | 46.25 | 46.75 | 0.5 | 3.21 | 0.43 | |

| 53.75 | 55.25 | 1.5 | 17.91 | 1.40 | ||

| Including | 53.75 | 54.75 | 1 | 26.75 | ||

| 75.7 | 76.2 | 0.5 | 1.87 | 0.47 | ||

| 80.9 | 81.7 | 0.8 | 2.11 | 0.61 | ||

| BMU-25-111 | 26.5 | 27 | 0.5 | 1.89 | 0.48 | |

| 30.5 | 31.5 | 1 | 2.33 | 0.87 | ||

| Including | 31 | 31.5 | 0.5 | 4.46 | ||

| 60 | 62 | 2 | 11.20 | 1.81 | ||

| Including | 60 | 60.5 | 0.5 | 39.87 | 0.43 | |

| and | 61 | 61.5 | 0.5 | 4.70 | 0.47 | |

| 66.5 | 67 | 0.5 | 3.25 | 0.45 | ||

| 78.5 | 79 | 0.5 | 3.10 | 0.47 | ||

| 87 | 87.5 | 0.5 | 4.27 | 0.45 | ||

| 90.35 | 90.85 | 0.5 | 2.62 | 0.29 | ||

| BMU-25-112 | 4.85 | 5.45 | 0.6 | 2.37 | 0.46 | |

| 23.75 | 25.25 | 1.5 | 2.03 | 1.23 | ||

| Including | 23.75 | 24.25 | 0.5 | 2.94 | 0.43 | |

| and | 24.75 | 25.25 | 0.5 | 2.96 | ||

| 51 | 53 | 2 | 2.06 | 1.73 | ||

| Including | 51.5 | 52 | 0.5 | 7.78 | 0.43 | |

| 57.5 | 58.5 | 1 | 1.92 | 0.87 | ||

| Including | 57.5 | 58 | 0.5 | 3.10 | 0.43 | |

| BMU-25-113 | 55.5 | 56 | 0.5 | 3.43 | 0.35 | |

| 83.3 | 85.75 | 2.45 | 4.71 | 2.12 | ||

| Including | 84.75 | 85.25 | 0.5 | 11.68 | 0.43 | |

| and | 85.25 | 85.75 | 0.5 | 10.69 | ||

| BMU-25-114 | 0 | 1.15 | 1.15 | 3.17 | 0.94 | |

| Including | 0 | 0.5 | 0.5 | 6.48 | 0.41 | |

| 3.5 | 4.25 | 0.75 | 2.84 | 0.68 | ||

| 7.1 | 8.15 | 1.05 | 2.13 | 0.95 | ||

| Including | 7.1 | 7.65 | 0.55 | 3.71 | 0.50 | |

| 9 | 10 | 1 | 2.76 | 0.91 | ||

| 11 | 12 | 1 | 5.31 | 0.87 | ||

| 14.5 | 15 | 0.5 | 85.97 | 0.43 | ||

| 40.5 | 41 | 0.5 | 4.04 | 0.50 | ||

| 75.3 | 75.85 | 0.55 | 8.90 | 0.53 | ||

| BMU-25-116 | 0.7 | 1.2 | 0.5 | 7.86 | 0.41 | |

| 5 | 6 | 1 | 2.37 | 0.87 | ||

| 82.5 | 85.65 | 3.15 | 1.97 | 2.81 | ||

| Including | 82.5 | 83.1 | 0.6 | 7.25 | 0.54 | |

| and | 84.6 | 85.15 | 0.55 | 2.09 | 0.42 | |

| 90 | 90.5 | 0.5 | 2.26 | 0.43 | ||

| BMU-25-117 | 38.8 | 39.8 | 1 | 1.81 | 0.98 | |

| 49 | 50 | 1 | 2.37 | 0.87 | ||

| Including | 49.5 | 50 | 0.5 | 3.98 | 0.43 | |

| 70.5 | 71.5 | 1 | 2.56 | 0.98 | ||

| Including | 70.5 | 71 | 0.5 | 4.92 | 0.49 | |

| BMU-25-118 | 6.5 | 7.5 | 1 | 9.11 | 0.82 | |

| Including | 6.5 | 7 | 0.5 | 18.11 | 0.41 | |

| 56.5 | 57.05 | 0.55 | 2.17 | 0.32 | ||

| 100.5 | 101.75 | 1.25 | 12.95 | 1.17 | ||

| Including | 101 | 101.75 | 0.75 | 21.26 | 0.70 | |

| 107.3 | 108 | 0.7 | 2.13 | 0.61 | ||

| BMU-25-120 | 11 | 13 | 2 | 2.40 | 1.97 | |

| 11 | 11.5 | 0.5 | 3.83 | 0.49 | ||

| Including | 12.5 | 13 | 0.5 | 5.23 | 0.49 | |

| 25 | 25.5 | 0.5 | 3.17 | 0.48 | ||

| 44 | 44.5 | 0.5 | 1.93 | 0.49 | ||

| 59.5 | 61.5 | 2 | 7.12 | 1.99 | ||

| Including | 60 | 60.5 | 0.5 | 13.72 | 0.50 | |

| and | 60.5 | 61 | 0.5 | 14.43 | ||

| 65.5 | 66 | 0.5 | 2.81 | 0.49 | ||

| 68.5 | 69.5 | 1 | 2.67 | 0.94 | ||

| Including | 68.5 | 69 | 0.5 | 4.56 | 0.47 | |

| BMU-25-121 | 11.5 | 13.5 | 2 | 2.82 | 1.93 | |

| Including | 13 | 13.5 | 0.5 | 10.92 | 0.48 | |

| 23 | 23.5 | 0.5 | 5.30 | 0.47 | ||

| 25 | 25.5 | 0.5 | 58.55 | 0.47 | ||

| 43 | 44.5 | 1.5 | 6.94 | 1.46 | ||

| Including | 43 | 43.5 | 0.5 | 8.82 | 0.47 | |

| and | 44 | 44.5 | 0.5 | 11.87 | 0.50 | |

| 61 | 64 | 3 | 6.31 | 2.78 | ||

| Including | 61 | 61.5 | 0.5 | 10.56 | 0.43 | |

| and | 61.5 | 62 | 0.5 | 16.75 | 0.47 | |

| and | 63.5 | 64 | 0.5 | 9.92 | 0.48 | |

| 65.5 | 66 | 0.5 | 1.81 | 0.50 | ||

| 69 | 69.5 | 0.5 | 2.18 | 0.48 | ||

| 78.5 | 79.5 | 1 | 1.98 | 1.00 | ||

| Including | 79 | 79.5 | 0.5 | 3.80 | 0.50 | |

| BMU-25-124 | 8.6 | 10.8 | 2.2 | 4.65 | 1.91 | |

| Including | 9.6 | 10.1 | 0.5 | 18.47 | 0.38 | |

| 41.5 | 42 | 0.5 | 2.41 | 0.43 | ||

| 66 | 67 | 1 | 14.70 | 0.94 | ||

| 69 | 72 | 3 | 3.11 | 2.82 | ||

| Including | 69 | 69.5 | 0.5 | 2.08 | 0.45 | |

| and | 70.5 | 71 | 0.5 | 3.27 | ||

| and | 71 | 71.5 | 0.5 | 3.16 | ||

| and | 71.5 | 72 | 0.5 | 8.52 | 0.48 | |

| 75 | 75.5 | 0.5 | 9.40 | 0.48 | ||

| 81 | 82.5 | 1.5 | 3.65 | 1.45 | ||

| Including | 81 | 82 | 1 | 5.27 | ||

| BMU-25-126 | 38.5 | 39 | 0.5 | 31.54 | 0.43 | |

| 45.35 | 46.85 | 1.5 | 15.25 | 1.36 | ||

| Including | 45.35 | 45.85 | 0.5 | 38.22 | 0.45 | |

| Including | 46.35 | 46.85 | 0.5 | 7.53 | 0.45 | |

| 61 | 63 | 2 | 2.43 | 1.53 | ||

| Including | 61.5 | 62 | 0.5 | 9.15 | 0.38 | |

| BMU-25-129 | 21.45 | 23 | 1.55 | 3.93 | 1.19 | |

| Including | 21.95 | 22.45 | 0.5 | 10.84 | 0.38 | |

| 51.3 | 52.3 | 1 | 1.90 | 0.71 | ||

| Including | 51.8 | 52.3 | 0.5 | 3.64 | 0.35 | |

| 64.6 | 65.6 | 1 | 4.42 | 0.77 | ||

| Including | 65.1 | 65.6 | 0.5 | 8.73 | 0.38 |

Table 2: Underground DD collar locations, drillhole orientations, and max depths. Negative dips point down.

| Drillhole ID | Mine Location | Easting (UTM z12N) | Northing (UTM z12N) | Elevation (m) | Dip | Azimuth | Depth (m) |

| BMU-25-084 | L1260-ORE-003-DBY-006 | 596479.1 | 5882785.6 | 1261.8 | -35 | 125 | 114 |

| BMU-25-086 | L1260-ORE-003-DBY-002 | 596499.2 | 5882820.1 | 1260.0 | -35 | 125 | 114 |

| BMU-25-087 | L1260-ORE-003-DBY-010 | 596458.5 | 5882751.7 | 1264.0 | -35 | 125 | 114 |

| BMU-25-088 | L1260-ORE-003-DBY-006 | 596479.3 | 5882785.5 | 1261.1 | -25 | 125 | 103.5 |

| BMU-25-089 | L1260-ORE-003-DBY-010 | 596458.2 | 5882751.9 | 1263.0 | -25 | 125 | 102 |

| BMU-25-090 | L1260-ORE-003-DBY-002 | 596499.3 | 5882820.1 | 1259.5 | -25 | 125 | 102 |

| BMU-25-091 | L1260-ORE-003-DBY-006 | 596479.3 | 5882785.5 | 1260.6 | -15 | 125 | 81 |

| BMU-25-092 | L1260-ORE-003-DBY-002 | 596499.3 | 5882820.1 | 1259.0 | -15 | 125 | 96 |

| BMU-25-093 | L1260-ORE-003-DBY-010 | 596458.2 | 5882751.9 | 1262.5 | -15 | 125 | 96 |

| BMU-25-094 | L1260-ORE-003-DBY-002 | 596499.0 | 5882820.3 | 1257.5 | 25 | 125 | 93 |

| BMU-25-095 | L1260-ORE-003-DBY-006 | 596479.5 | 5882785.4 | 1260.1 | -5 | 125 | 81 |

| BMU-25-096 | L1260-ORE-003-DBY-002 | 596498.9 | 5882820.4 | 1257.3 | 35 | 125 | 96 |

| BMU-25-097 | L1260-ORE-003-DBY-010 | 596458.4 | 5882751.8 | 1262.1 | -5 | 125 | 81 |

| BMU-25-098 | L1260-ORE-003-DBY-006 | 596479.4 | 5882785.5 | 1259.7 | 5 | 125 | 81 |

| BMU-25-099 | L1260-ORE-003-DBY-002 | 596498.7 | 5882820.5 | 1257.1 | 45 | 125 | 114 |

| BMU-25-100 | L1260-ORE-003-DBY-006 | 596479.3 | 5882785.5 | 1259.5 | 15 | 125 | 84 |

| BMU-25-101 | L1260-ORE-003-DBY-010 | 596458.6 | 5882751.7 | 1261.8 | 5 | 125 | 81 |

| BMU-25-102 | L1260-ORE-003-DBY-006 | 596479.3 | 5882785.5 | 1259.3 | 25 | 125 | 90 |

| BMU-25-103 | L1260-ORE-003-DBY-001 | 596504.5 | 5882828.9 | 1260.0 | -35 | 125 | 114 |

| BMU-25-104 | L1260-ORE-003-DBY-006 | 596479.3 | 5882785.5 | 1259.0 | 35 | 125 | 99 |

| BMU-25-105 | L1260-ORE-003-DBY-001 | 596504.5 | 5882828.9 | 1259.5 | -25 | 125 | 102 |

| BMU-25-106 | L1260-ORE-003-DBY-006 | 596479.2 | 5882785.7 | 1258.9 | 45 | 125 | 114 |

| BMU-25-107 | L1260-ORE-003-DBY-010 | 596458.6 | 5882751.7 | 1261.6 | 15 | 125 | 84 |

| BMU-25-108 | L1260-ORE-003-DBY-001 | 596504.6 | 5882828.9 | 1259.2 | -15 | 125 | 96 |

| BMU-25-109 | L1260-ORE-003-DBY-005 | 596483.7 | 5882794.2 | 1261.6 | -35 | 125 | 114 |

| BMU-25-110 | L1260-ORE-003-DBY-010 | 596458.5 | 5882751.7 | 1261.4 | 25 | 125 | 90 |

| BMU-25-111 | L1260-ORE-003-DBY-005 | 596484.0 | 5882794.1 | 1260.8 | -24 | 125 | 102 |

| BMU-25-112 | L1260-ORE-003-DBY-010 | 596458.4 | 5882751.7 | 1261.2 | 35 | 125 | 99 |

| BMU-25-113 | L1260-ORE-003-DBY-010 | 596458.3 | 5882751.7 | 1261.1 | 45 | 125 | 114 |

| BMU-25-114 | L1260-ORE-003-DBY-001 | 596504.9 | 5882828.7 | 1257.4 | 25 | 125 | 90 |

| BMU-25-116 | L1260-ORE-003-DBY-001 | 596504.8 | 5882828.8 | 1257.3 | 35 | 125 | 99 |

| BMU-25-117 | L1260-ORE-003-DBY-005 | 596484.0 | 5882794.0 | 1260.4 | -15 | 125 | 81 |

| BMU-25-118 | L1260-ORE-003-DBY-001 | 596504.8 | 5882828.9 | 1257.0 | 45 | 125 | 114 |

| BMU-25-120 | L1260-ORE-003-DBY-005 | 596484.0 | 5882793.9 | 1260.2 | -6 | 125 | 84 |

| BMU-25-121 | L1260-ORE-003-DBY-005 | 596484.1 | 5882794.0 | 1259.8 | 5 | 125 | 81 |

| BMU-25-124 | L1260-ORE-003-DBY-005 | 596484.2 | 5882793.9 | 1259.2 | 25 | 125 | 90 |

| BMU-25-126 | L1260-ORE-003-DBY-005 | 596484.1 | 5882793.6 | 1258.8 | 37 | 125 | 99 |

| BMU-25-129 | L1260-ORE-003-DBY-005 | 596484.0 | 5882793.6 | 1258.4 | 44 | 124 | 114 |

ABOUT LOWHEE ZONE

Geological mapping and geochemical sampling were carried out on Barkerville Mountain from 2017-2018, with the Lowhee Zone identified as a high-priority drill target.

In 2019, two southeast-oriented stratigraphic and 22 northwest-southeast oriented drillholes (8,337.0 m) were drilled at the Lowhee Zone. The drilling successfully identified auriferous quartz-carbonate veins at similar orientations to those observed elsewhere on the Cariboo Gold project. Initial 3D geological modelling and resource estimation commenced, and further drilling was recommended.

In 2020, 24 northwest-oriented diamond drillholes (10,144.5 m) were drilled. The focus of the exploration program was to test the extent of mineralization along the down-dip and northeast strike-extent of veining. An internal resource estimation of the Lowhee deposit was completed at that time, with further drilling recommended to improve confidence.

In 2021, a total of 94 diamond drillholes (29,449.1 m) were drilled. The focus of drilling was to delineate, and infill modelled veins with 25 m spacing. BGM's resource modelling team produced a mineral resource estimate, and the collection of a bulk sample was recommended.

In 2022, a total of 27 diamond drillholes (6,563.90 m) were drilled. There were two main goals with this drill program. The first goal was to infill a potential bulk sample location achieving category conversion from indicated (25 m spacing) to measured (12.5 m spacing). The second goal was to continue to delineate and infill modelled veins with 25 m spacing.

Lowhee zone access is through Cow portal on the northwestern flank of Barkerville Mountain (Figure 1 and Figure 2) Cow portal construction was completed in Q4 2024 and development of the underground ramp into the Lowhee zone commenced in Q1 2025. Approximately 350 m of development has been advanced within the Lowhee zone deposit at the 1,290 and 1,260-elevation levels since completion of the main access ramp. The probable mineral reserves estimate for the Lowhee Zone includes 104,491 ounces of contained Au (923,162 tonnes grading 3.52 g/t Au) and represents approximately 5% of the total contained gold in the estimated probable mineral reserves for the Cariboo Gold Project.

ABOUT CARIBOO GOLD PROJECT

The Cariboo Gold Project is a permitted, 100%-owned feasibility-stage project located in the historic Wells-Barkerville mining camp of central British Columbia, Canada. Spanning approximately 186,740 hectares, the Company's land package includes 443 mineral titles and covers a ~77-kilometre strike of highly prospective exploration targets extending northwest to southeast. In late 2024, the Project was granted the Mines Act and Environmental Management Act (British Columbia) permits, marking the successful completion of the permitting process for key approvals, solidifying the Project's shovel-ready status.

The Cariboo Gold Project hosts probable mineral reserves of 2.071 million ounces of contained Au (17,815 kt grading 3.62 g/t Au); measured mineral resources of 8,000 ounces of contained Au (47 kt grading 5.06 g/t Au); indicated mineral resources of 1.604 million ounces of contained Au (17,332 kt grading 2.88 g/t Au); and inferred mineral resources of 1.864 million ounces of contained Au (18,774 kt grading 3.09 g/t Au). Mineral resources are reported exclusive of mineral reserves.

Technical Reports

Scientific and technical information relating to the Cariboo Gold Project and the 2025 feasibility study on the Cariboo Gold Project is supported by the technical report, titled " NI 43-101 Technical Report, Feasibility Study for the Cariboo Gold Project, District of Wells, British Columbia, Canada " and dated June 11, 2025 (with an effective date of April 25, 2025) (the " Cariboo Technical Report ").

For readers to fully understand the information in the Cariboo Technical Report, reference should be made to the full text of the Cariboo Technical Report in its entirety, including all assumptions, parameters, qualifications, limitations and methods therein. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context. The Technical Report was prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (" NI 43-101 ") and is available electronically on SEDAR+ ( www.sedarplus.ca ) and on EDGAR ( www.sec.gov ) under Osisko Development's issuer profile and on the Company's website at www.osiskodev.com .

Qualified Persons

The scientific and technical information contained in this news release has been reviewed, verified and approved by Scott Smith, P. Geo., Vice President, Exploration of Osisko Development, a "qualified person" within the meaning of NI 43-101. Verification includes core photo and three-dimensional review of logged drillhole data and assays consistent with the Company's standard operating procedures.

Quality Assurance (QA) – Quality Control (QC)

Whole core sampling was used for all HQ core completed in the logging facilities following daily QAQC checks for logging and sampling errors. Quality control (QC) samples are inserted at regular intervals in the sample stream, including blanks and reference materials with all sample shipments to monitor laboratory performance. Samples are bagged, labeled, sealed with numbered security tags.

Samples are taken by expeditor from the logging facilities direct to MSALABS's analytical facility in Prince George, B.C., Canada, for preparation and analysis. The MSALABS facility is accredited to the ISO/IEC 17025 standard for gold assays and all analytical methods include quality control materials at set frequencies with established data acceptance criteria. The entire sample is dried, crushed, and split into sealed containers. Analysis for gold is by gamma ray analysis using the Chrysos PhotonAssay (PA1408X). Samples are bombarded with gamma rays and the resulting signal is sent to the detectors.

Alternatively Drill core samples are submitted to ALS Geochemistry's analytical facility in North Vancouver, British Columbia for preparation and analysis. The ALS facility is accredited to the ISO/IEC 17025 standard for gold assays and all analytical methods include quality control materials at set frequencies with established data acceptance criteria. The entire sample is crushed, and 250 grams is pulverized. Analysis for gold is by 50 gram fire assay fusion with atomic absorption (AAS) finish with a lower limit of 0.01 ppm and upper limit of 100 ppm. Samples with gold assays greater than 100 ppm are re-analyzed using a 1,000-gram screen metallic fire assay. A selected number of samples are also analyzed using a 48 multi-elemental geochemical package by a 4-acid digestion, followed by Inductively Coupled Plasma Atomic Emission Spectroscopy (ICP-AES) and Inductively Coupled Plasma Mass Spectroscopy (ICP-MS).

ABOUT OSISKO DEVELOPMENT CORP.

Osisko Development Corp. is a continental North American gold development company focused on past-producing mining camps located in mining friendly jurisdictions with district scale potential. The Company's objective is to become an intermediate gold producer by advancing its flagship permitted 100%-owned Cariboo Gold Project, located in central B.C., Canada. Its project pipeline is complemented by the Tintic Project in the historic East Tintic mining district in Utah, U.S.A., and the San Antonio Gold Project in Sonora, Mexico—brownfield properties with significant exploration potential, extensive historical mining data, access to existing infrastructure and skilled labour. The Company's strategy is to develop attractive, long-life, socially and environmentally responsible mining assets, while minimizing exposure to development risk and growing mineral resources.

For further information, visit our website at www.osiskodev.com or contact:

| Sean Roosen | Philip Rabenok |

| Chairman and CEO | Vice President, Investor Relations |

| Email: sroosen@osiskodev.com | Email: prabenok@osiskodev.com |

| Tel: +1 (514) 940-0685 | Tel: +1 (437) 423-3644 |

CAUTION REGARDING FORWARD LOOKING STATEMENTS

Certain statements contained in this news release may be deemed "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation (together, "forward-looking statements"). These forward-looking statements, by their nature, require Osisko Development to make certain assumptions and necessarily involve known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward-looking statements. Forward-looking statements are not guarantees of performance. Words such as "may", "will", "would", "could", "expect", "believe", "plan", "anticipate", "intend", "estimate", "continue", "objective", "strategy", variants of these words or the negative or comparable terminology, as well as terms usually used in the future and the conditional, are intended to identify forward-looking statements. Information contained in forward-looking statements is based upon certain material assumptions that were applied in drawing a conclusion or making a forecast or projection, including the assumptions, qualifications, limitations or statements relating to the prospectivity of exploration in the Lowhee Zone and targets outside of currently defined mineral reserves and/or mineral resources; the consistency of results with modelled reserve stopes (if at all); the results (if any) of further exploration work to define and expand mineral resources; the results, timing, utility and significance of the ongoing 13,000-meter infill drill program and its impacts on the local block model and/or future production stope designs (if any); the ability and utility of exploration work (including drilling) to inform resource modeling, mine planning, production stope design procedures and parameters, and the appropriate drill spacing for future infill drilling (if at all); the ability and timing (if at all) to complete future additional systemic grid infill drill programs; the interpretation and accuracy of spatial geometries, geological structure and local variability modeling and assumptions in regard to potential reserve or resource revisions (if at all); the Company's strategy and objectives relating to the Cariboo Gold Project as well as its other projects; the assumptions, qualifications and limitations relating to the Cariboo Gold Project being permitted; assumptions, qualifications and parameters underlying the Cariboo Technical Report (including, but not limited to, the mineral resources, mineral reserves, production profile, mine design and project economics); the results of the Cariboo Technical Report as an indicator of quality and robustness of the Cariboo Gold Project, as well as other considerations that are believed to be appropriate in the circumstances; the ability of the Company to achieve the estimates outlined in the Cariboo Technical Report in the timing contemplated (if at all); the ability, progress and timing in respect of the 13,000-meter infill drill program; the contemplated work plan and activities at the Cariboo Gold Project and the timing, scope and results thereof and associated costs thereto; the potential impact of tariffs and other trade restrictions (if any); mineral resource category conversion; the future development and operations at the Cariboo Gold Project; management's perceptions of historical trends, current conditions and expected future developments; the utility and significance of historic data, including the significance of the district hosting past producing mines; future mining activities; the ability of exploration work (including drilling and sampling) to accurately predict mineralization; the ability of the Company to expand mineral resources beyond current mineral resource estimates; the ability of the Company to complete its exploration and development objectives for its projects in the timing contemplated and within expected costs (if at all); the ongoing advancement of the deposits on the Company's properties; sustainability and environmental impacts of operations at the Company's properties; gold prices; the costs required to advance the Company's properties; the ability to adapt to changes in gold prices, estimates of costs, estimates of planned exploration and development expenditures; the profitability (if at all) of the Company's operations; regulatory framework remaining defined and understood as well as other considerations that are believed to be appropriate in the circumstances, and any other information herein that is not a historical fact may be "forward looking information". Osisko Development considers its assumptions to be reasonable based on information currently available, but cautions the reader that their assumptions regarding future events, many of which are beyond the control of Osisko Development, may ultimately prove to be incorrect since they are subject to risks and uncertainties that affect Osisko Development and its business. Such risks and uncertainties include, among others, risks relating to third-party approvals, including the issuance of permits by governments, capital market conditions and the Company's ability to access capital on terms acceptable to the Company for the contemplated exploration and development at the Company's properties; the ability to continue current operations and exploration; regulatory framework and presence of laws and regulations that may impose restrictions on mining; errors in management's geological modelling; the timing and ability of the Company to obtain and maintain required approvals and permits; the results of exploration activities; risks relating to exploration, development and mining activities; the global economic climate; fluctuations in metal and commodity prices; fluctuations in the currency markets; dilution; environmental risks; and community, non-governmental and governmental actions and the impact of stakeholder actions. Osisko Development is confident a robust consultation process was followed in relation to its received BC Mines Act and Environmental Management Act permits for the Cariboo Gold Project and continues to actively consult and engage with Indigenous nations and stakeholders. While any party may seek to have the decision related to the BC Mines Act and/or Environmental Management Act permits reviewed by the courts, the Company does not expect that such a review would, were it to occur, impact its ability to proceed with the construction and operation of the Cariboo Gold Project in accordance with the approved BC Mines Act and Environmental Management Act permits. Readers are urged to consult the disclosure provided under the heading "Risk Factors" in the Company's annual information form for the year ended December 31, 2024 as well as the financial statements and MD&A for the year ended December 31, 2024 and quarter ended September 30, 2025, which have been filed on SEDAR+ ( www.sedarplus.ca ) under Osisko Development's issuer profile and on the SEC's EDGAR website ( www.sec.gov ), for further information regarding the risks and other factors facing the Company, its business and operations. Although the Company's believes the expectations conveyed by the forward-looking statements are reasonable based on information available as of the date hereof, no assurances can be given as to future results, levels of activity and achievements. The Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by law. Forward-looking statements are not guarantees of performance and there can be no assurance that these forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/c5f1b324-34fa-4cdb-aff1-e5ca4881d026

https://www.globenewswire.com/NewsRoom/AttachmentNg/495ec015-0771-457c-8976-630b684cace8

https://www.globenewswire.com/NewsRoom/AttachmentNg/e199f4af-47bd-4261-96b5-acf0e7570fa6

https://www.globenewswire.com/NewsRoom/AttachmentNg/2d088185-2197-433d-ac8a-336a160ea619

https://www.globenewswire.com/NewsRoom/AttachmentNg/b5a77de3-add1-4874-848a-08884e442825

https://www.globenewswire.com/NewsRoom/AttachmentNg/08a8734d-28cc-4bad-9f01-3aab1c69fbab

https://www.globenewswire.com/NewsRoom/AttachmentNg/588a5c0c-5f2a-4318-b1ca-19e4962c1643

https://www.globenewswire.com/NewsRoom/AttachmentNg/b5c766c3-93a8-4ea8-91b3-ede54d1696ca