Ongoing exploration indicates new discovery east of Ermitaño

TSXV:OGN)(OTCQX:OGNRF) Orogen Royalties Inc. ("Orogen" or the "Company") is pleased to announce that it has received its first quarterly royalty payment of approximately US$480,000 from initial production at the Ermitaño deposit in Sonora, Mexico. Orogen organically generated a 2% net smelter return ("NSR") royalty on the sale of the Ermitaño project to First Majestic Silver Corp. ("First Majestic

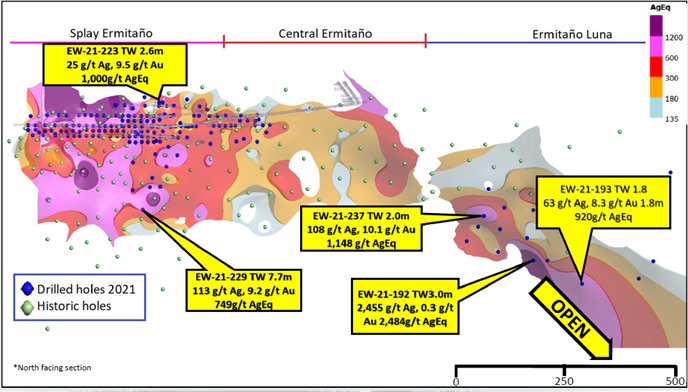

Ongoing exploration by First Majestic east of Ermitaño has revealed a new discovery called Ermitaño-Luna that is subject to Orogen's royalty.

Highlights

- Royalty revenue of $480,000 from the sale of 13,479 ounces of gold and 66,338 ounces silver for the period ending December 31, 2021, representing at least a 60% increase over First Majestic's November 2021 43-101 Prefeasibility Study ("PFS")1 estimate

- A total of 103,742 metric tonnes produced with average head grades of 5.28 grams per tonne ("g/t") gold and 49 g/t silver which are 52.1% and 22.5% higher than expected in First Majestic's PFS, respectively

- Royalty revenue excludes the remaining 5% of gold doré produced and in-process inventory which are expected in be settled in Q1-2022

- Expected royalty revenue for fiscal 2022 at Ermitaño based on First Majestic's PFS is US$1.85 million

- Drilling at Luna indicates potential for a second Ermitaño-type deposit from drilling reported by First Majestic: EW-21-237 grading 10.1 g/t gold and 108 g/t silver over 2.0 metres, EW-21-193 grading 8.3 g/t gold and 63 g/t silver over 1.8 metres, and EW-21-192 grading 0.3 g/t gold and 2,455 g/t silver over 3.0 metres (all holes are true width)2

"Initial production of Ermitaño has gone exceptionally well and we look forward to the ramp-up of full-scale production in 2022," commented Orogen CEO Paddy Nicol. "We are also very encouraged with the discovery of Luna, which lies approximately 200 metres east of the Central Ermitaño vein area. It provides significant upside to increase the size of existing resources at Ermitaño and value to Orogen's royalty."

About the Ermitaño Project and Luna Area

The 120 square kilometre Ermitaño project in Sonora, Mexico contains the Ermitaño deposit and Luna area, a low-sulphidation epithermal gold-silver system. It is located in the Rio Sonora Valley, an area known to host epithermal gold-silver deposits and active mines including the Santa Elena Mine (First Majestic), Mercedes Mine (Bear Creek Mining Corporation) and Las Chispas deposit (SilverCrest Metals Inc.). The Ermitaño deposit and Luna are situated four kilometres east of the Santa Elena mine and processing plant.

First Majestic has 30,000 metres of drilling planned in 2022 for resource expansion at Ermitaño with the system open at depth and to the east.

Total resources at Ermitaño as per First Majestic's PFS (November 2021) (excluding Ermitaño Luna area):

| Domain | ktonnes | Gold (g/t) | Silver (g/t) | Gold (koz) | Silver (Moz) |

| P&P Reserves | 2,835 | 3.69 | 54 | 337 | 4.9 |

| M&I Resources | 2,958 | 4.27 | 61 | 406 | 5.8 |

| Inferred Resources | 5,072 | 2.70 | 64 | 440 | 10.6 |

Note: Measured and Indicated Resources are inclusive of Mineral Reserves

Figure 1 - Ermitaño long section with Luna area on the right.

Source: First Majestic Corporate Presentation dated January 25, 2022, page 26.2

Note: Silver equivalent grades calculated by First Majestic consider US$1750/oz gold and US$22.50/oz silver.

Qualified Person Statement

Certain technical disclosure in this release is a summary of previously released third-party information and the Company is relying on the interpretation provided. Additional information can be found on the links in the footnotes or on SEDAR (www.sedar.com).

All technical data, as disclosed in this press release, has been verified by Laurence Pryer, Ph.D., P.Geo., Exploration Manager for Orogen. Dr. Pryer is a qualified person as defined under the terms of National Instrument 43-101.

On Behalf of the Board

Orogen Royalties Inc.

Paddy Nicol

President & CEO

To find out more about Orogen, please contact Paddy Nicol, President & CEO at 604-248-8648, or Marco LoCascio, Vice President of Corporate Development at 604-248-8648. Visit our website at www.orogenroyalties.com.

Orogen Royalties Inc.

1201 - 510 West Hastings Street

Vancouver, BC

Canada V6B 1L8

info@orogenroyalties.com

- https://www.firstmajestic.com/_resources/reports/Santa-Elena-Technical-Report-Final-2021-11-23.pdf

- https://www.firstmajestic.com/investors/presentation/

Forward-Looking Information

This news release includes certain statements that may be deemed "forward-looking statements". All statements in this presentation, other than statements of historical facts, that address events or developments that Orogen Royalties Inc. (the "Company") expect to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur.

Forward-looking information relates to statements concerning the Company's future outlook and anticipated events or results, as well as the Company's management expectations with respect to the proposed business combination (the "Transaction"). This document also contains forward-looking statements regarding the anticipated completion of the Transaction and timing thereof. Forward-looking statements in this document are based on certain key expectations and assumptions made by the Company, including expectations and assumptions concerning the receipt, in a timely manner, of regulatory and stock exchange approvals in respect of the Transaction.

Although the Company believe the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include market prices, exploitation and exploration successes, and continued availability of capital and financing, and general economic, market or business conditions. Furthermore, the extent to which COVID-19 may impact the Company's business will depend on future developments such as the geographic spread of the disease, the duration of the outbreak, travel restrictions, physical distancing, business closures or business disruptions, and the effectiveness of actions taken in Canada and other countries to contain and treat the disease. Although it is not possible to reliably estimate the length or severity of these developments and their financial impact as of the date of approval of these condensed interim consolidated financial statements, continuation of the prevailing conditions could have a significant adverse impact on the Company's financial position and results of operations for future periods.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

SOURCE: Orogen Royalties Inc.

View source version on accesswire.com:

https://www.accesswire.com/688985/Orogen-Receives-First-Royalty-Payment-from-the-Ermitao-Deposit