TSXV:OGN)(OTCQX:OGNRF) Orogen Royalties Inc. ("Orogen" or the "Company") is pleased to announce that is has signed an agreement (the "Agreement") with K2 Gold Corporation (TSX.V:KTO). ("K2"), to option Orogen's Si2 gold project in Nevada, U.S.A

K2 can earn a 100% interest in the Si2 project (formerly known as the Elba project) by making cash payments totaling US$2.5 million, spending US$2.5 million in exploration expenditures over a five-year period, and granting to Orogen a 2.0% net smelter return ("NSR") royalty.

"Si2 is an underexplored steam heated alteration cell with no drilling that has targeted the appropriate depth for gold mineralization," commented Paddy Nicol, Orogen's CEO. "The project shares many similarities with AngloGold Ashanti NA's Silicon project in the growing Beatty gold district, where Orogen holds a 1.0% NSR royalty. We are excited to partner with K2 to advance another asset in Nevada's prolific Walker Lane Trend."

About The Si2 Property

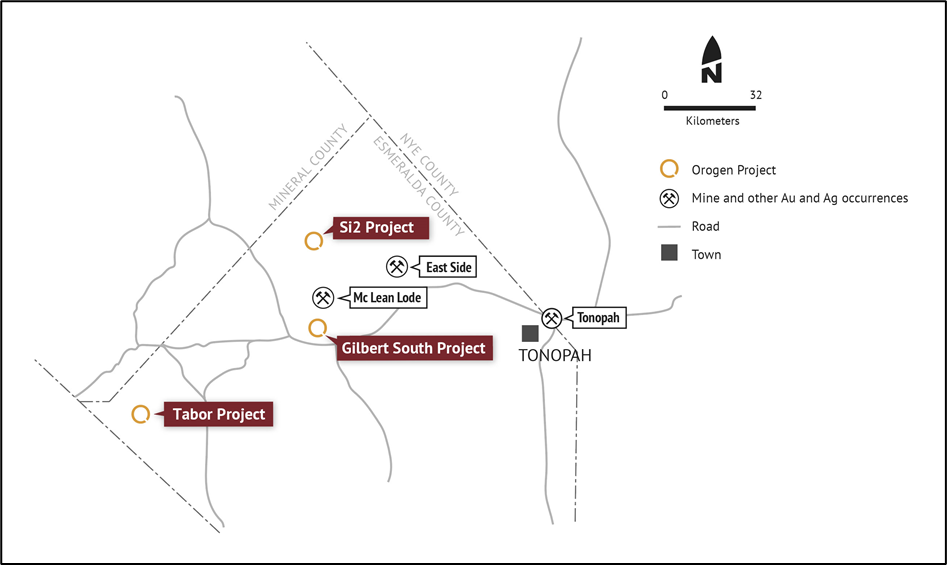

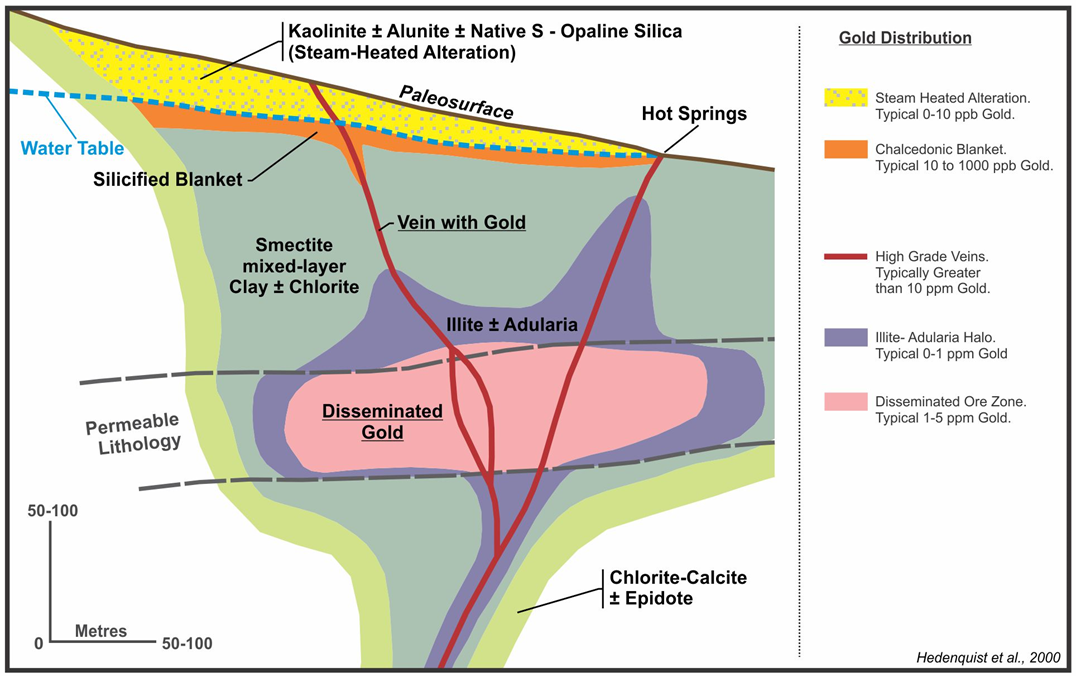

The four-square kilometre Si2 project is located 60 kilometres northwest of Tonopah in Esmeralda County, Nevada (Figure 1). The project was generated using the same methodology used by Orogen when it staked the Silicon Gold Project in 2015 (subsequently optioned and now owned by AngloGold Ashanti NA). Si2 consists of a large steam heated alteration cell coincident with highly anomalous mercury and no gold or trace elements on surface. This property has the potential to host a buried low-sulphidation epithermal gold deposit (Figure 2).

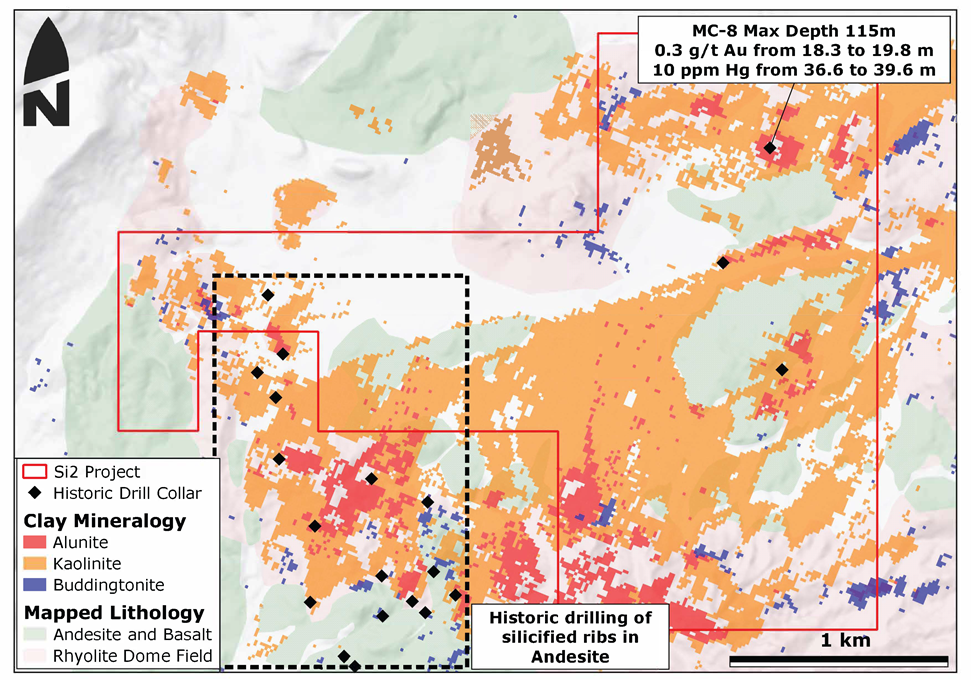

The steam heated alteration cell at Si2 is hosted by a rhyolite dome complex. Alteration is dominated by pervasive alunite and chalcedony replacement of breccias with mercury values up to 20 parts per million ("ppm"). Breccias and altered domes define an annular zone cored by a large recessive area mostly covered by shallow alluvium. Rare exposures in the central portion of the target include milled hydrothermal breccias with leached silica textures and cross-cutting chalcedonic silica veins.

Only three shallow drill holes (maximum depth of 115 metres) have been completed at the main Si2 target. These holes encountered opalite alteration with locally anomalous gold (up to 0.3 g/t gold over 1.5 metres) and strongly anomalous mercury, positive indicators of a buried low-sulphidation epithermal deposit. These holes did not penetrate the chalcedonic blanket and were not drilled deep enough to test for a developed gold system (Figure 3).

Figure 1: Location of Si2

Figure 2: Geology and Clay Mineralogy on the Si2 Project

Figure 3: Schematic of a low-sulphidation epithermal system adapted from Hedenquist et al 2000

Si2 transaction terms

K2 can earn a 100% interest in the Si2 project by making cash payments totaling US$2.5 million, spending a minimum of US$2.5 million over a five-year period subject to the following schedule:

- US$50,000 cash on the date of signing the Agreement;

- US$100,000 cash and $150,000 cumulative incurred expenditures on or before the first anniversary;

- US$100,000 cash and $650,000 cumulative incurred expenditures on or before the second anniversary;

- US$250,000 cash and $1,250,000 cumulative incurred expenditures on or before the third anniversary;

- US$500,000 cash and $1,750,000 cumulative incurred expenditures on or before the fourth anniversary; and

- US$1,500,000 cash and $2,500,000 cumulative incurred expenditures on or before the fifth anniversary.

Orogen will retain a 2% NSR upon K2 exercising the option.

Qualified Person Statement

All technical data, as disclosed in this press release, has been verified by Laurence Pryer, Ph.D., P.Geo., Exploration Manager for Orogen. Dr. Pryer is a qualified person as defined under the terms of National Instrument 43-101.

About Orogen Royalties Inc.

Orogen Royalties Inc. is focused on organic royalty creation and royalty acquisitions on precious and base metal discoveries in western North America. The Company's royalty portfolio includes the Ermitaño West gold deposit in Sonora, Mexico (2% NSR royalty) being developed by First Majestic Silver Corp. and the Silicon gold project (1% NSR royalty) in Nevada, USA, being advanced by AngloGold Ashanti N.A. The Company is well financed with several projects actively being developed by joint venture partners.

On Behalf of the Board

Paddy Nicol

President & CEO

To find out more about Orogen, please contact Paddy Nicol, President & CEO at 604-248-8648, and Marco LoCascio, Vice President of Corporate Development at 604-248-8648. Visit our website at www.orogenroyalties.com.

Orogen Royalties Inc.

1201 - 510 West Hastings Street

Vancouver, BC

Canada V6B 1L8

info@orogenroyalties.com

Forward Looking Information

This news release includes certain statements that may be deemed "forward looking statements". All statements in this presentation, other than statements of historical facts, that address events or developments that Orogen Royalties Inc. (the "Company") expect to occur, are forward looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur.

Forward looking information relates to statements concerning the Company's future outlook and anticipated events or results, as well as the Company's management expectations with respect to the proposed business combination (the "Transaction"). This document also contains forward-looking statements regarding the anticipated completion of the Transaction and timing thereof. Forward-looking statements in this document are based on certain key expectations and assumptions made by the Company, including expectations and assumptions concerning the receipt, in a timely manner, of regulatory and stock exchange approvals in respect of the Transaction.

Although the Company believe the expectations expressed in such forward looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward looking statements. Factors that could cause the actual results to differ materially from those in forward looking statements include market prices, exploitation and exploration successes, and continued availability of capital and financing, and general economic, market or business conditions. Furthermore, the extent to which COVID-19 may impact the Company's business will depend on future developments such as the geographic spread of the disease, the duration of the outbreak, travel restrictions, physical distancing, business closures or business disruptions, and the effectiveness of actions taken in Canada and other countries to contain and treat the disease. Although it is not possible to reliably estimate the length or severity of these developments and their financial impact as of the date of approval of these condensed interim consolidated financial statements, continuation of the prevailing conditions could have a significant adverse impact on the Company's financial position and results of operations for future periods.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward looking statements. Forward looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by securities laws, the Company undertakes no obligation to update these forward looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

SOURCE: Orogen Royalties Inc.

View source version on accesswire.com:

https://www.accesswire.com/684520/Orogen-options-the-Si2-Gold-Project-to-K2-Gold