Oil and Gas Price Update: Q1 2024 in Review

Oil and gas are important energy fuels in the global economy. How did they perform in Q1, and what do experts expect moving forward?

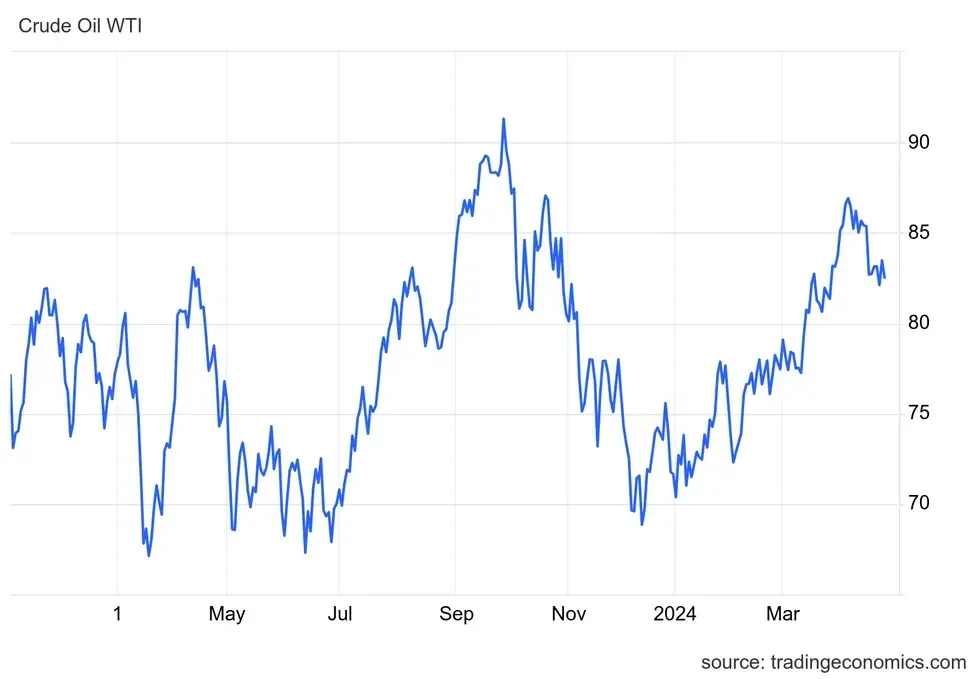

Brent and West Texas Intermediate (WTI) crude prices both fluctuated widely in 2023, but ended the year about where they began. To start off 2024, they trended higher, picking up steam during Q1.

Ongoing tensions stemming from the Russia-Ukraine war led to concerns about potential disruptions in global oil supply, helping to support prices. Global economic conditions, such as inflation concerns, monetary policy decisions and geopolitical tensions in oil-producing regions, played a significant role in shaping oil price movements during the quarter, with Brent and WTI registering 14 percent and 18 percent increases, respectively, over the 90 day session.

Prices were also supported when several OPEC+ countries, including Saudi Arabia, Iraq, the United Arab Emirates, Kuwait and Algeria, extended voluntary production cuts to support oil market stability. Russia also committed to a voluntary production cut of 471,000 barrels per day for the second quarter, alongside reductions in exports.

Eric Nuttall, partner and senior portfolio manager at Ninepoint Partners, said these output cuts in the name of stability impacted oil prices in the first quarter of the year. “Oil volatility has actually fallen,” he said during an April 5 interview.

“You wouldn't know it necessarily when looking at the oil price, but volatility is low. I think you can attribute that to the OPEC cut — one of the biggest goals of OPEC’s intervention into the market was to reduce volatility.”

The actions from OPEC+ were successful, and kept oil prices at between US$70 and US$87 per barrel in Q1.

How did oil prices perform in Q1?

Brent crude reached a 2023 high of US$93.10 on September 11, but prices spent the remainder of the year sliding until bottoming at US$75.80 on December 4. WTI followed a similar trajectory, although it displayed more volatility, reaching a yearly high of US$91.43 in late September 2023 and then slipping to US$68.71 in early December.

Brent crude price, January 2023 to April 2024.

Chart via TradingEconomics.

The upswing in prices in Q1 of this year can be attributed to several factors, according to Nuttall.

First, values were rebounding from a period of low activity, driven by unfounded concerns about weak oil demand and exaggerated fears about increased US shale production.

Second were the OPEC+ production cuts, which played a significant role in reducing oil inventories.

Nuttall explained that typically, demand is weakest at the beginning of the year; this year, however, inventories have only seen a minimal increase compared to the substantial buildup last year. This underscores the effectiveness of OPEC+'s cuts in counteracting the impact of strategic petroleum reserve releases and stabilizing oil prices.

WTI price, January 2023 to April 2024.

Chart via TradingEconomics.

“Lastly, we do have a geopolitical risk premium on the oil price now, I'm guessing US$5 a barrel,” he said.

“We haven't had a risk premium in quite a while. But what we're seeing in the Middle East, what we're seeing (with) Russia, Ukraine, it just fast forwarded where I thought we were going to be — I thought we'd be at US$90 in the summertime, (but) we’re there a few months earlier than I thought," Nuttall added.

US stalls on refilling Strategic Petroleum Reserve

In 2022, the Biden administration sold 180 million barrels of oil from the Strategic Petroleum Reserve (SPR), responding to global turmoil caused by the start of the Russia-Ukraine war.

Since then it has reversed its strategy and is looking to refill the SPR.

On February 26, the US Department of Energy said it wanted to purchase up to 3 million barrels of crude oil for the SPR, aiming to enhance the nation's energy security. However, less than a week later, the administration scrapped two purchases that would have fulfilled that plan, citing high prices.

While Ninepoint’s Nuttall doesn’t think SPR restocking will impact broader oil prices, he was surprised by the government’s decision to refill. “The biggest threat to (US President Joe Biden's) re-election is inflation. And the biggest input to inflation is energy pricing, specifically oil and gasoline,” the expert explained.

“So it was counterintuitive to me, and I think it was purely for political theater that he started to refill it.”

Experts bullish on oil prices long term

A report from FocusEconomics shows that analysts polled by the firm are forecasting a 10 percent decline in Brent and WTI prices over the next decade compared to 2023 levels.

However, prices are anticipated to remain historically high in the near term due to increased demand from China and India. The panelists see Brent crude averaging around US$85 for the remainder of the year.

Nuttall has a more bullish stance, supported by an increase in demand while global inventories are already at multi-year lows. Using the "days of supply" metric, which estimates how many days current inventory levels will last based on the current consumption rate, he expects inventories to reach the “lowest level in history later this year.”

“That's very supportive of a high price,” he said. He sees oil prices remaining in the US$90 range.

Nuttall noted that geopolitical events have accelerated the approach to this price target. In his view, the subsequent trajectory of prices will depend on when Saudi Arabia decides to return barrels and the pace of that return; he is also watching geopolitical developments in the Middle East and Russia.

While there are uncertainties, such as how potential infrastructure damage could impact oil flows, factors like stronger US demand, solid Indian demand and better-than-expected European performance contribute to his bullish outlook.

“But we're not calling for US$150 oil, we just don't think that's reasonable right now," he clarified.

How did natural gas prices perform in Q1?

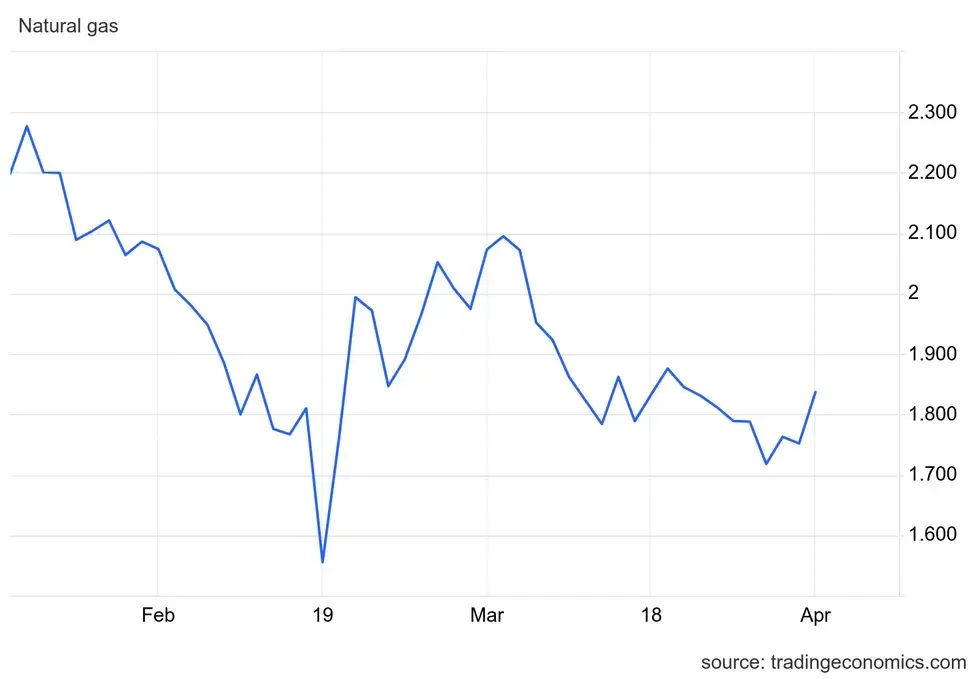

While oil prices remained relatively stable throughout the first quarter of this year, natural gas prices sank to multi-decade lows, hitting US$1.55 per metric million British thermal units.

The decline has been attributed to a warmer-than-expected winter in the northern hemisphere and ample supply.

Natural gas price, January 2024 to April 2024.

Chart via TradingEconomics.

“Higher LNG production (up by 3 percent y-o-y), together with stronger piped gas deliveries to Europe and China, further eased supply fundamentals and supported demand growth,” states the International Energy Agency.

The market overview from the organization also notes that global natural gas demand was up 2 percent for the quarter, but was more than offset by the production uptick.

Natural gas prices subdued after previous highs

Natural gas prices are expected to remain well below the highs set in 2022, when values neared US$10, propelled by market uncertainty brought on by Russia’s invasion of Ukraine and fears around supply security.

After a steep decline in late 2022, prices remained below US$5 throughout 2023.

Although concerns about Panama Canal and Red Sea disruptions led to speculation about a geopolitical premium, an uptick of this kind has yet to materialize in the natural gas market.

For the remainder of the year, FocusEconomics panelists expect natural gas prices to decrease in Asia and Europe compared to 2023 averages, while remaining steady in the US, staying below the pre-pandemic 10 year average.

Prices could see declines brought on by an abundance in natural gas inventories in all regions, attributed to mild weather conditions from the El Niño pattern and subdued industrial activity.

Europe will continue to be an important region to watch as ongoing sanctions on Russian gas, the continued conflict in Ukraine and supply security trends could add tailwinds to prices.

“The structural deficit in European natural gas has yet to be fully resolved with increased (liquefied natural gas) supply not yet fully making up for lost Russian imports. Thus, European gas prices remain vulnerable to supply interruptions or increases in demand,” analysts at Goldman Sachs (NYSE:GS) told FocusEconomics.

“This is especially the case during winter, when weather-dependent heating comprises the bulk of demand and bouts of cold weather can lead to rapidly falling stocks and higher prices," they added.

Increased US LNG export capacity could facilitate a price convergence among regions by the end of 2025.

“In 2025, US natural gas prices are expected to surpass the pre-pandemic average, with Europe seeing a slight increase and Asia maintaining stability,” FocusEconomics' natural gas market outlook reads. "The absence of El Niño is predicted to boost heating demand, while industrial output growth will drive up consumption.”

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Have We Reached Peak Oil? ›

- How to Invest in Oil and Gas ›

- Top 10 Oil-producing Countries ›

- Oil Price and Inflation: What’s the Correlation? ›