July 03, 2022

Challenger Exploration (ASX: CEL) (“CEL” the “Company”) is pleased to announce results from the next three drill holes CVDD-22-003 to CVDD-22-005 in the Colorado V concession in El Oro Province, Ecuador, where the Company is farming in to earn an initial 50% interest.

Highlights

- Next drill holes on the CV-A and CV-B soil anomalies in Colorado V, Ecuador, significantly expand the scale of the mineralisation with results including (refer Table 1):

- 564.1 m at 0.4 g/t AuEq2 - 0.2 g/t Au, 2.3 g/t Ag, 0.1 % Cu, 44.1 ppm Mo from 8.1m including;278.0 m at 0.6 g/t AuEq2 - 0.3 g/t Au, 3.2 g/t Ag, 0.1% Cu, 68.2 ppm Mo from 8.1m including;146.5 m at 0.7 g/t AuEq2 - 0.4 g/t Au, 3.2 g/t Ag, 0.1 Cu, 101 ppm Mo from 8.1m (CVDD-22- 005)

- 509.9 m at 0.4 g/t AuEq2 - 0.2 g/t Au, 1.4 g/t Ag, 0.1% Cu, 31.3 ppm Mo from 2.5m including;242.5 m at 0.6 g/t AuEq2 - 0.4 g/t Au, 1.8 g/t Ag, 0.1% Cu, 44.8 ppm Mo from 2.5m Including 156.9m at 0.7 g/t AuEq2 - 0.4 g/t Au, 1.8 g/t Ag, 0.1% Cu, 54.7 ppm Mo from 2.5m including 75.8 m at 0.8 g/t AuEq2 - 0.6 g/t Au, 2.0 g/t Ag, 0.1% Cu,59.1 ppm Mo (CVDD-22-003)

- Mineralisation extended at CV-A 400 metres southwest and outside the boundaries of the CV-A soil anomaly confirming the mineralisation has a true width of over 600 metres

- CVDD-22-004, the second hole on the CV-B soil anomaly, extends the mineralisation at CV-B some 200 metres to the north of the CVDD-22-002 discovery hole with mineralisation remaining open

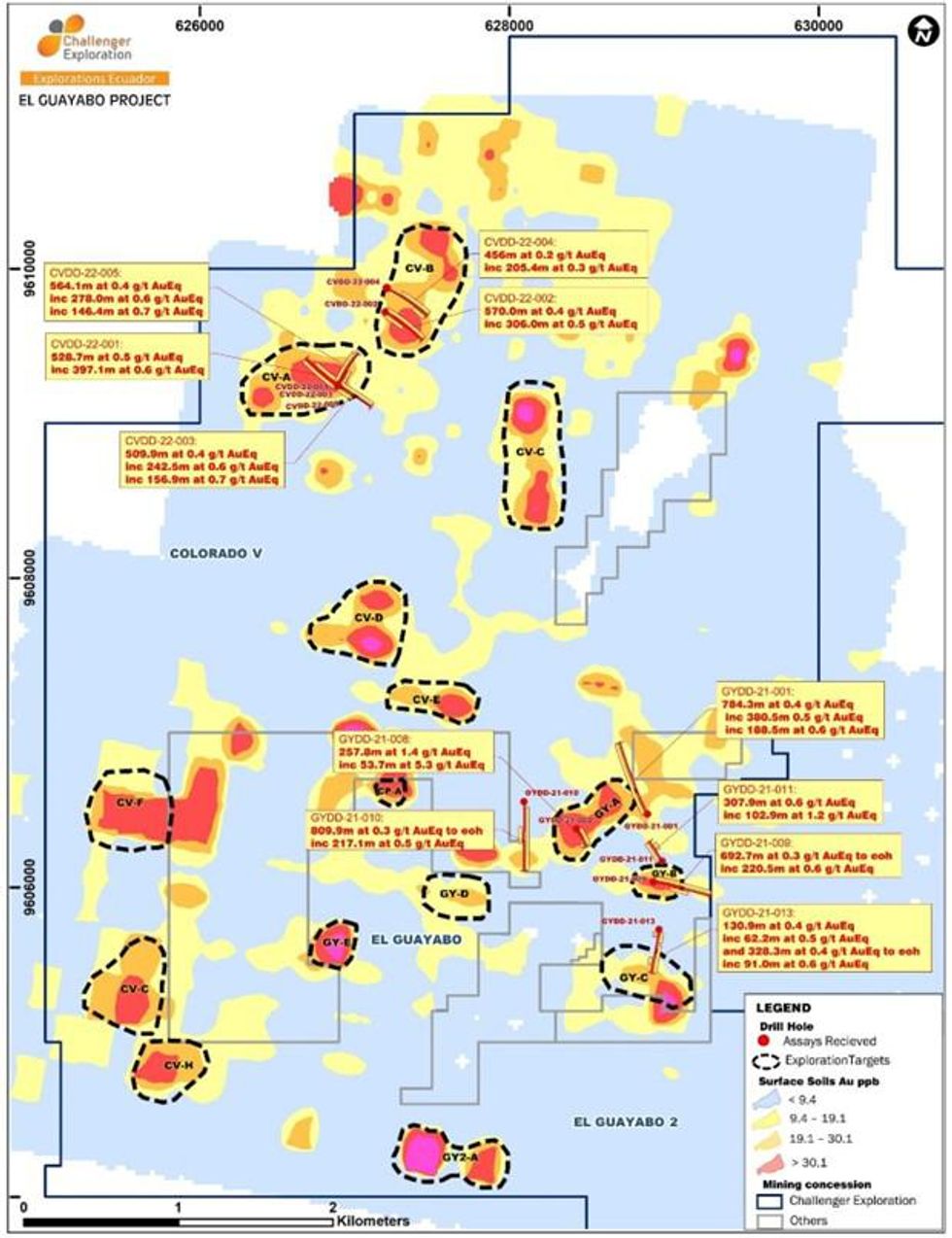

- Confirms two Au-Cu-Ag-Mo discoveries of significant scale. Both Au-soil anomalies are 1 kilometre long and 500 metres wide and lie within a structural corridor over a 3 kilometre strike distance.

- CEL has drilled five of fifteen regionally significant Au-soil anomalies with over 500 metres of mineralisation intersected at all anomalies, confirming the potential for a major bulk gold system.

Commenting on the results, CEL Managing Director, Mr Kris Knauer, said

“These next three holes from Colorado V confirm that we have made two significant discoveries at Colorado V. The intersections significantly extend the mineralisation in the discovery holes at the CV-A and CV-B anomalies both of which are just a few kilometres on strike from the 22-million ounce Cangrejos Gold Project1. The anomalies have the same geology and surface footprint as Cangrejos and drilling is showing us they have similar mineralisation.

We have drilled five of fifteen regional gold-soil anomalies and all five have returned significant mineralisation. The results continue to crystalise our strategy that our high-grade resource of 1.1 million ounces at 5.6 g/t gold equivalent in Argentina, which is continuing to grow, will fund a large bulk gold discovery in Ecuador."

Figure 1 - Regional Au-soil anomalies and drilling results at El Guayabo and Colorado V

They follow CVDD-22-001 and CVDD-22-002, both of which intersected significant mineralisation, and confirm Au-Cu-Ag-Mo discoveries in the first two regional gold in soil anomalies in Colorado V to be drilled by the Company. Additionally, the results extend the mineralisation outside the boundary of the CV-A soil anomaly and confirm the CV-A mineralisation has a true width of at least 600 metres.

The new discoveries have significant scale with both the CV-A and CV-B Au-soil anomalies 1 kilometre long and 500 metres wide. The Colorado V concession adjoins CEL's 100% owned El Guayabo concession to the south and the Cangrejos concession to the north which hosts the 22-million ounce Cangrejos Gold Project1.

1 Source : Lumina Gold (TSX : LUM) July 2020 43-101 Technical Report

CVDD-22-003: CV-A anomalyCVDD-22-003 was the Company's second drill hole targeting the CV-A soil anomaly at Colorado V. The hole was drilled as a follow up to CVDD-22-001 which intersected 528.7m at 0.5 g/t AuEq from surface to the end of the hole including 397.1m at 0.6 g/t AuEq from surface. CVDD-22-003 was drilled from the same pad as CVDD-22-001 in the opposite direction outwards from the CV-A soil anomaly to test the entire 500 metre width.

As can be seen from Figure 2 (Plan view) CVDD-22-003 drilled outside the projected CV-A soil anomaly at approximately 200 metres down hole. This makes the intercept of 509.9m at 0.4 g/t AuEq (0.2 g/t gold, 1.4 g/t silver, 0.1 % copper, 31.3 ppm molybdenum) from surface until the end of the hole more impressive as it confirms that the mineralisation extends significantly beyond the boundary of the CV-A soil anomaly.

The hole intersected a higher-grade zone of 242.5 metres at 0.6 g/t AuEq (0.4 g/t gold, 1.8 g/t silver, 0.1% copper, 44.8 ppm molybdenum) including 156.9 metres at 0.7 g/t AuEq (0.4 g/t gold,1.8 g/t silver, 0.1% copper, 54.7 ppm molybdenum) and 75.8 metres at 0.8 g/t AuEq (0.6 g/t gold, 1.8g/t silver, 0.1% copper, 59.1 ppm molybdenum), all from surface. This higher-grade zone correlates with the area below the CV-A soil anomaly, which is an extension of mineralisation intersected in CVDD-22-001 (397.1m at 0.6 g/t AuEq from surface), confirming mineralisation at the CV-A anomaly begins at surface and has higher-grades at surface.

The intersection confirms that the CV-A soil anomaly which is a gold, silver, and copper soil anomaly some 1 kilometre long and 500 metres wide is mineralised across its entire 500 metre width and beyond. The mineralisation is consistent and pervasive throughout the hole and appears to have similar paragenetic relationships to mineralisation intersected in the discovery holes 3 kilometres to the south at El Guayabo, as well as Lumina Gold's Cangrejos Project 6 kilometres to the northeast.

Click here for the full ASX Release

This article includes content from [Company Name][ticker symbol], licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CEL:AU

The Conversation (0)

14 February 2022

Challenger Exploration

Gold and Copper Exploration Across Known and Untapped Sources

Gold and Copper Exploration Across Known and Untapped Sources Keep Reading...

30 January

Editor's Picks: Gold and Silver Prices Hit New Highs, Then Drop — What's Next?

Gold and silver are wrapping up a record-setting week once again. Starting with gold, the yellow metal left market participants hanging last week after finishing just shy of US$5,000 per ounce. However, it made up for it in spades this week, breaking through that level and continuing on up to... Keep Reading...

30 January

Lobo Tiggre: Gold, Silver Hit Record Highs, Next "Buy Low" Sector

Did gold and silver just experience a blow-off top, or do they have more room to run? Lobo Tiggre, CEO of IndependentSpeculator.com, shares his thoughts on what's going on with the precious metals, and how investors may want to position.Don't forget to follow us @INN_Resource for real-time... Keep Reading...

30 January

Ross Beaty: Gold, Silver in "Bubble Territory," What Happens Next?

Ross Beaty of Equinox Gold (TSX:EQX,NYSEAMERICAN:EQX) and Pan American Silver (TSX:PAAS,NASDAQ:PAAS) shares his thoughts on gold and silver's record-setting runs. While high prices are exciting, he noted that even US$50 per ounce silver is good for miners. "At the end of the day, there's still... Keep Reading...

30 January

Is it Time to Take Profits? Experts Share Gold and Silver Strategies in Vancouver

Optimism was building at last year’s Vancouver Resource Investment Conference (VRIC), with fresh capital flowing back into the mining sector, lifting project financings and investor portfolios alike.This year's VRIC, which ran from January 25 to 26, saw that optimism tip into outright... Keep Reading...

30 January

Adoption of Omnibus Incentive Plan & Private Placement Update

iMetal Resources Inc. (TSXV: IMR,OTC:IMRFF) (OTCQB: IMRFF) (FSE: A7VA) ("iMetal" or the "Company"). The Company confirms shareholders approved the adoption of a new omnibus incentive plan (the "Plan") at the annual general and special meeting (the "Meeting") of shareholders held on August 7,... Keep Reading...

30 January

Flow Metals Announces Closing of Shares for Debt

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to announce that, further to its news release dated January 23, 2026, it has closed a debt settlement transaction (the "Debt Settlement") with certain insiders' of the Company pursuant to which the Company settled... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00