Nutrien Ltd. (TSX and NYSE: NTR) announced today that its Board of Directors has declared a quarterly dividend of US$0.545 per share payable on January 16, 2026, to shareholders of record on December 31, 2025.

Registered shareholders who are residents of Canada as reflected in Nutrien's shareholders register, as well as beneficial holders (i.e., shareholders who hold their common shares through a broker or other intermediary) whose intermediary is a participant in CDS Clearing and Depositary Services Inc. or its nominee, CDS & Co., will receive their dividend in Canadian dollars, calculated based on the Bank of Canada daily average exchange rate on December 31, 2025. Registered shareholders resident outside of Canada as reflected in Nutrien's shareholders register, including the United States, as well as beneficial holders whose intermediary is a participant in The Depository Trust Company or its nominee, Cede & Co., will receive their dividend in US dollars. However, registered shareholders of Nutrien may elect to change the currency of their dividend payments to US dollars or Canadian dollars, as applicable. In addition, Nutrien offers registered shareholders direct deposit by electronic funds transfer for dividend payments.

Registered shareholders may elect to change the currency of their dividend and enroll for direct deposit by contacting, Nutrien's registrar and transfer agent, Computershare Investor Services Inc., directly ( 1-800-564-6253 or service@computershare.com ). Beneficial shareholders should contact their broker or other intermediary to determine the ability and necessary steps involved in an election to change the currency of their dividend payment. For further details, please visit www.nutrien.com/investors/shareholder-information/dividends .

All dividends paid by Nutrien are, pursuant to subsection 89(14) of the Income Tax Act (Canada), designated as eligible dividends.

About Nutrien

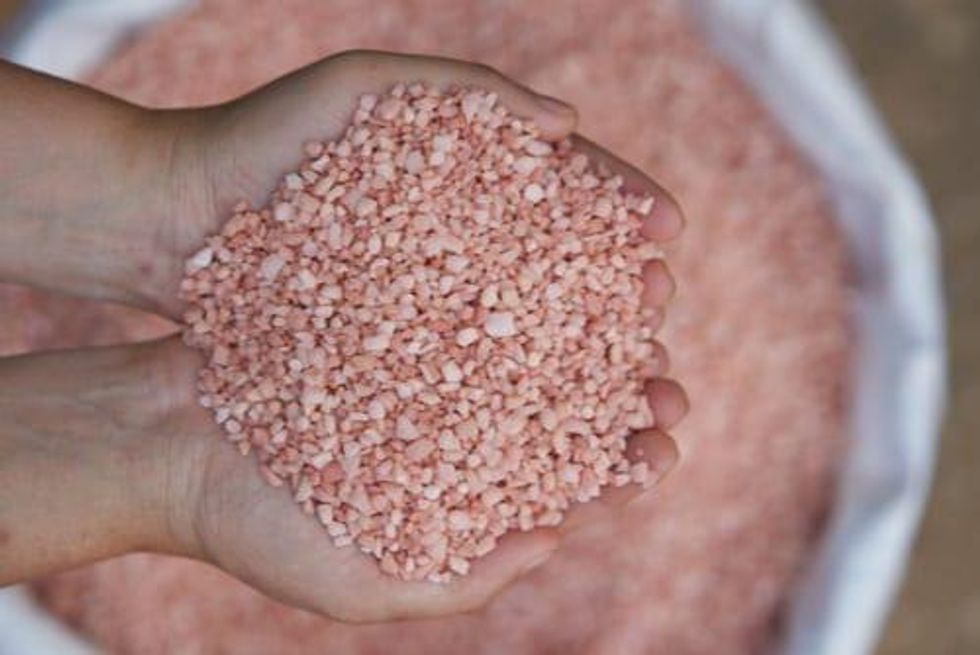

Nutrien is a leading global provider of crop inputs and services. We operate a world-class network of production, distribution and ag retail facilities that positions us to efficiently serve the needs of growers. We focus on creating long-term value by prioritizing investments that strengthen the advantages of our business across the ag value chain and by maintaining access to the resources and the relationships with stakeholders needed to achieve our goals.

View source version on businesswire.com: https://www.businesswire.com/news/home/20251104207292/en/

FOR FURTHER INFORMATION

Jeff Holzman

Senior Vice President, Investor Relations and FP&A

(306) 933-8545 – investors@nutrien.com

Contact us at: www.nutrien.com