North Peak Resources Ltd. (TSXV: NPR,OTC:NPRLF) (OTCQB: NPRLF) (the "Company" or "North Peak") announces that it has begun investigations into the economic potential of the historic dumps within the Plan of Operations (PoO) of the Prospect Mountain Mine complex (the "Property").

The main dump, which sits in front of the main Diamond tunnel portal entrance is estimated to contain between 210,000-230,000 mt of material. Historical investigations from 2008 & 2010 included volume assessments, agitated leach and bulk density test work, have indicated that the material is fully oxidized and readily leachable with gold recoveries between 75-85%. Composite metallurgical samples from the various reports had feed grades averaging from a low of 0.76 g/t Au, 27.5 /t Ag to a high of 3.19 g/t, 34.46 g/t Ag (see the Company's Technical Report (described below) at pp. 42-44). The potential quantity and grade of the dump is conceptual in nature and there has been insufficient exploration to define a mineral resource and it is uncertain if further exploration will result in the target being delineated as a mineral resource.

North Peak will be initiating an aircore drill program on the dump to better characterize the grade distribution across the dump, which is expected to start in mid-September. A composite bulk sample will be sent to McLelland laboratories for metallurgical test work including column leach testing to allow a fuller investigation of the potential of the dumps for toll leach treatment offsite, which will take several months.

"The Diamond Tunnel dump represents a potentially valuable asset to the Company, particularly given the current gold prices. If the test work is successful, and other key elements are in place, it could give the Company a revenue stream to offset future exploration expenses whilst the Company follows up on the excellent drill results from the 2024 drilling campaign and continues to explore and expand the potential of Prospect Mountain", commented Rupert Williams, CEO.

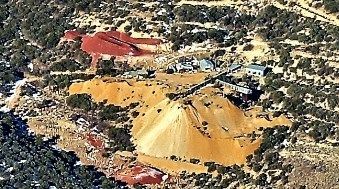

East Side of Prospect Mountain: Main Diamond Mine portal entrance and dumps

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9875/262826_6212883c2421e891_002full.jpg

Review by Qualified Person, Quality Control and Reports

Mr. David Pym, CGeol., Consulting Geologist for the Company, is the Qualified Person (QP), as defined under National Instrument 43-101 - Standards of Disclosure for Mineral Projects, who reviewed and approved scientific and technical disclosure in this press release. The Qualified Person has not reviewed the mineral tenure, nor independently verified the legal status and ownership of the Property or any underlying property agreements.

The QP has not independently verified the data in the underlying historical reports referenced in this news release as the original samples and assay certificates are not available. In the QP's opinion, the metallurgical test work was carried out by reputable accredited laboratories and the results are largely in agreeance, giving reasonable confidence in the historical data.

For further information, please contact:

| Rupert Williams, CEO Phone: +1-647-424-2305 Email: info@northpeakresources.com | Chelsea Hayes, Director Phone: +1-647-424-2305 Email: info@northpeakresources.com |

About North Peak

The Company is a Canadian based gold exploration and development company listed on the TSX Venture Exchange under the symbol "NPR" and the OTCQB under the symbol "NPRLF". Launched by the founding team behind both Kirkland Lake Gold and Rupert Resources, the team has a strong track record of acquiring mining assets, applying modern exploration techniques and taking

them into operational mines.

North Peak's flagship property is the Prospect Mountain Mine complex which lies in the Battle Mountain Eureka trend, in an area known as the Southern Eureka Gold Belt, where three styles of mineralization have been identified, gold, silver Carlin style mineralization, Carbonate Replacement gold, silver, lead, zinc mineralization (CRD) and carbonate hosted Porphyry Related Skarn lead, zinc

and gold mineralization associated with cretaceous intrusions. At the Property, the CRD mineralization is heavily oxidized to depths of at least 610m (2,000ft) below the top of the ridge line.

A Plan of Operations is in place which covers part of the Property and entitles an operator to pursue surface exploration (totaling 189 acres), underground mining of up to 365,000 tons per annum and certain infrastructural works. A more complete description of the Property's geology and mineralization, including at the Wabash area, can be found in the NI 43-101 Technical Report (the "Technical Report") on the Prospect Mountain Property, Eureka County, Nevada, USA dated and with an effective date April 10, 2023, prepared by David Pym (Msc), CGeol. of LTI Advisory Ltd. and Dr Toby Strauss, CGeol, EurGeol., of Merlyn Consulting Ltd., which has been filed on SEDAR+ at www.sedarplus.ca under the profile of the Company and on the Company's website.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS: This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward-looking statements include, but are not limited to, timing and completion of any exploration on the Company's properties, estimates of mineralization from drilling, sampling and geophysical surveys, geological information projected from drilling and sampling results and the potential quantities and grades of the target zones, the potential for minerals and/or mineral resources and reserves, intentions, beliefs, and current expectations of the Prospect Mountain Mine complex and the Company, including with respect to the future business activities and operating performance of the Company that may be described herein. Forward-looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations or intentions regarding the future. Such information can generally be identified by the use of forwarding-looking wording such as "may", "expect", "estimate", "anticipate", "intend", "believe" and "continue" or the negative thereof or similar variations. Readers are cautioned not to place undue reliance on forward-looking statements, as there can be no assurance that the plans, intentions or expectations upon which they are based will occur.

By their nature, forward-looking statements involve numerous assumptions, known and unknown risks and uncertainties, both general and specific, that contribute to the possibility that the predictions, estimates, forecasts, projections and other forward-looking statements will not occur. These assumptions, risks and uncertainties include, among other things, the state of the economy in general and capital markets in particular, accuracy of assay results, geological interpretations from drilling results, timing and amount of capital expenditures; performance of available laboratory and other related services, future operating costs, and the historical basis for current estimates of potential quantities and grades of target zones, as well as those risk factors discussed or referred to in the Company's Management's Discussion and Analysis for the year ended December 31, 2024 and the period ended March 31, 2025 available at www.sedarplus.ca, many of which are beyond the control of the Company. Forward-looking statements contained in this press release are expressly qualified by this cautionary statement.

The forward-looking statements contained in this press release are made as of the date of this press release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Additionally, the Company undertakes no obligation to comment on the expectations of, or statements made by, third parties in respect of the matters discussed above.

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/262826