July 16, 2023

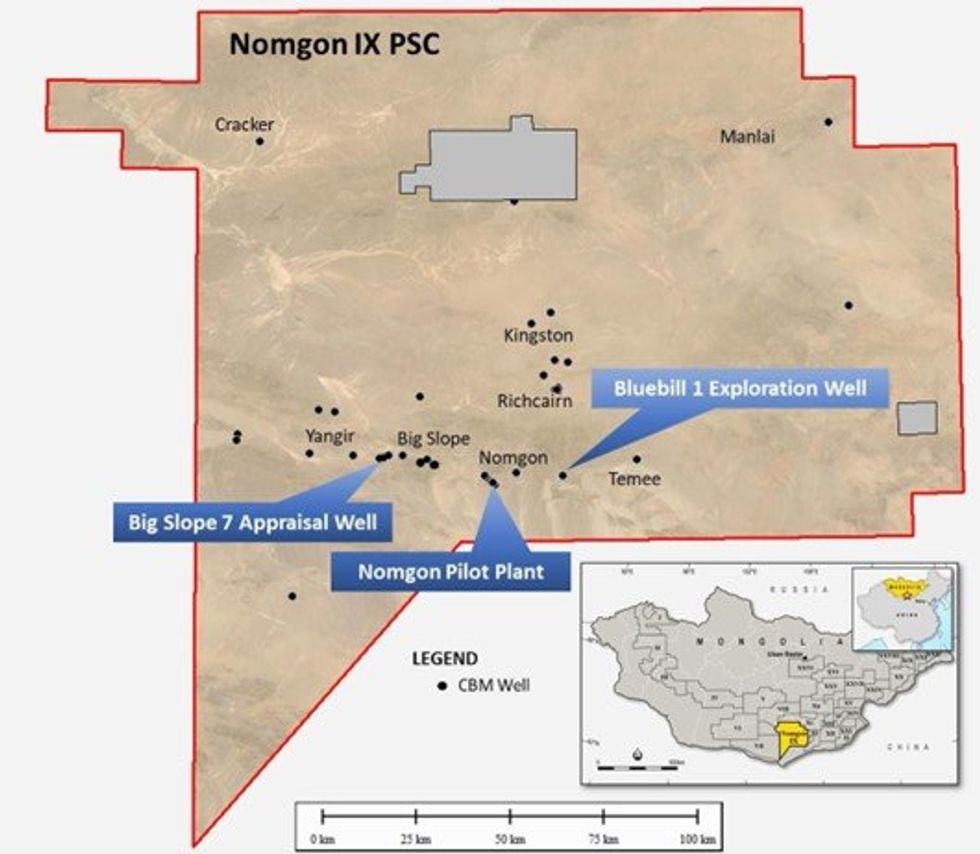

Elixir Energy Limited (“Elixir” or the “Company”) is pleased to provide an operations update on the work currently underway in its 100% owned Nomgon IX Coal Bed Methane (CBM) Production Sharing Contract (PSC) in the South Gobi Basin, Mongolia.

HIGHLIGHTS

- Big Slope-7 appraisal well intersects gassy coal and is currently undergoing injectivity testing

- Bluebill-1S exploration well intersects coal

- Pilot production project continues with planning for another well on foot

The Big Slope-7 appraisal well spudded just over a week ago and has already intersected gaseous coal. The well is now undergoing Injectivity Fall Off Testing (IFOT) to measure permeability in this upper coal section. Big Slope 7 is situated west of the Big Slope-4 well drilled in 2022 and has a planned total depth (TD) of 800 metres. Big Slope-4 intersected > 50 metres of coal. The well is being drilled by Mongolian drilling contractor Erdene Drilling LLC (ED) and is the first of a number of wells ED is contracted to Elixir for drill in the region.

Exploration drilling progresses at Bluebill-1. The well has intersected gaseous coal, with drilling ongoing.

Operations at the Nomgon extended pilot test continue, with water production ongoing at sustained rates. Planning for a new well in the pilot is advancing, with contract negotiations with drilling contractors and various regulatory processes well underway.

Last month Elixir engaged the services of the THREE60 Energy Group to assist with the production management of the Pilot and to boost the Company’s drilling support. See more on THREE60 below.

Elixir’s Managing Director, Mr Neil Young, said: “It is a pleasure this year to be working with Erdene Drilling again – they were pioneer drilling contractors with us from 2019 to 2021 – but took a break from CBM work for a year after that. We look forward to the results of the appraisal drilling program over the coming months. Drilling results from both wells underway are encouraging – if successful could open up significant new areas to the East and West of Nomgon.”

Click here for the full ASX Release

This article includes content from Elixir Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EXR:AU

The Conversation (0)

02 May 2024

Elixir Energy

Early-mover in natural gas exploration and appraisal in Australia and Mongolia.

Early-mover in natural gas exploration and appraisal in Australia and Mongolia. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00