Nickel Price Update: Q1 2023 in Review

How has nickel performed so far this year? Read our quarterly update to find out what factors have been driving the metal.

Nickel prices declined more than 20 percent in the first three months of the year, and uncertainty and volatility are expected to continue rocking the sector as 2023 moves ahead.

Increasing supply from Indonesia and a slower-than-forecast demand rebound from China hit the market in Q1, creating a slowdown at a time when the industry is still recovering from last year’s London Metal Exchange (LME) meltdown.

What else happened to nickel in the first quarter of this year? Read on to learn what experts told the Investing News Network (INN) about supply and demand dynamics and what they're expecting for the rest of the year.

How did nickel prices perform in Q1?

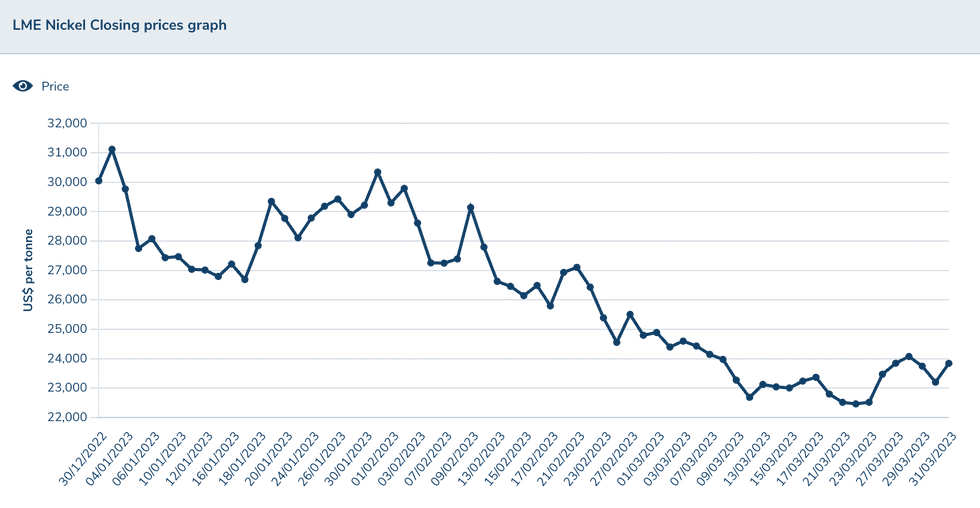

Nickel prices kicked off the year trading at the US$30,000 per metric ton (MT) level, hitting their highest point of the quarter on January 3 at US$31,118.

Nickel's Q1 2023 price performance.

Chart via the London Metal Exchange.

But the nickel market remained in a surplus during the first three months of 2023, with slightly lower-than-expected demand from top metals consumer China impacting prices.

“Nickel prices have remained volatile in 2023 with the US dollar strength and fears of a potential US banking crisis driving prices lower in the past month,” Ewa Manthey of ING told INN.

The base metal was unable to sustain gains throughout the three month period, falling steadily to reach its lowest quarterly mark on March 23, when it was changing hands for US$22,517.

“March’s double-digit percentage decline was likely driven by an adjustment between LME prices for Class 1 nickel and prices in the larger lower-grade nickel market,” FocusEconomics analysts said in their latest report. “Many analysts argue that the gap between the price of lower-grade nickel and the LME price has become too wide for the latter to be used in trades.”

Nickel market participants remain focused on what's ahead for the LME contract — the exchange had to suspend trading last year after prices climbed to US$100,000. Adding to the lack of liquidity it has been experiencing, the LME said in March that it discovered bags of stones instead of nickel in one of its warehouses.

“There remains considerable doubt regarding trust with the LME nickel contract,” Adrian Gardner of Wood Mackenzie told INN. “I doubt this sentiment will change until the court cases currently underway are concluded, and that will take months.”

For her part, Manthey expects LME nickel liquidity to remain thin, with prices staying volatile in the near term until the LME restores market confidence in its nickel contract.

“These illiquid trading conditions will continue to exacerbate the bearish drivers for nickel,” she said.

Prices closed the quarter trading at US$23,838, 20.6 percent lower than where they started the year.

“Prices ended up slightly softer than we expected,” Gardner said. In mid-December 2022, the firm was calling for a Q1 LME cash average price of US$27,190, but it ended up at US$26,065.

Nickel supply and demand dynamics in 2023

At the end of last year, analysts were expecting the nickel market to remain under pressure as a surplus in the market built up.

Production of stainless steel accounts for around 70 percent of nickel demand, and this is largely fueled by developing countries in the midst of infrastructure expansions. But Chinese demand during Q1 did not pick up as strongly as analysts had expected.

“In Europe and North America, stainless steel production has been tepid at best, and scrap utilization rates have been high, reducing the demand for primary nickel products,” Gardner said.

Demand was also not as strong for the battery segment. Nickel is a key element used in cathodes for electric car batteries, and many believe demand from this sector will increase significantly in the coming decades.

“China will be the key driver of nickel demand this year, helped by the reopening of its economy, with pent-up consumer demand expected to drive the country’s economic recovery,” Manthey said.

During the second quarter. Wood Mackenzie expects to see an 8 percent global demand growth compared to the first three months of the year, reaching 830,000 MT.

“That will be another quarterly global demand record, beating the prior record of 780,000 tonnes set in Q4 2022,” he said. “However, with refined supply also setting a new record at 870,000 tonnes, Q2 will still see a surplus in the market.”

Last year, Indonesia remained by far the largest producer of nickel, followed by the Philippines and Russia.

US Geological Survey data shows that estimated global nickel mine production increased by about 20 percent in 2022, reaching 3.3 million MT; almost all of the increased production was attributed to Indonesia.

“The nickel market will remain in surplus over the medium term on the back of strong supply growth in Indonesia,” Manthey said.

For its part, Wood Mackenzie expects primary refined nickel supply to increase by over 11 percent in 2023 compared to 2022, rising to 3.482 million MT.

“That 11 percent growth could be conservative, given the amount of projects that intend to come on stream this year,” Gardner said. “However, the biggest challenge will be demand – can current offtake rates accommodate so much more material? We doubt that it can, and so the question will be which suppliers moderate their own growth/expansions in order to protect prices.”

Indonesia's role in the nickel space

Indonesia has been gaining attention from investors in the nickel space for some months, particularly when it comes to the role the country could play in the battery space. Reuters data shows that the country has signed more than a dozen deals worth over US$15 billion for battery materials and EV production.

“For the next 18 months or so, the headlines out of Indonesia will focus on the mining and processing of nickel semi-manufactured products of mixed hydroxide precipitate and matte, which will, for the most part, be exported to China for further processing into nickel sulfate or metal,” Gardner said.

But into the second half of 2024 and beyond, the analyst expects to see further investments in value-added sectors within Indonesia, taking that mixed hydroxide precipitate and matte into refined sulfate and then into precursors and cathode active materials.

“Most of the investments in such downstream activities … remain in the discussion phases, but Indonesia is in a hurry for all this investment, yet construction takes longer than one thinks,” Gardner said. “Indonesia also needs to work out if it wants to diversify its sources of investment to include other western partners.”

But one serious challenge that the expert sees for Indonesia is the global — excluding China — perception of how “green” it is to get nickel into batteries made entirely in Indonesia versus coming from recycled batteries in Europe or North America.

“There’s a lot of financial backing available to companies wanting to invest in the truly green battery space, but is Indonesia positioning itself to be sufficiently attractive to be a contender to receive it?” he said.

What's ahead for the nickel market in 2023?

Looking ahead, FocusEconomics analysts believe nickel prices should decline this year, but remain well above their 10 year average. Panelists at the firm see the metal averaging US$22,973 in Q4 of this year, and US$22,131 in the same quarter in 2024.

Meanwhile, ING expects nickel to gradually move higher over the course of 2023, averaging US$25,250 in for the year.

“However, price gains are likely to be capped by rising Indonesian production, keeping the market in a surplus this year,” Manthey said.

For its part, Wood Mackenzie is forecasting an average Q2 price of US$22,900.

“We really need to see Chinese and European stainless steel demand pick up,” Gardner said. “Everyone talks about batteries, but stainless steel still accounts for 65 to 70 percent of primary nickel demand.”

Another factor to keep in mind, according to the analyst, is high and rising interest rates, which make everyone cautious about buying or investing in industrial metals assets and products.

“And holding nickel and/or stainless steel products in inventory at high 'costs' at a time of such high interest rates and tepid demand is not for the faint hearted,” he said.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Nickel Price Hits Record US$100,000 on Short Squeeze, LME Suspends Trading ›

- Top 5 Nickel Stocks on the TSX and TSXV in 2022 ›

- Nickel Price 2022 Year-End Review ›