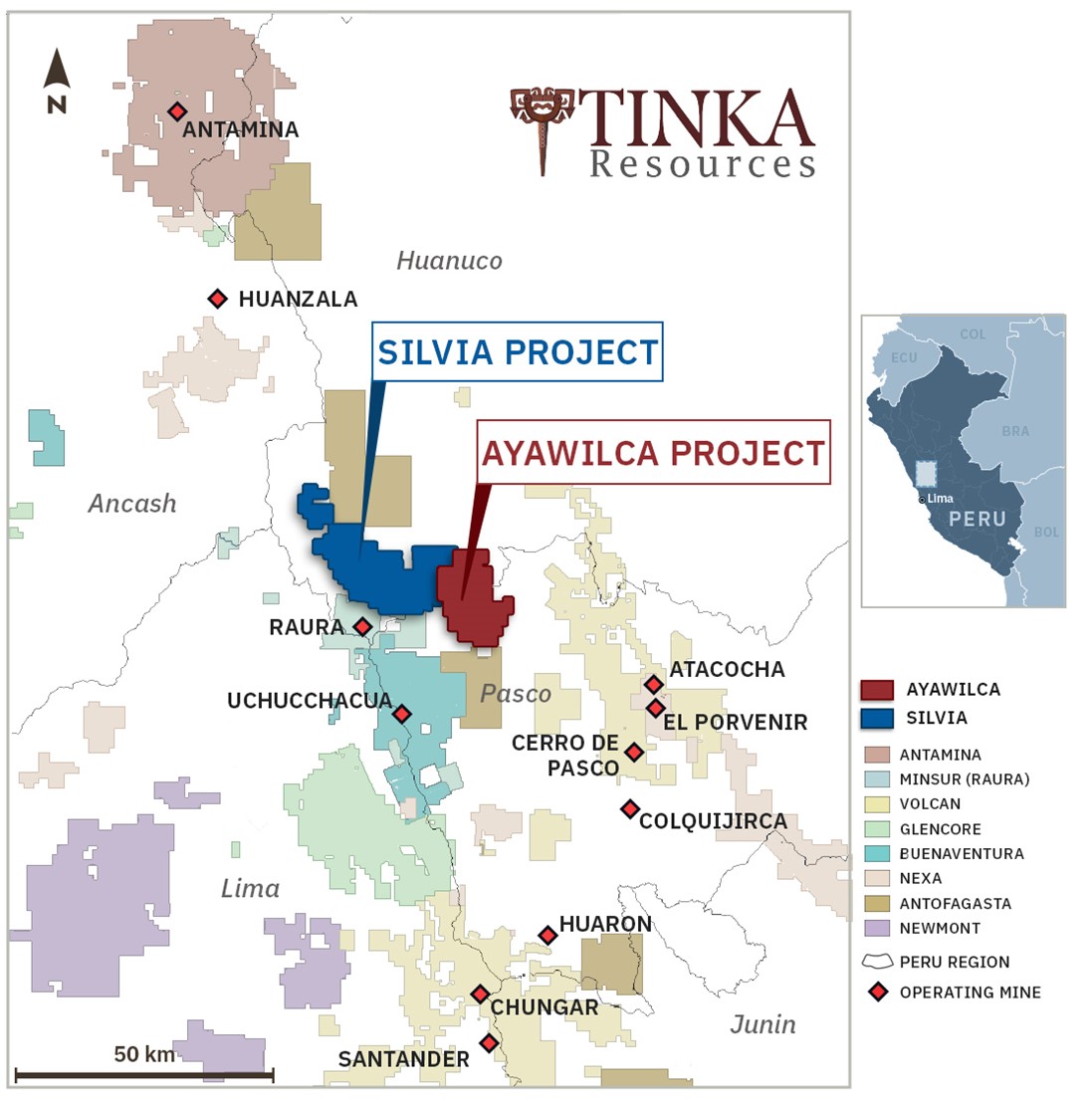

Tinka Resources Limited (" Tinka " or the " Company ") ( TSXV:TK)(BVL:TK )( OTCQB:TKRFF ) is pleased to announce the signing of a definitive agreement ( the "Agreement") with BHP World Exploration Inc. Sucursal del Peru (" BHP ") pursuant to which Tinka, through its wholly-owned subsidiary Darwin Peru S.A.C. (" Darwin "), has acquired a 100% interest in the Silvia copper-gold-zinc exploration project (the " Silvia Project "). The Silvia Project consists of 29,500 hectares of mining concessions believed to be prospective for large copper-gold-zinc skarn and porphyry copper deposits, lying immediately adjacent to the Company's 100%-owned Ayawilca zinc-silver project in central Peru. Tinka now controls over 46,000 hectares of contiguous mining concessions in central Peru, one of the world´s most prolific base metal belts - see Figure 1

The Silvia Project lies ~80 km south and along strike of Antamina, one of the largest copper mines in Peru and the world's biggest skarn deposit (beneficially owned by BHP Group 33.75%, Glencore 33.75%, Teck 22.5% and Mitsubishi 10%). The project also lies immediately to the north of the Raura zinc-silver-lead-copper mine (owned by Minsur).

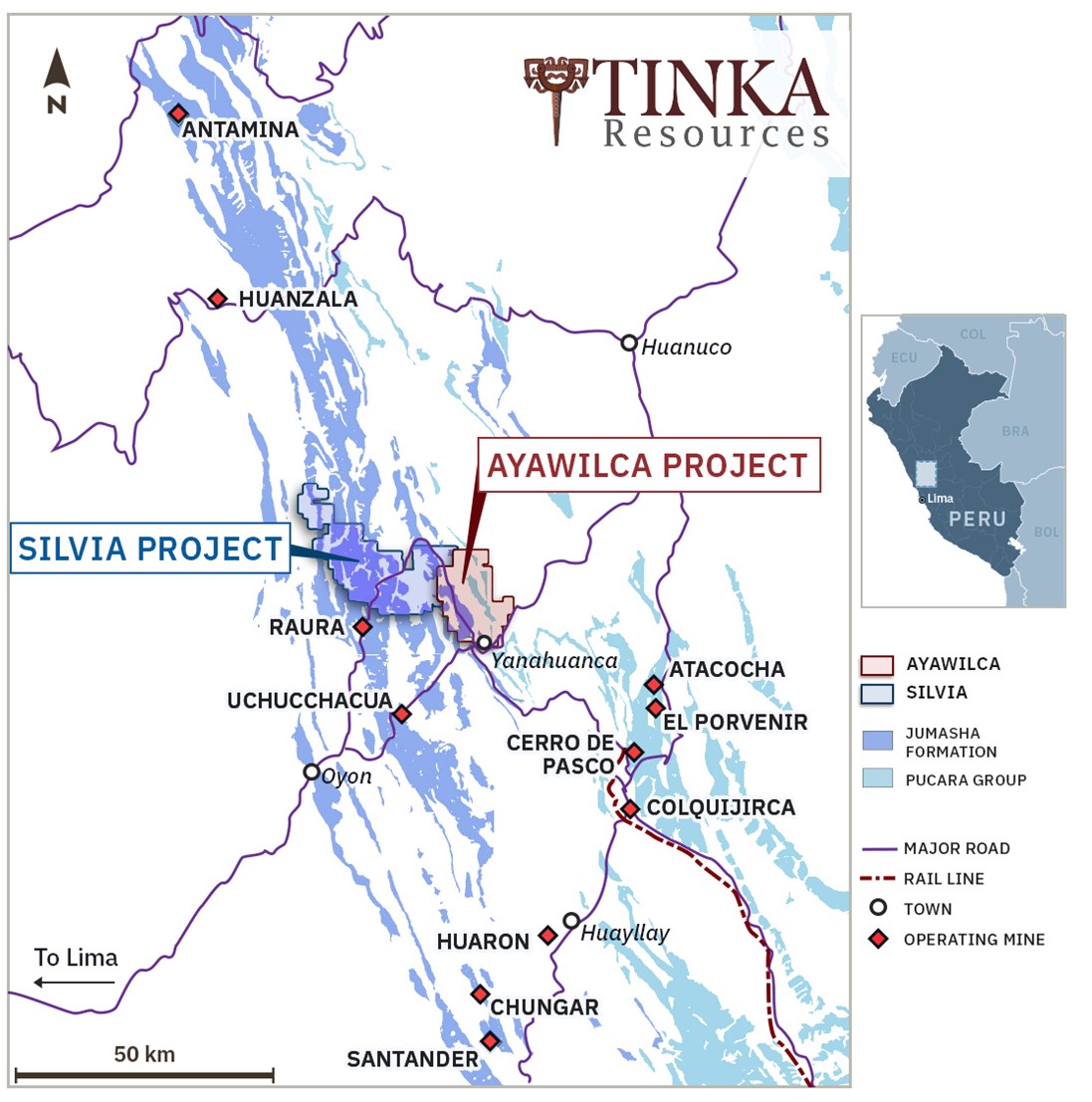

Greenfield exploration by BHP at the Silvia Project has identified copper-gold-zinc mineralization in outcropping skarns at two broad target areas both associated with coincident geophysical anomalies. Neither of these targets have been drill tested. Limestone belonging to the Jumasha Formation, the main host to the Antamina copper-zinc-silver skarn deposit, is widespread throughout the Silvia Project area - see Figure 2.

Key Highlights of the Silvia Copper-Gold Project

- Acquisition by Tinka of a 100% ownership of 29,500 hectares of contiguous mining concessions located in the Huanuco Andean region of central Peru immediately adjacent to the Company's Ayawilca project;

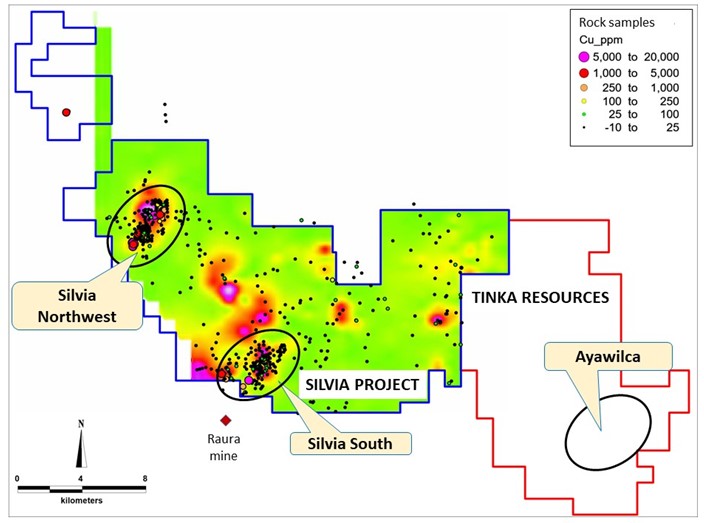

- The Silvia Project hosts two priority copper targets with outcropping skarn and coincident copper and geophysical anomalies at ‘Silvia Northwest' and ‘Silvia South' - see Figure 3;

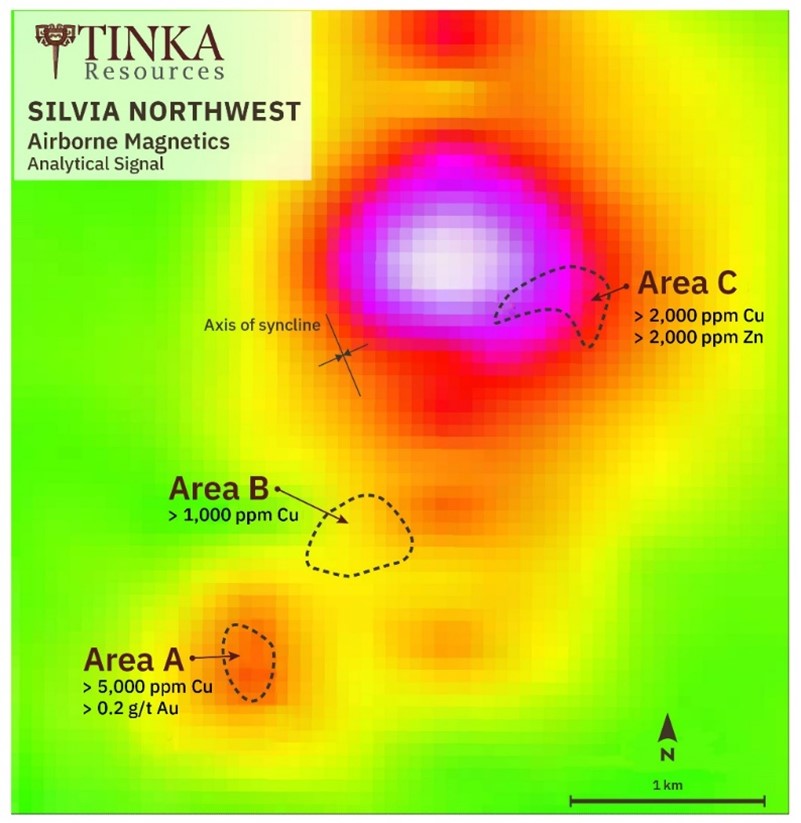

- At Silvia Northwest, copper-gold-zinc mineralized skarns outcrop over several hectares within three zones (Area A, Area B, Area C) along a 3 kilometre northeast trend associated with diorite and dacitic porphyry. High grade rock chip samples of skarn at Area A grade up to 1.9% copper, 0.9 g/t gold, and 3.9% zinc - see Figure 4;

- At Silvia South, copper-gold mineralized skarns outcrop over several hectares associated with monzodiorite porphyry with rock samples grading up to 1.4% copper and 0.3 g/t gold associated with magnetic anomalies;

- Regional and prospect scale datasets are included with the property acquisition. These datasets include:

- 320 line kilometres of project-wide airborne magnetics;

- 15 line kilometres of IP geophysical data;

- 64 line kilometres of ground magnetics; and

- 661 surface rock chip geochemical results - copper anomalous areas are highlighted in Figure 3.

Dr. Graham Carman, the CEO of Tinka, said: "The Silvia Project acquisition fits in very well with Tinka's vision of exploring for potential world-class base and precious metal discoveries in Peru. Tinka considers the Silvia Project to be highly prospective for large copper skarn and porphyry deposits, and we are thrilled to have acquired this exciting portfolio from BHP right next door to our flagship Ayawilca project. This acquisition triples the size of Tinka's mining concessions in central Peru, turning the Company into one of the largest landholders in this highly mineralized belt. The target limestone at the Silvia Project is the Jumasha Formation which hosts the giant Antamina skarn deposit, while the Ayawilca deposit is hosted by the Pucara limestone."

"Tinka plans to move forward with the exploration for copper at the Silvia Project while work progresses at the Ayawilca zinc-silver project and specifically the preliminary economic assessment (" PEA "). Given the close proximity to Ayawilca, Tinka's exploration team can access the copper targets at the Silvia Project from our existing camp facilities, simplifying logistics and minimizing exploration costs."

"Tinka remains firmly committed to creating value through mineral exploration in Peru, and we believe that mining will continue to be a mainstay of the country´s economy and development in the future. We also believe that we will continue to advance our exploration projects while working together constructively with our stakeholders. We look forward to commencing our field programs at the Silvia Project as soon as possible."

Terms of the Silvia Project Acquisition

- 100% of the right and title of 35 granted mining concessions (plus 2 applications) to be transferred to Darwin;

- Darwin has made a one-time cash payment to BHP. No other milestone payments are required;

- BHP retains a 1% NSR royalty over the Silvia Project, which may be repurchased by Darwin;

- Darwin is required to keep all mining concessions in good standing, with BHP retaining the right of first refusal on any mining concession that Darwin wishes to relinquish.

Silvia Project Target Details

Silvia Northwest target

At Silvia Northwest, three areas of outcropping copper mineralization occur along a northeast-southwest trend encompassing a broad area of approximately 3.0 km by 1.0 km, each area referred to as Areas A, B, and C respectively - see Figure 3. Copper mineralization is associated with skarn alteration of Upper Cretaceous Jumasha Formation limestone and various intrusive and sub-volcanic rocks including diorite and dacitic porphyry. Coincident magnetic anomalies are interpreted to reflect the underlying intrusive rocks and, possibly, magnetite or pyrrhotite associated with the mineralization.

At Area A, previous exploration identified copper-bearing skarn mineralization over a surface area of approximately 0.4 km by 0.2 km associated with altered dacitic porphyry. The skarn consists mostly of garnet and pyroxene accompanied by chlorite, biotite, quartz and magnetite. Sulphide minerals include chalcopyrite, pyrite, pyrrhotite, chalcocite and rare bornite. Copper oxide (malachite) is common. Copper values from 13 rock chip samples of skarn and altered porphyry at Area A range from 0.02% to 1.90% Cu; Gold values range from

At Area B, skarn alteration outcrops sporadically over an area of approximately 0.7 km by 0.7 km associated with quartz diorite and porphyritic andesite dikes. Extensive areas of white and grey marble surround the intrusive and skarn rocks. Fine grained hornfels alteration interpreted to be caused by thermal metamorphism is associated with silty limestone of the younger Celendin Formation in the axis of a synclinal fold. Copper values from 28 rock chip samples of skarn at Target B range from 0.02% to 1.09% Cu; Gold values range from

At Area C, copper-bearing skarn occurs in sporadic outcrops over a surface area of approximately 0.5 km by 0.3 km together with outcrops of diorite and dacitic porphyry. Garnet skarn has been mapped around the contact of dacitic porphyry surrounded by a wide area of white and grey marble. Copper values from 13 rock chip samples from outcrop of skarn at Target C range from

Silvia South target

At Silvia South, skarn alteration is exposed in numerous sporadic outcrops along a northeast-southwest trend within an area of approximately 3.7 km x 0.8 km associated with outcropping diorite and monzodiorite porphyry. Garnet and pyroxene skarns are associated with minor sulphides (pyrite, chalcopyrite) and sporadic malachite.

Copper values from 23 samples of outcropping skarn at Silvia South range from

Figure 1. Selected mining concession holdings in central Peru highlighting Tinka's Ayawilca and Silvia Projects

Figure 2. Map of major limestone formations in central Peru highlighting Tinka's Ayawilca and Silvia Projects

Figure 3. Silvia Project rock chip copper geochemistry (on airborne magnetic analytic signal image)

Figure 4. Maps of the Silvia Northwest target area at same scale.

- Simplified geological map.

- Analytical signal magnetic anomalies (note: hot colours are the modelled locations of the magnetic sources)

On behalf of the Board,

" Graham Carman "

Dr. Graham Carman, President & CEO

Investor Information:

www.tinkaresources.com

Rob Bruggeman 1.416.884.3556

rbruggeman@tinkaresources.com

Company Contact:

Mariana Bermudez 1.604.699.0202

info@tinkaresources.com

About Tinka Resources Limited

Tinka is an exploration and development company with its flagship property being the 100%-owned Ayawilca zinc-silver-tin project in central Peru. The Zinc Zone deposit has an estimated Indicated mineral resource of 11.7 Mt grading 6.9% zinc, 15 g/t silver & 0.2% lead and an Inferred mineral resource of 45.0 Mt grading 5.6% zinc, 17 g/t silver & 0.2% lead (dated November 26, 2018). The Tin Zone has an estimated Inferred mineral resource of 14.5 Mt grading 0.63% tin (dated November 26, 2018). A Preliminary Economic Assessment (PEA) for the Zinc Zone was released on July 2, 2019 ( news release ). The Company has announced its intention to update the resource estimation and PEA by the end of 2021.

Forward Looking Statements: Certain information in this news release contains forward-looking statements and forward-looking information within the meaning of applicable securities laws (collectively "forward-looking statements"). All statements, other than statements of historical fact are forward-looking statements. Forward-looking statements are based on the beliefs and expectations of Tinka as well as assumptions made by and information currently available to Tinka's management. Such statements reflect the current risks, uncertainties and assumptions related to certain factors including, without limitations: timing of planned work programs and results varying from expectations; delay in obtaining results; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; equipment failure, unexpected geological conditions; imprecision in resource estimates or metal recoveries; success of future development initiatives; competition and operating performance; environmental and safety risks; the Company's expectations regarding the Ayawilca Project PEA; the political environment in which the Company operates continuing to support the development and operation of mining projects; risks related to negative publicity with respect to the Company or the mining industry in general; the threat associated with outbreaks of viruses and infectious diseases, including the novel COVID-19 virus; delays in obtaining or failure to obtain necessary permits and approvals from local authorities; community agreements and relations; and, other development and operating risks. Should any one or more of these risks or uncertainties materialize, or should any underlying assumptions prove incorrect, actual results may vary materially from those described herein. Although Tinka believes that assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein. Except as may be required by applicable securities laws, Tinka disclaims any intent or obligation to update any forward-looking statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release

SOURCE: Tinka Resources Ltd.

View source version on accesswire.com:

https://www.accesswire.com/655033/Tinka-Triples-Property-at-Ayawilca-With-Acquisition-of-the-Silvia-Copper-Project