CMC Metals Ltd. (TSX-V:CMB), (Frankfurt:ZM5N), (OTC PINK:CMCZF); (the "Company") announces an update of exploration at its flagship Silver Hart Project in Yukon

Kevin Brewer, P.Geo. President and CEO notes, "The SkyTEM airborne geophysical survey identified several attractive drill targets new areas for us at Silver Hart and Blue Heaven in areas that prior to this field season had never been explored. Subsequently, we have completed geochemical surveys, mapping and prospecting over these areas to help further delineate the potential of these zones, all of which we eventually plan to drill. It has been a challenging start for many explorationists in Yukon due to very high snowfall levels this past winter, but fortunately we still expect to complete Phase 1 of the drill program. For the first time CMC is investigating the potential for higher tonnage carbonate replacement deposits that have been speculated to exist in the Silver Hart area, but never pursued with systematic exploration efforts. Our geophysical investigations, combined with our modelling efforts, geochemical, and geological data has served to identify several areas with the potential to host CRD style mineralization. Such a discovery would add significant resources to this project. Our drilling efforts this season will begin to test CRD style targets as well as explore extensions of the Main Zone at depth and along strike. We remain confident that this program will result in a significantly increased understanding of the true potential of this project and increase our known high-grade silver-lead-zinc +/- copper +/- gold resources at Silver Hart and Blue Heaven."

To date the exploration program has:

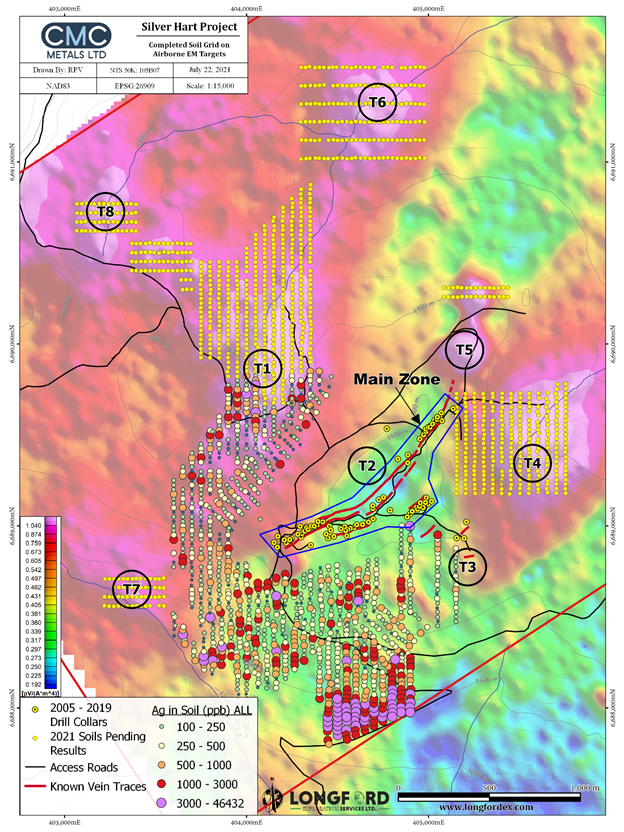

- Completed a geochemical soil sampling program that has collected approximately 1,084 soils over six of the anomalies identified by the SkyTem airborne geophysical survey. The closely spaced soil survey (see attached figure) was designed to detect silver-lead-zinc vein structures and potential carbonate replacement deposit (CRD) style mineralization.

- Geological mapping, prospecting, and rock sampling (176 rocks) over all exploration targets which has served to locate new strata-bound mineral occurrences in favorable limestone and diopside skarn horizons. Carbonate beds are overlain by quartz muscovite schist providing a cap for potential CRD mineralization. All targets are confirmed to be in close proximity to the underlying Cassiar Batholith (the "heat source). The detailed mapping will assist in planning future drill targets.

- Completion of excavator trenching which has exposed the uppermost carbonate beds in several locations which are overlain by siliceous schist. Within the trenches, mineralization has been observed and has been noted to consist of disseminated to semi-massive sphalerite (zinc sulfide), galena (lead sulfide) and pyrrhotite present within diopside skarn, limestone and quartz veins found along the contact.

- SkyTem targets T4, T5 and T6 lie along strike of each other and are situated on the uppermost calcareous unit in the local stratigraphy. T5 is directly along strike of the high-grade silver-lead-zinc veins in the Main Zone, produced the strongest electromagnetic anomaly on the property, and therefore presents an attractive exploration target.

- Vein fault structures have also been encountered on trend with several of the airborne anomalies. These structures historically have proven to be important components of the defined high grade silver-lead-zinc +/-copper +/- gold mineralization within the Main zone.

Figure 1: Highlighting the key target areas.

In addition, CMC is seeking partners for both its Rancheria South project in British Columbia and its Bridal Veil Project in Newfoundland. The Rancheria South Project consist of three property areas that we have previously noted to have known high grade silver-lead-zinc showings. Bridal Veil is known to host high grade copper-lead-silver +/- gold mineralization in veins and a unexplained geophysical anomaly. Only a small portion of the property to date has been explored. In both projects a partner is being sought so that required exploration efforts can be initiated in the foreseeable future.

John Bossio, Chairman noted, "The significance of the major gold discovery by Newfound Gold and the current exploration rush in the central Newfoundland area has made us realize that we should elevate our attention on Bridal Veil. Bridal Vein is in the Gander zone, has documented high grade copper-lead-silver veins of possible orogenic origin, and only the southern portion of this property has been explored to date. The Newfoundland Geological Survey prepared a report on the property and prospecting and geophysical efforts have served to identify a significant anomaly which is yet to be explained. The property is traversed by the Trans Canada Highway and is located 10 kilometers east of the community of Gander. As we wish to maintain our focus on our flagship Silver Hart project, we have decided to seek a partner for Bridal Veil as it clearly merits advanced exploration. With or without partners, we will conduct exploration on both of our Newfoundland properties, Bridal Veil and Terra Nova, this fall and our field crews will be commencing work on our Rancheria South project next week. It is important that the potential of our portfolio be identified further at this time so that their value will start to be recognized."

Qualified Person

Kevin Brewer, a registered professional geoscientist in BC, Yukon and Newfoundland, is the Company's President and CEO, and Qualified Person (as defined by National Instrument 43-101). He has approved the technical information reported herein. The Company is committed to meeting the highest standards of integrity, transparency and consistency in reporting technical content, including geological reporting, geophysical investigations, environmental and baseline studies, engineering studies, metallurgical testing, assaying and all other technical data.

About CMC Metals Ltd.

CMC Metals Ltd. is a growth stage exploration company focused on opportunities for silver in Yukon and British Columbia and polymetallic deposits in Yukon and Newfoundland. Our silver-lead-zinc prospects include the Silver Hart Deposit and Blue Heaven claims (the "Silver Hart Project") and the recently acquired Rancheria South, Amy and Silverknife claims (the "Rancheria South Project"). Our polymetallic projects with potential for copper-silver-gold and other metals include Logjam (Yukon), Bridal Veil and Terra Nova (both in Newfoundland).

On behalf of the Board:

"John Bossio"

John Bossio, Chairman

CMC METALS LTD.

For further information concerning the CMC Metals Ltd., or its exploration projects, please contact:

Investor Inquiries:

Kevin Brewer, P. Geo.

President, CEO and Director

Tel: (604) 605-0166

kbrewer80@hotmail.com

To be added to CMC's news distribution list, please send an email to info@cmcmetals.ca or contact Mr. Kevin Brewer at 604-605-0166.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

"This news release may contain certain statements that constitute "forward-looking information" within the meaning of applicable securities law, including without limitation, statements that address the timing and content of upcoming work programs, geological interpretations, receipt of property titles and exploitation activities and developments. In this release disclosure regarding the potential to undertake future exploration work comprise forward looking statements. Forward-looking statements address future events and conditions and are necessarily based upon a number of estimates and assumptions. While such estimates and assumptions are considered reasonable by the management of the Company, they are inherently subject to significant business, economic, competitive and regulatory uncertainties and risks, including the ability of the Company to raise the funds necessary to fund its projects, to carry out the work and, accordingly, may not occur as described herein or at all. Actual results may differ materially from those currently anticipated in such statements. Factors that could cause actual results to differ materially from those in forward looking statements include market prices, exploitation and exploration successes, the timing and receipt of government and regulatory approvals, the impact of the constantly evolving COVID-19 pandemic crisis and continued availability of capital and financing and general economic, market or business conditions. Readers are referred to the Company's filings with the Canadian securities regulators for information on these and other risk factors, available at www.sedar.com. Investors are cautioned that forward-looking statements are not guarantees of future performance or events and, accordingly are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty of such statements. The forward-looking statements included in this news release are made as of the date hereof and the Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable securities legislation."

SOURCE: CMC Metals Ltd.

View source version on accesswire.com:

https://www.accesswire.com/657643/CMC-Provides-Exploration-Update-on-Its-Silver-Hart-Project-Yukon