Western Resources Corp. (TSX: WRX) (the "Company") is pleased to report on the overall status of and progress on the Company's Milestone Potash Phase 1 Project (the "Project") operated by the Company's wholly-owned subsidiary, Western Potash Corp. ("Western"), and the Company's gradual phase out of its real estate investments from its business model in order to improve its financial position and refocus its efforts on the successful completion of the Project.

Since suspending construction of the Project in May of last year, Western has continued advancing and optimizing its mining operations. These are key to securing the remaining project financing required to complete the balance of plant construction. From April 28, 2020, when hot mining started, until its suspension on May 28 this year, Western's operation team has accumulated extensive experience and collected valuable mining data relevant to the application of its innovative solution mining technology. After extensive analysis of the data, and with the help of a number of leading solution mining experts, Western is developing an optimized solution mining plan.

The new plan is to focus on the increase of solution mining efficiency and life span of the mining caverns. To have those positive changes reflected in the overall economic assessment of the Project, Western has engaged a third-party engineering firm to review the operation plans and update its National Instrument 43-101 technical report. The updated report will also include an anticipated increase in the Project's mine life from 12 to 40 years. Key findings of the report are expected to be released by mid-October 2021.

In terms of financing, the Company would like to express its utmost thanks to all the contractors and suppliers for their kind understanding and support and we are pleased to note that majority of key creditors have agreed to extend Western's payment deadlines, which enables Western to focus on obtaining the investments necessary to secure Project financing. Although the Company and Western have been faced with certain challenges and uncertainties, our goal remains to complete Project financing by end of this year, which is expected to allow Western to pay off outstanding creditors, and to restart mining operations and Project construction.

In order to support the Company's liquidity, the Company commenced the process of selling its real estate investments earlier this year, with all property sales expected to close by the end of the 3 rd quarter of this year. Thereafter, the Company will focus its business efforts solely on the development of the Project.

About Western Resources Corp.

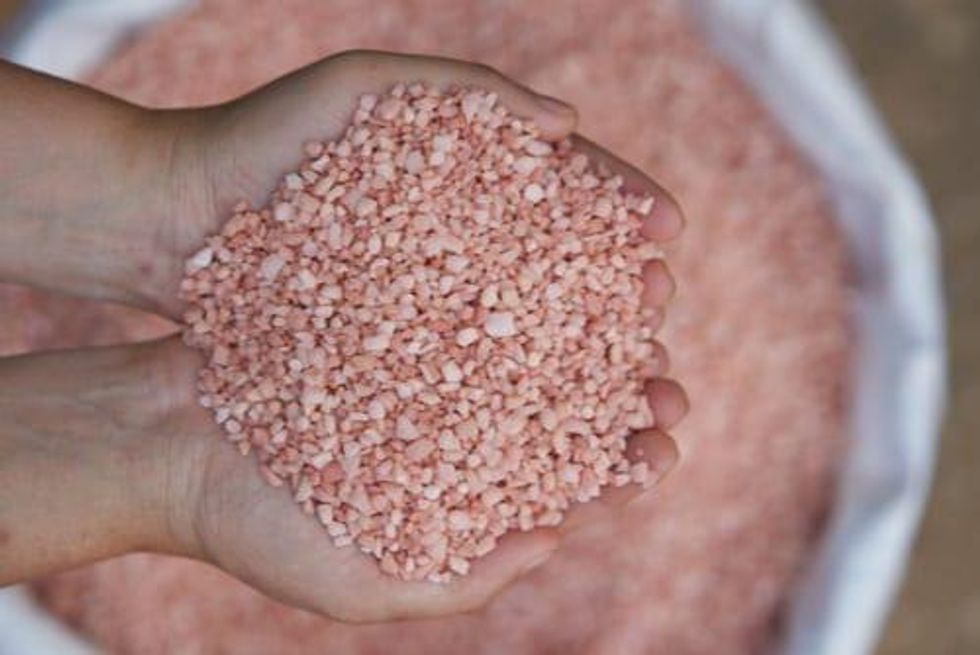

Western Resources Corp. (TSX: WRX) and its wholly owned subsidiary Western Potash Corp. are constructing what is expected will be Canada's newest and most innovative, environmentally friendly, and capital-efficient potash mine. This will be the first potash mine in the world that is expected to leave no surface salt tailings, reducing the water consumption by half as well as significantly improving energy efficiency. The Phase I Project is expected to move into production in 2022 (subject, among other things, to successful completion of additional project financing), and will form the basis for further expansions.

For more information on the Project, please refer to: www.westernpotash.com , or call Tel: 306-924-9378.

Cautions Regarding Forward-Looking Statements

Except for statements of historical fact relating to the Company, certain information contained herein constitutes "forward-looking information" under Canadian securities legislation. Forward-looking information includes, but is not limited to, statements with respect to the filing and results of the Technical Report. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results of the Company to be materially different from those expressed or implied by such forward-looking statements or forward-looking information. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information that is set out herein, except in accordance with applicable securities laws.