NOT FOR DISSEMINATION IN THE UNITED STATES OF AMERICA OR TO US WIRE SERVICES

Phase 2 drilling to start in january with Missinaibi DRILLING Services, an aboriginal-owned contractor

- Based on the very strong initial results from Phase 1, the Company now plans on launching Phase 2 in January

- The first half of Phase 1 was announced last week: extremely high-grade nickel (including 8.66% Ni over 1.11 metres (approximately equivalent to ~30 grams per ton gold at current metal prices)

- The pending Phase 1 assay results are expected to be received in early January, and will be released with the full details of the Phase 2 drill plan

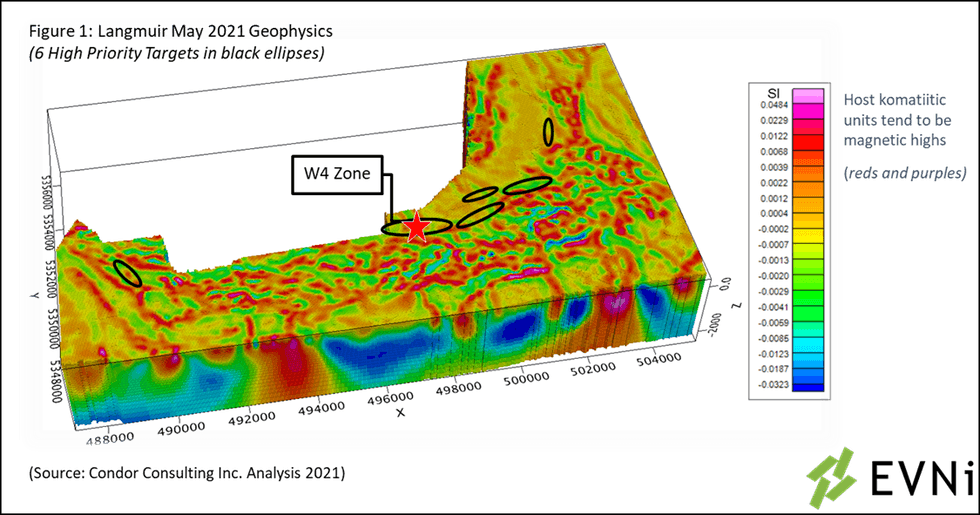

- 6 High Priority Geophysical Target areas were identified across the Langmuir Property

- Missinaibi Drilling Services are now contracted for a minimum of 10,000 metres, starting early in January, 2022

EV Nickel Inc. (TSX-V:EVNI) ("EVNi" or the "Company") is pleased to announce that based on the strength of the initial Phase 1 drilling results on the Langmuir Project ("Langmuir" or the "Property"), they will launch Phase 2 immediately in 2022 and have contracted Missinaibi Drilling Services Inc. ("MDS" or the "Drillers") for drilling Phase 2

MDS is a 100% aboriginally owned and operated company, based out of Timmins, Ontario. The Drillers have an excellent health, safety and environmental record and strong reputation for performance. MDS are a values-driven company and aligned with EV Nickel in terms of prioritizing an environmental, social and social governance ("ESG") focus.

"The first half of the Phase 1 assay results were very impressive and have the Company excited to get back into Langmuir immediately and continue learning more about the Property's mineralization," said Sean Samson, President & CEO of EVNi. "Missinaibi Drilling Services will be a great partner for us and there is excellent alignment between our two organizations."

"Phase 1 has demonstrated the potential of Langmuir, with high grade nickel and excellent nickel tenors expanding the mineralized trend to beyond the W4 Zone." states Paul Davis, EVNi's Vice President of Exploration. "We will review in further detail in January but high-level, Phase 2 will test additional High Priority Targets across Langmuir, opportunities to expand the W4 Mineralized Zone and provide a metallurgical sample for further testing."

Developing the Drilling Strategy - May 2021 Geophysics Review with Condor

Prior to any drilling this year, EVNI contracted Condor Consulting Inc., of Lakewood, Colorado ("Condor") and reprocessed airborne and borehole geophysical data available from Langmuir's prior exploration. Using modern systems and processing capabilities, Condor reviewed the Langmuir land package to prioritize opportunities, where they identified 16 electromagnetic ("EM") conductor trends across the property. From these EM conductor trends, 6 High Priority Targets ("HPT"s) were established. One of these HPTs correlates with the W4 Zone, location of the 2010 Historic Resource and target of a majority of drilling to date. In addition to W4, Condor developed 5 more HPTs for further exploration.

Phase 1 Drilling

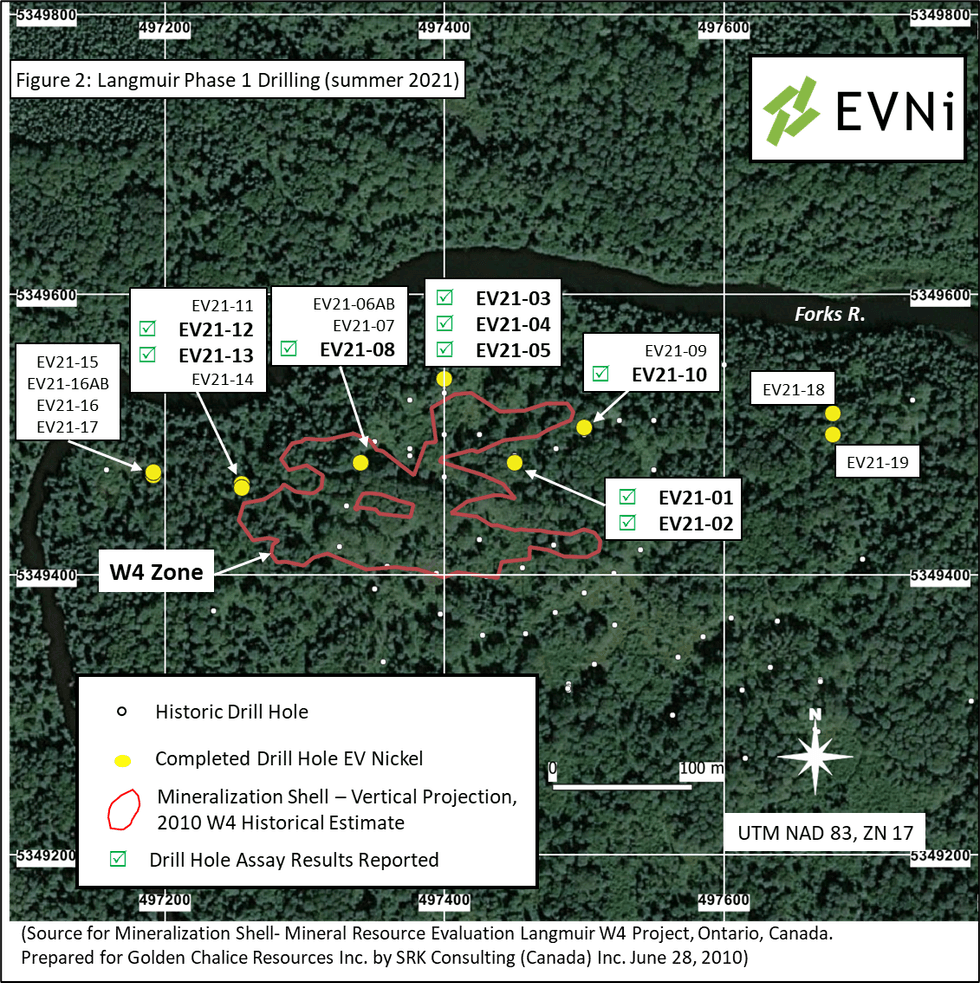

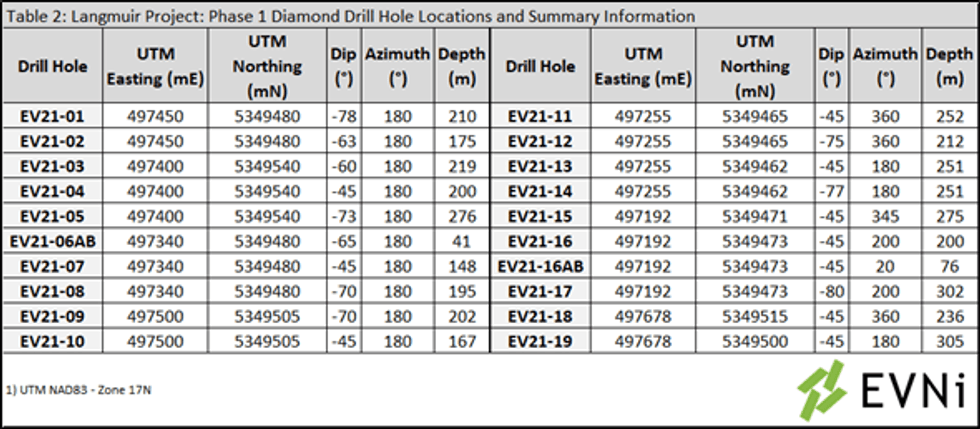

Phase 1 focussed within and proximal to the W4 Zone and was designed to test gaps within the historic drilling, provide representative intersections of the mineralization and test the favourable ultramafic horizon to the east and west of the W4 mineralization. Phase 1 totalled 20 holes, comprising 4,192 metres of diamond drilling.

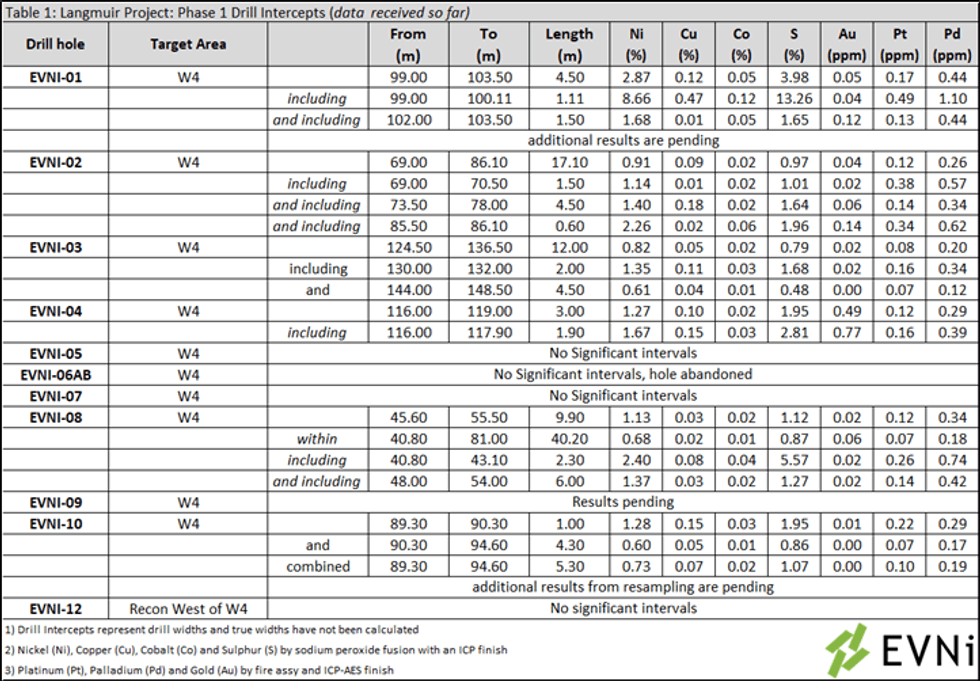

Results of the First Half of the Phase 1 Drilling

Last week the Company released assay results for 10 holes from Phase 1 (see December 8, 2021 news release entitled "EV Nickel Announces HIGH-GRADE NICKEL INTERSECTIONS from Langmuir Project") and are noted with checkmarks in Figure 2 above.

Included in last week's results was drill hole EV21-01, which intercepted 8.66% Ni over 1.11 metres and was located to the east of the 2010 W4 Historical Estimate. To emphasize the significance of this high grade nickel intersection, by comparison, using US$19,950 per tonne for nickel and US$1,780 per troy ounce for gold (market spot prices for December 9, 2021), this is an equivalent value to more than 30 grams per tonne gold.

In addition, EVNI has implemented the analysis of sulphur for all drill core samples, allowing the Company to determine the nickel tenor of the mineralization (nickel content in 100% sulphide). Nickel tenors determined to date are typically between 20% to 40% and are atypical of this style of nickel mineralization and indicate that pentlandite is the dominant sulphide mineral in the W4 Zone. These high nickel tenors are encouraging where significant nickel mineralization is associated with low sulphide concentrations of less than 5% and reflected in the very high nickel grades associated with the more massive sulphides as observed in EV21-01. This will be further examined with metallurgical analysis to be completed in 2022 to determine the recovery characteristics and the potential grades of a future nickel concentrate.

Upcoming Release of Drilling Information

The Company anticipates receiving the remainder of the Phase 1 results in early January.

In addition, EVNI plans to provide the full details of the Phase 2 drilling plan, also in January.

Assay QA/QC

Drill core samples from the 2021 drill program at the Langmuir Project are cut and bagged at the core logging facility located near the property and transported to ALS Canada Ltd for analysis. Samples, along with certified standards and blanks that are included by the Company for quality assurance and quality control, were prepared and analyzed at the laboratory. Samples are crushed to 70% less than 2mm. A riffle split is pulverized to 85% passing 75 microns. Nickel, copper, cobalt and sulphur are analyzed by sodium peroxide fusion with an ICP finish and platinum, palladium and gold by fire assay and ICP-AES finish. These and future assay results may vary from time to time due to re‒analysis for quality assurance and quality control.

CORRECTION- Option issuance to Insiders

A December 2, 2021 news release entitled "EV Nickel Update on Corporate Activity" stated, "The Company has issued 810,000 options at $0.75 to officers and directors of the Company, that shall vest at 25% every 6 months, for a total vesting schedule of two (2) years". This was incorrect. More accurately, the Company is still waiting on the TSXV to approve this award, as they wait to see where the share price settles.

About EV Nickel Inc.

EV Nickel is a Canadian nickel exploration company, focussed on the Shaw Dome area, south of Timmins, Ontario. The Shaw Dome area is home to its Langmuir project which includes W4, the basis of a 2010 historical estimate of 677K tonnes @ 1.00% Ni, ~15M lbs of Class 1 Nickel. EV Nickel's objective is to grow and advance a nickel business, targeting the growing demand for Class 1 Nickel, from the electric vehicle battery sector. EV Nickel has almost 9,100 hectares to explore across the Shaw Dome and has identified 30km of additional favourable strike length.

Qualified Person

The Company's Projects are under the direct technical supervision of Paul Davis, P.Geo., and Vice-President of the Company. Mr. Davis is a Qualified Person as defined by NI 43-101. He has reviewed and approved the technical information in this press release. There are no known factors that could materially affect the reliability of the information verified by Mr. Davis.

Cautionary Note Regarding the Langmuir project's 2010 historical estimate:

Historical mineral resources for Langmuir were estimated by SRK Consulting (Canada) Inc., as documented in a report entitled, "Golden Chalice Resources Inc., Mineral Resource Evaluation, Langmuir W4 Project, Ontario, Canada", dated June 28, 2010 (the "Historical Report"). A qualified person, as defined by NI 43-101, has not done sufficient work to verify the historical assay results and technical information reported herein. The Company is not treating the Historical Report as current. The reader is cautioned not to rely upon any of the Historical Report, or the estimates therein. The historical estimates are presented herein as geological information only, as a guide to follow-up technical work, and for targeting of confirmation and exploration drilling.

Cautionary Note Regarding Forward-Looking Statements:

This press release contains forward-looking information. Such forward-looking statements or information are provided for the purpose of providing information about management's current expectations and plans relating to the future. Readers are cautioned that reliance on such information may not be appropriate for other purposes. Any such forward-looking information may be identified by words such as "proposed", "expects", "intends", "may", "will", and similar expressions. Forward-looking statements or information are based on a number of factors and assumptions which have been used to develop such statements and information, but which may prove to be incorrect. Although EV Nickel believes that the expectations reflected in such forward-looking statements or information are reasonable, undue reliance should not be placed on forward-looking statements because the Company can give no assurance that such expectations will prove to be correct. Factors that could cause actual results to differ materially from those described in such forward-looking information include, but are not limited to, changes in business plans and strategies, market conditions, share price, best use of available cash, the ability of the Company to raise sufficient capital to fund its obligations under various contractual arrangements, to maintain its mineral tenures and concessions in good standing, and to explore and develop its projects and for general working capital purposes, changes in economic conditions or financial markets, the inherent hazards associated with mineral exploration, future prices of metals and other commodities, environmental challenges and risks, the Company's ability to obtain the necessary permits and consents required to explore, drill and develop its projects and if obtained, to obtain such permits and consents in a timely fashion relative to the Company's plans and business objectives, changes in environmental and other laws or regulations that could have an impact on the Company's operations, compliance with such laws and regulations, the Company's ability to obtain required shareholder or regulatory approvals, dependence on key management personnel, natural disasters and global pandemics, including COVID-19 and general competition in the mining industry. These risks, as well as others, could cause actual results and events to vary significantly. The forward-looking information in this press release reflects the current expectations, assumptions and/or beliefs of EV Nickel based on information currently available to the Company. Any forward-looking information speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking information, whether as a result of new information, future events or results or expressly qualified by this cautionary statement.

Contact Information

For further information, visit www.evnickel.com

Or contact: Sean Samson, Chief Executive Officer at info@evnickel.com.

EV Nickel Inc.

200 - 150 King St. W,

Toronto, ON M5H 1J9

www.evnickel.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy of this release.

SOURCE: EV Nickel Inc.

View source version on accesswire.com:

https://www.accesswire.com/677179/Phase-2-Drilling-to-Start-in-January-with-Missinaibi-Drilling-Services-an-Aboriginal-Owned-Contractor