Noram Lithium Corp. ("Noram" or the "Company") (TSX - Venture: NRM Frankfurt:N7R OTCQB:NRVTF) today announced the summary results of a National Instrument 43-101 compliant Preliminary Economic Assessment ("PEA") for the high-grade lithium deposit at its wholly-owned Zeus Lithium Project ("Zeus" or the "Project") located less than 1 mile from Albermarle's Silver Peak Mine, which is currently the only lithium production facility in the United States. The PEA was prepared by ABH Engineering ("ABH",) an independent engineering services firm with extensive experience in mining and mineral processing. All dollar values are in US dollars

PEA Highlights

- Robust Economics.

- $1.299 Billion Net Present Value ("NPV"). Base case after-tax Net Present Value ("NPV") of $1.299 billion (8% discount rate).

- 31% Internal Rate of Return ("IRR"). Base case after-tax IRR of 31%.

- Capital Costs ("CAPEX"). Estimated initial CAPEX of $528M with after-tax payback period of 3.23 years.

- Gross Revenue of $303.4 Million/year

- Low Operating Cost. Operating Cost ("OPEX") of $3,355.30/tonne Lithium Carbonate Equivalent ("LCE") with a break-even price of $4016.6/tonne LCE LOM.

- Long Mine Life ("LOM). The mine production rate during full operation is set at 17,000 tpd. The production schedule uses ore from the first 11 phases, which results in 40-year mine life ("LOM"). The mine production schedule results in 245.4 million tonnes averaging 1,093 ppm Li.

- Very Low Strip Ratio. Mining strip ratios are very low, averaging 0.07:1 for LOM. Mining consists of a truck and shovel method, with blasting being unnecessary due to the ore softness.

- Low Environmental Impact. The leaching and filtration flowsheet includes dry stack tailings, thus, eliminating the environmental risk and long-term management issues associated with tailings ponds.

- LCE market Price. Base case market price of $9500/tonne LCE is well below long term forecasted rate of $14,000/tonne[1].

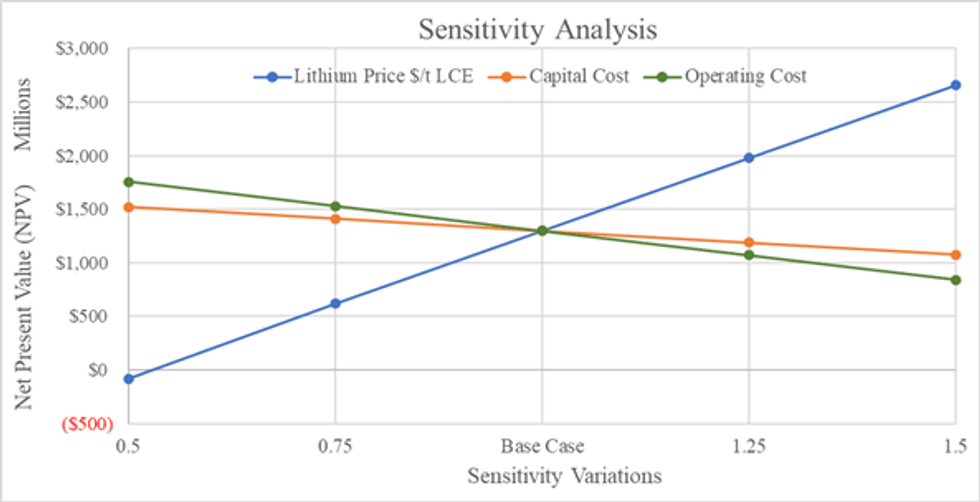

- Price Sensitivity. As noted in the sensitivity chart below, the after-tax NPV reaches $2.665 billion at $14,250/Tonne LCE (8% discount rate).

"We are thrilled with the results of this PEA," stated Sandy MacDougall, Noram's Chief Executive Officer and Director. "This study represents the most significant milestone to date for Noram and establishes us among limited peers as the newest low cost, high-grade, near-term lithium producer in North America. I am very pleased with what our team has achieved quickly, on schedule, and at the opportune time considering current and forecasted demand for Lithium Carbonate. This initial economic assessment is the most significant step to date towards our goal of lithium production and provides the market with a benchmark to evaluate our project's viability and value compared with other lithium developers. We are excited as we enter 2022 pushing aggressively towards the completion of a Pre-Feasibility Study."

| Net Present Value ("NPV") | US$1.299 Billion |

| Internal Rate of Return ("IRR") | 31% |

| Life of Mine ("LOM") | 40 years |

| Operating Cost ("OPEX") | US$3355.30/tonne |

| Capital Cost Estimate | US$528 Million |

| Average Annual Production Lithium Carbonate Equivalent ("LCE") | 31,900 tonnes |

| Average Daily Mine Production Rate LOM | 17,000 tpd |

| LOM Production | 245.4 MT @ 1093 ppm Li |

| LCE Market Price used in PEA Study* | US$9500/tonne |

| Strip Ratio | 0.07 : 1.00 |

| Pay Back Period | 3.23 years |

| Gross Revenue per Year | US$303.4 Million |

PEA Summary

Infrastructure

The project is located next to the Cypress Development's Clayton Valley Lithium Project and within 1 mile of Albermarle's Silver Peak Lithium Mine. The Project is accessible via the Silver Peak Road, a two-lane road that connects the Silver Peak mine with Highway 95 to the east. General site infrastructure includes administration, laboratory, warehouse, reagent, comminution plant, and lithium recovery plant. Tailings are to be conveyed to the tailings storage areas for final spreading and contouring by dozers.

Metallurgical Testing

The objective of the metallurgical test program conducted on the Zeus Lithium deposit was to develop a viable process flowsheet to produce lithium carbonate. Information generated during the test program was used to define the process variables. Metallurgical testing began in 2018 at Actlabs Ltd (Actlabs) and AuTec Innovative Extractive Solutions Ltd (AuTec). This PEA report includes metallurgical test work conducted by SGS Canada Inc. in collaboration with ABH Engineering.

The following observations, conclusions and interpretations were obtained from the metallurgical test program:

- Zeus Lithium deposit ore is soft and disintegrates easily if agitated in water.

- Sulfuric acid solution effectively leaches lithium at high extraction.

- Test work achieved 90% lithium extraction at 65°C, 30% solids density and 2 hours residence time.

Mine Option Selection

An ultimate pit of processable material will be created, consuming most of the property area. The ultimate pit has been divided into phases of which the first 11 contain enough resources for 40 years of production at a 17,000 tpd production rate. Resources contained within the entire ultimate pit limits provide enough ore for over 190 years of production at 17,000 tpd. All resources regardless of the material classification are treated equally for the purpose of this study.

An optimized cut-off grade of 850 ppm was used to schedule the processed feed, compared to the economic cut-off grade of 400 ppm. Low-grade ore with grades between the economic cut-off of 400 ppm and optimized cut-off of 850 ppm are scheduled to be deposited in the low-grade ore stockpile. This is done to initially increase the average processed ore grade and improve the overall economics of the project by accelerating higher grade material to earlier years.

| Category | Units | Value |

| Gross Revenue | $M | 303.4 |

| Operating Cost | $/tonne LCE | 3,355.3 |

| Capital Cost | $M | 528.0 |

| Property tax | % of Capex | 1.05% |

| State Tax | % | Up to 5% |

| Federal Tax | % of net income | 21% |

| Discount Rate | % | 8% |

| Pre-Tax NPV (8%) | $M | 1,675.1 |

| After-Tax NPV (8%) | $M | 1,299.9 |

| Pre-Tax IRR | % | 36% |

| After-Tax IRR | % | 31% |

| Payback Period | years | 3.23 |

| Break-even Price (0% IRR) | $/tonne LCE | 4,016.6 |

Economic Analysis for Zeus Lithium Project

Sensitivity Analysis at 8% NPV with Varying Conditions

Measured | ||||

Li Cutoff (ppm) | Tonnes x 1,000,000 | Li Grade (ppm) | Contained Li (tonnes) | LCE (tonnes) |

400 | 66.74 | 927 | 61,863 | 329,299 |

600 | 61.34 | 964 | 59,128 | 314,738 |

800 | 46.47 | 1051 | 48,840 | 259,975 |

1000 | 27.70 | 1150 | 31,854 | 169,558 |

Indicated | ||||

Li Cutoff (ppm) | Tonnes x 1,000,000 | Li Grade (ppm) | Contained Li (tonnes) | LCE (tonnes) |

400 | 296.42 | 922 | 272,297 | 1,454,762 |

600 | 279.66 | 947 | 264,837 | 1,409,728 |

800 | 221.64 | 1007 | 223,193 | 1,188,059 |

1000 | 103.76 | 1128 | 117,044 | 623,023 |

Measured + Indicated | ||||

Li Cutoff (ppm) | Tonnes x 1,000,000 | Li Grade (ppm) | Contained Li (tonnes) | LCE (tonnes) |

400 | 363.15 | 923 | 335,191 | 1,784,222 |

600 | 341.00 | 950 | 323,945 | 1,724,361 |

800 | 268.11 | 1014 | 271,865 | 1,447,135 |

1000 | 131.46 | 1133 | 148,945 | 792,836 |

Inferred | ||||

Li Cutoff (ppm) | Tonnes x 1,000,000 | Li Grade (ppm) | Contained Li (tonnes) | LCE (tonnes) |

400 | 827.22 | 884 | 731,261 | 3,892,501 |

600 | 715.91 | 942 | 674,383 | 3,589,743 |

800 | 546.48 | 1013 | 553,588 | 2,946,750 |

1000 | 265.47 | 1134 | 301,043 | 1,602,452 |

Final Tonnages and Grades of the Classes of Mineral Resources

Qualified Person

The technical information contained in this news release has been reviewed and approved by Brad Peek., M.Sc., CPG, who is a Qualified Person with respect to Noram's Clayton Valley Lithium Project as defined under National Instrument 43-101.

About Noram Lithium Corp.

Noram Lithium Corp (TSX - Venture: NRM / Frankfurt: N7R / OTCQB: NRVTF) is a Canadian based junior exploration company, with a goal of developing lithium deposits and becoming a low - cost supplier. The Company's primary business is the Zeus Lithium Project ("Zeus") in Clayton Valley, Nevada. The Zeus Project has a recently updated resource estimate of 363 million tonnes at 923 ppm lithium measured + indicated resources, and 827 million tonnes lithium at 884 ppm lithium inferred resources (400 ppm Li cut-off).

Noram's long term strategy is to build a multi-national lithium minerals company to produce and sell lithium into the markets of North America, Europe, and Asia.

Please visit our web site for further information: www.noramlithiumcorp.com.

ON BEHALF OF THE BOARD OF DIRECTORS

Sandy MacDougall

CEO, Director

Investor Relations Contact:

Rich Matthews

Managing Partner

Integrous Communications

rmatthews@integcom.us

+1 604 757 7179

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking information which is not comprised of historical facts. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes statements regarding, among other things, the completion transactions completed in the Agreement. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, regulatory approval processes. Although Noram believes that the assumptions used in preparing the forward-looking information in this news release are reasonable, including that all necessary regulatory approvals will be obtained in a timely manner, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Noram disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by applicable securities laws.

[1] Lithium Carbonate Price (2015-2040) (Lane, T.; Harvey, J. T.; Fayram, T.; Samari, H.; Brown, J. J.;, 2018)

SOURCE: Noram Lithium Corp.

View source version on accesswire.com:

https://www.accesswire.com/676501/Noram-Lithium-Corp-Zeus-PEA-shows-31-After-Tax-IRR-USD1299-Billion-After-Tax-NPV