The board of International Lithium Corp. (TSXV: ILC) (the "Company" or "ILC") is pleased to announce the further expansion of its Raleigh Lake lithium and rubidium project in Ontario, Canada where it now has claims totalling over 47,000 hectares (470 square kilometres), an increase of more than 20,000 hectares from the previously announced 27,000 hectares (October 25, 2021). At the same time the Company announces the completion of an exploration program at Raleigh Lake and the discovery of several new pegmatite occurrences within the expanded claim holdings.

Highlights

- Raleigh Lake claims expanded to 47,000 hectares based on structural interpretations and successful discoveries of pegmatites during short field program

- Over 20 new and previously unknown pegmatites discovered throughout the expanded Raleigh Lake project claim groupings

- Potassium and rubidium ratios in several pegmatites sampled indicate a highly evolved pegmatite system capable of hosting lithium, caesium, rubidium and tantalum mineralization

International Lithium Corp. carried out a field program at the Raleigh Lake project in October 2021 which included a regional lithogeochemical survey within the newly expanded historical claim group, a biogeochemical orientation survey over the main pegmatites in Zone 1, regional prospecting and mapping of cut blocks within the historical claim group and a cursory examination of highly prospective ground recently acquired through staking. Highlights of the recent work include the discovery of over 20 new and previously unknown pegmatites within the newly acquired mineral claims.

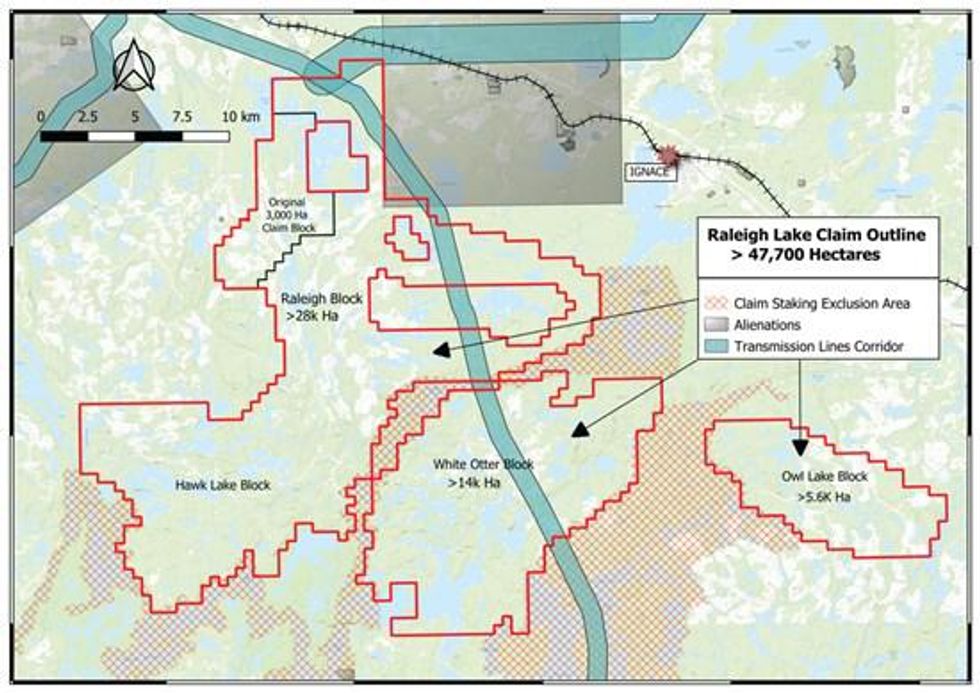

Given the sizeable area and the number of new claims, the project is being divided according to geographic parameters and certain controls on the type of mineralization styles within these zones (Figure 1):

- Raleigh Lake - approximately 14,000 hectares consisting of the original 3,000 hectare claim group and hosting the spodumene rich mineralization in Pegmatite 1 and Pegmatite 3. This claim group was divided into 5 zones previously and is now extended to the south and east encompassing most of the Raleigh Lake Greenstone Belt.

- Hawk Lake - is approximately 14,000 hectares southwest of and contiguous with the Raleigh Lake claims. Hawk Lake encompasses portions of the Bending Lake Greenstone Belt and has demonstrated pegmatite occurrences.

- Owl Lake - is an independent contiguous block of approximately 5,600 hectares located 15 kilometres south-southeast of Ignace, Ontario. The claim group is road accessible yet the lack of historical records suggests it is underexplored. The claims were acquired based on structural interpretations derived from regional geophysical data sets and initial prospecting late in the fall 2021 program identified several pegmatites in outcrop that are worth further investigation.

- White Otter - approximately 14,000 hectares immediately south of the Raleigh Lake block and between the Hawk Lake and Owl Lake blocks. The first White Otter claims were acquired based on pegmatites reported in drill holes by previous operators. Subsequent fieldwork revealed an extensive swarm of pegmatites located in road beds, road cuts and recent harvested cut blocks. Over sixteen pegmatites, with most exhibiting favourable peraluminous mineralization indicating a highly evolved pegmatite system, were discovered in a short time within this claim block with analytical and interpretive results pending.

Figure 1: Raleigh Lake Project Claim Blocks.

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/3232/107795_da8e9cba6404eaa7_003full.jpg

Exploration Program

The Fall 2021 exploration program carried out over the month of October included three major activities that were designed to identify and prioritise targets for future exploration focus, drilling and eventual resource evaluation.

- Lithogeochemistry program

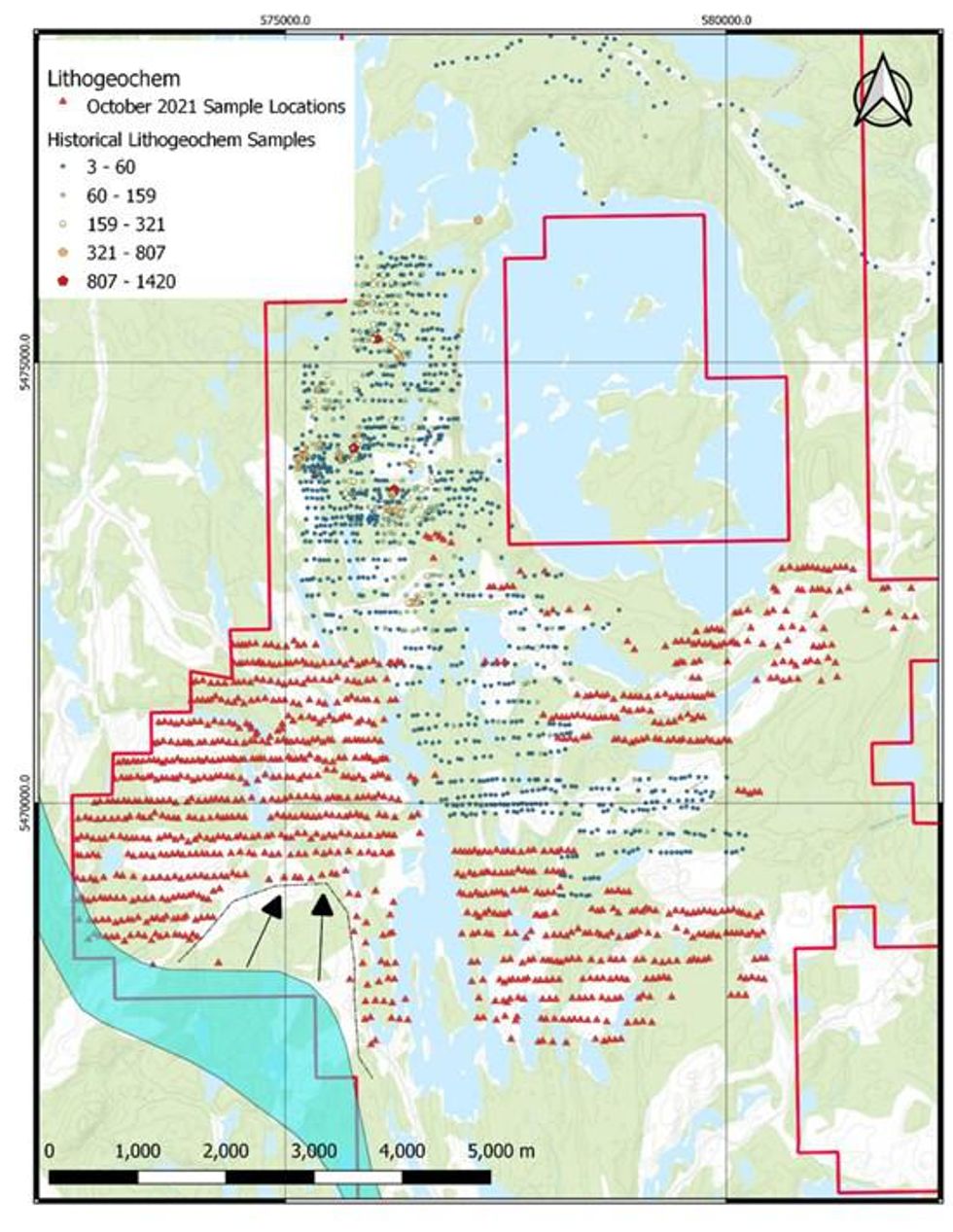

A total of 1089 lithogeochemistry samples were collected between September 29th and October 30th (Figure 2). The primary goal for this component of work was to test for exomorphic dispersion of lithium and other rare-metals into the volcanic, volcaniclastic and subvolcanic intrusions of the host greenstone belt. The bedrock sampling program also ensures a systematic examination of outcrops are completed while conducting traverses.

Sampling lines were designed to mesh seamlessly into the grids of historical work programs. The sampling procedure at each site mirrored historical procedures with the goal to minimize levelling of data between seasons. The results for this program will be evaluated and related to earlier work in order to determine if further levelling is required to merge with the historic data sets or alternatively be analysed independently of historical results.

Analytical results are still under process at the time of writing.

Figure 2: Lithogeochemistry sampling coverage for the Raleigh Lake project.

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/3232/107795_da8e9cba6404eaa7_004full.jpg

- Biogeochemistry Orientation Survey program

A biogeochemical survey was conducted over the Pegmatite 1 and Pegmatite 3 areas following a favourable outcome reported in a paper describing deployment of that same survey type in the Patterson Lake pegmatite belt by Avalon Advanced Materials Inc. north of Kenora in 2017. The terrain, biodiversity of boreal terrains, target type and host rock geology of the Patterson Lake group of rare-metal pegmatites are comparable to Raleigh Lake. If successful, the results will highlight anomalies within the selected medium that can be used to directly identify blind pegmatite bodies. The method can be scaled accordingly to accommodate areas within the Raleigh Lake pegmatite field or other broadly based regional targets.

A four-line, 66 station vegetation orientation survey was conducted between September 29th and October 1st of 2021. The four survey lines were oriented normal to the projected strike of pegmatites that were both exposed and buried beneath varying amounts of overburden. About 100 grams of bark-strip was collected from black spruce trees (picea mariana) within a 3 metre search radius of the pre-defined station. Sample preference was given to trees with a larger trunk, longer growing history and wider root base for anomaly catchment and recognition. To complement the bark samples, leaves and twigs from the outer 30 centimetres of alder branches were also collected. An equipment failure at the prep lab has delayed the chemical analysis of the biogeochemistry samples with no estimated time for completion available at the time of writing.

- Rock Sampling, Prospecting and Mapping Program

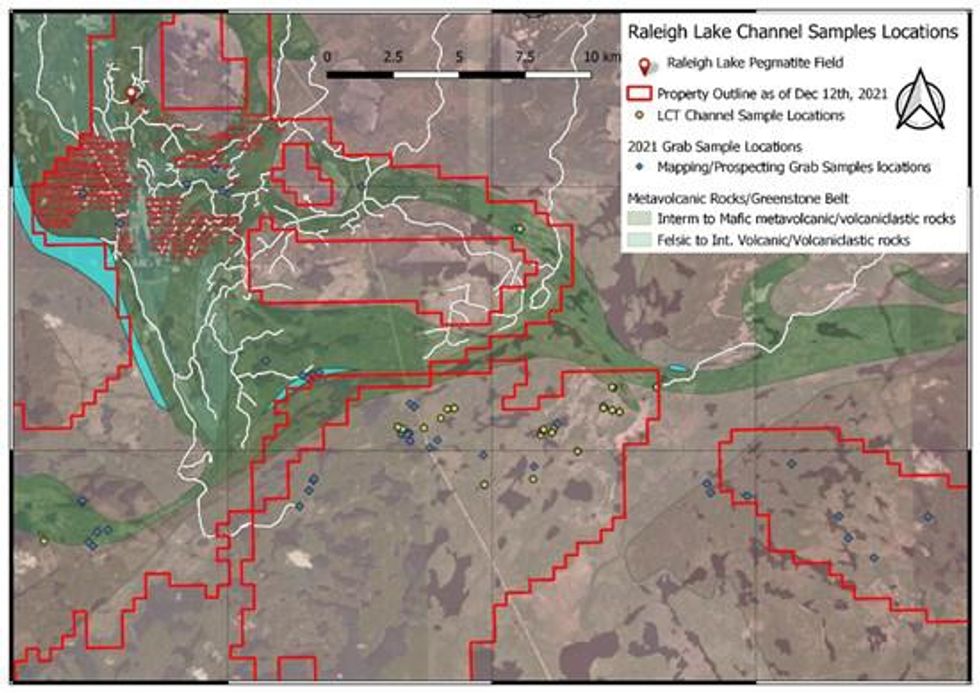

A total of 59 various grab samples were collected during the mapping and prospecting program conducted as a first pass over sections of the greatly expanded project area. Fifty-one (51) of the samples were prospective for rare-metal enrichment and the remaining eight (8) were sent for base-metal and multi-element analysis. The approximate locations and spatial distribution of the grab samples is shown in Figure 3.

Geological mapping was conducted by crew members in recently harvested clear cut blocks. Any significant rare or base-metal occurrences were mapped and sampled appropriately by the mapping crews. Over 20 new pegmatite sites spanning a region 12 kilometres long by 4 kilometres wide were identified within the White Otter claim block with additional pegmatites discovered in the Hawk Lake, Owl Lake and Raleigh Lake blocks.

The most abundant pegmatite type in the White Otter area was composed predominantly of megacrystic potassium feldspar, smoky quartz and dark muscovite pegmatite. Occasional traces of molybdenite and even rarer purple fluorite were observed which increased in abundance from west to east. Evolved textures like the exsolution of quartz in feldspar (graphic textures), were identified in many locations. The dominant emplacement geometries in this location seem to lay in a 070° trend through the centre of the claim block.

The second style pegmatite is albite-muscovite-quartz-garnet, and primarily occurs within ground mapped as mafic volcanic or bedded to laminated volcaniclastic. These are visually quite different from the first style, presenting as bright white and not as coarse grained.

Testing For Rare-Element (lithium-caesium-tantalum) Potential

To fully understand the mineral and exploration potential of the newly discovered White Otter pegmatites to host lithium, caesium, rubidium, tantalum and associated mineralization typical of LCT-type pegmatites, a total of 48 channel samples were collected across the claim group (Figure 3). Forty-one (41) were collected from rare-metal prospects and new pegmatite discoveries and seven (7) were collected from base-metal and gold prospects.

Final results for all channel samples are still pending, however, some mineralogical work was fast-tracked on the rare-metal pegmatite channel samples and those results have been released and are currently being fully evaluated. Initial implications are that most of the 16 White Otter pegmatites have reported highly anomalous rubidium values and no associated lithium bearing minerals indicating that the rubidium is likely to be present in the potassium feldspar minerals. The elevated rubidium to potassium ratios in these samples coupled with high rubidium/strontium ratios indicates that these pegmatites are derived from a peraluminous source and have a high probability to host lithium-bearing deposits enriched in caesium and rubidium minerals, among others. This conclusion is further supported by the high manganese values coincident with abundant orange spessartine garnets observed in some of the samples.

Figure 3: Spatial Distribution of grab and channel samples within the Raleigh Lake project area. The channel sample locations coincide with new pegmatite discoveries, however, not all new pegmatite discoveries were sampled and therefore are not indicated on the image.

To view an enhanced version of Figure 3, please visit:

https://orders.newsfilecorp.com/files/3232/107795_da8e9cba6404eaa7_005full.jpg

In conclusion, the Company is highly encouraged by the results of the program whereby such a high number of previously unknown pegmatites were discovered in such a short time during a field program originally designed to advance and expand the highly prospective pegmatite discoveries on the original 3,000 hectare Raleigh Project claim block. The Company is planning for an extensive exploration campaign in 2022 that will further evaluate the potential of the entire Raleigh Lake project area.

John Wisbey, Chairman and CEO of International Lithium Corp., commented:

"This was a very encouraging exploration program, with over 20 new pegmatites discovered at ground level over multiple kilometres. A consistent theme is that the Raleigh Lake project is a mineral rich area with appreciable anomalous (i.e. high) amounts of rubidium as well as lithium. This mineral richness and the extent of the pegmatites is why we expanded and expanded again our claims area beyond what we originally intended. 47,000 hectares is the size of the city of Stuttgart, and larger than the cities of Montreal, Denver or Detroit - so clearly this program will require various stages and careful planning. Analysis laboratories are stretched at the moment, and we are still waiting for some of the results, with an equipment failure at one of the third party laboratories holding us up even beyond the expected waiting period. Once we get all these results we will rapidly decide on the optimal drilling program for Raleigh Lake in 2022 with a view to getting some resource estimates in 2022 from a portion of our claims."

About International Lithium Corp.

International Lithium Corp. believes that the '20s will be the decade of battery metals, at a time that the world faces a significant turning point in the energy market's dependence on oil and gas and in the governmental and public view of climate change. Our key mission in this decade is to make money for our shareholders from lithium and rare metals while at the same time helping to create a greener, cleaner planet. This includes optimizing the value of our existing projects in Canada and Ireland as well as finding, exploring and developing projects that have the potential to become world class lithium and rare metal deposits. In addition, we have seen the clear and growing wish by the USA and Canada to safeguard their supplies of critical battery metals, and our Canadian Raleigh Lake property is strategic in that respect.

A key goal has been to become a well funded company to turn our aspirations into reality, and following the disposal of the Mariana project in Argentina in 2021, the Board of the Company considers that ILC is already well placed in that respect with a strong net cash position. The disposal of Mavis Lake, assuming the option is exercised as planned, will add useful further liquidity.

International Lithium Corp. has a significant portfolio of projects, strong management, and strong partners. Partners include Ganfeng Lithium Co. Ltd., ("Ganfeng Lithium") a leading China-based lithium product manufacturer quoted on the Shenzhen and Hong Kong stock exchanges (A share code: 002460, H share code: 1772) and Essential Metals Limited, quoted on the Australian Stock Exchange (ASX: ESS).

The Company's primary strategic focus is now on the Raleigh Lake lithium and rubidium project in Canada and on identifying additional properties.

The Raleigh Lake project now consists of over 47,000 hectares (470 square kilometres) of adjoining mineral claims in Ontario, and is ILC's most significant project in Canada. The exploration results there so far, which are on only about 5% of ILC's current claims, have shown significant quantities of rubidium and caesium in the pegmatite as well as lithium. Raleigh Lake is 100% owned by ILC, is not subject to any encumbrances, and is royalty free.

Complementing the Company's rare metal pegmatite property at Raleigh Lake, are interests in two other rare metal pegmatite properties in Ontario, Canada known as the Mavis Lake and Forgan Lake projects, and the Avalonia project in Ireland, which encompasses an extensive 50-km-long pegmatite belt.

The ownership of the Mavis Lake project is currently 51% Essential Metals Limited (ASX: ESS, "ESS") and 49% ILC. In addition, ILC owns a 1.5% NSR on Mavis Lake. ESS has an option to earn an additional 29% by sole-funding a further CAD $8.5 million expenditures of exploration activities, at which time the ownership will be 80% ESS and 20% ILC. Mavis Lake is now under option until January 2022 to Critical Resources Ltd. (ASX: CRR) to buy 100% at which point ILC's NSR would also be surrendered. If exercised, that option will bring the Company approximately CAD$1.4m of cash and shares in CRR, with up to a further CAD$1.4m if certain resource targets are achieved by CRR. If CRR were to complete its purchase but then sell or joint venture the Mavis Lake claims in future, this further payment obligation would pass to any future owner of the claims. ILC and ESS would have a right of first refusal to buy the claims back if CRR had not achieved and made additional payment for the first additional payment milestone.

The Forgan Lake project will, upon Ultra Resources Inc. meeting its contractual requirements pursuant to its agreement with ILC, become 100% owned by Ultra Resources (TSXV: ULT), and ILC will retain a 1.5% NSR on Forgan Lake.

The ownership of the Avalonia project is currently 55% Ganfeng Lithium and 45% ILC. Ganfeng Lithium has an option to earn an additional 24% by either incurring CAD$ 10 million expenditures on exploration activities by September 2024 or delivering a positive feasibility study on the project, at which time the ownership will be 79% Ganfeng Lithium and 21% ILC. In the event that ILC does not contribute to the project after that, and its share consequently falls below 10% of the project, its share will be substituted by a 1% NSR.

With the increasing demand for high tech rechargeable batteries used in electric vehicles and electrical storage as well as portable electronics, lithium has been designated "the new oil", and is a key part of a "green tech" sustainable economy. By positioning itself with projects with significant resource potential and with solid strategic partners, ILC aims to be one of the lithium and rare metals resource developers of choice for investors and to continue to build value for its shareholders in the '20s, the decade of battery metals.

Patrick McLaughlin, P. Geo., a Qualified Person as defined by NI 43-101, has verified the disclosed technical information and has reviewed and approved the contents of this news release.

On behalf of the Company,

John Wisbey

Chairman and CEO

For further information concerning this news release please contact +1 604-449-6520

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

Except for statements of historical fact, this news release or other releases contain certain "forward-looking information" within the meaning of applicable securities law. Forward-looking information or forward-looking statements in this or other news releases may include: the effect of results of anticipated production rates, the timing and/or anticipated results of drilling on the Raleigh Lake or Avalonia projects, the expectation of resource estimates, preliminary economic assessments, feasibility studies, lithium or rubidium or caesium recoveries, modeling of capital and operating costs, results of studies utilizing various technologies at the Company's projects, budgeted expenditures and planned exploration work on the Avalonia Joint Venture, satisfactory completion of the sale of mineral rights at Forgan Lake, increased value of shareholder investments, and assumptions about ethical behaviour by our joint venture partners where we have them. Such forward-looking information is based on a number of assumptions and subject to a variety of risks and uncertainties, including but not limited to those discussed in the sections entitled "Risks" and "Forward-Looking Statements" in the interim and annual Management's Discussion and Analysis which are available at www.sedar.com. While management believes that the assumptions made are reasonable, there can be no assurance that forward-looking statements will prove to be accurate. Should one or more of the risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking information. Forward-looking information herein, and all subsequent written and oral forward-looking information are based on expectations, estimates and opinions of management on the dates they are made that, while considered reasonable by the Company as of the time of such statements, are subject to significant business, economic, legislative, and competitive uncertainties and contingencies. These estimates and assumptions may prove to be incorrect and are expressly qualified in their entirety by this cautionary statement. Except as required by law, the Company assumes no obligation to update forward-looking information should circumstances or management's estimates or opinions change.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/107795