(TheNewswire)

Nexus Gold Corp. (" Nexus " or the " Company ") (TSXV:NXS ) ( OTC:NXXGF ) ( FSE:N6E) is pleased to report that it has completed its second round of phase two diamond drilling on its 100% owned McKenzie Project located at Red Lake, Ontario

This second round of drilling was designed to test gold anomalies occurring in and around historic trenches identified earlier in the fall by prospecting teams employed by the Company. The program was also testing the potential strike extension of mineralization identified in the first round of phase two drilling in the spring of this year. The program consisted of eight drill holes totaling 2000 meters a summary of the holes is tabled below:

| Hole ID | Easting | Northing | Elevation | Azimuth | Dip | Actual Length |

| MK-21-023 | 437725 | 5653016 | 366 | 240 | -45 | 261 |

| MK-21-024 | 437725 | 5652960 | 360 | 300 | -45 | 237 |

| MK-21-025 | 437608 | 5652969 | 362 | 130 | -45 | 99 |

| MK-21-026 | 437608 | 5652980 | 362 | 190 | -50 | 95 |

| MK-21-027 | 437718 | 5652792 | 360 | 195 | -45 | 318 |

| MK-21-028 | 437718 | 5652792 | 360 | 230 | -45 | 347 |

| MK-21-029 | 437725 | 5652342 | 380 | 290 | -70 | 315 |

| MK-21-030 | 437725 | 5652342 | 380 | 350 | -50 | 328 |

All drill holes were collared in the Dome Stock and successfully cored through granitic rock displaying zones of potassic ("K") alteration with zones of silica and sericitic alteration; sulphide mineralization consisting primarily of pyrite with lesser chalcopyrite; and occasional molybdenite and sphalerite hosted in quartz carbonate stringers and veins, which was reported occurring in both alteration styles but in greater amounts in the siliceous sericitically altered granite.

"The speed and efficiency of the FullForce drill team kept everyone on their toes for this round of drilling," said Warren Robb, VP of Exploration. "Given the style and intensity of the mineralization we encountered in this round of drilling this will certainly aid us immensely in understanding the structural framework of the gold deposition at McKenzie. This is an exciting property where earlier holes in 2021 gave us significant intercepts of length and grade. We're eager to see results from the new target areas," continued Mr. Robb.

Drill core is logged and sampled in a secure core storage facility located in Red Lake, Ontario. Core samples from the program are cut in half, using a diamond cutting saw, and are sent to Activation Laboratories in Ontario, an accredited independent mineral analysis laboratory, for analysis. All samples are analyzed for gold using standard Fire Assay-AA techniques. Certified gold reference standards, blanks and field duplicates are routinely inserted into the sample stream, as part of Nexus's quality control/quality assurance program (QA/QC).

Assay results will be released once received, reviewed, and verified by the Company's Qualified Person.

Drilling at McKenzie Gold Project

The just completed 2000-meter drill program commenced with the first hole being drilled to test the northern extent of gold mineralization identified by earlier drilling conducted by the Company in April 2021 which included holes MK-21-018 and MK-21-019, both of which returned significant gold intercepts (see Company news releases dated May 25 and June 1, 2021), and to test gold mineralization recently identified during a fall targeting and prospecting program conducted north of Perch Lake.

Selective grab samples obtained during the fall program have now returned gold assays of ^13.40 grams-per-tonne ("g/t") gold ("Au"), 7.70 g/t Au, 6.83 g/t Au, 3.54 g/t Au, and 3.51 g/t Au, respectively, confirming mineralization in this new area.

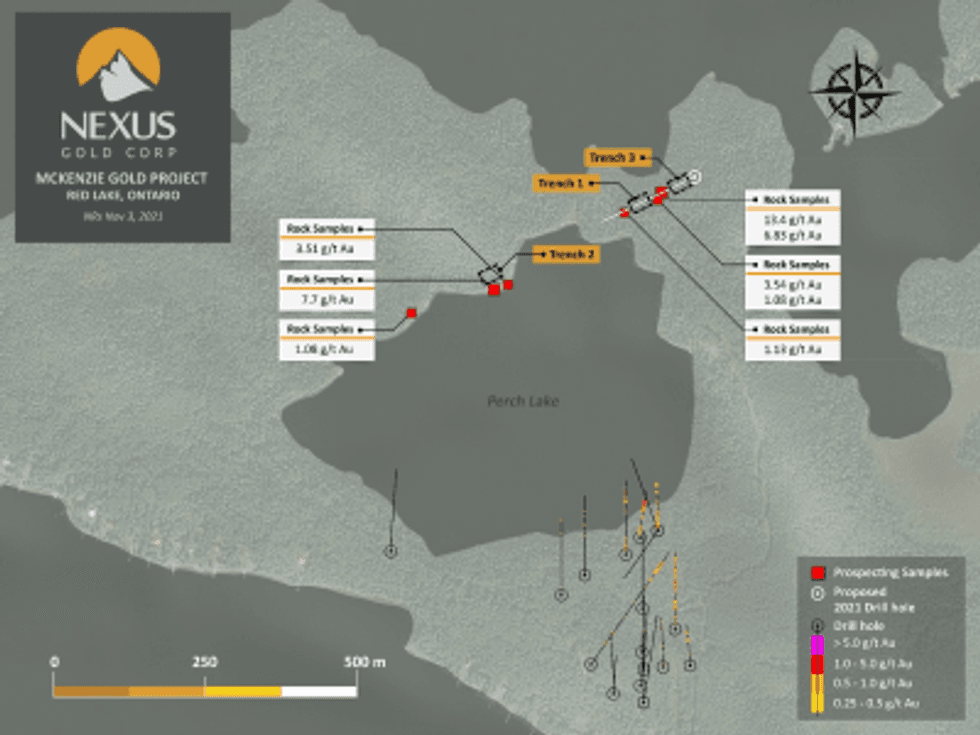

Three historical trenches and a new showing were also identified during the prospecting program (see image 1). The trenches are comprised of quartz veins containing clots and patches of semi massive chalcopyrite, pyrite and molybdenite. The veins are hosted in granite which displays strong pervasive silica flooding. Local discrete shearing in both trenches trend at approximate attitudes of 330° and dip 70° to 80° to the east, displaying similar trends and lithologies established in the Company's previous drill campaigns.

This second round of diamond drilling was pursued to expand on the results obtained in the Company's previous drill programs. These programs outlined a broad zone of gold mineralization in the St. Paul's Bay area, located in the southernmost section of the claim block below Perch Lake (see Image 1) .

Significant results from these drill programs include:

-

-- MK-20-RC-006: 2.75m of 13.25 grams-per-tonne ("g/t") gold ("Au") , including 1m of 36.20 g/t Au (68.75m to 70.5m)

-

-- MK-20-RC-008: 55.5m of 1 g/t Au (67.5m to 123m), including 16m of 1.42 g/t Au, 6m of 2.37 g/t Au, and 9m of 1.14 g/t Au

-

-- MK-21-DD-018: 56m of 1.01 g/t Au (13m to 69m), including 21.5m of 1.84 g/t Au, 10m of 3.30 g/t Au, and 1m of 23.1 g/t Au. Other intercepts included 37.6m of 2.78 g/t Au (77m to 115m), including 24.7m of 4.05 g/t Au, 14m of 7.01 g/t Au, and 1m of 94.2 g/t Au.

-

-- he entire length of MK-21-DD-018 averaged .99 g/t Au over 198m

-

-- MK-21-DD-019: 136m of 1.25 g/t Au (148m to 285m), including 44.9m of 3.00 g/t Au, 15.5m of 5.25 g/t Au, 29.4m of 1.82 g/t Au, and 6m of 5.45 g/t Au. High-grade intercepts included 1m of 59.8 g/t Au, 1m of 15.5 g/t Au, and 1m of 26.7 g/t Au.

-

-- Hole MK-21-DD-19 ended in mineralization at 285 meters, with an average grade of the hole returning .74 g/t Au over 283.4m

See Company news releases, September 3, 2020, May 25, 2021, and June 1, 2021, for more details on previous diamond drill programs.

All reported holes were drilled entirely in a granitic rock of the Dome stock and displayed patchy moderate-to-strong silica alteration. Silica altered intervals are typically associated with high density micro-fracturing and increased molybdenite and chalcopyrite mineralization. Fine-grained fluorescent scheelite was also observed. The granite was strongly magnetic, containing 2-3% fine-grained disseminated magnetite.

Click Image To View Full Size

Image 1: New sample locations, new showings (red) and historical trenches, north side of Perch Lake, with 2020-2021 drill locations to the south, McKenzie Gold Project, Red Lake, ON

Click Image To View Full Size

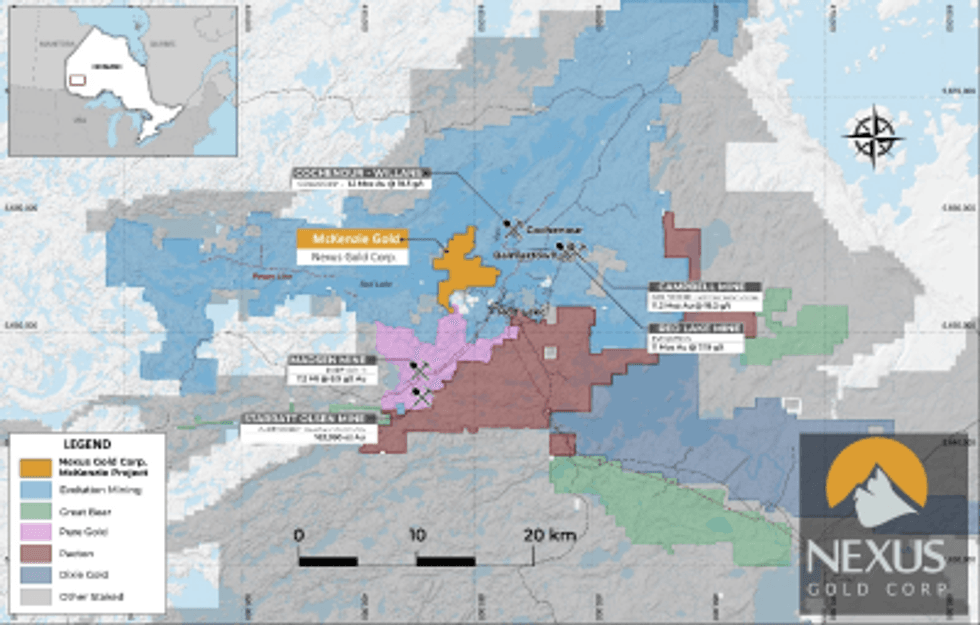

Figure 2: McKenzie Gold Project, Red Lake, Ontario, with nearby advanced prospects, producers, and past producers

About the McKenzie Gold Project

The 100%-owned McKenzie Gold Project is an approximately 1,400-hectare gold exploration project located in the heart of the historic Red Lake gold camp, in western Ontario, Canada. Areas of high-grade gold mineralization have been established within the northern portion of the claim block (McKenzie Island), with significant gold values having been drilled along a 600-meter strike in the southern portion of the property (St. Paul's Bay area).

Numerous high-grade historical samples^ have been recovered on the property, including 331.14 g/t Au, 18.02 g/t Au, 212.8 g/t Au, 313 g/t Au, 18.02 g/t Au and 9.37 g/t Au. In the summer of 2019, the Company conducted it's first ground reconnaissance program at McKenzie and results returned notable sample assays, including 135.4 g/t Au and 9.3 g/t Au (see Company news releases dated June 25, 2019, and October 11, 2019).

Additional high-grade historical grab samples^ previously unknown to the Company and revealed in a report supplied by Rimini Exploration include several high-grade assays, including 142.49 g/t Au, 115.2 g/t Au, 114.57 g/t Au, 93.71 g/t Au, 68.03 g/t Au, 53.01 g/t Au, and 16.65 g/t Au from areas located on McKenzie Island (north block) (see Company news release dated October 11, 2019).

Significant results from the Company's initial drill program in August 2020 include hole MK-20-006 which returned 2.75 meters of 13.25 g/t Au, including 1m of 36.2 g/t Au; hole MK-20-007 which returned 117.4m of 0.33 g/t Aum including 9.4m of 1.26 g/t Au, and 1.5m of 4.64 g/t Au; and hole MK-20-007, which returned 117.5m of .62 g/t Au, including 55.5m of 1.00 g/t Au, which included 16m of 1.42 g/t Au (including 6m of 2.37 g/t Au and 2m of 4.28 g/t Au), and 9m of 1.14 g/t Au. See the Company website – www.nxs.gold – for the complete McKenzie project drill table.

Results from the Company's initial summer 2020 drill program returned values similar to historic drilling in the area, which have been typically higher-grade intercepts over narrow widths (i.e., 0.5m to 1m of > 5 g/t Au). In addition, holes 007 and 008 identified a second style of gold mineralization on the McKenzie property. These lengthy (> 100m) disseminated, sub and near one-gram gold intercepts more closely resemble the type of mineralization being explored at the Hasaga Project, located approximately 5kms to the south-east of the McKenzie project ground.

The Hasaga property is host to the past-producing Hasaga and Gold Shore Mines and is strategically located proximal to the Balmer-Confederation regional unconformity, recognized as an important geologic feature at the multi-million ounce past and currently producing Red Lake area mines. The deposits on the Hasaga Project are estimated as hosting an Indicated mineral resource of 42.294 million tonnes at a grade of 0.83 g/t gold representing 1,123,900 ounces of gold*.

* Reported lengths are intercepts and are not true widths

^ Grab samples are selected samples and are not necessarily representative of mineralization hosted on the property. All samples were sent to Activation Laboratories in Ontario, an accredited mineral analysis laboratory, for analysis.

Drill core is logged and sampled in a secure core storage facility located in Red Lake Ontario. Core samples from the program are cut in half, using a diamond cutting saw, and are sent to Activation Laboratories in Ontario, an accredited mineral analysis laboratory, for analysis. All samples are analyzed for gold using standard Fire Assay-AA techniques. Certified gold reference standards, blanks and field duplicates are routinely inserted into the sample stream, as part of Nexus's quality control/quality assurance program (QA/QC). No QA/QC issues were noted with the results reported herein.

* HASAGA PROJECT RED LAKE MINING DISTRICT, ONTARIO, CANADA NTS MAP SHEETS 52K/13 AND 52N/04 by Vincent Jourdain (Ph.D., P.Eng.), John Langton (M.Sc., P. Geo.) & Abderrazak Ladidi (P.Geo.) dated February 24 th , 2017).

Warren Robb P.Geo., Vice President, Exploration, is the designated Qualified Person and has reviewed and approved the technical information contained in this release. Any historic drill and sample data contained in this release was verified by the QP by comparing reported assay data with Certificates of Analysis documented. The QP has verified mineral showings and areas of select sampling and the collars of reported historic drill hole locations. It is the QP's opinion that the data as presented is adequate and can be relied upon for use in this press release.

About the Company

Nexus Gold is a Canadian-based gold exploration and development company with an extensive portfolio of projects in Canada and West Africa. The Company's primary focus is on its 100%-owned, 98-sq km Dakouli 2 Gold Concession in Burkina Faso, West Africa, and the approximately 1400-ha McKenzie Gold Project, located in Red Lake, Ontario. The Company is focusing on the development of its core assets while seeking joint-venture, earn-in, and strategic partnerships for other projects in its portfolio.

For more information, please visit nxs.gold

On behalf of the Board of Directors of

Nexus Gold CORP.

Alex Klenman

President & CEO

604-558-1920

info@nexusgoldcorp.com

www.nexusgoldcorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors discussed in the management discussion and analysis section of our interim and most recent annual financial statement or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. We do not assume any obligation to update any forward-looking statements, except as required by applicable laws.

Copyright (c) 2021 TheNewswire - All rights reserved.