Sterling Metals Corp. (TSXV:SAG) ("Sterling Metals" or the "Company") and GoldSpot Discoveries Corp (SPOT)(SPOFF) ("GoldSpot"), a leading technology services company leveraging machine learning to transform the mineral discovery process, are very pleased to report on the results of a property-wide comprehensive data review, compilation, and target generation using traditional geological and machine learning methods. The results of this exercise identified 33 drill targets, ranked in order of priority with 18 identified as the highest priority silver and base metal targets. Accordingly, Sterling Metals is launching a fully-funded 7,500 meter drilling program beginning in June for which contracts have been signed with both drillers and a geological consultancy group

Mathew Wilson, CEO of Sterling Metals, commented "We are well financed for an aggressive exploration program and in only 7 months we have generated exceptional silver and base metal targets that our team is keen to test in this upcoming drill program. The planned 7,500 m of drilling is just the beginning, and I am confident that we can expand to 10,000 m based on the success of our inaugural drilling. The team at GoldSpot has given Sterling Metals the resources of a large mining company and together we have generated world class drill targets where grades, surface footprint, and geophysical footprint align. The GoldSpot team lead the way in discovering the Queensway gold project, one of the highest-grade new gold discoveries globally in recent years. We hope to add a world class silver and base metal discovery to their resume."

Denis Laviolette, Executive Chairman of GoldSpot, commented "We are pleased to present 33 drill targets at the Sail Pond Silver Project, a very promising high-grade silver and base metals project located on Newfoundland's Great Northern Peninsula. Our team of leading geoscientists and data scientists continues to deliver unrivalled results for our clients through our machine learning algorithms and expansive technology portfolio. We look forward to continuing our work with Mathew and the world-class Sterling Metals exploration team to validate these targets and advance the project."

Drill Program

Sterling Metals has contracted Logan Drilling Group International out of Stewiacke, Nova Scotia; and Mercator Geological Services out of Dartmouth, Nova Scotia to complete its upcoming initial 7,500 metre program. Pending receipt of final permit approval, Sterling Metals anticipates the program starting in mid-June. Assays will be sent to Eastern Analytical in Springdale, approximately 3 hours south of the Sail Pond project. Sterling Metals will initially focus on the South Zone, where previous exploration campaigns have identified extremely high-grade mineralization with results up to 4,526.1 g/t Ag, 0.9 g/t Au, 14.9 % Cu, 7.5 % Pb, 5.0 % Sb, and 9.6 % Zn (see Sterling Metals press release dated January 6, 2021).

GoldSpot Target Generation

GoldSpot is a mining-focused technology company that is working with some of the leading exploration and mining names in the industry to apply cutting edge Artificial Intelligence ("AI") algorithms to significantly increase the efficiency and success rate of mineral exploration. Recent successes by GoldSpot with both leading producers and explorer/developers have demonstrated the potential to expand resources and make new discoveries using this advanced analytical technology. GoldSpot utilizes its proprietary 'Smart Targeting' approach to distill all available geological information from large land packages and identify the most efficient and cost-effective way to explore, saving time, resources, and capital.

The information used in the GoldSpot investigation included: geological data from mapping, trenching & channel sampling, and structural studies; geochemical data including >6,000 soil samples and >2,000 rock samples; geophysical data including gravity surveys, an IP/resistivity survey; and remote sensing data including regional digital elevation maps, regional aerial imagery, drone imagery from trenching, and a high-resolution LiDAR survey completed in 2020. Significant findings include:

Geophysics

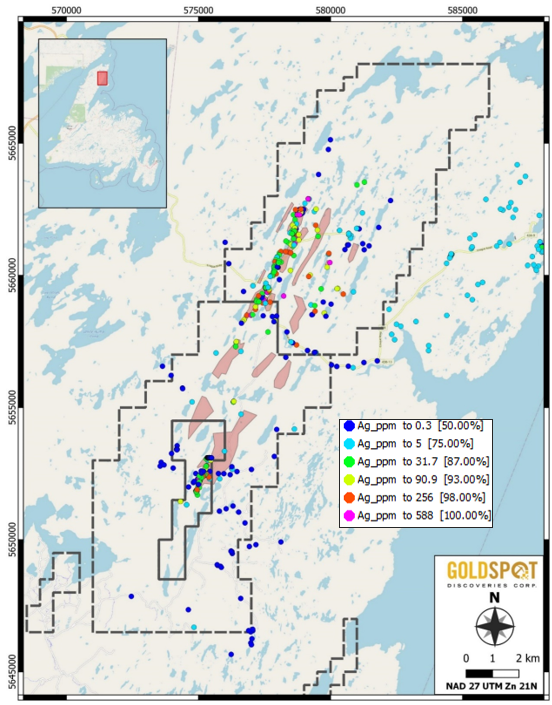

- Reprocessing and interpretation of induced-polarization data identified favourable zones of weak conductors within resistive zones that coincide with known silver occurrences as well as areas not yet tested (Figure 1).

- Using public surveys, GoldSpot also identified favourable lineaments for mineralization.

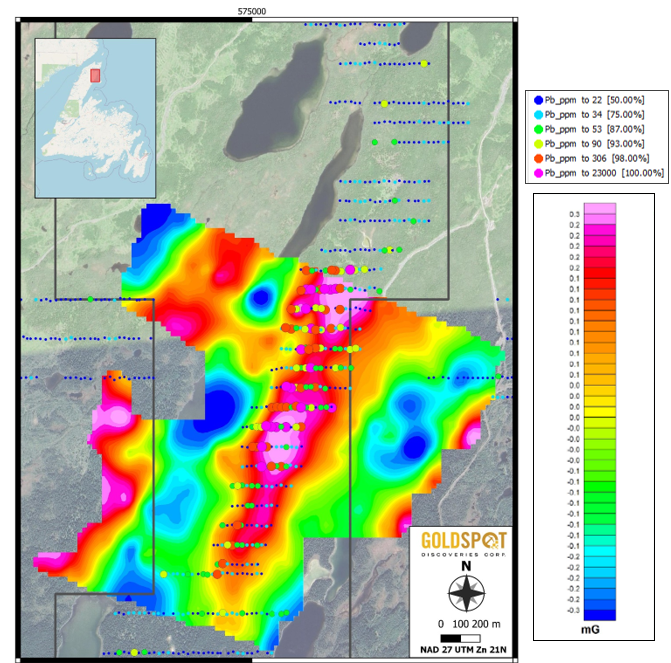

- Sterling Metals has also recently completed a gravity survey over the South Zone of the Sail Pond project, that shows promising results as both high values for metals-in-soil and grab samples coincide with gravity highs as shown in Figure 2. Further study of these new data will add value by helping refine targeting and prioritizing of the drill program.

Geology, Structure, and Mineralization

- Sail Pond is a structurally controlled Ag-Cu-Pb-Zn vein system hosted in a pervasively altered (silica +- calcite +- sericite) dolostone unit.

- Through the compilation and review of historic work and interpretation of trench maps and drone imagery, GoldSpot highlighted important geological features:

- Veins occupy a set of co-genetic structures and their orientations are a function of the local major stress regime. The original vein orientations have likely been modified by progressive and later deformation events.

- The silicified dolostone host unit has undergone significant deformation resulting in boudinaged and rotated blocks.

- True thickness of the host unit is locally unconstrained, suggesting further exploration potential.

- A structural interpretation combined the identification of lineaments and discontinuities in geophysical surveys and in several enhanced topographic products created using GoldSpot's geoprocessing pipeline for LiDAR data. Specific findings include:

- Northeast trending lineaments associated with boudinage and adjustments to the host unit morphology.

- Lineaments along stratigraphy following the orientation of the mineralized trend.

- Folding, offering potential of additional structural traps for mineralization.

Geochemistry

- From the soils data (both XRF and ICP) GoldSpot has used exploratory data analysis techniques to identify that there is a stronger copper signal in the north, and a stronger lead-zinc signal in the south of the property. This may represent metal zonation and can be a deposit feature which will be investigated further during the maiden drilling program.

- Geochemical interpretation of the channel samples has yielded several significant outcomes:

- A Mineralization Component has been identified using a dimension reduction technique (Principal Components Analysis). The geochemical affinity defined in the Mineralization Component includes Ag, Sb, As, Pb, Cu, Zn and S. This association is applied to the soils data available and has assisted with targeting.

- A geochemical proxy for lithology was achieved through multivariate analysis, and a classification diagram was created which distinguishes the marble, sandstone/phyllite, carbonate, dolostone, and mineralized units.

Figure 1: Silver (ppm) from grab and channel samples with by interpreted resistive zones (pink). Note the strong coincidence of the resistive zones with the highest grade (>100 g/t silver) throughout the trend.

Figure 2: Filtered, interpreted, gravity data (in mG) on the South Zone of the Sail Pond project overlain by Lead-in-soil data. Note the very strong correlation of the gravity highs (warm colours) with the high-grade lead values.

Kelly Malcolm, Technical Advisor, states, "We are very pleased with Goldspot's detailed analytical review of the Sail Pond data. In particular, their review and modelling of the geophysical data, which previously wasn't generating many targets, combined with geochemical and geological data has identified numerous multi-parameter high-priority targets. In addition, Goldspot's experience in Newfoundland geology and mineralization has contributed greatly to our understanding of the potential of the high grade Sail Pond project. Our recently completed gravity survey is also showing an excellent correlation with surface mineralization, which may reflect an accumulation of high-density minerals at depth, such as galena which is intimately related to silver mineralization. I'm eager to see what lies beneath the surface as we start the first-ever drill program next month."

Sterling Metals is presenting in a live webinar hosted by Red Cloud Securities on May 20 at 2pm where we will discuss our results and exploration plan. The link to the invite is: https://www.redcloudfs.com/rcwebinar-sag/

We encourage you to join us so we can take you through our findings and planned drill holes in more detail.

Qualified Persons

Kelly Malcolm, P.Geo., Technical Advisor to Sterling Metals, and a Qualified Person within the meaning of National Instrument 43-101 Standards of Disclosure for Minerals Projects, has reviewed and approved the technical information presented herein.

Lindsay Hall, P.Geo. (APGO 0891), Chief Geologist of GoldSpot Discoveries Corp. and a Qualified Person within the meaning of NI 43-101 Standards of Disclosure for Minerals Projects, has also reviewed and approved the technical information presented herein.

About Sterling Metals

Sterling Metals (TSXV:SAG) is a mineral exploration company focused on Canadian exploration opportunities. The company is currently exploring for silver and base metals at the Sail Pond project in Northwestern Newfoundland. Sterling has the option to acquire 100% of the 13,500 Ha Project.

About GoldSpot Discoveries

GoldSpot Discoveries (SPOT)(SPOFF) is a technology services company in mineral exploration. GoldSpot is a leading team of expert scientists who merge geoscience and data science to deliver bespoke solutions that transform the mineral discovery process. In the race to make discoveries, GoldSpot produces Smart Targets and advanced geological modelling that saves time, reduces costs and provides accurate results.

For more information, please contact:

Mathew Wilson, President & CEO

Tel: (416) 643-3887

Email: info@sterlingmetals.ca

Website: www.sterlingmetals.ca

GoldSpot Discoveries Corp.

Denis Laviolette

Executive Chairman and President

GoldSpot Discoveries Corp.

Tel: 647-992-9837

Email: investors@GoldSpot.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains certain "forward-looking information" within the meaning of applicable securities laws. Forward looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate", "may", "will", "would", "potential", "proposed" and other similar words, or statements that certain events or conditions "may" or "will" occur. These statements are only predictions. Forward-looking information is based on the opinions and estimates of management at the date the information is provided, and is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. For a description of the risks and uncertainties facing the Company and its business and affairs, readers should refer to the Company's Management's Discussion and Analysis. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change, unless required by law. The reader is cautioned not to place undue reliance on forward-looking information.

SOURCE: Sterling Metals Corp.

View source version on accesswire.com:

https://www.accesswire.com/647127/Sterling-Metals-and-GoldSpot-Discoveries-Identify-Numerous-Silver-Targets-on-the-Sail-Pond-Silver-Project-in-Newfoundland-and-Announce-Drilling-Program