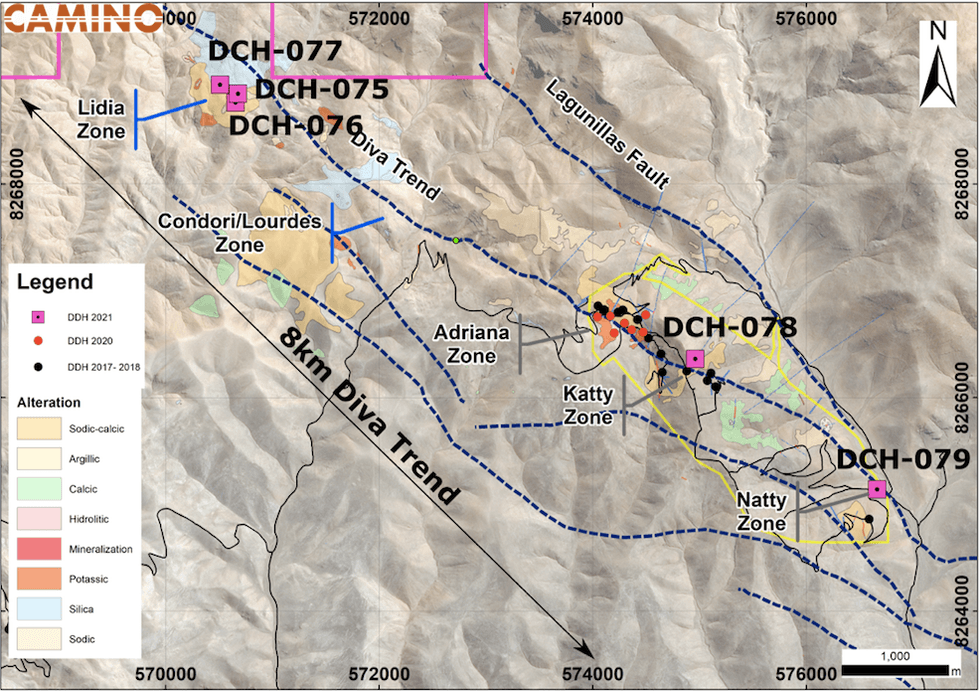

Camino Corp. (TSXV:COR)(OTC PINK:CAMZF) (WKN:A116E1) ("Camino" or the "Company") is pleased to announce that discovery drilling at its Los Chapitos copper project (Los Chapitos), consisting of 5 exploration drillholes, intercepted anomalous copper mineralization over a strike extent of approximately 6.5 kilometres (Figure 1 and Table 1) with grades up to 1.05% Cu. The drillholes also contained consistent cobalt mineralization, and trace amounts of silver and gold. Drilling to date has only tested a portion of the copper mineralization along the more than 8 km Diva Trend. Parallel fault structures along Atajo and Lagunillas are also prospective for copper discoveries within the Los Chapitos claims. The drilling at Los Chapitos is targeting new copper mineralization in addition to the previously drilled Adriana Zone, as newly permitted areas become available for drilling. At the Adriana Zone, drilling results reported in January 2021 showed significant intercepts of copper mineralization, including 55.5 m of 0.72% copper (Cu), with 22.5 m @ 1.15% Cu (see news release dated January 19, 2021). The next priority drill target is the Lourdes copper oxidized outcrop with geological similarities to Adriana

Highlights:

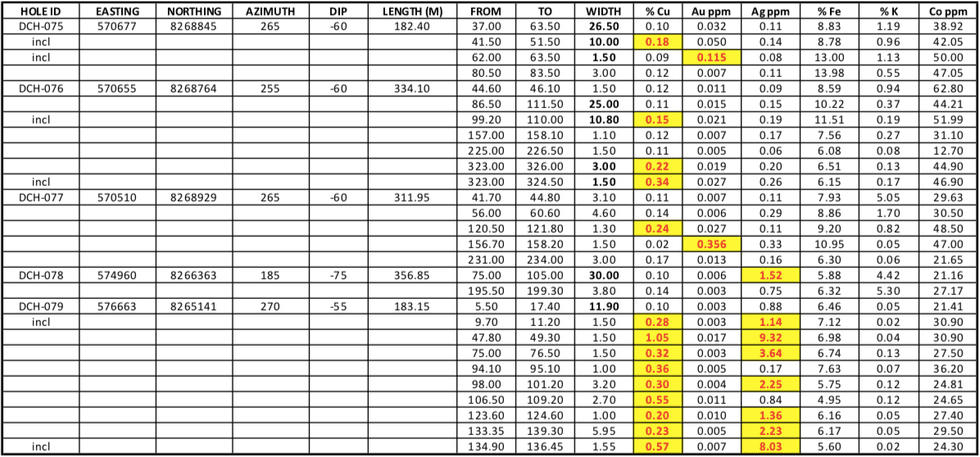

- Initial 5 exploration drillholes show anomalous copper, cobalt, and trace gold and silver with up to 1.05% copper and 0.36 g/t gold, covering 6.5 km of strike extent on the Diva Trend and only a fraction has been drill tested with very encouraging results in this round of exploration drilling.

- Drilling identified copper sulphides in both volcanic and intrusive rocks that indicate potential for a sulphide feeder deposit.

- The next priority drill target is at the Lourdes outcrop (Figure 1), which shows structurally controlled manto-style copper oxide mineralization similar to the Adriana and Carlotta zones.

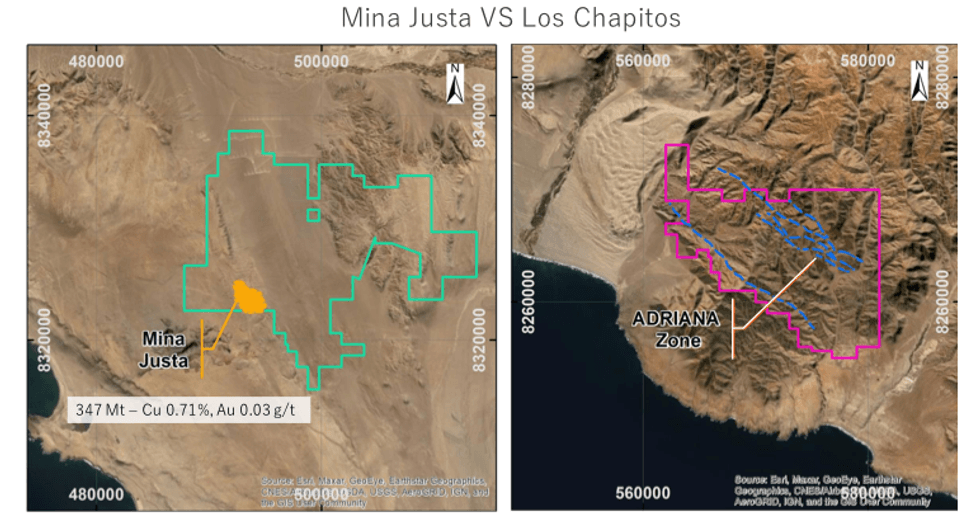

"We appear to be in the right geological sequence of rock for a large discovery to be made that is similar to the nearby large manto-style Mina Justa deposit. The presence of mineralized intercepts is giving us confidence that we are drilling near a large distal ore body," said Chief Geologist, Jose Bassan. "Chalcopyrite, chalcocite, bornite, and oxidized copper have been logged in a rock assemblage of volcanic andesitic tuff with moderate alteration and the presence of epidote, chlorite, hematite, magnetite, and carbonates, and evidence of magnetite replacement by specularite. This is a lithological sequence similar to the new Mina Justa copper mine that is hosted in the same Chocolate Formation as Los Chapitos."

Figure 1. Alteration Plan Map of Diva Trend Showing Recent and Historical Drillholes

The Company expects that a Declaracion Impacto Ambiental ("DIA") drilling permit will be received imminently, allowing for drilling to commence in the new Lourdes and Condori Zones located 3 km north of the Adriana Zone. The Company plans to prioritize its drilling between its Los Chapitos Project and its new Maria Cecilia copper porphyry project pending receipt of permits in the new year.

"We are selectively stepping out and drilling new mineralized areas as new permits become available at both our Los Chapitos and Maria Cecilia copper projects," said Jay Chmelauskas, CEO of Camino. "Both copper projects are expected to receive new DIA drilling permits at the end of 2021 or beginning of 2022, which will allow for more discovery drilling at the beginning of 2022. These projects have the right geology to make large scale copper discoveries which is our opportunity early next year."

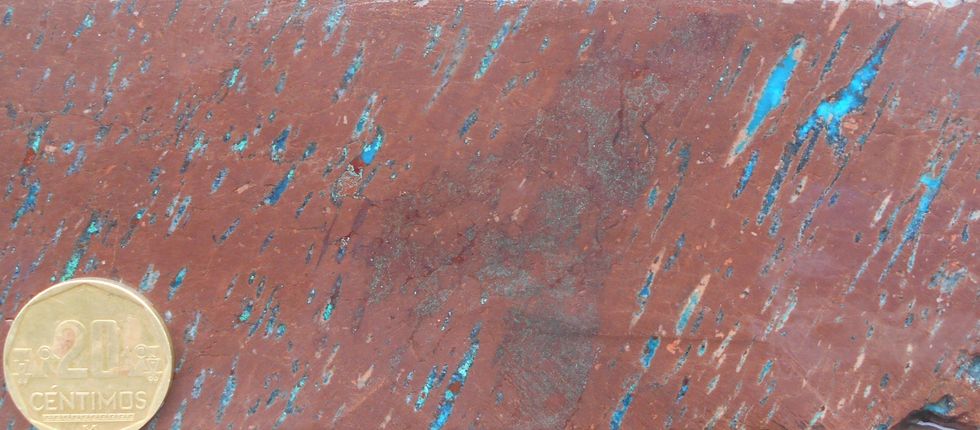

Figure 2. Chocolate Formation Hosting Copper Oxides in Drillhole DCH-074 at 74 Metres

The mineralization encountered in the recent drilling campaign was intercepted in volcanic andesites known as the Chocolate Formation (Figure 2), which is a sequence of volcanic rocks that extend along the coast of Peru and host other significant mining projects. Notably, the Mina Justa copper mine, located 100 km north of Los Chapitos, is Peru's newest copper and gold mine with invested capital of over $1.6 Billion. The Company believes that Los Chapitos has a similar alteration assemblage with hematite, magnetite, epidote, chlorite, feldspar, potassium, and calcite capable of hosting a major deposit like Mina Justa (Figure 3).

Figure 3. Mina Justa Copper Deposit Footprint Compared Against the Los Chapitos Claims

All 5 exploration drillholes, totalling approximately 1,400 metres, have intercepted anomalous copper mineralization. Three drillholes in the Lidia Zone located 4 km to the north of the Adriana Zone and spaced approximately 75m apart, DCH-075, DCH-076, DCH-077, have intercepted copper mineralization up to 0.34% Cu and 0.36ppm Au, that appears continuous and manto-like between drillholes.

A step-out hole 1 km south of Adriana has extended the mineralization halo in the Katty Zone by 200 m. Drillhole DCH-079, located 2.5 km to the south of Adriana, intercepted anomalous copper enriched in secondary sulfide chalcocite, bornite, and covellite with up to 1.05% Cu and 9.32ppm Ag. The Company believes that the anomalous copper results in exploration drilling support the potential for a large-scale distal deposit.

Camino is selectively drilling new areas that the Company believes could intercept additional mineralization like the copper oxides at Adriana. The recent drilling campaign has also identified copper sulphides in the intrusive monzonite that may indicate a sulphide feeder deposit that would account for the widespread copper oxide mineralization at surface. Copper sulphides were also encountered in our 2020 drill campaign where DCH-072 intercepted up to 2.04% Cu in monzonite intrusives. The sulphide mineralization provides additional exploration potential at Los Chapitos.

Figure 4. 2020 drill campaign. Chalcopyrite in hole DCH-072, interval 481.7-483.8m copper value up to 2.04% Cu

Table 1. Drilling Results from Fall 2021 Drilling Campaign at Los Chapitos

Additional Information:

- Figure 5 - Geophysics Plan Map of Diva Trend Showing Recent and Historical Drillholes

- Figure 6 - Oblique Cross-Section of Drillholes DCH-075, 076, 077

- Figure 7 - Cross-Section of Drillhole DCH-078

- Figure 8 - Cross-Section of Drillhole DCH-079

- Figure 9 - Cross-Section of Drillholes DCH-078 and DCH-079

About Camino Minerals Corporation

Camino is a discovery and development stage copper exploration company. The Company is focused on advancing its high-grade Los Chapitos copper project located in Peru towards potential resource delineation and new discoveries. In addition, the company has commenced field studies at its copper and silver Plata Dorada project. Camino has also recently acquired the Maria Cecilia copper porphyry project. The Company seeks to acquire a portfolio of advanced copper assets that have the potential to deliver copper into an electrifying copper intensive global economy. For more information, please refer to Camino's website at www.caminocorp.com.

Jose Bassan MAusIMM (CP) 227922, MSc. Geologist, a Qualified Person as defined by NI 43-101, has reviewed and approved the technical contents of this document. Mr. Bassan has reviewed and verified relevant data supporting the technical disclosure, including sampling and analytical test data.

| ON BEHALF OF THE BOARD

| For further information, please contact: Camino Investor Relations |

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward Looking Statements: Certain disclosures in this release constitute forward-looking information. In making the forward-looking disclosures in this release, the Company has applied certain factors and assumptions that are based on the Company's current beliefs as well as assumptions made by and information currently available to the Company. Forward-looking information in the release includes the prospectivity of future exploration work on the Los Chapitos and Maria Cecilia projects the ability to complete the necessary permit requirements for drilling, or that actual results of exploration and engineering activities are consistent with management's expectations. Although the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect, and the forward-looking information in this release is subject to numerous risks, uncertainties and other factors that may cause future results to differ materially from those expressed or implied in such forward-looking information. Such risk factors include, among others, that actual results of the Company's exploration activities will be different than those expected by management, that the Company will be unable to obtain or will experience delays in obtaining any required approvals and the state of equity and commodity markets. Readers are cautioned not to place undue reliance on forward-looking statements. The Company does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law.

SOURCE: Camino Minerals Corp.

View source version on accesswire.com:

https://www.accesswire.com/677496/District-Scale-Manto-Style-Copper-Oxides-with-Primary-Sulphide-Mineralization-Potential-at-the-Los-Chapitos-Project-in-Peru