Camino Corp. (TSXV:COR)(OTC PINK:CAMZF)(WKN:A116E1) ("Camino" or the "Company") is pleased to announce that it has engaged AK Drilling International S.A. ("AK"), a Peru-based drilling company, to commence core drilling at its Los Chapitos copper project near the coastal town of Chala in Arequipa Department, Peru ("Los Chapitos"). Camino received the necessary drilling permit from the Ministry of Energy and Mines at the beginning of August for its high-grade copper and gold Lidia Zone and has submitted its Start of Operations notice to mobilize and commence exploration drilling by the end of August

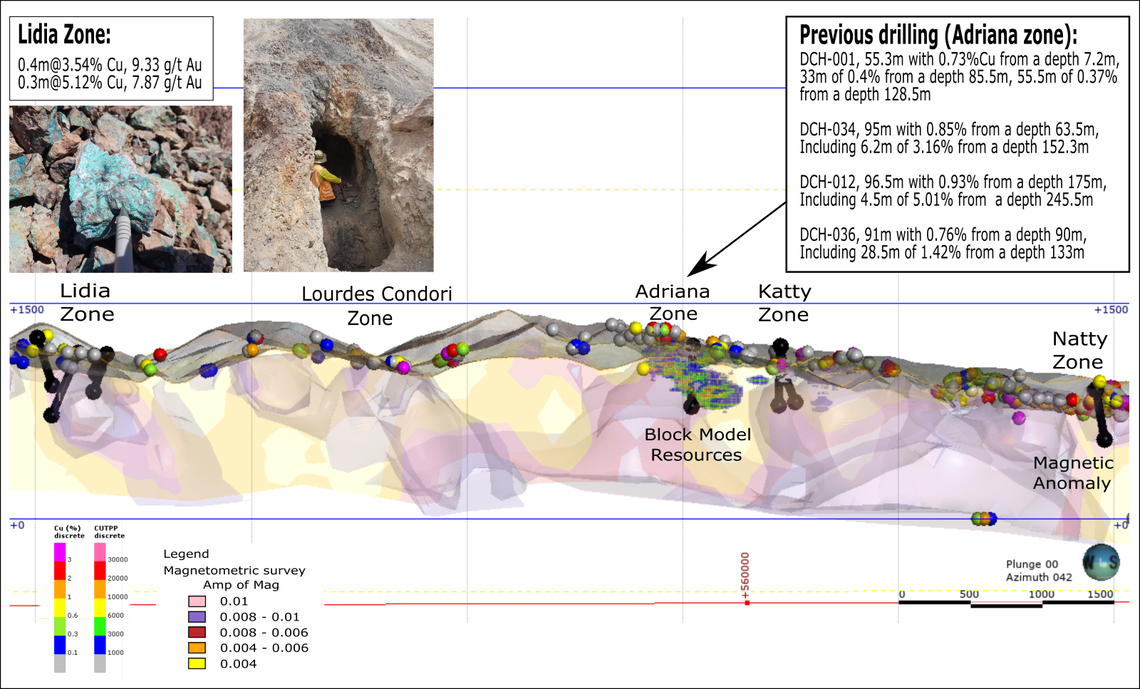

The Company is also pleased to report that it completed the ground magnetometry survey (see news release dated July 6, 2021) and is processing the results to help guide the proposed drill program over its new Lidia Zone. The Lidia Zone demonstrates similar geophysical signatures (See Figure 1) to those that host the significant copper intercepts made at the Adriana Zone (see news release dated January 19, 2021).

"Our August exploration campaign is focussed on new discovery targets that are 4 km north from previous drilling," said Chief Geologist, Jose Bassan. "Copper mineralization is structurally controlled along the major Diva Fault and we are seeing imprinting of epithermal mineralization and calc-sodic alteration as part of a large iron oxide copper gold - IOCG system. Targeting these alteration zones that demonstrate high-grade mineralization can lead us to the controls and mineralization traps for a new discovery."

Initial drill holes will specifically target artisanal mining sites with copper workings to depths of 10 m. Copper mineralization at the Lidia Zone is hosted in the Chocolate Formation with monzonites and calco-sodic and siliceous alteration, in addition to saccharoidal-crystalline quartz veins with gold grades up to 9.3 g/t gold (Au) and up to 5.1% copper (Cu). This is the same Chocolate Formation that hosts other large deposits along the coast of Peru such as Peru's newest copper mine, Mina Justa. Anomalies by xrf analyses in soil samples show the presence of copper and gold, and 238 rock chip samples taken in 2018/19 averaged 0.78 % Cu, with up to 23% Cu and 11 g/t Au over a 3 km by 4 km area.

"This marks the start of our drilling campaigns in 2021, commencing at a new high-grade copper and gold extension of our Los Chapitos copper project," said Jay Chmelauskas, CEO of Camino. "We plan to keep the drill campaigns going through the rest of the year as we target new areas of mineralization at Los Chapitos, and ultimately, finish the year drilling at our new Maria Cecilia porphyry project, as permits are received. Los Chapitos and Maria Cecilia are big geological systems that show potential for large tonnage copper discoveries."

Figure 1. Lidia high-grade copper gold zone at the Los Chapitos copper project

Almost 90% of historical drilling has been near the Adriana Zone where the company has intercepted significant copper mineralization such as:

- DCH-001, 55.3 m with 0.73% Cu from a depth 7.2 m, 33 m of 0.4% from a depth 85.5 m, 55.5 m of 0.37% from a depth 128.5 m;

- DCH-034, 95 m with 0.85% Cu from a depth 63.5 m, Including 6.2 m of 3.16% from a depth 152.3 m;

- DCH-012, 96.5 m with 0.93% Cu from a depth 175 m, Including 4.5 m of 5.01% from a depth 245.5 m;

- DCH-036, 91 m with 0.76% Cu from a depth 90 m, Including 28.5 m of 1.42% from a depth 133 m.

Camino is now selectively testing new areas to make new discoveries along the 10 km Diva Structure Fault that controls mineralization at Los Chapitos. Following the Diva trend, 4 km to the north from the Adriana to the Lidia Zone, there is an occurrence of copper oxide bodies and gold-bearing quartz veins mainly in the Lourdes-Condori Zone that also extends to the Lidia Zone.

About Camino Minerals Corporation

Camino is a discovery and development stage copper exploration company. The Company is focused on advancing its high-grade Los Chapitos copper project located in Peru towards potential resource delineation and new discoveries. In addition, the company has commenced field studies at its copper and silver Plata Dorada project. Camino has also recently acquired the Maria Cecilia copper porphyry project. The Company seeks to acquire a portfolio of advanced copper assets that have the potential to deliver copper into an electrifying copper intensive global economy. For more information, please refer to Camino's website at www.caminocorp.com.

Jose Bassan MAusIMM (CP) 227922, MSc. Geologist, a Qualified Person as defined by NI 43-101, has reviewed and approved the technical contents of this document. Mr. Bassan has reviewed and verified relevant data supporting the technical disclosure, including sampling and analytical test data.

ON BEHALF OF THE BOARD

/S/ 'Jay Chmelauskas'

President and CEO

For further information, please contact:

Camino Investor Relations

info@caminocorp.com

Tel: (604) 608-4513

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward Looking Statements: Certain disclosures in this release constitute forward-looking information. In making the forward-looking disclosures in this release, the Company has applied certain factors and assumptions that are based on the Company's current beliefs as well as assumptions made by and information currently available to the Company. Forward-looking information in the release includes the prospectivity of future exploration work on the Los Chapitos, Plata Dorada, and Maria Cecilia projects, the ability to complete the necessary permit requirements for drilling, or that actual results of exploration and engineering activities are consistent with management's expectations. Although the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect, and the forward-looking information in this release is subject to numerous risks, uncertainties and other factors that may cause future results to differ materially from those expressed or implied in such forward-looking information. Such risk factors include, among others, that actual results of the Company's exploration activities will be different than those expected by management, that the Company will be unable to obtain or will experience delays in obtaining any required approvals and the state of equity and commodity markets. Readers are cautioned not to place undue reliance on forward-looking statements. The Company does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law.

SOURCE: Camino Minerals Corp.

View source version on accesswire.com:

https://www.accesswire.com/659072/Camino-to-Commence-Drilling-at-its-New-Lidia-Copper-Gold-Zone-at-Los-Chapitos-Project