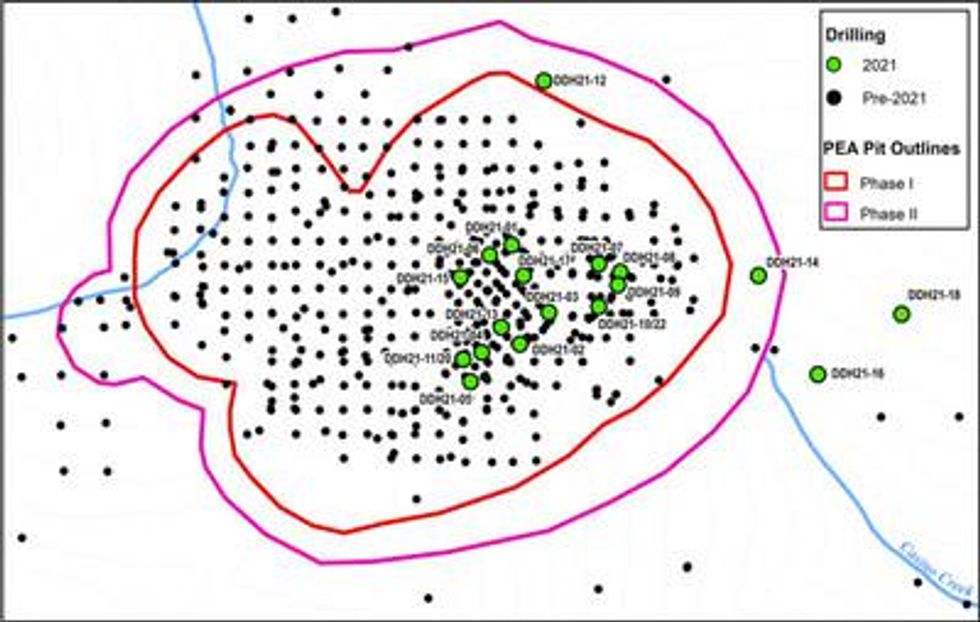

Western Copper and Gold Corporation ("Western" or the "Company") (TSX: WRN) (NYSE American: WRN) is pleased to announce assay results from the initial nine holes of the 2021 diamond drilling program at its wholly-owned Casino Project in the Yukon Territory, Canada . The program, developed with input from Rio Tinto, comprised a total of 6,074.97 metres in 22 holes.

Highlights

- The importance of the core of the deposit to the overall resource at Casino ("Deposit Core", see news release dated February 2, 2021 ) was reinforced by long intercepts of above-resource grades in both the Leached Cap and Sulphide zones (Table 1):

- DDH21-02, -04, and -06 encountered over 200 metres of 0.86%, 0.97%, and 0.81% CuEq 1 , respectively , in the Sulphide zone within the Deposit Core.

- DDH21-02 and -04 intersected over 100 m of higher-grade Leached Cap in the Deposit Core with grades of 0.47 g/t and 0.61 g/t Au, respectively.

- DDH21-07 and -09 intercepted above-resource grades in the Sulphide zone just east of the Deposit Core:

- Hole DDH21-07 returned a 289.6 m intercept of 1.01% CuEq 1 from 36.6 m . This intercept confirmed the higher-grade nature of the upper zones of sulphide mineralization within previous holes and extended those higher grades zones by approximately 100 m of true vertical depth.

- DDH21-09 returned a 65.8 m intercept of 2.53% CuEq 1 from 10.6 m , one of the highest-grade intercepts drilled to date on the property.

Summary

The results from these nine drill holes essentially confirmed or, in some cases, improved upon historical drilling in the area. This confirmation, and in some cases an increase in grades and/or extension of higher-grade zones, are important achievements of these initial results.

At Casino, higher grades are hosted mostly by intrusive breccias and, in the Deposit Core, also by Patton Porphyry intrusive rock. DDH21-07, -08, and -09, which were drilled east of the Deposit Core, indicate that higher grades also occur in the Dawson Batholith proximal to the brecciated rocks.

"The results from the first holes drilled as part of the 2021 drilling campaign clearly outline the importance of the Deposit Core at Casino.", said Paul West-Sells , President & CEO, "Intercepted grades encountered in and around this area are some of the highest drilled to date on the property, and importantly occur at the top of the Sulphide zone in these areas, representing material that will be mined early on during operations."

Table 1: Initial drill intercepts from 2021 drill program.

| Hole | From (m) | To (m) | Width 2 (m) | Zone 3 | Cu (%) | Au (g/t) | Ag (g/t) | Mo (%) | CuEq 1 (%) |

| DDH21-01 | 0.5 | 57.3 | 56.8 | LC | 0.07 | 0.15 | 0.98 | 0.035 | 0.33 |

| and | 57.3 | 352.0 | 294.8 | SUL | 0.19 | 0.22 | 1.00 | 0.025 | 0.48 |

| DDH21-02 | 5.2 | 109.9 | 104.7 | LC | 0.01 | 0.47 | 3.92 | 0.010 | 0.46 |

| and | 109.9 | 350.2 | 240.3 | SUL | 0.28 | 0.44 | 2.69 | 0.050 | 0.86 |

| DDH21-03 | 0.0 | 115.5 | 115.5 | LC | 0.01 | 0.20 | 1.39 | 0.039 | 0.34 |

| and | 115.5 | 228.6 | 113.1 | SUL | 0.19 | 0.22 | 3.34 | 0.012 | 0.45 |

| DDH21-04 | 3.0 | 115.9 | 112.9 | LC | 0.05 | 0.61 | 3.67 | 0.020 | 0.65 |

| and | 115.9 | 350.5 | 234.6 | SUL | 0.36 | 0.53 | 4.20 | 0.037 | 0.97 |

| DDH21-05 | 3.0 | 82.0 | 79.0 | LC | 0.04 | 0.48 | 2.23 | 0.008 | 0.48 |

| and | 82.0 | 300.2 | 218.2 | SUL | 0.21 | 0.33 | 1.89 | 0.015 | 0.55 |

| DDH21-06 | 0 | 39.6 | 39.6 | LC | 0.11 | 0.19 | 0.77 | 0.007 | 0.30 |

| and | 39.6 | 324.6 | 285.0 | SUL | 0.29 | 0.48 | 2.20 | 0.028 | 0.81 |

| DDH21-07 | 18.3 | 36.6 | 18.3 | LC | 0.05 | 0.53 | 2.82 | 0.019 | 0.58 |

| and | 36.6 | 326.1 | 289.6 | SUL | 0.45 | 0.52 | 2.10 | 0.031 | 1.01 |

| DDH21-08 | 1.5 | 18.6 | 17.0 | LC | 0.06 | 0.12 | 1.02 | 0.004 | 0.18 |

| and | 18.6 | 256.0 | 237.5 | SUL | 0.18 | 0.23 | 1.24 | 0.005 | 0.39 |

| DDH21-09 | 0.0 | 10.6 | 16.7 | LC | 0.05 | 0.18 | 1.11 | 0.005 | 0.23 |

| and | 10.6 | 225.6 | 214.9 | SUL | 0.54 | 0.55 | 3.13 | 0.008 | 1.05 |

| including | 10.6 | 76.4 | 65.8 | SUL | 1.32 | 1.33 | 7.09 | 0.019 | 2.53 |

| including | 34.7 | 35.7 | 1.0 | SUL | 3.27 | 4.20 | 112.00 | 0.018 | 7.75 |

| | |

| 1 | CuEq Metal Prices: US$2.75/lb copper, US$1,500/oz gold, US$11/lb molybdenum, US$18/oz silver with no adjustment for metallurgical recovery. |

| 2 | Widths are core length, not true width of mineralized intersection |

| 3 | Zone refers to oxidation zone. LC designates material from the "Leached Cap" zone and SUL to material from the "Sulphide" zone comprised of the supergene and hypogene zones. |

Table 2: Collar data DDH21-01 through DDH21-09, 2021 program

| Drill Hole | Easting | Northing | Elevation (masl) | Azimuth | Inclination | Location |

| DDH21-01 | 611067 | 6958785 | 1239.2 | 225 | -60 | NE of Deposit Core |

| DDH21-02 | 611101 | 6958375 | 1286.8 | 195 | -60 | Deposit Core |

| DDH21-03 | 611222 | 6958506 | 1269.1 | 315 | -60 | E. Edge Deposit Core |

| DDH21-04 | 610941 | 6958341 | 1359.0 | 35 | -60 | Deposit Core |

| DDH21-05 | 610894 | 6958219 | 1393.1 | 240 | -60 | Deposit Core |

| DDH21-06 | 610974 | 6958744 | 1287.6 | 215 | -60 | Deposit Core |

| DDH21-07 | 611432 | 6958707 | 1177.1 | 170 | -55 | E. Edge Deposit Core |

| DDH21-08 | 611522 | 6958674 | 1168.5 | 60 | -60 | E. Edge Deposit Core |

| DDH21-09 | 611512 | 6958620 | 1161.9 | 100 | -60 | E. Edge Deposit Core |

Carl Schulze , P.Geo. is the qualified person responsible for the execution of the Casino Project exploration program and the preparation of the technical information in this news release.

QA/QC including assurance of chain of custody has been implemented. Split core samples are prepared and analyzed by ALS Geochemistry. Prepared samples are initially run using a four acid digestion process and conventional multi-element ICP-AES analysis. Additional assaying for total copper and molybdenum is run using a 4-acid digestion – AES or AAS method to a 0.001% detection limit. Gold assays are run using 30-gram sample fire assay with an AA finish to a 0.005 ppm detection limit, with samples greater than 10 ppm finished gravimetrically. The QA/QC procedure involves regular submission of Certified Analytical Standards and property specific duplicates.

ABOUT Western Copper and Gold Corporation

Western Copper and Gold Corporation is developing the Casino Project, Canada's premier copper-gold mine in the Yukon Territory and one of the most economic greenfield copper-gold mining projects in the world. For more information, visit www.westerncopperandgold.com .

On behalf of the board,

"Paul West-Sells"

Dr. Paul West-Sells

President and CEO

Western Copper and Gold Corporation

Cautionary Disclaimer Regarding Forward-Looking Statements and Information

This news release contains certain forward-looking statements concerning anticipated developments in Western's operations in future periods. Statements that are not historical fact are "forward-looking statements" as that term is defined in the United States Private Securities Litigation Reform Act of 1995 and "forward looking information" as that term is defined in National Instrument 51-102 ("NI 51-102") of the Canadian Securities Administrators (collectively, "forward-looking statements"). Certain forward looking information should also be considered future-oriented financial information ("FOFI") as that term is defined in NI 51-102. The purpose of disclosing FOFI is to provide a general overview of management's expectations regarding the anticipated results of operations and capital expenditures and readers are cautioned that FOFI may not be appropriate for other purposes. Forward-looking statements are frequently, but not always, identified by words such as "expects", "anticipates", "believes", "intends", "estimates", "potential", "possible" and similar expressions, or statements that events, conditions or results "will", "may", "could" or "should" occur or be achieved. These forward-looking statements may include, but are not limited to, statements regarding perceived merit of properties; mineral reserve and resource estimates; capital expenditures; feasibility study results (including projected economic returns, operating costs, and capital costs in connection with the Casino Project); exploration results at the Company's property; budgets; permitting or other timelines; economic benefits from the mine and/or the access road; strategic plans; market price of precious and base metals; or other statements that are not statement of fact. The material factors or assumptions used to develop forward-looking statements include prevailing and projected market prices and foreign exchange rates, exploration estimates and results, continued availability of capital and financing, construction and operations, the Company not experiencing unforeseen delays, unexpected geological or other effects, equipment failures, permitting delays, and general economic, market or business conditions and as more specifically disclosed throughout this document, and in the AIF and Form 40-F.

Forward-looking statements are statements about the future and are inherently uncertain, and actual results, performance or achievements of Western and its subsidiaries may differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements due to a variety of risks, uncertainties and other factors. Such risks and other factors include, among others, risks involved in fluctuations in gold, copper and other commodity prices and currency exchange rates; uncertainties relating to interpretation of drill results and the geology, continuity and grade of mineral deposits; uncertainty of estimates of capital and operating costs, recovery rates, production estimates and estimated economic return; risks related to joint venture operations; risks related to cooperation of government agencies and First Nations in the development of the property and the issuance of required permits; risks related to the need to obtain additional financing to develop the property and uncertainty as to the availability and terms of future financing; the possibility of delay in construction projects and uncertainty of meeting anticipated program milestones; uncertainty as to timely availability of permits and other governmental approvals; and other risks and uncertainties disclosed in Western's AIF and Form 40-F, and other information released by Western and filed with the applicable regulatory agencies.

Western's forward-looking statements are based on the beliefs, expectations and opinions of management on the date the statements are made, and Western does not assume, and expressly disclaims, any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as otherwise required by applicable securities legislation. For the reasons set forth above, investors should not place undue reliance on forward-looking statements.

SOURCE Western Copper and Gold Corporation