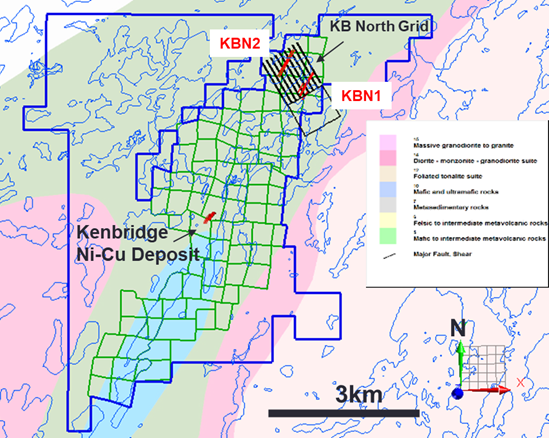

Tartisan Nickel Corp. (CSE:TN)(OTC PINK:TTSRF)(FSE:A2D) ("Tartisan", or the "Company") is pleased to provide an update from the ongoing 10,000 metre diamond drilling program at the 100% owned Kenbridge Nickel Project located in the Kenora Mining District, Ontario. The Phase 1 drill campaign, utilizing 2 drill rigs, is approximately 90% completed. One drill has been mobilized to the Kenbridge North target where it will complete 3 planned drill holes, approximately 500 meters each drill hole. The Kenbridge North target is located approximately 2.5 kilometres north of the Kenbridge Nickel Deposit and was identified from a ground based Time Domain Electromagnetic (TDEM) survey completed in early 2021. The Kenbridge North target is interpreted to represent similar rock types that host the Kenbridge Nickel Deposit

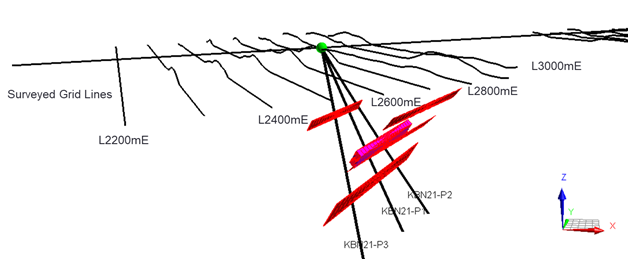

A geophysical crew has completed Time Domain Electromagnetic (TDEM) surveying of holes KB21-199, 201, 202, and 204 in addition to previously surveyed holes KB21-198 and KB21-200. Preliminary interpretation from data collected in KB21-198 and KB21-200 suggest that two parallel, steeply dipping, strongly conductive zones extend below the intersections from holes KB21-198, KB21-200 and KB21-202. Hole KB21-204 was targeted to test these same interpreted conductors approximately 200 metres down dip of KB21-202. Highlights from KB21-202 included two nickel-copper zones (Zone A and B) at a drill depth of 663.0 metres and 693.7 metres. KB21-202 Zone A returned 25.5 metres of 1.13% Ni and 0.61% Cu including higher grade intersections of 4.5 metres of 2.96% Ni and 1.66% Cu and 1.5 metres of 4.17% Ni and 2.14% Cu. (SEDAR October 12, 2021). Hole KB21-204 has been completed with assays pending. Hole KB21-205 was completed to a depth of 1179 metres and intersected the gabbro pyroxenite host rock approximately 150m north of KB21-204. Assays are also pending. Hole KB21-206 is in progress and is targeted to test the gabbro pyroxenite host rocks between KB21-204 and KB21-205.

Interpretation of all available data including recently acquired borehole TDEM and drill core assays will be incorporated into the existing geological model to aid in guiding additional diamond drilling, particularly downdip of the known mineralization.

The current drill program was designed to target the down dip and along strike extension of the Kenbridge Ni-Cu Deposit and to test the Kenbridge North target.

Figure 1: Location of the Kenbridge North Grid Drill Target

Figure 2: Inclined 3D view of proposed drill holes and interpreted TDEM geophysical conductors (red plates represent KBN1 conductor).

Figure 3. Section at Kenbridge Deposit looking south. Green outline is the current Mineral Resource. Blue and purple are associated gabbro pyroxenite favorable host rocks. Hole 204 is located approximately 150m below the deepest drill hole intersection completed in the 1950's (Drill hole K2011- 4.25% Ni over 3m).

The Company previously released an Updated Mineral Resource Estimate (MRE) of the Kenbridge Nickel-Copper-Cobalt Project, Atikwa Lake Area, Northwestern Ontario (SEDAR June 1, 2021).

About Tartisan Nickel Corp.

Tartisan Nickel Corp. is a Canadian based mineral exploration and development company whose flag ship asset is the Kenbridge Nickel Deposit located in the Kenora Mining District, Ontario. Tartisan also owns; the Sill Lake Silver Property in Sault St. Marie, Ontario as well as the Don Pancho Manganese-Zinc-Lead-Silver Project in Peru.

Tartisan Nickel Corp. owns an equity stake in; Eloro Resources Limited, Class 1 Nickel and Technologies Limited, Peruvian Metals Corp. and Silver Bullet Mines Inc.

Tartisan Nickel Corp. common shares are listed on the Canadian Securities Exchange (CSE:TN; OTCQX:TTSRF; FSE:A2D). Currently, there are 110,817,303 shares outstanding (122,113,344 fully diluted).

Dean MacEachern P.Geo. is the Qualified Person under NI 43-101 and has read and approved the technical content of this News Release.

For further information, please contact Mark Appleby, President & CEO and a Director of the Company, at 416-804-0280 (info@tartisannickel.com). Additional information about Tartisan Nickel Corp. can be found at the Company's website at www.tartisannickel.com or on SEDAR at www.sedar.com.

This news release may contain forward-looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, potential mineral recovery processes, etc. Forward-looking statements address future events and conditions and therefore, involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements.

The Canadian Securities Exchange (operated by CNSX Markets Inc.) has neither approved nor disapproved of the contents of this press release.

SOURCE: Tartisan Nickel Corp.

View source version on accesswire.com:

https://www.accesswire.com/670047/Tartisan-Nickel-Corp-Drilling-Kenbridge-North-Targets-Updates-Progress-at-the-Kenbridge-Nickel-Copper-Cobalt-Project-NW-Ontario