Camino Corp. (TSXV:COR)(OTC PINK:CAMZF)(WKN:A116E1) ("Camino" or the "Company") is pleased to announce that it is preparing to drill its second copper project in Peru at the Maria Cecilia copper porphyry district ("Maria Cecilia" or "the Project"). Camino closed the purchase of Maria Cecilia from Denham Capital in July 2021 (see news release dated July 14, 2021). Camino's CEO, Jay Chmelauskas, recently visited a village adjacent to the Project and participated in a community assembly to introduce the Company. Mr. Chmelauskas was accompanied by Camino's community relations team that included two Quechua speakers and the Director of Camino's Peruvian operations. The Company presented the proposed work program that includes building roads for exploration access, soil and rock sampling and trenching, and diamond drilling. Management at Camino was pleased to participate in this meeting as part of Camino's commitment to social responsibility at Maria Cecilia

An environmental instrument is in the final stages of review with the General Directorate of Mining Environmental Affairs (DGAAM) of the Ministry of Energy and Mines to permit a maiden drilling program at the Maria Cecilia copper porphyry, and is expected in December 2021, followed by the start of operations at the beginning of 2022.

Photo 1. Jay Chmelauskas, Camino CEO at Maria Cecilia. Hand sanitizer and personal protective equipment were left with the community.

"It was a pleasure to meet with the community that lives near Maria Cecilia and to commence exploration activities at the Project," said Jay Chmelauskas, CEO of Camino. "The community has supported previous exploration programs in the area, including drilling activities that have identified over 120 million tonnes of copper, gold, silver, and molybdenum inferred resources at Maria Cecilia (see further details below and link to Technical Report). This is the first time that the central Maria Cecilia porphyry will be drilled within this district. Similar to the drilling that is underway at our Los Chapitos IOCG copper project, we are exploring for major extensions to known copper mineralization at Maria Cecilia in order to expand existing copper resources with a potential new discovery in the central porphyry."

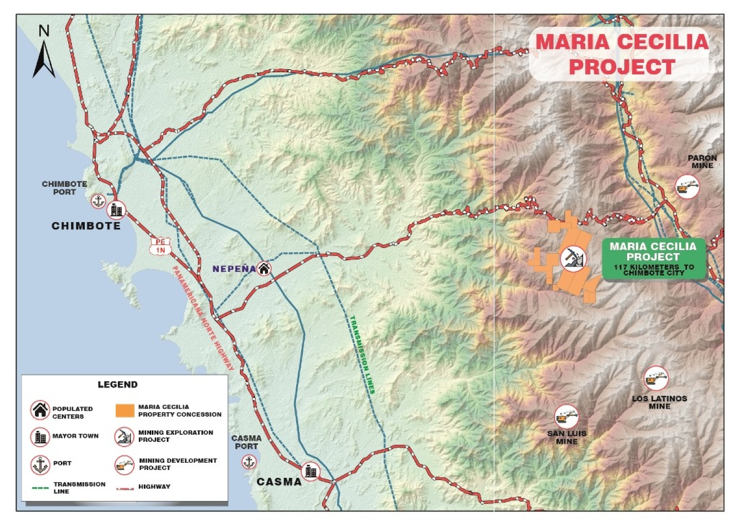

The Maria Cecilia property is 100% owned by Camino. Toropunto, Emmanuel, and Maria Cecilia are three contiguous porphyry centers that form the Maria Cecilia project. The property consists of 15 mineral concessions (approximately 7,110 ha) in the northern Peruvian region of Huaraz. The property is located in the district of Pamparomas, province of Huaylas, Ancash department, approximately 62 km southwest of Caraz city and 400 km north of the city of Lima. Historically, the properties have developed a series of exploratory works since 2009, with geological mapping, geochemical sampling, surface geophysics, and diamond drilling.

"During this visit to Peru, I had the opportunity to drive from Caraz, over the top of Maria Cecilia, down the western slopes of the Cordillera Negra, all the way to the Pan-American Highway to the west coast of Peru," added Mr. Chmelauskas. "We drove past several powerline corridors and recognized the close proximity of Maria Cecilia to the coastline (60 to 100 km)."

Figure 1. Claim Map of Maria Cecilia and proximity to Caraz and the Peruvian coastline.

Exploration History, Geology, and Resources

The mineralogy at Maria Cecilia is situated within Cretaceous sedimentary geology that host an epithermal and porphyry metallogenetic belt considered prospective for Cu-Mo-Au porphyries, Pb-Zn-Cu-Ag skarn and polymetallic deposits related to Miocene intrusives. The project is located in the Cordillera Negra that belongs to geotectonic domain number 3, known as the Cordillera Occidental. The Cordillera Negra is characterized by different types of deposits such as polymetallic, low and high sulphidation epithermal, porphyry and skarn systems located in the western sector of the central Andes in northern Peru. Regionally, it is composed of Mesozoic sedimentary rocks to Cenozoic volcanic rocks that are intruded by granitic to tonalitic rocks of Miocene and Pliocene age. This domain is controlled by regional fold and fault systems that have a NW-SE to NNW-SSE direction. In Toropunto, two styles of mineralization have been recognized, the first style with polymetallic mineralization Zn-Pb-Cu-Ag, is hosted within garnet skarns, adjacent to dioritic sills. The second style of Cu-Au-Mo mineralization is characteristic of hydrothermal systems distally related to porphyries that occur within mineralized structures in intrusive rocks with advanced argillic and phyllic alteration. A total of 59 drill holes have been used to complete the mineral resource estimate at Toropunto and Emmanuel.

About Camino Minerals Corporation

Camino is a discovery and development stage copper exploration company. The Company is focused on advancing its high-grade Los Chapitos copper project located in Peru towards potential resource delineation and new discoveries. Camino has recently acquired the Maria Cecilia copper porphyry project that has a NI43-101 copper, gold, silver and molybdenum resource. In addition, the company has commenced field studies at its copper and silver Plata Dorada project. The Company seeks to acquire a portfolio of advanced copper assets that have the potential to deliver copper into an electrifying copper intensive global economy. For more information, please refer to Camino's website at www.caminocorp.com.

Technical Information

Jose Bassan MAusIMM (CP) 227922, MSc. Geologist, a Qualified Person as defined by NI 43-101, has reviewed and approved the technical contents of this document. Mr. Bassan has reviewed and verified relevant data supporting the technical disclosure, including sampling and analytical test data.

The mineral resources reported in this news release are derived from a resource estimate dated December 18, 2020, and included in the "Independent Technical Report under NI 43-101 for the Toropunto, Emmanuel and Maria Cecilia deposits, Peru" dated December 2020 and available on Camino's SEDAR profile at www.sedar.com. This resource estimate reported the following:

Mineral Resource Statement for Toropunto and Emmanuel projects (8.9 US$/t NSR cut-off), December, 2020

Project | Category | Tonnes (Mt) | CuEq (%) | Cu (%) | Au (g/t) | Ag (g/t) | Mo (ppm) (%) |

Toropunto | Inferred | 32.0 | 0.215 | 0.14 | 0.06 | 5.75 | 4.7 |

Emmanuel | Inferred | 93.7 | 0.294 | 0.18 | 0.18 | 1.38 | 43.2 |

Sources: SRK

1. The Mineral Resource estimates are prepared in accordance with the "CIM Definition Standards on Mineral Resources and Mineral Reserves", adopted by the CIM Council on May 10, 2014, and the "CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines".

2. Mineral Resources have an effective date of 18 December 2020. Fernando Saez, an SRK employee, is the Qualified Person responsible for the review of Mineral Resource estimate.

3. There is no certainty that all or any part of the Mineral Resources estimated will be converted into Mineral Reserves.

4. Mineral resources are reported to 8.90 US$/t NSR cut-off.

5. Density was calculated based on each mineralized structure ranging from 2.46 t/m3 to 2.72 t/m3

Further information about the resource estimate, including information about assumptions, parameters, methods and risks, can be found in the technical report.

ON BEHALF OF THE BOARD | For further information, please contact: |

/S/ "Jay Chmelauskas" | Camino Investor Relations |

President and CEO | |

Tel: (604) 493-2058 |

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements: Certain disclosures in this release constitute forward-looking information. In making the forward-looking disclosures in this release, the Company has applied certain factors and assumptions that are based on the Company's current beliefs as well as assumptions made by and information currently available to the Company. Forward-looking information in the release includes the prospectivity of future exploration work on the Los Chapitos and Maria Cecilia projects the ability to complete the necessary permit requirements for drilling or that actual results of exploration and engineering activities are consistent with management's expectations. Although the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect, and the forward-looking information in this release is subject to numerous risks, uncertainties and other factors that may cause future results to differ materially from those expressed or implied in such forward-looking information. Such risk factors include, among others, that actual results of the Company's exploration activities will be different than those expected by management, that the Company will be unable to obtain or will experience delays in obtaining any required approvals and the state of equity and commodity markets. Readers are cautioned not to place undue reliance on forward-looking statements. The Company does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law.

SOURCE: Camino Minerals Corp.

View source version on accesswire.com:

https://www.accesswire.com/670722/Camino-Management-Visits-Local-Community-at-Maria-Cecilia-Copper-Porphyry-Project-Ahead-of-New-Drilling-Campaign