(TheNewswire)

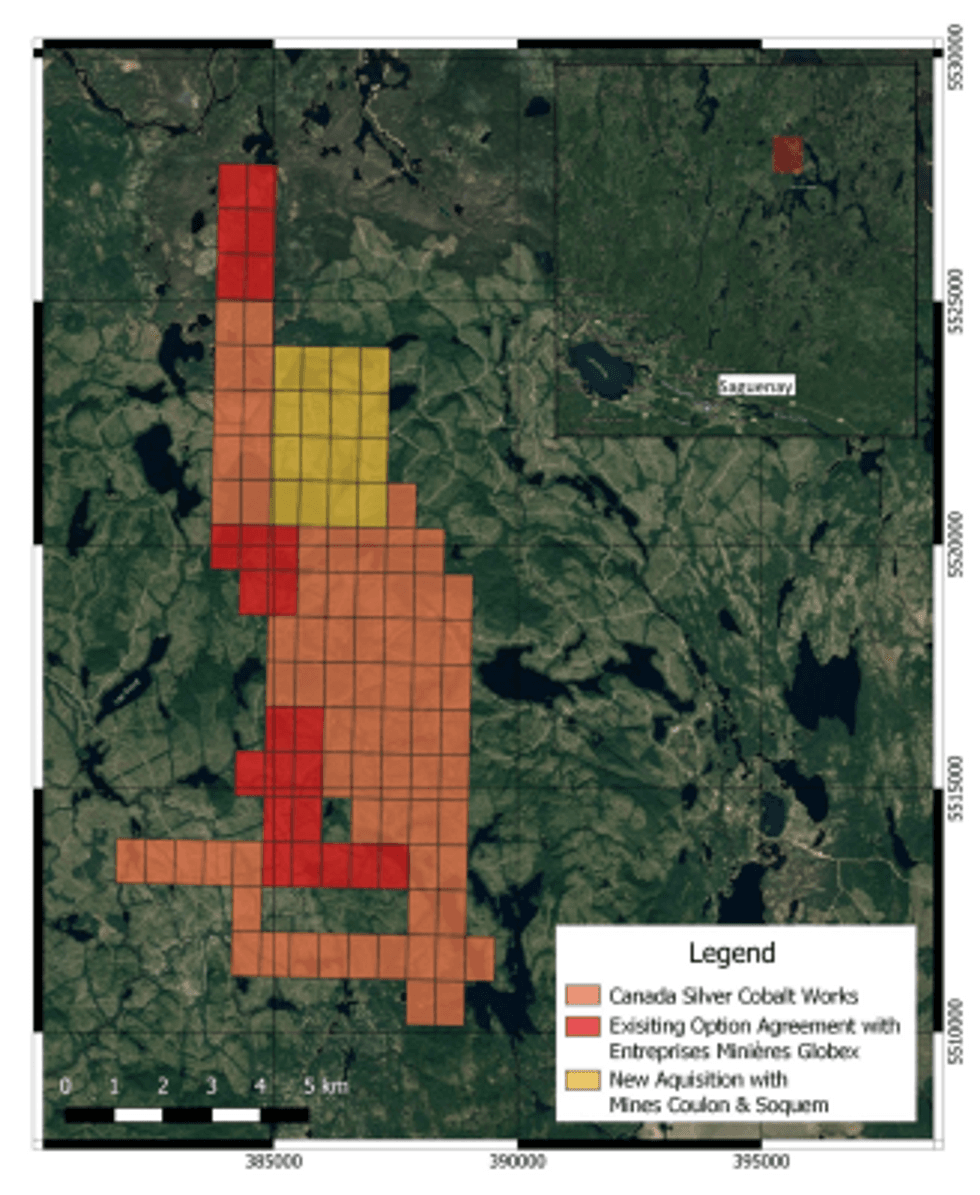

Coquitlam, BC TheNewswire - November 22, 2021 - Canada Silver Cobalt Works Inc. (TSXV:CCW) (OTC:CCWOF) (Frankfurt:4T9B) (the "Company" or "Canada Silver Cobalt") is pleased to announce that an acquisition agreement for 100% ownership of the 16 Chute-des-Passes Property claims jointly owned by SOQUEM INC. (50% ownership) and MINES COULON INC. (50% ownership) has been signed. The property is adjacent and northeast of the Graal-Nourricier-Lac Suzanne property in the Lac St-Jean region of Quebec where the ongoing drill program is located.

The company intends to quickly adjust and expand it's drill permits as the drill program is already in progress with 2 drills on the Graal property. The 16 new claims cover an area of 888.56 hectares. The agreement is for the acquisition of 100% of the Chute des Passes property in return of payment of $10,000 in cash and each company will retain a NSR as described below:

Royalties SOQUEM & COULON:

(i) In consideration for the sale of its interest in the Chute-des-Passes Property, the Company grants SOQUEM the right to receive a royalty of 0.5% of the net smelter return (NSR) on the Chute-des-Passes Property (the Soquem Royalty), half of which is redeemable for an amount of $ 125,000.

(ii) In return for the transfer of its interest in the Chute-des-Passes Property, the Company grants Mines Coulon the right to receive a royalty of 0.5% of the net smelter income (net smelter return or NSR) on the Chute-des-Passes Property (the Coulon Royalty), half of which is redeemable for an amount of $ 125,000.

Existing Royalty means the royalty on the net income of the smelter of 1% in favor of the Fond Minier Du Saguenay-Lac-Saint-Jean, of which 0.5% is redeemable for $ 500,000. The total Royalties on the property is 2% where 1% is redeemable for the sum of $750,000 between the different parties.

The claim numbers included with the acquisition are: CDC-2377582, 2377583, 2377584, 2377585, 2377586, 2377587, 2377588, 2377589, 2377590, 2377591, 2377592, 2377593, 2377594, 2377595, 2377596, and 2377597.

Click Image To View Full Size

Figure 1: Locations of Property, Claims, Option Agreement, and New Acquisition.

Qualified person

The technical information in this news release has been reviewed by Claude Duplessis, P.Eng., GoldMinds Geoservices Inc., a member of the Québec Order of Engineers, and is a qualified person in accordance with the National Instrument 43- 101 standards.

About Canada Silver Cobalt Works Inc.

Canada Silver Cobalt Works Inc. recently discovered a major high-grade silver vein system at Castle East located 1.5 km from its 100%-owned, past-producing Castle Mine near Gowganda in the prolific and world-class silver-cobalt mining district of Northern Ontario. This discovery has the highest silver resource grade in the world, with recent drill intercepts of up to 89,853 grams/tonne silver (2,621 oz/ton Ag). A drill program is underway to expand the size of the deposit with an update to the resource estimate scheduled for Q1 2022.

In May 2020, based on a small initial drill program, the Company published the region's first 43-101 resource estimate that contained a total of 7.56 million ounces of silver in Inferred resources, comprising very high-grade silver (8,582 grams per tonne un-cut or 250.2 oz/ton) in 27,400 tonnes of material from two sections (1A and 1B) of the Castle East Robinson Zone, beginning at a vertical depth of approximately 400 meters. Note that mineral resources that are not mineral reserves do not have demonstrated economic viability. Please refer to Canada Silver Cobalt Works Press Release May 28, 2020, for the resource estimate. Report reference: Rachidi, M. 2020, NI 43-101 Technical Report Mineral Resource Estimate for Castle East, Robinson Zone, Ontario, Canada, with an effective date of May 28, 2020, and a signature date of July 13, 2020.

Canada Silver Cobalt's flagship silver-cobalt Castle mine and 78 sq. km Castle Property feature strong exploration upside for silver, cobalt, nickel, gold, and copper. With underground access at the fully owned Castle Mine, an exceptional high-grade silver discovery at Castle East, a pilot plant to produce cobalt-rich gravity concentrates on site, a processing facility (TTL Laboratories) in the town of Cobalt, and a proprietary hydrometallurgical process known as Re-2Ox (for the creation of technical-grade cobalt sulphate as well as nickel-manganese-cobalt (NMC) formulations), Canada Silver Cobalt is strategically positioned to become a Canadian leader in the silver-cobalt space. More information at www.canadasilvercobaltworks.com.

"Frank J. Basa"

Frank J. Basa, P. Eng.

Chief Executive Officer

For further information, contact:

Frank J. Basa, P.Eng.

Chief Executive Officer

416-625-2342

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Caution Regarding Forward-Looking Statements

This news release may contain forward-looking statements which include, but are not limited to, comments regarding the Offering and comments that involve other future events and conditions, which are subject to various risks and uncertainties. Except for statements of historical facts, comments that address the Offering, resource potential, upcoming work programs, geological interpretations, receipt and security of mineral property titles, future financings, availability of funds, and others are forward-looking. Forward-looking statements are not guarantees of future performance and actual results may vary materially from those statements. No assurance can be given that the Offering will close on the terms and conditions set out in this news release or at all. General business conditions are factors that could cause actual results to vary materially from forward-looking statements. A detailed discussion of the risk factors encountered by Canada Silver Cobalt is available in the Company's Annual Information Form dated July 19, 2021 for the fiscal year ended December 31, 2020 available under the Company's profile on SEDAR at www.sedar.com.

Copyright (c) 2021 TheNewswire - All rights reserved.