October 16, 2023

More thick high-grade assays at Never Never; New discovery at Patient Wolf, immediately to the north; And West Winds continues to grow.

Spartan Resources Limited (“Spartan” or “Company”) (ASX: SPR) is pleased to announce that it has made a new shallow high-grade gold discovery immediately north of its high-grade Never Never Gold Deposit as assay results begin to flow from the ongoing 25,000m multi-rig drilling campaign at the 100%- owned Dalgaranga Gold Project in Western Australia.

Highlights:

- First Reverse Circulation (RC) hole drilled to test the new “Patient Wolf” gold prospect (geophysical target), immediately north of Never Never, has returned outstanding assay results, including:

- 10.00m @ 19.84g/t gold from 96.00m, incl. 4.00m @ 40.15g/t (DGRC1295) – 1,600m north of Never Never and 1,900m from Process Plant under site access/haul road. Follow-up RC drilling underway.

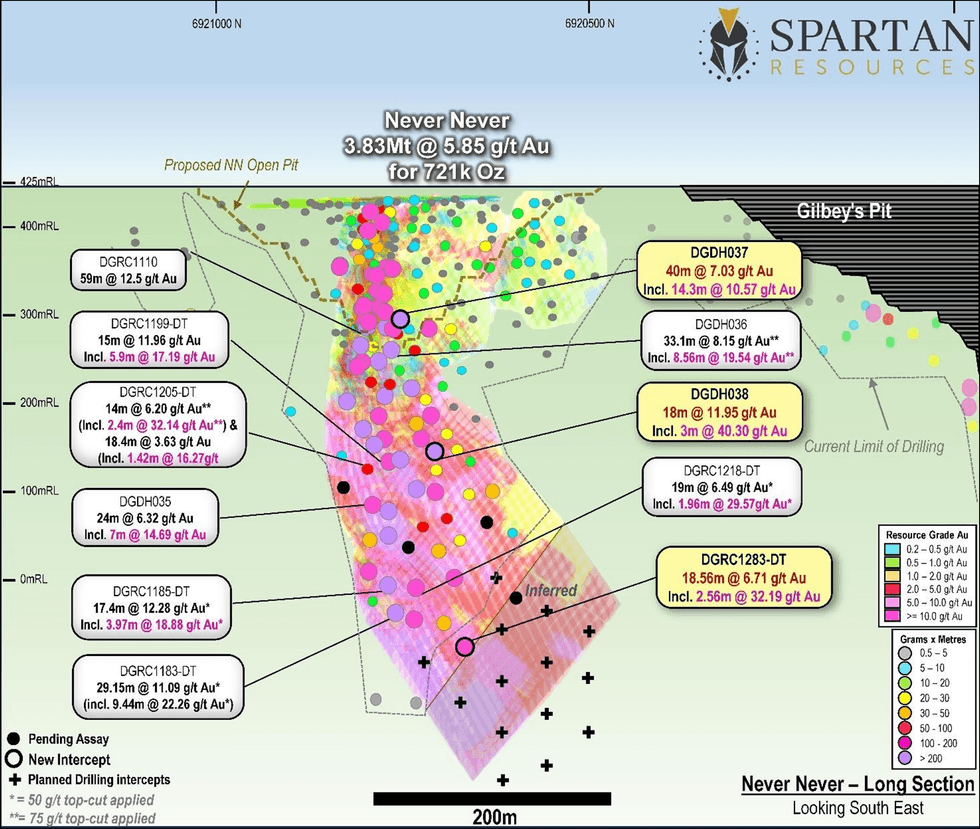

- Further significant high-grade gold assays from recent drilling at the Never Never Gold Deposit:

- 40.00m @ 7.03g/t gold from 160.00m incl. 14.30m @ 10.57g/t (DGDH037) – targeting high-grade mineralisation at base of conceptual Never Never open pit.

- 18.00m @ 11.95g/t gold from 315.00m incl. 3.00m @ 40.30g/t (DGDH038) – expands southern extent of thick high-grade mineralisation for future Resource update.

- 18.56m @ 6.71g/t gold from 495.00m incl. 2.56m @ 32.19g/t (DGRC1283-DT) – deepest mineralised intercept to date at Never Never, located on boundary of Indicated to Inferred classification.

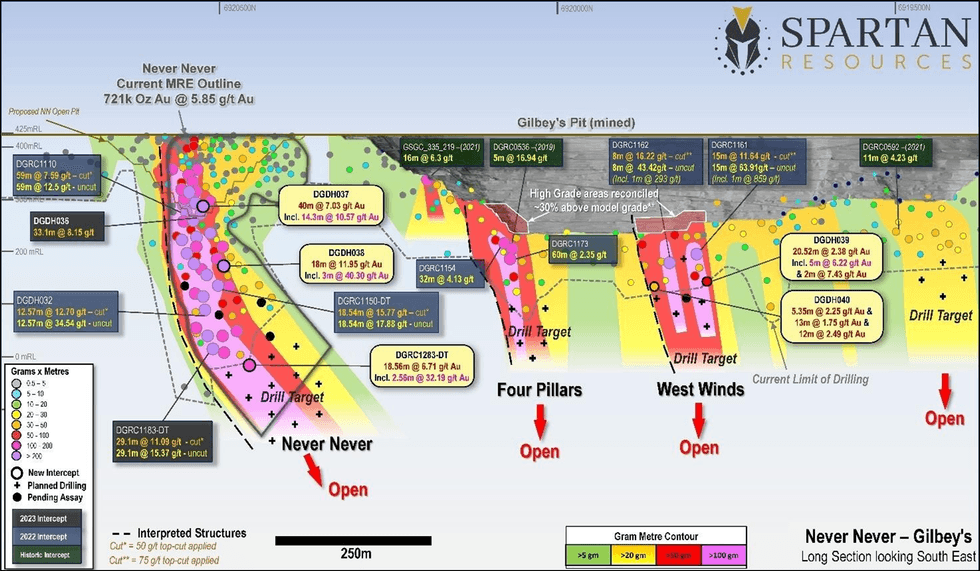

- Targeting of the high-grade West Winds area within the previously planned but un-mined “Stage 3 Gilbey’s Open Pit”, directly south of Never Never, has returned:

- 20.52m @ 2.38g/t gold from 420.48m down-hole, incl. 5.00m @ 6.22g/t (DGDH039) – hole intersected the southern West Winds high-grade target zone.

- 12.00m @ 2.49g/t gold from 353.00m & 7.00m @ 2.23g/t & 5.00m & 2.25g/t (DGDH040) – hole deviated north of northern West Winds high-grade target zone.

- Drilling at the Arc gold prospect, 1,000m north of the Never Never Gold Deposit, has returned:

- 4.00m @ 8.33g/t gold from 106m, incl. 1m @ 30.66g/t (DGRC1245) – Follow-up drilling underway.

- Ongoing 25,000m multi-rig drill program to be expanded to 32,000m with up to six rigs on site. Updated global Mineral Resource statement for Dalgaranga scheduled for December 2023 Quarter. This will include an updated MRE for Never Never and the broader “Gilbey’s Complex” including West Winds and Four Pillars.

In light of the success being achieved with the current drilling program, Spartan has decided to expand the program to 32,000m with up to six rigs operating on-site. The expanded program will look to target extensions of known mineralisation, further upgrading the high-grade 721,200oz Mineral Resource Estimate (MRE) for the Never Never Gold Deposit.

In parallel, several “near-mine” targets are being aggressively drilled out, including the high-grade West Winds and Four Pillars structural targets, located within and beneath the former Gilbey’s Open Pit to the south of Never Never, as well as the nearby Arc and Patient Wolf gold prospects to the north.

The overall objective of the program is to grow the Company’s high-grade resource inventory within a close 2km radius of the 2.5Mtpa Dalgaranga Process Plant.

Never Never Gold Deposit Update

Drill Target Update

Click here for the full ASX Release

This article includes content from Spartan Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SPR:AU

The Conversation (0)

03 April 2024

Spartan Resources

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00