April 27, 2025

Significant reconnaissance air‐core drilling results confirm multiple zones of gold mineralisation at Cardinia, further strengthening Patronus Resources’ exploration pipeline in this highly prospective region.

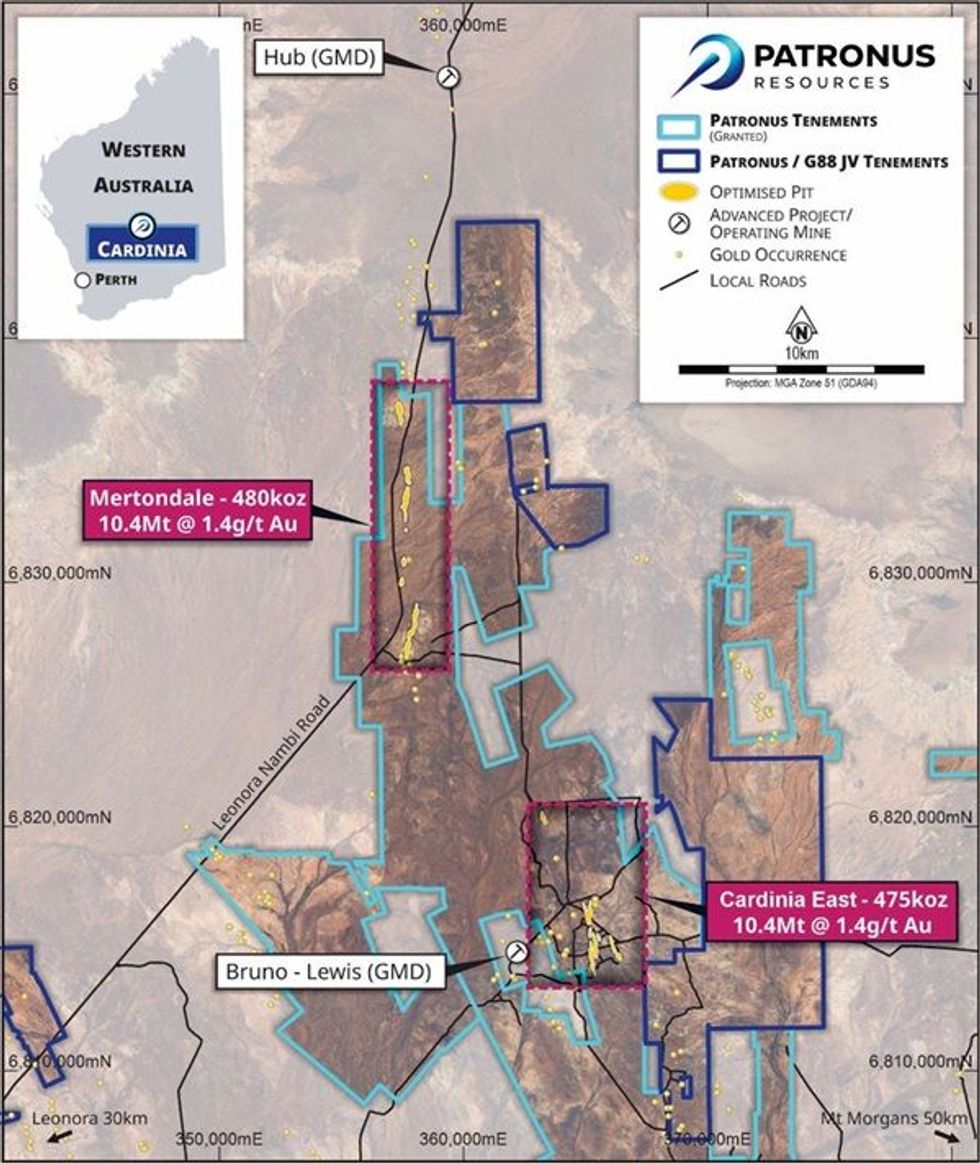

Patronus Resources Limited (ASX: PTN; “Patronus” or “the Company”) is pleased to report assay results from recent air‐ core drilling at its 100%‐owned Cardinia Gold Project, located near Leonora in Western Australia (see Figure 1), which has resulted in the delineation of multiple strong gold anomalies.

Highlights

- 153‐hole/6,679m reconnaissance Air‐Core (AC) drilling program completed at Cardinia East.

- Significant gold intersections returned, including:

- SC24AC002: 7m @ 0.86 g/t Au from 68m

- X424AC015: 8m @ 1.20 g/t Au from 32m

- X424AC016: 4m @ 1.69 g/t Au from 44m

- The new Scallop Prospect now hosts a confirmed 1km‐long gold trend, situated adjacent to the established Cardinia East resources.

- Follow‐up Reverse Circulation (RC) drilling planned for next quarter to further assess these promising targets.

The results further enhance the Cardinia Gold Project’s reputation as a high‐potential gold asset and reinforce the Company's commitment to advancing this exciting exploration opportunity.

The latest exploration campaign involved an integrated approach, including Induced Polarisation (IP) geophysical surveying, geological mapping, geochemical sampling, RC drilling, and Down‐Hole Electro‐Magnetic (DHEM) surveys—all of which have contributed to a growing understanding of the Cardinia gold system.

Patronus Resources’ Managing Director, John Ingram, commented: “This air‐core program has delivered highly encouraging results, further enhancing our understanding of the mineralised corridors within the Cardinia East Project. The identification of a new 1km‐long anomalous gold trend at Scallop, coupled with its strategic location adjacent to existing resources, significantly enhances the potential of this area. We are excited to commence follow‐up RC drilling next quarter to refine these targets and unlock further value for our shareholders.”

Air‐core Program Overview

The recently completed AC drilling campaign spanned 6,679m across 13 lines and six key prospects within the Cardinia East area (Figure 2). Line spacing varied between 200m and 350m, strategically designed to test geochemical anomalies and underlying structures beneath transported and weathered cover.

Several targets were identified as potential extensions of known mineralised systems, providing further evidence of gold continuity within the project area.

Significant gold intercepts include:

- SC24AC002: 7m @ 0.86 g/t Au from 68m

- SC24AC007: 4m @ 0.61 g/t Au from 8m

- X424AC015: 8m @ 1.20 g/t Au from 32m

- X424AC016: 4m @ 1.69 g/t Au from 44m

The Scallop prospect continues to emerge as a priority exploration target, with geological logging revealing the presence of a distinct pink porphyritic unit—a feature commonly associated with high‐ grade gold shoots in the Cardinia‐Mertondale corridor.

The 1km‐long corridor of gold anomalism sits within a highly prospective structural setting, adjacent to an interpreted D1 shear zone, in close proximity to significant gold mineralisation and with historic workings located nearby. The trend is located between the Helens deposit to the east and the Chieftess and Comedy King prospects to the west (Figure 3). The relationship between the mineralisation at Chieftess, Comedy King, Scallop and Helens is not yet known, and the Company believes that further RC drilling will aid in the geological understanding of these mineralised structures.

Notably, mineralisation appears to continue to the north of the prospect, where the Cardinia Creek currently creates a gap in drilling coverage. However, strong geochemical signatures indicate the potential extension of gold mineralisation beyond the currently drilled area.

Click here for the full ASX Release

This article includes content from Patronus Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

5h

David Erfle: Gold, Silver Under Pressure, Key Price Levels to Watch

David Erfle, editor and founder of Junior Miner Junky, explains why gold and silver prices took a hit not long after war in the Middle East was announced. While the near term could be volatile, he said the long-term outlook for precious metals is strong. Don't forget to follow us @INN_Resource... Keep Reading...

6h

Tavi Costa: Gold, Silver Stocks to Rerate, "Explosive" Energy, Copper Opportunities

Tavi Costa, CEO of Azuria Capital, explains where he's looking to deploy capital right now, mentioning mining, energy and emerging markets. "When I apply macro analysis into markets, there's a few things that look exceptionally cheap today that could be extremely asymmetric," he commented.... Keep Reading...

6h

One Bullion Advances Toward Drill-Ready Targets at Botswana Gold Assets

One Bullion (TSXV:OBUL,OTCPL:OBULF) CEO and President Adam Berk shared the advantages of working in the mining-friendly jurisdiction of Botswana and big milestones ahead in 2026.Surveys are expected to commence within the next few weeks at the company's Maitengwe and Vumba projects, which will... Keep Reading...

09 March

Byron King: Gold, Silver, Oil/Gas — Stock Ideas and Strategy Now

Byron King, editor at Paradigm Press, shares his approach to the gold and silver sectors as tensions in the Middle East intensify, also touching on oil and gas. Overall he sees hard assets becoming increasingly key as global uncertainty escalates."Own gold, own silver — physically own the metal... Keep Reading...

09 March

Jaime Carrasco: Gold Going "Much Higher," Silver Force Majeure Inevitable

Jaime Carrasco, senior portfolio manager and senior financial advisor at Harbourfront Wealth Management, shares his outlook for gold and silver, saying prices must rise much higher. He also talks about how to build a strong precious metals portfolio. "We're moving from a credit-based economy, a... Keep Reading...

09 March

Garrett Goggin: Gold, Silver in New Era, My Stock Strategy Now

Garrett Goggin, founder of Golden Portfolio, says although gold and silver haven't gone mainstream yet, the metals — and the mining sector overall — have entered a new era. "It's a real mind shift — it's a new era in mining right here," he said.Don't forget to follow us @INN_Resource for... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00