April 27, 2025

Significant reconnaissance air‐core drilling results confirm multiple zones of gold mineralisation at Cardinia, further strengthening Patronus Resources’ exploration pipeline in this highly prospective region.

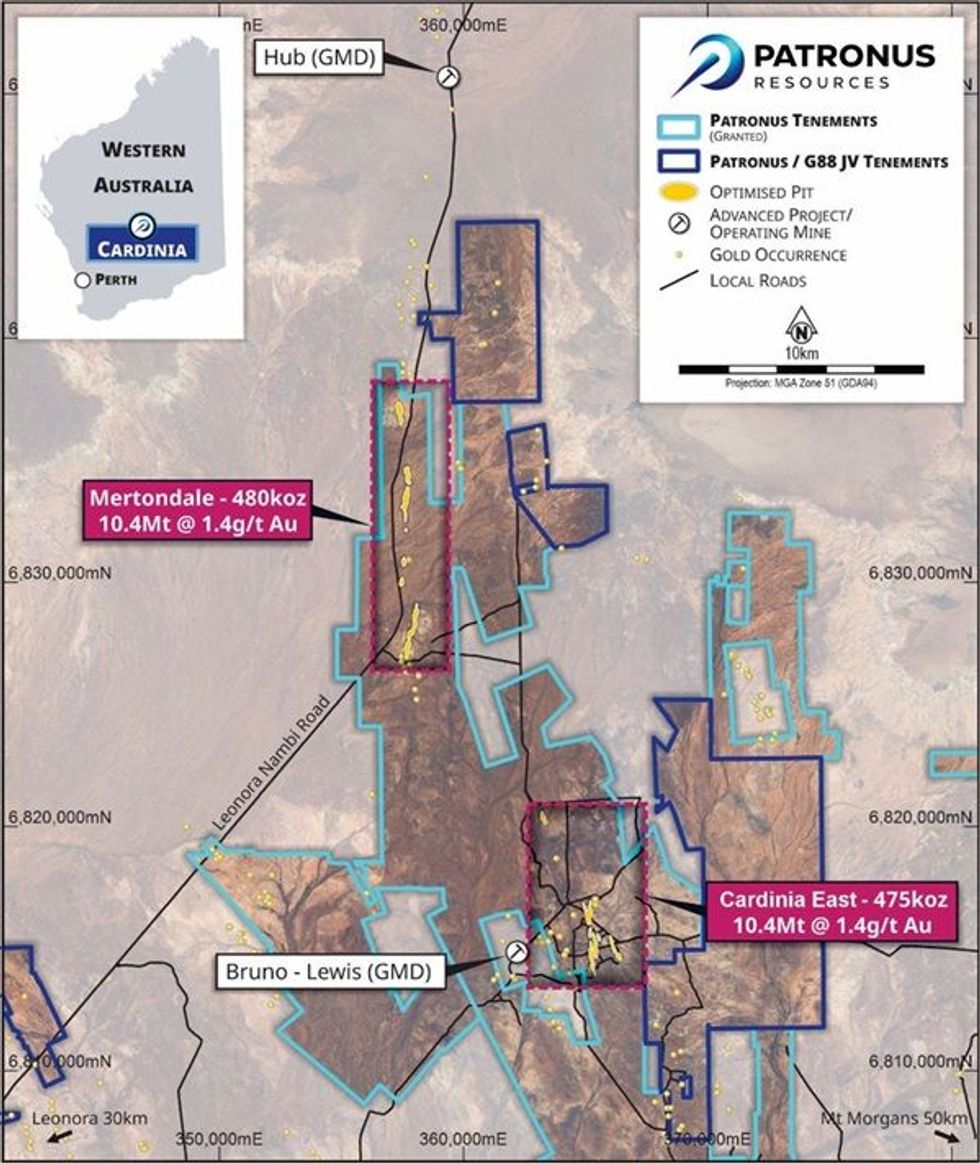

Patronus Resources Limited (ASX: PTN; “Patronus” or “the Company”) is pleased to report assay results from recent air‐ core drilling at its 100%‐owned Cardinia Gold Project, located near Leonora in Western Australia (see Figure 1), which has resulted in the delineation of multiple strong gold anomalies.

Highlights

- 153‐hole/6,679m reconnaissance Air‐Core (AC) drilling program completed at Cardinia East.

- Significant gold intersections returned, including:

- SC24AC002: 7m @ 0.86 g/t Au from 68m

- X424AC015: 8m @ 1.20 g/t Au from 32m

- X424AC016: 4m @ 1.69 g/t Au from 44m

- The new Scallop Prospect now hosts a confirmed 1km‐long gold trend, situated adjacent to the established Cardinia East resources.

- Follow‐up Reverse Circulation (RC) drilling planned for next quarter to further assess these promising targets.

The results further enhance the Cardinia Gold Project’s reputation as a high‐potential gold asset and reinforce the Company's commitment to advancing this exciting exploration opportunity.

The latest exploration campaign involved an integrated approach, including Induced Polarisation (IP) geophysical surveying, geological mapping, geochemical sampling, RC drilling, and Down‐Hole Electro‐Magnetic (DHEM) surveys—all of which have contributed to a growing understanding of the Cardinia gold system.

Patronus Resources’ Managing Director, John Ingram, commented: “This air‐core program has delivered highly encouraging results, further enhancing our understanding of the mineralised corridors within the Cardinia East Project. The identification of a new 1km‐long anomalous gold trend at Scallop, coupled with its strategic location adjacent to existing resources, significantly enhances the potential of this area. We are excited to commence follow‐up RC drilling next quarter to refine these targets and unlock further value for our shareholders.”

Air‐core Program Overview

The recently completed AC drilling campaign spanned 6,679m across 13 lines and six key prospects within the Cardinia East area (Figure 2). Line spacing varied between 200m and 350m, strategically designed to test geochemical anomalies and underlying structures beneath transported and weathered cover.

Several targets were identified as potential extensions of known mineralised systems, providing further evidence of gold continuity within the project area.

Significant gold intercepts include:

- SC24AC002: 7m @ 0.86 g/t Au from 68m

- SC24AC007: 4m @ 0.61 g/t Au from 8m

- X424AC015: 8m @ 1.20 g/t Au from 32m

- X424AC016: 4m @ 1.69 g/t Au from 44m

The Scallop prospect continues to emerge as a priority exploration target, with geological logging revealing the presence of a distinct pink porphyritic unit—a feature commonly associated with high‐ grade gold shoots in the Cardinia‐Mertondale corridor.

The 1km‐long corridor of gold anomalism sits within a highly prospective structural setting, adjacent to an interpreted D1 shear zone, in close proximity to significant gold mineralisation and with historic workings located nearby. The trend is located between the Helens deposit to the east and the Chieftess and Comedy King prospects to the west (Figure 3). The relationship between the mineralisation at Chieftess, Comedy King, Scallop and Helens is not yet known, and the Company believes that further RC drilling will aid in the geological understanding of these mineralised structures.

Notably, mineralisation appears to continue to the north of the prospect, where the Cardinia Creek currently creates a gap in drilling coverage. However, strong geochemical signatures indicate the potential extension of gold mineralisation beyond the currently drilled area.

Click here for the full ASX Release

This article includes content from Patronus Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

12h

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

23h

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

03 March

Blackrock Silver Receives First of Three Key Permits for the Tonopah West Project

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the issuance by the Nevada Department of Environmental Protection (NDEP), through the Bureau of Air Pollution Control, the Class II Air Quality and Surface Disturbance... Keep Reading...

02 March

Steve Barton: Gold, Silver, Oil — Key Price Levels to Watch Now

Steve Barton, host of In It To Win It, shares key price levels for silver and gold.He also explains his current approach to the oil and copper markets, and outlines an emerging opportunity in nickel as Indonesia loosens its hold on the space. Don't forget to follow us @INN_Resource for real-time... Keep Reading...

02 March

Gold, Silver Prices Spike on US-Iran War

Prices for gold and silver spiked higher over the weekend and in early morning trading on Monday (March 2) as a full-blown war broke out in the Middle East.Tensions between Iran on one side and the US and Israel on the other have been intensifying over the past few weeks. On Sunday (February... Keep Reading...

02 March

As Gold Investment Surges, Fake Platforms and AI Drive New Fraud Wave

As gold prices continue to soar past record highs, investors are pouring billions into bars, coins, and digital tokens. However, regulators and analysts warn that the same rally is fueling a surge in scams that are quietly draining retirement accounts and life savings.Gold has long been marketed... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00