NOT FOR DISSEMINATION IN THE UNITED STATES OR THROUGH U.S. NEWS WIRES

- Completes acquisition of all outstanding shares of North Star Manganese Inc via share exchange with minority NSM shareholders.

- Increases NSC shareholder exposure to 100% of the high-grade Emily Manganese Project in Minnesota, USA.

- Drilling progresses on schedule at the Emily Manganese Project with seven diamond core drill holes now completed and additional samples submitted for analyses. Assays from the initial three drill holes are expected in coming weeks.

Nevada Silver Corporation ("NSC" or the "Company") (TSXV:NSC)(OTCQB:NVDSF) is pleased to announce it has completed the acquisition of all of the outstanding securities of North Star Manganese Inc ("NSM") that it did not already hold through its wholly-owned subsidiary Electric Metals (USA) Pty Limited ("EML") (the "NSM Share Acquisition"). As disclosed in the news release of the Company dated August 31, 2022, NSM closed the sale of 3,160,233 of its shares (the "NSM Shares") representing 9.5% of its issued and outstanding shares of NSM on August 31, 2022. The other 90.5% of the outstanding shares continued to be held by EML. On November 23, 2022, the Company announced that the Emily Manganese Project will become the Company's flagship asset and that the Company planned to change its name to "Electric Metals (USA) Limited" in order to better reflect the entirety of its value proposition as a developer of battery and technology-related minerals, including its US manganese and silver properties

As a result, the Company determined to repurchase the NSM Shares and the NSM Share Acquisition was accomplished pursuant to share exchange agreements whereby each holder of NSM Shares agreed to exchange their NSM Shares for units of NSC (the "Units") on the basis of 2.04545 Units per NSM Share, with each Unit comprised of one common share and one common share purchase warrant (the "Warrant"). In the aggregate the Company issued 6,464,113 Units to the (former) NSM Shareholders. Each Warrant is exercisable to acquire one common share of the Company (the "Common Shares") at a price of $0.25 per Common Share for a period of 24 months following issuance thereof. The expiry date of the Warrants will accelerate in the event the volume weighted average trading price of the Common Shares on the TSX Venture Exchange (the "TSXV") is equal to or exceeds $0.30 per Common Share for a period of 20 consecutive trading days (an "Acceleration Event"). If an Acceleration Event occurs, the Warrants will expire 30 days after notice of such Acceleration Event.

Following the NSM Share Acquisition, the Company once again indirectly holds 100% of the outstanding NSM Shares. The NSM Share Acquisition is subject to the receipt of all regulatory approvals, including the final approval of the TSXV.

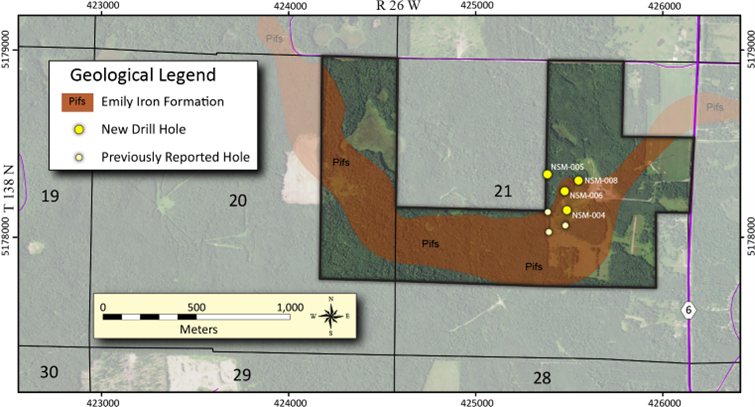

The Company is also pleased to provide an update on the inaugural drill program at its high-grade Emily Manganese Project in Minnesota, USA. A total of 3,780.6 feet (1,152.3 metres) of diamond core drilling has been completed to date at the Emily Manganese Project. Seven holes (Figure 1) have been completed to target depth and samples forwarded to the ALS laboratory facility in Reno, NV for analyses.

Figure 1. Location map showing land under NSC control, Emily Iron Formation bedrock which is the host strata to manganese mineralization and locations of the seven completed NSC drill holes.

Further to its announcement of 13th January 2023, the Company wishes to clarify that it has granted an aggregate of only 3,150,000 stock options to certain directors, officers and consultants of the Company, and not the amount of 3,650,000 stock options as previously advised. These stock options were issued in accordance with, and subject to, the provisions of the Company's stock option plan and are subject to approval of the TSX Venture Exchange. Each stock option entitles the holder to purchase one Common Share of the Company at an exercise price of $0.25 per share for a 5-year period.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to "U.S. persons" (as that term is defined in Rule 902(k) of Regulation S under the U.S. Securities Act) unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

Qualified Person

The scientific and technical data contained in this news release was reviewed and approved by Ian James Pringle PhD, who is a Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

About Nevada Silver Corporation

Nevada Silver Corporation (TSXV: NSC) (OTCQB: NVDSF) is a U.S.-based mineral development company with manganese and silver projects geared to supporting the transition to clean energy. NSC's principal asset is the Emily Manganese Project in Minnesota, which has been the subject of considerable technical studies, with US$25 million invested to date. The Company's mission in Minnesota is to become a domestic U.S. producer of high-purity, high-value manganese metal and chemical products for supply to U.S. energy, technology and industrial markets. With manganese playing a critical and prominent role in lithium-ion battery formulations, and with no domestic supply or active mines in North America, this represents a significant opportunity for NSC shareholders. In addition, NSC owns and operates the Corcoran Silver-Gold Project in Nevada. Both Corcoran and Emily have been the subject of National Instrument 43-101 compliant mineral resource estimates.

NSC will seek shareholder approval to change its name to Electric Metals USA Limited at the Company's Annual General Meeting in May 2023.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further Information please contact:

Gary Lewis, Group CEO & Director: (647) 846 5299 - gl@nevadasilvercorp.com

Forward-Looking Statements: Information set forth in this news release may involve forward-looking statements under applicable securities laws. The forward-looking statements contained herein are expressly qualified in their entirety by this cautionary statement. The forward-looking statements included in this document are made as of the date of this document and Nevada Silver Corporation disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable securities legislation. Although management believes that the expectations represented in such forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. This news release does not constitute an offer to sell or solicitation of an offer to buy any securities that may be described herein and accordingly undue reliance should not be put on such.

SOURCE: Nevada Silver Corporation

View source version on accesswire.com:

https://www.accesswire.com/747476/Nevada-Silver-Increases-Ownership-of-North-Star-Manganese-Inc-to-100-Via-Acquisition-of-Minority-Shareholder-Interests