- WORLD EDITIONAustraliaNorth AmericaWorld

February 08, 2023

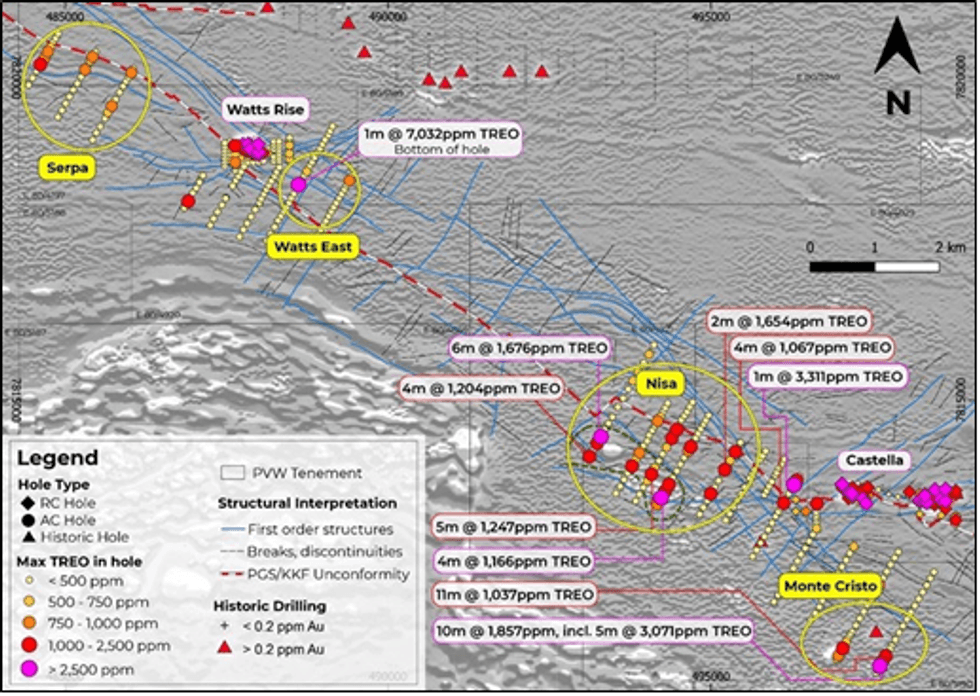

Significant results of up to 7,053ppm TREO at Watts East opens up new areas for follow-up exploration

PVW Resources (‘PVW’, “the Company”) is pleased to advise that it has identified multiple significant new REE anomalies from air-core drilling completed in 2022 at its 100%-owned Tanami Heavy Rare Earth and Gold Project in Western Australia, opening up exciting new opportunities for follow-up exploration in 2023.

Highlights

- Significant TREO assay results returned from 2022 air-core drilling, including:

- Monte Cristo Prospect 22TAAC0352: 10m @ 1,857ppm TREO (59ppm Dy2O3 468ppm Y2O3) from 19m including 5m @ 3,071ppm TREO (95ppm Dy2O3 568ppm Y2O3) from 20m (65% HREO).

- Monte Cristo Prospect 22TAAC0351: 11m @ 1,037ppm TREO from 22m.

- Serpa Prospect 22TAAC0176: 6m @ 1,676ppm TREO from 35m.

- Watts East Prospect 22TAAC134: 1m @ 7,032ppm TREO (634ppm Dy2O3 4394ppm Y2O3) from 30m (93% HREO).

- Monte Cristo Prospect 22TAAC0352: 10m @ 1,857ppm TREO (59ppm Dy2O3 468ppm Y2O3) from 19m including 5m @ 3,071ppm TREO (95ppm Dy2O3 568ppm Y2O3) from 20m (65% HREO).

- Successful air-core campaign defines multiple new follow-up REE drill targets:

- Watts East: highly elevated REE with 1m @ 7,032ppm TREO at the bottom of the hole and very high HREO ratios at 93% suggesting the target is an offset extension of Watts Rise.

- Serpa: structurally-controlled and mafic hosted mineralisation which is open along strike within the Killi Killi Formation and below the unconformity – confirming the Company’s exploration model.

- The significant widespread TREO mineralisation at Monte Cristo are saprolite clay-hosted, with the peak of the anomaly at 5m @ 3,071ppm open along strike.

- Watts East: highly elevated REE with 1m @ 7,032ppm TREO at the bottom of the hole and very high HREO ratios at 93% suggesting the target is an offset extension of Watts Rise.

Following a lengthy wait for assay results, the Company has now received results from its extensive regional air-core program in 2022, successfully identifying new high-priority exploration targets and confirming the significant prospectivity of the Project.

Importantly, the wide-spaced regional air-core drilling undertaken by the Company has proven to be a viable exploration technique for buried REE mineralisation in the Tanami.

Detailed ground gravity has also proven to be a very effective exploration tool, with the areas surveyed at Watts Rise and Castella both revealing additional detail to the sub-surface that will complement drilling and magnetics.

By utilising the structural geological interpretation, detailed ground gravity, multi-element geochemistry of mineralisation and the host stratigraphy, the shallow regional REE results represent complementary targets to the exciting new Watts Rise Breccia Zone target identified in 2022 (see ASX announcement, 29 November 2022).

PVW Executive Director, Mr George Bauk, said: “These new air-core results are very exciting and mark a significant development in our exploration of the Tanami Project. They have outlined a number of new priority targets, taken from conceptual targets to highly anomalous TREO results ready for follow-up, substantially enhancing our exploration pipeline in the Tanami.

“Since field work was completed in November 2022, the Company’s exploration geologists have continued to improve their understanding of REE mineralisation in the Tanami. Recognising the need to find ore zones, the 2022 exploration effort has provided PVW with a pipeline of prospects and targets that were previously unknown.

“We are now ideally positioned to prioritise and test these new targets in 2023.

“The results reported in this announcement, stemming from exploration undertaken in 2022, highlight the value of systematic exploration utilising tried and tested methods. The results of the ground gravity survey provide an exciting exploration technique that can quickly advance the understanding at a prospect level, complementing the more regional magnetics and local drilling data.

“With these results from regional air-core drilling, we have developed a detailed targeting methodology using structural, stratigraphic, geochemical and geophysical characteristics.

“We are excited to return to the Tanami in 2023 for an exploration campaign that will be focused on follow-up of these new targets and exploring the regional tenements for the next generation of REE discoveries.”

Click here for the full ASX Release

This article includes content from PVW Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

PVW:AU

The Conversation (0)

24 March 2022

PVW Resources

Exploring Western Australia for REE and HREE

Exploring Western Australia for REE and HREE Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00