October 30, 2023

Marquee Resources Limited (“Marquee” or “Company”) (ASX:MQR) is pleased to provide this Quarterly Activities Report for the September 2023 quarter.

West Spargoville Project (Lithium, Gold & Nickel Project)

The Company provided an update to the market regarding the ongoing exploration activities at the West Spargoville Project (“WSP”). The WSP Project is a JV between Marquee Resources (75%) and Mineral Resources Limited (ASX:MIN) (25%).

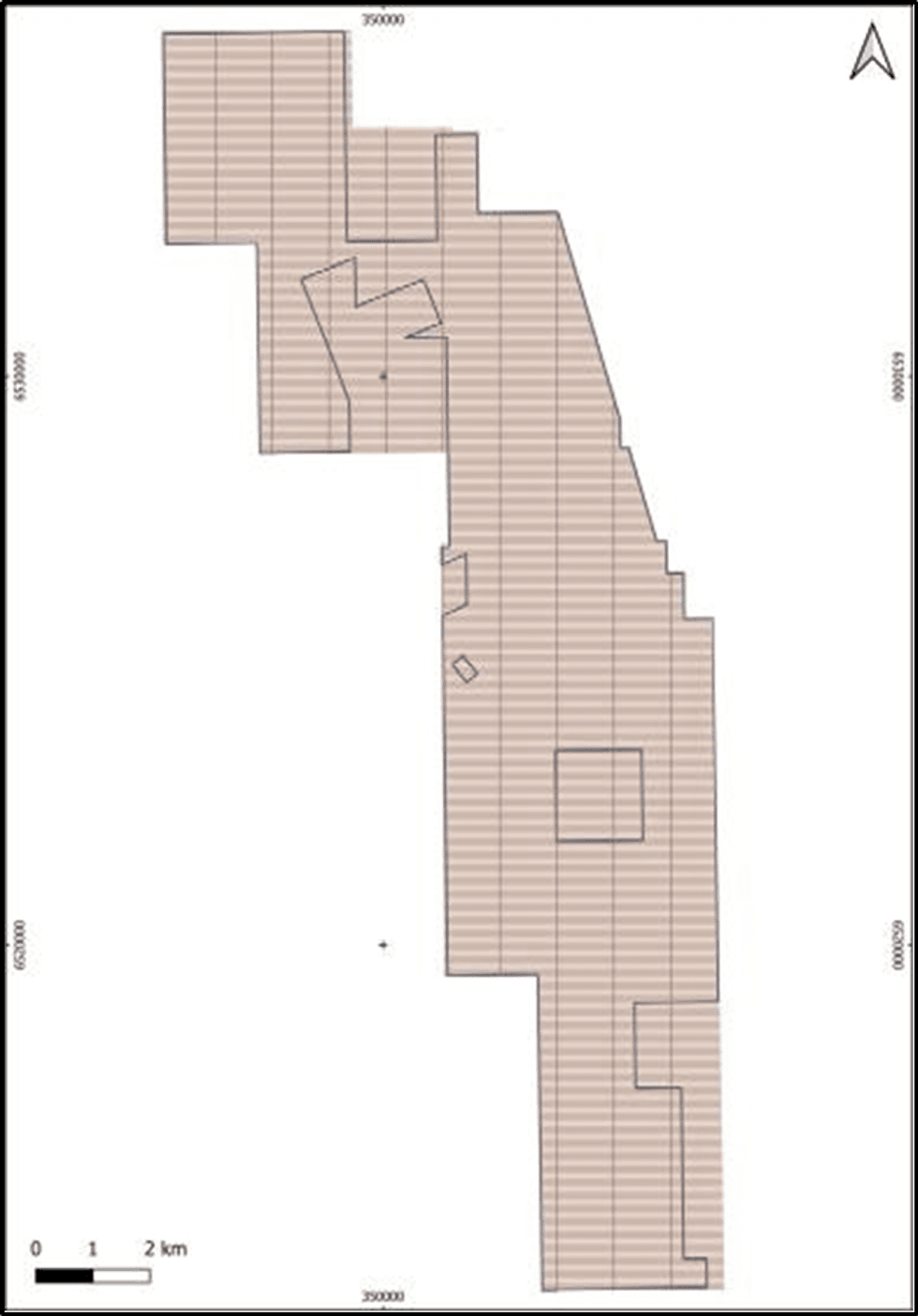

The Company engaged Thomson Aviation to complete a 2,258 line-km aerial magnetics survey (figure 1) over the Project extents, with the survey completed during the quarter. The aim of this high-resolution survey is to provide further detail on structures hosting potential lithium bearing pegmatites. Following the completion of a 37,843m reverse-circulation (RC) and aircore (AC) drilling campaign in Q4-2022, the Company and Mineral Resources (ASX:MIN) geologists have been busy interpreting and modelling the data to delineate priority targets for follow-up work. The acquisition of high-resolution geophysics will greatly enhance the understanding of the subsurface and guide the planning of the next drill campaign that is being planned for 2024.

The processing of the aerial magnetics survey is nearing completion and the Company in conjunction with Mineral Resources Limited (ASX:MIN) will provide an update with future work plans in due course.

The West Spargoville Project

The West Spargoville Project is located in the core of the Southern Yilgarn Lithium Belt, an area that is well known for spodumene deposits that include; the Bald Hill Mine, the Mt Marion Mine, the Buldania Project and Essential Metals Pioneer Dome Project. Marquee and Mineral Resources entered into a updated JV agreement earlier this year over the lithium rights at the West Spargoville Project (refer ASX Release dated 09 June 2023).

Redlings Rare Earth Project

Marquee Resources Limited conducted a ground gravity survey at the Company’s Redlings Rare Earth Element Project in July 2023 (see ASX Announcement 27 July 2023). The gravity survey aimed to test for deep-seated carbonatite intrusions to identify the potential source of surficial rare earth element (REE) anomalism up to 7,503ppm TREO (see ASX Announcement dated 19 May 2023).

The ground gravity survey consisted of 1,907 survey stations over the Redlings Project extents and results of the survey were released post quarter end (see ASX Announcement 05 October 2023). Final data processing and 3D modelling results of the survey have been announced highlighting a complex structural architecture intruded by dense bodies, which are interpreted to represent carbonatite pipes, extending to significant depths. The gravity survey focused on a ~4.9 km x 1.2 km geochemical anomaly to assist in interpreting the primary controls on surficial mineralisation. Although historical exploration has focused on NW trending structures, the gravity data has highlighted that the interpreted carbonatite pipes have a NNE trending orientation and the exploration model needs to be refined and shifted to focus on these NNE trending structures. Company geologists have mapped REE-bearing dykes/veins with varying structural orientations which may represent late-stage carbonatite cone sheets or ring dykes. Following the completion of the gravity survey, further mapping and auger geochemistry is planned with deeper reverse circulation drilling to follow in 2024. The Company aims to fully test the potential of the Project to host an economic REE mineral resource.

Click here for the full ASX Release

This article includes content from Marquee Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

gold-explorationlithium-stocksgold-stockscopper-explorationasx-stockscopper-stocksresource-stockslithium-explorationasx-mqr

MQR:AU

The Conversation (0)

12 July 2022

Marquee Resources

Capitalizing on the Electric Revolution with a Diverse Battery Metal Portfolio

Capitalizing on the Electric Revolution with a Diverse Battery Metal Portfolio Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00