May 30, 2023

Metalite Resources Inc. (CSE:METL)(OTC:JNCCF) (Frankfurt:5VHA) ("Metalite" or the "Company") is pleased to provide an overview of its portfolio of assets obtained through the recent acquisition of Next Generation Resources Inc. ("NextGen") and provide an update on its lithium exploration activities in Liberia.

Highlights

- The recent acquisition of NextGen provides the Company with control and access to a portfolio of properties in Liberia which are highly prospective in lithium, rare earth elements, base metals and gold in an under-explored portion of the West African craton.

- Metalite's portfolio of eight Reconnaissance Licenses (granted or pending as set out below) encompasses 3,228 km2 which are distributed across the country targeting exploration hotspots with numerous occurrences of pegmatites, coltan, rare earth elements, base metals and gold occurrences mapped and reported by USGS.

- Initial site visits, reconnaissance soil sampling, prospecting and mapping programs were completed in 2022.

- A total of 7,764 soil samples, and 137 rock samples were collected mostly from pegmatites.

- Samples are being analysed using a portable handheld XRF. Based on these results selected anomalous samples will be sent for geochemical analysis.

- 444 soil and 137 rock samples have been sent to the laboratory for analysis.

- Liberia first mover advantage for battery metals exploration.

Geological Background of Liberia

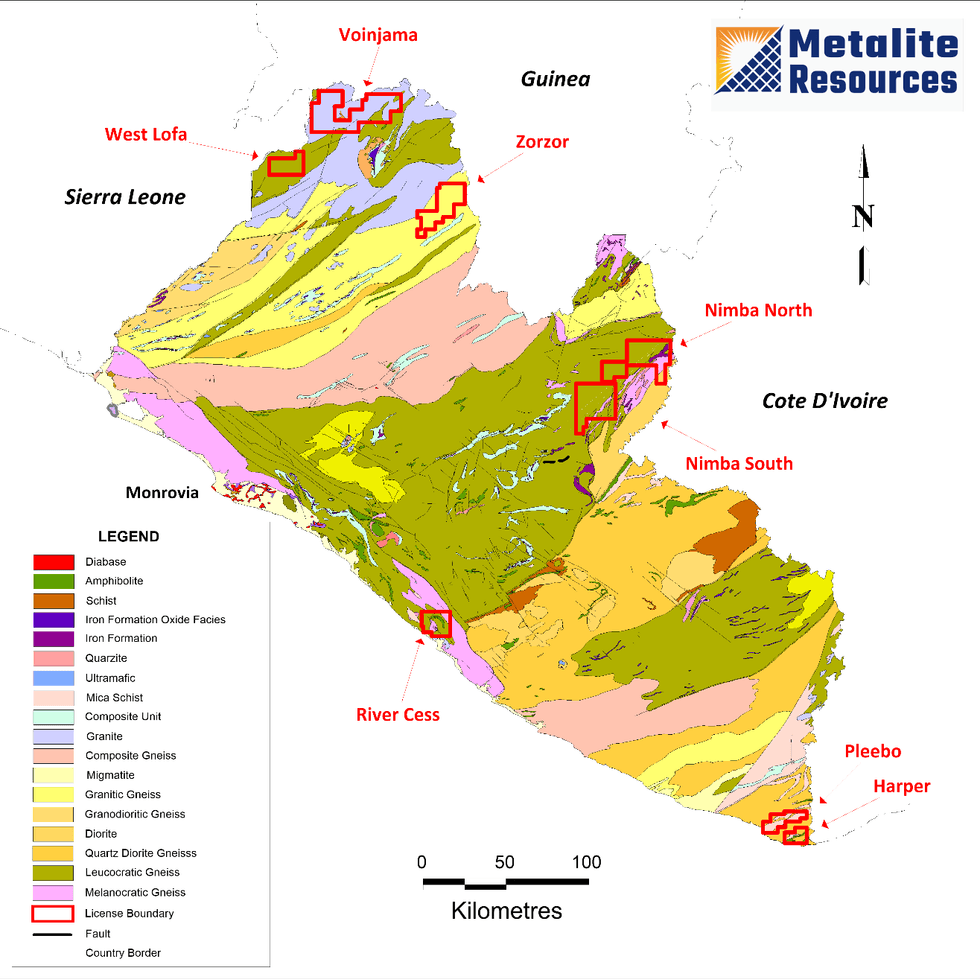

Metalite's portfolio of Liberian assets includes two active reconnaissance licenses and six Reconnaissance Licenses in various stages of renewal/application covering 3,228 km2 (Figure 1). The licences are located in favourable geologic settings that have the potential to host lithium and rare earth elements (REE) deposits in addition to gold and polymetallic base metal deposits. Prior to its acquisition by Metalite, NextGen had been actively investigating the LCT (Lithium-Caesium-Tantalum) Pegmatite potential of Liberia. Desktop studies and a compilation of historical geological, geophysical, and geochemical data was completed. Reconnaissance licence selection was based on the results of this work.

Liberia is underlain by rocks of the west African craton and straddles the boundary between the Archean (3260-2850 Ma) and Paleoproterozoic (2150-1800 Ma) basement rocks. The Archean rocks in central and western Liberia are characterized by gneisses, locally migmatitic, which are infolded with supracrustal greenstone belts of metavolcanic and metasedimentary rocks. In northern Liberia late-Archean granitoids intrude these strata. Eastern Liberia is underlain by Eburnean age tightly folded paragneiss, migmatite and amphibolite interpreted to be part of the Paleoproterozoic Birimian sequence (2200-2100 Ga). The prominent structural trend throughout most of the country is northeast to east-northeast. Along the coast to the southwest of the Archean basement is a north-northwest trending belt of Archean and Paleoproterozoic age metamorphosed sedimentary and mafic igneous rocks that were deformed during the much younger Pan African orogeny (580 Ma).

Mineral Deposits of Liberia

In comparison with other West African countries, the geology of Liberia is poorly understood and there has been limited recent systematic mineral exploration for most commodities, except gold. The mining sector in Liberia is currently dominated by iron ore, gold, and artisanal diamond production.

Historically, Liberia was a major iron ore producer, exporting 20 million tonnes annually up until 1980; however, the civil war (1992-2003) resulted in the suspension of all mining operations. Iron ore production has since resumed and totalled 5 million metric tonnes from the Tokadeh deposit in 2021. The most economically significant gold deposits are associated with northeast-trending fault structures in both the Archean and Paleoproterozoic rocks (Figure 1). Liberian gold production totalled 252,708 troy ounces from the New Liberty and Kokoya deposits and artisanal sources in 2021. Diamond deposits, primarily exploited via alluvial and artisanal diamond mining, are widespread throughout the country. Production totalled 63,207 carats in 2021.

Metalite Liberian Exploration Update

In 2022, reconnaissance scale soil sampling and prospecting/mapping programs were initiated on five of Metalite's eight reconnaissance licences (granted or pending as set out above). A total of 7,764 soil samples and 137 rock samples were taken during the field program. All these samples are being analysed using a Niton XL3t 950 GOLDD+ XRF. Although XRF units are not capable of detecting lithium directly they are very effective at analysing for the suite of pathfinder elements commonly associated with LCT Pegmatites (B, Be, Cu, Cs, Hf, K, Nb, Rb, Ta, Sn, W and Zr) as well as gold, REE and polymetallic base metal deposits. After processing these results it is anticipated that selected anomalous samples will be sent to ALS Laboratories for geochemical analysis. 444 soil and 137 rock samples have been sent to the laboratory for analysis to date. The results of this work will be reported when all results have been received, and the data sets interpreted.

Figure 1. Geology of Liberia and illustrating the location of Metalite's reconnaissance licences.

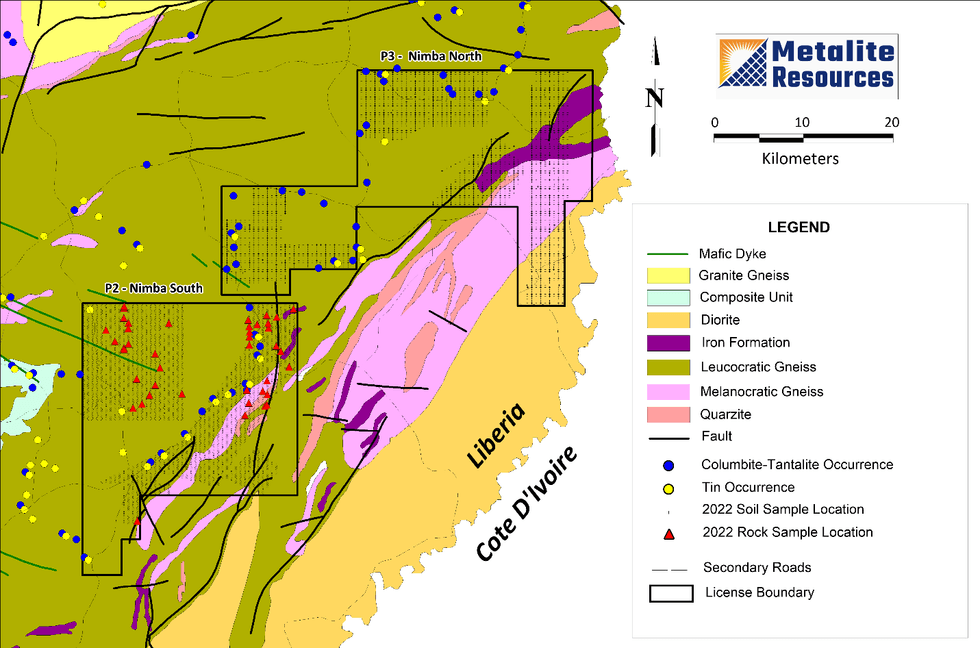

Nimba North (P3) and Nimba South (P2) Reconnaissance Licenses

The Nimba North and South reconnaissance licenses which are under application for an extension cover 616 and 562 km2 respectively, in Nimba County north-eastern Liberia (Figures 1 and 2). The bedrock geology consists of leucocratic gneiss to the west and Melanocratic gneiss, quartzite and iron formation units to the east. The contact between the two packages is marked by a northeast-trending fault zone that may be related to the Cestos shear zone located to the south where gold mineralization is known to occur. Numerous coltan (columbite-tantalite) and tin occurrences were documented in the area by the USGS in 1979 and recompiled in 2007.

A total of 5,503 soil samples and 44 rock samples were taken in 2022 (Figure 1). Soil samples were taken at a depth of 40 cm on 500 m grid lines at 250 m intervals. Most of the rock samples were from pegmatite dikes. The results of the XRF analyses are pending.

Figure 2. Nimba North (P3) and Nimba South (P2) license map illustrating geology, mineral

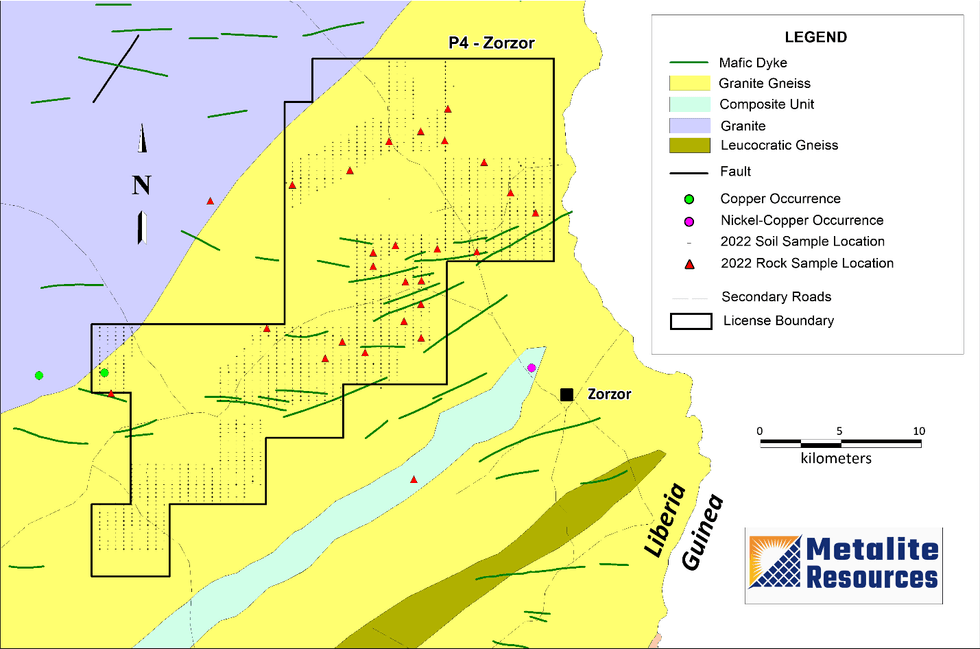

Zorzor (P4) Reconnaissance Licence

The Zorzor reconnaissance license which is under application for an extension covers 430 km2 in Lofa County, northern Liberia. The bedrock geology is dominated by granitic gneiss. To the northwest there is a large granite intrusion. A total of 1,838 soil samples and 26 rock samples were taken in 2022 (Figure 3). Soil samples were taken at a depth of 40 cm on 500 m grid lines at 250 m intervals. Most of the rock samples were from pegmatite dykes. Potential for LCT pegmatites and REEs within the migmatitic rocks within the granitic gneiss is high, particularly in proximity to the granite intrusion on the north boundary of the licence. Copper mineralization has been documented in the eastern part of the licence area. The results of the XRF analyses and are pending.

Figure 3. Zorzor P4 license map illustrating geology, mineral occurrences, soil and rock samples.

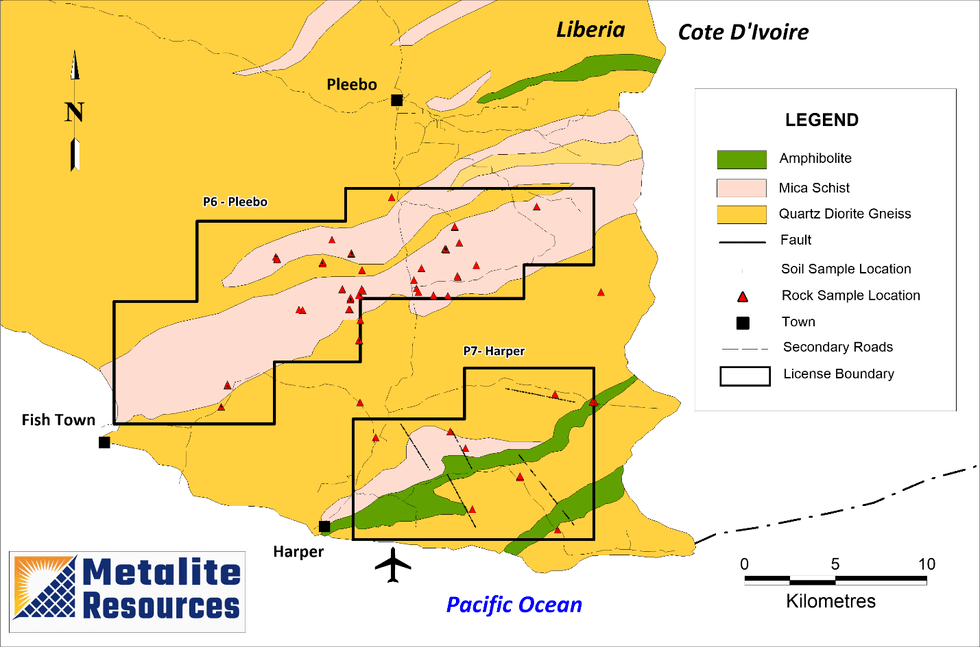

Pleebo (P6) and Harper (P7) Reconnaissance Licenses

The Pleebo (P6) and Harper (P7) reconnaissance licenses cover 186 and 107 km2 respectively, in Maryland County, south-eastern Liberia (Figures 1 and 4). The bedrock geology is dominated by quartz diorite schists with lesser units of mica schist and amphibolite.

A total of 423 soil samples and 67 rock samples were taken in 2022 (Figure 4). Soil samples were taken at a depth of 40 cm at 100 m intervals. on reconnaissance grid lines. Most of the rock samples were from pegmatite dikes. The results of the XRF and laboratory analysis are pending.

Figure 4. PleeboP6 and Harper P7 license map illustrating geology, mineral occurrences, soil and rock samples.

2023 Exploration Strategy

Metalite's 2023 exploration strategy is simple, cost effective and executable. Metalite plans to continue reconnaissance scale soil programs and integrate stream sediment sampling programs on its licenses going forward. In addition, initial mapping / prospecting programs are expected to be implemented. Active and historical artisanal mining sites are also planned to be mapped. Data will be collected digitally, and all samples analyzed using a Niton XL3t 950 GOLDD+ XRF. Once the XRF results have been interpreted selected samples will be sent to for further analyses. Management believes that this data will provide vectors used to delineate exploration targets for LCT Pegmatites, RREs, gold, and polymetallic base metal deposits.

The information in this news release was compiled and reviewed by David Melling, P.Geo who acts as Metalite's Qualified Person, under National Instrument 43-101 rules for mineral deposit disclosure. Mr. Melling is a Professional Geoscientist (P.Geo) and a registered member of the Engineer and Geoscientists of British Columbia (no. 18999) a Recognized Professional Organization. Mr. Melling is Metalite's CEO and has sufficient experience relevant to the crystallization of lithium-cesium-tantalum (LCT) type pegmatite deposits under evaluation.

About Metalite Resources Inc.

Metalite Resources Inc. is a Canadian junior mineral exploration issuer uniquely positioned to generate incremental shareholder value through its vast battery metals focused license portfolio in Liberia, West Africa and an extensive precious metals focused project portfolio in NSW, Australia. The Company has 6 Australian projects covering over 600 sq km's in NSW and includes 67 historical mines and prospects focused on Gold and Silver, along with various indicator minerals that occur along with these precious metals. With the recent acquisition of Next Generation Resources, the Company has amassed a set of eight highly prospective licenses (either granted or pending grant) that show evidence of high-potential mineralization containing various lucrative metals, including Lithium, REEs, Cobalt, Nickel, Copper, Zinc, Aluminium and Gold.

For further information please contact:

Ryan Bilodeau

(416) 910-1440

info@metaliteresources.com

To learn more, please visit https://www.metaliteresources.com/ .

Forward-Looking Statements

This news release contains certain "forward-looking statements." All statements, other than statements of historic fact, that address activities, events or developments that Metalite believes, expects or anticipates will or may occur in the future are forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as "seek," "anticipate," "believe," "plan," "estimate, "expect," and "intend" and statements that an event or result "may," "will," "can," "should," "could," or "might" occur or be achieved and other similar expressions. These forward-looking statements reflect the current expectations or beliefs of Metalite based on information currently available to Metalite. Forward-looking statements are subject to a number of risks and uncertainties that may cause the actual results of Metalite to differ materially from those discussed in the forward-looking statements, and even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on Metalite. Forward looking statements in this press release include statements regarding the applications for reconnaissance licenses or extensions thereof and planned exploration activities and the timing thereof. Factors that could cause actual results or events to differ materially from current expectations include, among other things, failure to complete the extension and/or application process for certain exploration licenses and or the failure to keep granted licenses in good standing, failure to successfully complete financings, capital and other costs varying significantly from estimates, production rates varying from estimates, changes in world mineral commodity markets, changes in equity markets, uncertainties relating to the availability and costs of financing needed in the future, equipment failure, unexpected geological conditions, imprecision in resource estimates, success of future development initiatives, competition, operating performance of facilities, environmental and safety risks, delays in obtaining or failure to obtain tenure to properties and/or necessary permits and approvals, and other development and operating risks. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Metalite disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Although Metalite believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release

METL:CC

The Conversation (0)

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00