Testwork results progressing towards future valuable tantalite by/co-product potential arising with lithium production

September 25, 2025 Sydney, Australia

Highlights

- Bench-scale testwork produces marketable tantalite concentrate from the CV5 Pegmatite's dense media separation ("DMS") waste stream fractions, at favorable grade and strong recovery.

- 8.7% Ta 2 O 5 at 45% global recovery (MC001).

- 6.6% Ta 2 O 5 at 49% global recovery (MC002).

- Recovery in-line with industry peers.

- Standard, low-cost mineral processing methods used which, if incorporated, will see tantalum being recovered from the DMS waste streams.

- Tantalite is commercially recovered as a by-product from multiple lithium pegmatite operations globally using simple, well-understood, and conventional methods – including Greenbushes, Pilgangoora, Wodgina, and Tanco.

- The Company believes this process will be applicable to the Shaakichiuwaanaan Project and will not affect global lithium recovery at CV5 .

- Shaakichiuwaanaan ranks as one of the largest tantalum pegmatite Mineral Resources 1 globally in terms of both grade and tonnage :

- Indicated: 108.0 Mt at 1.40% Li 2 O, 0.11% Cs 2 O, 166 ppm Ta 2 O 5 , and 66 ppm Ga.

- Inferred: 33.4 Mt at 1.33% Li 2 O, 0.21% Cs 2 O, 155 ppm Ta 2 O 5 , and 65 ppm Ga.

- The Company is actively evaluating options to advance and incorporate the tantalum opportunity at Shaakichiuwaanaan as a potential future by-product value stream :

- Testwork program commences shortly to advance the tantalite recovery circuit design to support inclusion in any future economic studies. 2

- The lithium-only, CV5 Feasibility Study (FS) is advancing towards completion and is targeted for release in approximately 4-6 weeks.

| ______________________________ |

| 1 Cut-off grade is variable depending on the mining method and pegmatite (0.40% Li 2 O open-pit, 0.60% Li 2 O underground CV5, and 0.70% Li 2 O underground CV13). The Effective Date of the MRE (announced July 20, 2025) is June 20, 2025 (through drill hole CV24-787). Mineral Resources are not Mineral or Ore Reserves as they do not have demonstrated economic viability. |

Darren L. Smith , Executive Vice President Exploration, comments: "With the initial recovery program for tantalite now complete, the Company has confirmed that a marketable tantalite concentrate can be produced from the CV5 Pegmatite's DMS waste streams at favorable grade and strong recovery. Tantalum – which is a critical and strategic metal in numerous jurisdictions globally and at Shaakichiuwaanaan – offers an attractive future opportunity to realize value from a portion of the Project's waste material."

"A follow-up testwork program is scheduled to commence shortly, which will target data collection sufficient to support the inclusion of the tantalum co-product opportunity at Shaakichiuwaanaan, with a view to further enhance the economic and financial returns of the Project," added Mr. Smith.

PMET Resources Inc. (the "Company" or "PMET") (TSX: PMET) (ASX: PMT) (OTCQX: PMETF) (FSE: R9GA) is pleased to advise that it has successfully produced a marketable tantalite concentrate from bench-scale testwork programs undertaken on material from the cornerstone CV5 Pegmatite. The CV5 Pegmatite is situated within the Company's 100%-owned Shaakichiuwaanaan Project (the "Property" or "Project"), located in the Eeyou Istchee James Bay region of Quebec.

The Shaakichiuwaanaan Mineral Resource 3 , comprised of the CV5 and CV13 Li-Cs-Ta ("LCT") pegmatites, is situated approximately 13 km south of the regional and all‑weather Trans-Taiga Road and powerline infrastructure corridor, and is accessible year-round by all-season road.

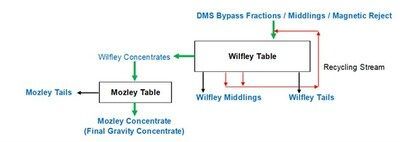

Although the majority of the Company's mineral processing test programs to date have focused on spodumene recovery in support of the pending lithium-only Feasibility Study on the CV5 Pegmatite, there is also significant opportunity for tantalum recovery as a secondary product. Given the nature of tantalite (the dominant tantalum-bearing mineral at the Project), it commonly concentrates into the waste stream fractions of a spodumene pegmatite's dense media separation ("DMS") circuit, such as that proposed to be developed for Shaakichiuwaanaan. This presents a strong opportunity for tantalum recovery from these waste streams using simple gravity separation and, potentially, flotation methods.

| ______________________________ |

| 2 Any future development and inclusion of a tantalum circuit at the Shaakichiuwaanaan Project would be subject to a separate and final feasibility level assessment, additional environmental approvals, and economic assessment. |

| 3 Shaakichiuwaanaan's Consolidated MRE (CV5 + CV13 pegmatites), which includes the Rigel and Vega caesium zones, totals 108.0 Mt at 1.40% Li 2 O, 0.11% Cs 2 O, 166 ppm Ta 2 O 5 , and 66 ppm Ga, Indicated, and 33.4 Mt at 1.33% Li 2 O, 0.21% Cs 2 O, 155 ppm Ta 2 O 5 , and 65 ppm Ga, Inferred, and is reported at a cut-off grade of 0.40% Li 2 O (open-pit), 0.60% Li 2 O (underground CV5), and 0.70% Li 2 O (underground CV13), with an Effective Date of June 20, 2025 (through drill hole CV24-787). Mineral resources are not mineral reserves as they do not have demonstrated economic viability. |

As part of this evaluation, two (2) master drill core composites were created from CV5 – one representing anticipated early open-pit mine-life (MC001) and another representing anticipated early underground mine-life (MC002). In DMS testwork on the CV5 Pegmatite's master composites MC001 and MC002, approximately 75% of the total tantalum budget reported collectively to the waste stream fractions – DMS magnetic rejects, bypass/undersize, floats (middlings), and floats (tails).

Using a series of bench-scale gravity separation (MC002) and flotation methods (gravity and flotation on the MC001 sample) on the magnetic reject, bypass/undersize, and middlings fractions, the Company was able to achieve strong tantalite concentrate stage grades at high stage recoveries ranging from 3 to >15% Ta 2 O 5 at 63% to 90% recovery (Figure 1, Figure 2).

When the concentrates from these three fractions are combined, a final marketable tantalite concentrate at strong global recovery is produced – 8.7% Ta 2 O 5 at 45% global recovery (MC001) and 6.6% Ta 2 O 5 at 49% global recovery (MC002).

Although preliminary, these results present a compelling opportunity for recovery of tantalite from the DMS waste fractions of the CV5 Pegmatite's flowsheet using both gravity and flotation methods. Additionally, there remains opportunity to potentially recover tantalite from the DMS floats tails fraction, which has yet to be evaluated.

Tantalum has been commercially recovered from other LCT pegmatites historically and at active mining operations today (e.g., Greenbushes, Pilgangoora, Wodgina, and Tanco), which further de-risks the pathway to recover tantalum at Shaakichiuwaanaan.

Not all LCT pegmatites in development or production host significant enough amounts of tantalum to warrant recovery. However, Shaakichiuwaanaan ranks as one of the largest (and at relatively high-grade) tantalum pegmatite Mineral Resources globally 4,5 (108.0 Mt at 166 ppm Ta 2 O 5 Indicated, and 33.4 Mt at 155 ppm Ta 2 O 5 Inferred), thus presenting a compelling opportunity for future tantalite recovery which has now been demonstrated at the bench scale using simple, conventional, and low-cost methods . Further, as the tantalite is recovered from the primary DMS lithium circuit waste streams, a tantalite recovery circuit – if incorporated at Shaakichiuwaanaan – is envisioned as a "bolt-on" with no impact on lithium recovery while still valorizing waste.

Next Steps

The tantalum recovery testwork programs are being completed by SGS Canada Inc. in collaboration with Primero Group Americas Inc. and associated Qualified Person(s). An expanded testwork program is currently being advanced to support tantalite recovery process design as a separate study with the ultimate objective of providing optionality to include it as a future by-product into the overall economic development of the Project as a "bolt-on" circuit.

| _____________________________ |

| 4 Shaakichiuwaanaan's Consolidated MRE (CV5 + CV13 pegmatites), which includes the Rigel and Vega caesium zones, totals 108.0 Mt at 1.40% Li 2 O, 0.11% Cs 2 O, 166 ppm Ta 2 O 5 , and 66 ppm Ga, Indicated, and 33.4 Mt at 1.33% Li 2 O, 0.21% Cs 2 O, 155 ppm Ta 2 O 5 , and 65 ppm Ga, Inferred, and is reported at a cut-off grade of 0.40% Li 2 O (open-pit), 0.60% Li 2 O (underground CV5), and 0.70% Li 2 O (underground CV13), with an Effective Date of June 20, 2025 (through drill hole CV24-787). Mineral resources are not mineral reserves as they do not have demonstrated economic viability. |

| 5 Determination based on Mineral Resource data, sourced through April 11, 2025, from corporate disclosure of NI 43-101, JORC, or equivalent regulatory body (see news release dated June 25, 2025). |

Additionally, the Company intends to actively engage with potential end-users and supply chain participants to further develop the economic opportunity in the tantalum product(s) anticipated to be derived from the Project.

The lithium-only Feasibility Study based on the CV5 Mineral Resource component of the overall Shaakichiuwaanaan MRE is scheduled for completion in the second half of 2025 and remains the near-term focus for the Company. The economic potential in critical metal by-products will be assessed separately from the lithium-only Feasibility Study, with various earlier stage studies concurrently underway to better evaluate the opportunities present for future inclusion of caesium, tantalum, and gallium specifically.

Tantalum Market

Tantalum is an essential component required for a range of high-tech devices, electronics, superalloys, and essential niche applications including capacitors. Due to these essential uses, tantalum is listed as a critical and strategic mineral by the province of Quebec ( Canada ), Canada , European Union , United Kingdom , Australia , Japan , India , South Korea , and the United States .

Tantalum is a unique, high-performance metal known for its high melting point, exceptional corrosion resistance, and ability to efficiently store and transfer electrical charge. High-growth and emerging applications of tantalum are being driven by both technological innovation and strategic shifts in global industries. Emerging industry applications include advanced electronics and 5G infrastructure, semiconductor manufacturing used in cloud and A.I.-focused GPUs and CPUs, medical technology including implants and medical imaging equipment, aerospace including defense applications, and quantum computing.

According to the United States Geological Survey , an estimated 2,100 tonnes of tantalum was produced globally in 2024. No significant amounts of tantalum are currently produced in North America or Europe , with a majority (85%+) of production coming out of the Democratic Republic of Congo , Rwanda , Nigeria , and Brazil . However, a significant amount of global supply (~60%) comes out of certain African regions where serious conflict and corruption are present with poor worker conditions, thus necessitating a conflict free source of supply. Growing tantalum production from lithium pegmatites, predominantly out of Australia at this time, is seen as a source of alternative, secure, stable, and conflict-free supply to global markets.

Tantalum currently trades for ~ US$214 /kg ( $97 /lb) in its refined form (Ta 2 O 5 ≥99.5%), and $170 /kg ( $77 /lb) as a concentrate (Ta ≥30%), per Shanghai Metals market reporting. Tantalum concentrate pricing is then adjusted for contained Ta 2 O 5, taking into account downstream recovery of product impurity factors. Depending on the source, market growth is forecasted at 4-6% CAGR through the end the decade.

Feasibility Study Update

The Company is advancing its Feasibility Study (FS) on the CV5 Pegmatite, focused exclusively on lithium, which has been underway for approximately 12 months. While the study was initially targeted for completion in Q3 2025, the significant scope of work and rigorous compliance requirements (covering both TSX and ASX requirements) have resulted in a slightly delayed publication date, compared to original estimates. The study is well advanced and targeted for release over approximately the next 4-6 weeks.

The FS and the Environmental and Social Impact Assessment (ESIA) documents are pre-requisites for the next-steps of final mine authorization. The FS scope contemplates a nameplate design of up to 800ktpa of spodumene concentrate production capacity, through staged development, and will underpin and align with the ESIA documentation.

Presentation of both the FS and ESIA to the regulators over approximately the next 3 months, maintains the Company's previously published mine authorisation schedule target.

Qualified/Competent Person

The information in this news release that relates to exploration results for the Shaakichiuwaanaan Property is based on, and fairly represents, information compiled by Mr. Darren L. Smith , M.Sc., P.Geo., who is a Qualified Person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects , and member in good standing with the Ordre des Géologues du Québec (Geologist Permit number 01968), and with the Association of Professional Engineers and Geoscientists of Alberta (member number 87868). Mr. Smith has reviewed and approved the technical information in this news release.

Mr. Smith is an Executive and Vice President of Exploration for PMET Resources Inc. and holds common shares, Restricted Share Units (RSUs), and Performance Share Units (PSUs) in the Company.

Mr. Smith has sufficient experience, which is relevant to the style of mineralization, type of deposit under consideration, and to the activities being undertaken to qualify as a Competent Person as described by the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (the JORC Code). Mr. Smith consents to the inclusion in this news release of the matters based on his information in the form and context in which it appears.

About PMET Resources Inc.

PMET Resources Inc. is a hard-rock lithium exploration company focused on advancing its district-scale 100%-owned Shaakichiuwaanaan Property (formerly known as Corvette) located in the Eeyou Istchee James Bay region of Quebec, Canada , which is accessible year-round by all-season road and is proximal to regional powerline infrastructure. The Project hosts the world's largest 6 pollucite-hosted caesium pegmatite Mineral Resource 7 at the Rigel and Vega zones with 0.69 Mt at 4.40% Cs 2 O, Indicated, and 1.70 Mt at 2.40% Cs 2 O, Inferred. Additionally, the Project hosts a Consolidated Mineral Resource, which includes the Rigel and Vega caesium zones, totalling 108.0 Mt at 1.40% Li 2 O, 0.11% Cs 2 O, 166 ppm Ta 2 O 5 , and 66 ppm Ga, Indicated, and 33.4 Mt at 1.33% Li 2 O, 0.21% Cs 2 O, 155 ppm Ta 2 O 5 , and 65 ppm Ga, Inferred, and ranks as the largest lithium pegmatite resource in the Americas, and in the top ten globally.

| ________________________________ |

| 6 Determination based on Mineral Resource data, sourced through July 11, 2025, from corporate disclosure. |

| 7 The Consolidated MRE cut-off grade is variable depending on the mining method and pegmatite (0.40% Li 2 O open-pit, 0.60% Li 2 O underground CV5, and 0.70% Li 2 O underground CV13). A grade constraint of 0.50% Cs 2 O was used to model the Rigel and Vega caesium zones, which are entirely within the CV13 Pegmatite's open-pit mining shape. The Effective Date of the MREs is June 20, 2025 (through drill hole CV24-787). Mineral Resources are not Mineral or Ore Reserves as they do not have demonstrated economic viability. |

For further information, please contact us at info@pmet.ca or by calling +1 (604) 279-8709, or visit www.pmet.ca . Please also refer to the Company's continuous disclosure filings, available under its profile at www.sedarplus.ca and www.asx.com.au , for available exploration data.

This news release has been approved by,

" KEN BRINSDEN "

Kenneth Brinsden , President, CEO, & Managing Director

Appendix 1 – JORC Code 2012 Table 1 (ASX Listing Rule 5.8.2)

Section 1 – Sampling Techniques and Data

| Criteria | JORC Code explanation | Commentary |

| Sampling techniques |

|

|

| Drilling techniques |

|

|

| Drill sample recovery |

|

|

| Logging |

|

|

| Sub-sampling techniques and sample preparation |

|

|

| Quality of assay data and laboratory tests |

|

|

| Verification of sampling and assaying |

|

|

| Location of data points |

|

|

| Data spacing and distribution |

|

|

| Orientation of data in relation to geological structure |

|

|

| Sample security |

|

|

| Audits or reviews |

|

|

Section 2 – Reporting of Exploration Results

| Criteria | JORC Code explanation | Commentary |

| Mineral tenement and land tenure status |

|

|

| Exploration done by other parties |

|

|

| Geology |

|

|

| Drill hole Information |

|

|

| Data aggregation methods |

|

|

| Relationship between mineralization widths and intercept lengths |

|

|

| Diagrams |

|

|

| Balanced reporting |

|

|

| Other substantive exploration data |

|

|

| Further work |

|

|

Disclaimer for Forward-Looking Information

This news release contains "forward-looking statements" and "forward-looking information" within the meaning of applicable securities laws.

All statements, other than statements of present or historical facts are forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and assumptions and accordingly, actual results could differ materially from those expressed or implied in such statements. You are hence cautioned not to place undue reliance on forward-looking statements. Forward-looking statements are typically identified by words such as "plan", "development", "growth", "continued", "intentions", "expectations", "emerging", "evolving", "strategy", "opportunities", "anticipated", "trends", "potential", "outlook", "ability", "additional", "on track", "prospects", "viability", "estimated", "reaches", "enhancing", "strengthen", "target", "believes", "next steps" or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking statements include, but are not limited to, statements concerning the ability of tantalum to be a high-value by-product at Shaakichiuwaanaan, Shaakichiuwaanaan's ability to become a critical minerals powerhouse, the recoverability of tantalite, timing of the lithium-only Feasibility Study, tantalum's ability to further enhance the economic and financial returns of the Project; the ability of each of lithium, caesium and tantalum as well as other critical and strategic metals to become further value-added by-products, the results and conclusion of the no-longer current PEA and the ability to further develop with potential end-users and supply chain participants the economic opportunity in the tantalum products derived from the Project.

Forward-looking statements are based upon certain assumptions and other important factors that, if untrue, could cause actual results to be materially different from future results expressed or implied by such statements. There can be no assurance that forward-looking statements will prove to be accurate. Key assumptions upon which the Company's forward-looking information is based include, without limitation, the market for tantalum, that proposed exploration work on the Property will continue as expected, the accuracy of reserve and resource estimates, the classification of resources between inferred and the assumptions on which the reserve and resource estimates are based, long-term demand for spodumene supply, and that exploration and development results continue to support management's current plans for Property development.

Forward-looking statements are also subject to risks and uncertainties facing the Company's business, any of which could have a material adverse effect on the Company's business, financial condition, results of operations and growth prospects. Readers should consider reviewing the detailed risk discussion in the Company's most recent Annual Information Form filed on SEDAR+, for a fuller understanding of the risks and uncertainties that affect the Company's business and operations.

Although the Company believes its expectations are based upon reasonable assumptions and has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information will prove to be accurate. If any of the risks or uncertainties mentioned above, which are not exhaustive, materialize, actual results may vary materially from those anticipated in the forward-looking statements.

The forward-looking statements contained herein are made only as of the date hereof. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent required by applicable law. The Company qualifies all of its forward-looking statements by these cautionary statements.

Competent Person Statement (ASX Listing Rule 5.23) for Shaakichiuwaanaan MRE

The mineral resource estimate in this release was reported by the Company in accordance with ASX Listing Rule 5.8 on July 21, 2025 . The Company confirms that, as of the date of this news release, it is not aware of any new information or data verified by the competent person that materially affects the information included in the announcement and that all material assumptions and technical parameters underpinning the estimates in the announcement continue to apply and have not materially changed. The Company confirms that, as at the date of this announcement, the form and context in which the competent person's findings are presented have not been materially modified from the original market announcement.

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/marketable-tantalite-concentrates-successfully-produced-from-the-cv5-deposit-at-shaakichiuwaanaan-302566401.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/marketable-tantalite-concentrates-successfully-produced-from-the-cv5-deposit-at-shaakichiuwaanaan-302566401.html

SOURCE PMET Resources Inc.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2025/24/c6742.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2025/24/c6742.html