- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

March 23, 2023

The Board of Ionic Rare Earths Limited (“IonicRE” or “The Company”) (ASX: IXR) advises that further to the Company’s announcement on 20 March 2023 detailing the results of the Definitive Feasibility Study (DFS or Study) for the Stage 1 development of the Makuutu Rare Earths Project (“Makuutu” or “the Project”) it is pleased to provide the following information in accordance with ASX Listing Rule 5.9.1 in respect of its maiden Ore Reserve (first reported to ASX on 20 March 2023) for Makuutu Stage 1 of 172.9MT at 848 ppm TREO, or 584 ppm TREO – CEO2, and 30 ppm Sc2O3.

As set out in the 20 March 2023 announcement the Stage 1 DFS contemplates a proposed open pit mining operation, and evaluation of an annualised mining rate of 5 Mtpa of mineralisation from the Project. Several scenarios were run to determine the optimal mine plan design. The revised Mineral Resource Estimate (MRE) prepared in May 2022 was used as the basis for the preliminary mine plans and mining optimisation studies.

The Stage 1 Project NPV, with Scandium production assumed, using a discount rate of 8%, was pre- tax, A$580 million (US$406 million), and post-tax A$397 million (US$278 million), and an IRR of 32.7%. The payback period was determined at three (3) years from first production.

In determining the results of the DFS and Ore Reserves the following factors were considered.

Assumptions

Ionic Rare Earths developed a detailed project financial capital and operating model for the Project and in that model the following material assumptions were made.

The capital cost of the Project is US$120.8 M (including 10% Contingency) and were estimated within the DFS by Mincore Pty Ltd and IonicRE with expected accuracy of -10% to +15% with construction duration for the project of 12 months from Financial Investment Decision (FID).

Operating costs were estimated within the DFS and included allowances for mining, administration, reagent costs, transport to Mombasa and shipping to rare earth refineries, with a nominated east coast of the USA location.

- All In Sustaining Cost (AISC) for the operation is ~US$12.40/t ROM feed;

- AISC for the operation is ~US$53/kg REO equivalent produced;

- AISC for the operation is ~US$46/kg REO equivalent produced (including Sc2O3 by-product credit);

Freight prices are derived from an independent logistic consultant for the DFS and include port costs and charges, road and sea transportation.

A range of forecast long-term rare earth prices were provided by leading external economic forecasters (Adamas Intelligence) and were used in the financial modelling.

- A range of forecast long-term rare earth prices provided by leading external economic forecasters were considered. IonicRE provided detail of the pricing basis on page 19 of the announcement, with an escalating basket price to 2035, excluding Sc2O3.

- A long term Sc2O3 price of $775/kg has been applied based on leading external economic forecasters. Assumption is that the Sc2O3 pricing is based upon nominated purity of 99.9%.

Exchange rates are derived from external economic forecasters. An exchange rate if AUD/USD of $0.70 was used.

The DFS assumes that a Mixed Rare Earth Carbonate (MREC) containing scandium will be produced on site and sent to a refinery for processing. No allowances were made for penalties for failure to meet specification.

Financial commitments are outlined in the Mining Act by the Ugandan Government. These have been incorporated in the detailed project financial model, including production royalties at the rate of 5% of mine-gate gross revenue for Uganda and an income tax rate of 30 percent has been applied.

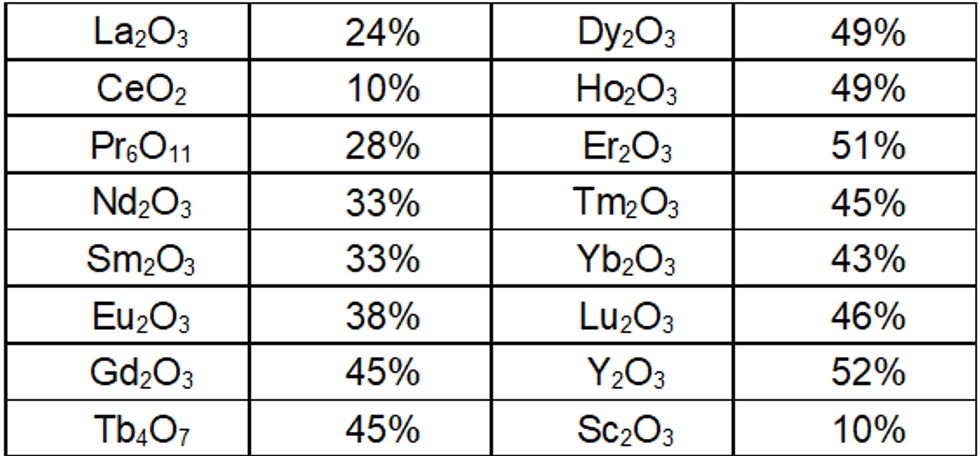

Average overall recovery estimates for each rare earth oxides are given in the table below:

A payability factor of 70 per cent of the forecast rare earth and scandium prices has been applied for calculating revenue. This aligns with advice received from independent consultants and potential offtake partners.

As IonicRE is targeting selling MREC ex-China, prices should be taken at face value, i.e. excluding Chinese VAT deductions.

No impurity penalties have been applied. Assuming all elements contained in the MREC attract the highest prices in the market – that is high purity carbonate/oxides.

Click here for the full ASX Release

This article includes content from Ionic Rare Earths, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IXR:AU

The Conversation (0)

14 September 2023

Ionic Rare Earths

Low Capital Operations With the Potential for High Margins

Low Capital Operations With the Potential for High Margins Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00