June 13, 2022

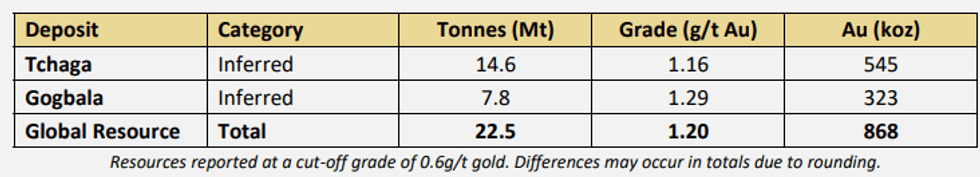

Mako Gold Limited (“Mako” or “the Company”; ASX:MKG) is pleased to announce a maiden JORC compliant (2012 edition) Inferred Mineral Resource Estimate (MRE) of 22.45Mt at 1.20g/t Au for 868,000 contained ounces of gold on the Tchaga and Gogbala prospects, within the Company’s flagship Napié Project (Napié) in Côte d’Ivoire. Tchaga and Gogbala are two of four prospects currently being explored by the Company, which are located on a +23km soil anomaly and coincident 30km‐long Napié Shear.

HIGHLIGHTS

- Mako Gold is pleased to announce its maiden JORC 2012 Mineral Resource Estimate (MRE) at the Tchaga and Gogbala Deposits, that forms part of its flagship Napié Project located in Côte d’Ivoire

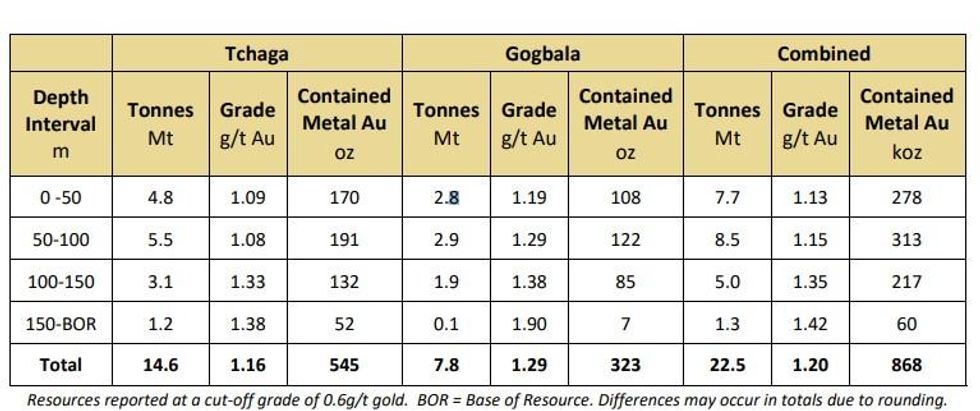

- Robust shallow deposit with 93% (808koz) of resource within 150m ofsurface and 68% (591koz) within 100m of surface

- Grade increases with depth at both deposits

- Tchaga and Gogbala are two of the four known prospects being explored on the Napié Project and

exhibit a clear pathway to significant resource growth

- Tchaga:

- Deeper drilling below the maximum 195m MRE base returned high‐grade results which were not included in the resource estimate and demonstrate immediate upside

- Gogbala:

- Resource is open along‐strike and can be increased cost‐effectively by shallow drilling

- Resource can be increased rapidly at depth below the 160m MRE base where high‐grade resource blocks were not included in the MRE

- Tchaga:

- Additional resource potential yet to be explored at Tchaga North and Komboro validates the gold district potential at Napié, and underpins Mako’s goal to define a multi‐million‐ounce deposit

- Preliminary metallurgical test work at Tchaga indicates high recoveries over 94% in oxide and fresh rock, demonstrating gold is recoverable via conventional cyanide leaching

NEXT STEPS

- The MRE provides a strong platform for significant short and long‐term resource growth

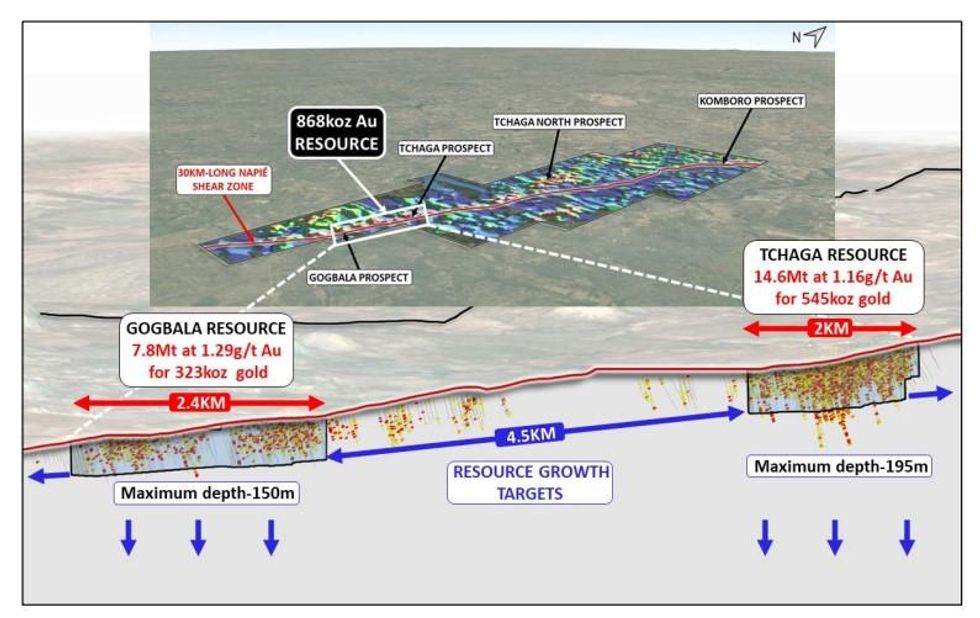

- Mako has systematically explored ad defined Mineral Resources over only 4.4km of the 30km long mineralised Napié Shear, representing c.13% of prospective Napié shear drilled to date

- RC and diamond drilling is planned to test high priority extensional targets along strike and at depth focusing on expanding the MRE at both Tchaga and Gogbala

- Shallow drilling scheduled to target the 4.5km strike‐length between Tchaga and Gogbala

- RC drilling ongoing at Komboro and planned at Tchaga North, both high priority regional targets, to follow up on 4m at 101.31g/t Au in AC, and 8m at 8.53g/t Au and 1m at 215g/t Au in RC

Mako’s Managing Director, Peter Ledwidge commented:

“The maiden Mineral Resource Estimate is a significant milestone for Mako Gold. It is the first step in our vision to discover a multi‐million‐ounce resource base at the Napié Project. This resource represents only 4.4km of the 30km shearzone and we have only ‘scratched the surface’ with respect to the broader exploration upside at Napié. We see a clear pathway to deliver a significant increase in the resource.

“The resource is shallow with Gogbala estimated to a maximum depth of 160m and Tchaga estimated to a maximum depth of 195m, significantly less than the 300m average resource depth for recent projects located in West Africa. Some of the high‐grade results returned from Tchaga and Gogbala were not included in the MRE as they were below the MRE base depth. The grade of the resource improves with depth. This indicates the potential for near‐term growth by deeper drilling at Tchaga and Gogbala. Encouragingly, there are several kilometres of undrilled portions of the Napié shear between Tchaga and Gogbala as well as a parallel shear at Gogbala that includes more than 4km of strike that remains to be drilled. These provide exceptional targets for near‐term resource expansion.

“We plan to recommence drilling shortly on high‐priority shallow targets at Gogbala which we consider a rapid, low‐cost pathway for near‐term resource growth. We also have plans to drill depth extensions at Gogbala and Tchaga, while we continue to explore the Tchaga North and Komboro prospects, with the aim of advancing the Napié Project to a world‐class multi‐million‐ounce deposit.”

GLOBAL RESOURCE

The maiden MRE comprises the Tchaga and Gogbala prospects which constitute only 4.4km of the 30km‐ long Napié Shear. Only 13% of the Napié Shear has been systematically drilled, indicating the strong potential for resource growth at Napié by drilling between Tchaga and Gogbala as well as on other undrilled portions of the Napié Shear (Figure 1).

The Napié maiden MRE is much shallower than the average 300m depth for recent resources1 in West Africa. The maximum resource depth, which is constrained due to limited deeper drilling, is 195m at Tchaga and 160m at Gogbala.

Part of the Company’s near‐term growth strategy is to drill below the current limits of the MRE at Tchaga and Gogbala as shown by the vertical blue arrows on Figure 1, below.

The grades at Tchaga and Gogbala increase with depth, as shown in Table 1, supporting the strategy that deeper drilling has the potential to add higher‐grade ounces to the resource.

Click here for the full ASX Release

This article includes content from Mako Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MKG:AU

The Conversation (0)

24 August 2021

Mako Gold

Exploring High-Grade Gold Deposits in Côte d'Ivoire

Exploring High-Grade Gold Deposits in Côte d'Ivoire Keep Reading...

4h

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

16h

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

17h

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

17h

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

18h

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

18h

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00