September 19, 2023

ChemX Materials Ltd (ASX: CMX) (ChemX or Company), an Australian based high purity critical materials developer, is delighted to announce a maiden resource on its 100% Company-owned Jamieson Tank deposit, located 150km from the infrastructure rich Port of Whyalla, South Australia.

- Maiden Mineral Resource 13.1 Mt at 5.7% Mn established with recent drilling program

- Significant potential upside with ~70% of the identified Jamieson Tank strike awaiting further extensional drilling of high grade, near surface targets

- Testwork shows the shallow resource has excellent upgrade characteristics

- Experienced global engineering firm Wood appointed to lead internal scoping study on high purity manganese battery grade products

- Manganese raw material demand set to double in next three years1

CEO Peter Lee commented:

“ChemX is pleased with the delivery of this maiden Mineral Resource Estimate (MRE) for the Jamieson Tank manganese deposit, the first of four manganese prospects within the South Australian 100%-owned tenements, and today represents a key milestone for the company’s shareholders.

“Importantly, the company expects to grow the mineral resource in grade and scale following the planned summer 2023/24 drilling program.

“This Mineral Resource defines a solid foundation for further strategic project advancement including internal scoping studies and mine optimisation plans, supported by the development of high purity manganese sulphate products for the global battery market. These studies will be supported by Wood (internal scoping study) and CSA Global (mine optimisation plan).”

MAIDEN MINERAL RESOURCE ESTIMATE FOR NEAR SURFACE DEPOSIT

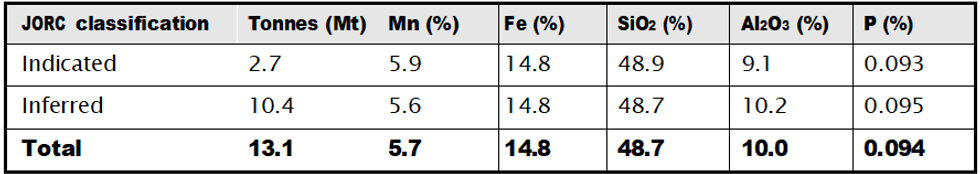

ChemX has worked closely with ERM Australia Consultants Pty Ltd (trading as CSA Global) to execute an extensive (+6,000m) infill Reverse Circulation (RC) program delivering the following maiden Mineral Resource Estimate (MRE), reported in accordance with the JORC 2012 Code.

Testwork has demonstrated excellent upgradability through gravity and magnetic separation and ChemX is moving swiftly to execute a follow up drill program to bolster this maiden Mineral Resource Estimate.

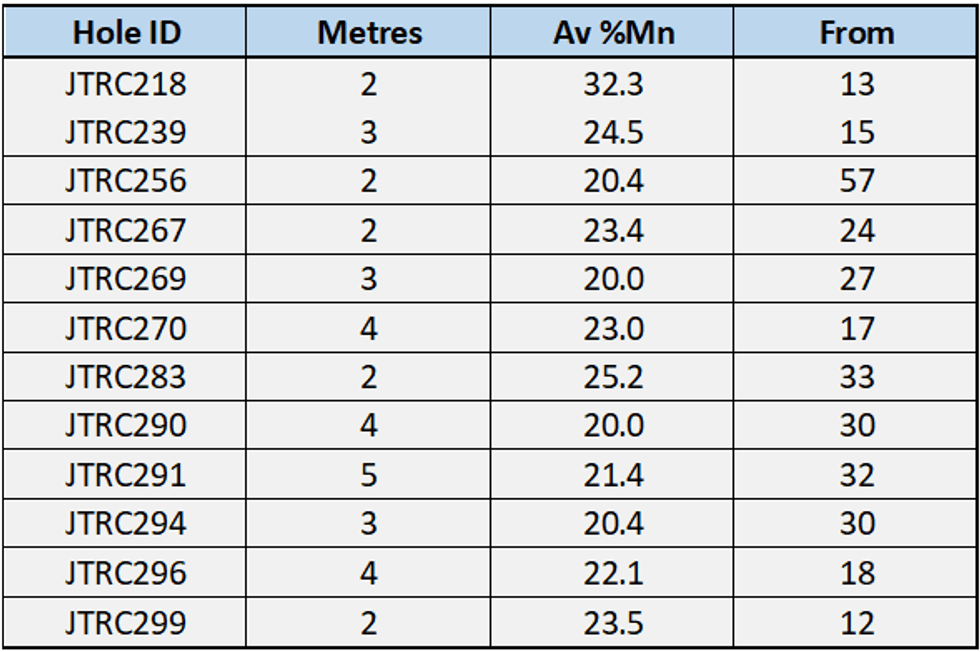

Initial holes intersected high grade zones of +20% Mn in the following drill holes.

SOUTH AUSTRALIA - INFRASTUCTURE RICH

The project is well positioned to take advantage of world-class regional infrastructure including sealed roads, rail networks, port operations, grid-power and an emerging renewable energy hub in Whyalla. ChemX has commenced an internal scoping study for the evaluation of the full High Purity Manganese (HPM) project including a possible hydrometallurgical facility in Whyalla supported by a skilled residential workforce and associated infrastructure.

WORLD CLASS BATTERY DOWN-STREAM OPPORTUNITY FOR SOUTH AUSTRALIA

ChemX seeks to develop South Australian sourced Manganese into a world-class HPM product for use within global battery supply chains, particularly Electric Vehicle (EV) markets. This will require a Beneficiation Plant, likely to be located in the Central Eyre Peninsula region and also a Hydrometallurgical facility, currently proposed to be located in Whyalla. It is envisaged both operations will create significant employment within a burgeoning Critical Minerals and High Purity Materials industry in South Australia.

Click here for the full ASX Release

This article includes content from ChemX Materials, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CMX:AU

The Conversation (0)

01 July 2024

ChemX Materials

Critical materials company developing innovative, processing technology to produce high purity alumina for advanced technology and clean energy applications.

Critical materials company developing innovative, processing technology to produce high purity alumina for advanced technology and clean energy applications. Keep Reading...

28 November 2024

Agreement with Vytas Ltd for High Purity Assay Services

ChemX Materials (CMX:AU) has announced Agreement with Vytas Ltd for High Purity Assay ServicesDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00