Overview

Canada has an astounding wealth of mineral resources, and when it comes to critical minerals, it is rich in 31 out of 35 of them. Deemed essential to electrification, decarbonization and technological advancement, many of these minerals are quickly approaching current global production limits while demand continues to increase. The need for reliable critical metals production goes far beyond Canada, too. The European Union recently identified 30 critical minerals, while the United States contains deposits for all 35 critical minerals. However, the US relies entirely on Canada for 14 of these minerals and is 50 percent import-reliant for 17.

From a global perspective, Canada also accounts for 70 percent of in-development graphite projects. It’s safe to say North America will require every one of those projects moving forward.

Graphite is expected to experience a 37-percent under-supply by 2030 and a considerable upturn in demand this year. Moreover, the production of minerals such as graphite, lithium and cobalt may need to increase by 500 percent by 2050.

Multiple major corporations are in talks with Quebec for the development of battery factories and gigafactories, with their combined investments representing billions of dollars. Stakeholders include Tesla (NASDAQ:TSLA), Britishvolt, Lion Electric Company (TSX:LEV), Stellantis, LG, Samsung Electronics (KRX: 005930) and Toyota Motor Corporation (TYO: 7203).

The Canadian Federal Government has also announced plans to hit net-zero emissions and 100-percent electric vehicle market penetration by 2035. If Canada is to reach this goal, it must look to domestic solutions for mineral development and production.

Lomiko Metals (TSXV:LMR, OTC:LMRMF, FSE:DH8C) is a Canadian mining, exploration and development company headquartered in Surrey, British Columbia. Its strategic vision is to develop a sustainable approach to mineral extraction based on a collaborative, people-first partnership approach with local communities and a strong understanding of Indigenous traditions and values. The company is heavily focused on supplying the critical minerals required to facilitate the transition to clean energy while maintaining a net positive environmental impact.

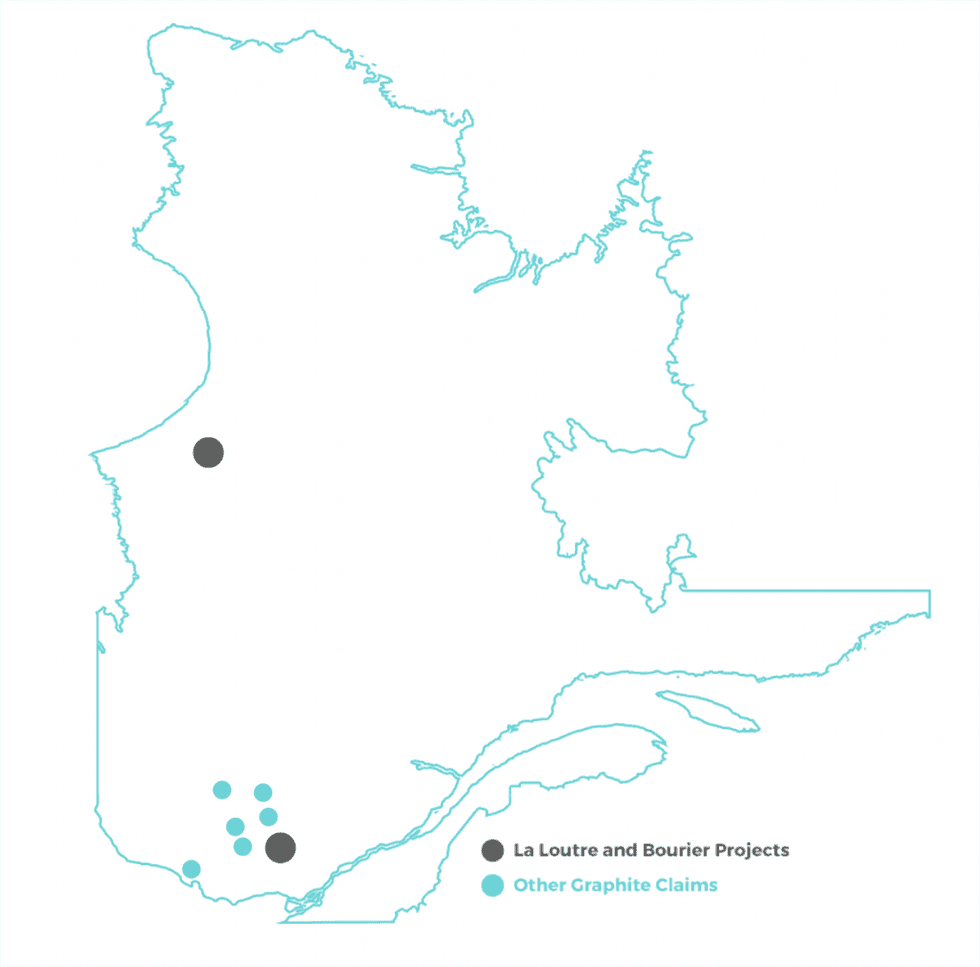

Currently, Lomiko Metals is involved in the development of two major mining projects in the Province of Quebec. The first, La Loutre, is situated within the Kitigan Zibi Anishinabeg First Nations Territory, located 180 kilometers northwest of Montreal. The 2,867-hectare site comprises 48 contiguous land claims. Based on a preliminary economic assessment, La Loutre has a potential graphite concentrate production of 1.43 Mt graded at 95.0 percent Cg.

Alongside Critical Elements Lithium (TSXV:CRE), Lomiko Metals is also exploring the Bourier lithium project. Located southeast of Quebec's Eeyou Istchee James Bay territory, Bourier covers 10,252 hectares. An AI analysis carried out by GoldSpot (TSXV:SPOT) in 2021 revealed the project has considerable lithium potential.

Six new prospective graphite projects have been acquired in the Grenville Province graphite metamorphic belt. The site consists of 236 claims over 14,255 hectares. The company has completed time-domain electromagnetic and magnetic surveys and will follow up on the survey results with field prospecting to identify near-surface conductors to help guide the fieldwork in the future.

Lomiko Metals is proudly represented by a diverse majority-female, majority-independent board, including Indigenous and francophone directors, who between them have decades of experience in mining development and production, capital raising and management. It believes that committed and open engagement with community, environment, investors and public stakeholders plays a crucial role in the successful advancement of its projects.

"It is our shared values of respect, integrity, personal performance and ingenuity that brought us together so we can grow a domestic, secure and stable supply chain of critical minerals in Quebec and in Canada," says CEO and Director Belinda Labatte. "We are creating a people-first, responsibly sourced, secure and stable supply of critical minerals assets where projects are developed alongside communities and with all the innovation and ingenuity required to ensure the projects have a net positive impact on the environment and the communities we serve."

Company Highlights

- Lomiko Metals is an exploration-stage mining company based in Quebec, Canada, with a focus on high-grade large flake graphite and lithium mining.

- The company intends to have a net positive environmental impact, rather than simply net-zero.

- The company holds a 100-percent interest in the La Loutre graphite development in Southern Quebec, with an estimated annual graphite production of 109 kt for the first eight years.

- Lomiko is exploring the Bourier lithium project near James Bay with Critical Elements Lithium Corporation, which according to a 2021 analysis has high lithium production potential.

- Six new prospective graphite projects in Grenville Province-graphite metamorphic belt

- Lomiko Metals has completed its infill and extension exploration drilling program at its wholly-owned La Loutre graphite project.

- Lomiko Metals is guided by a shared purpose through a leadership team that has decades of experience in the mining and capital markets.

Get access to more exclusive Graphite Investing Stock profiles here