Lion One Metals Limited (TSXV: LIO,OTC:LOMLF) (OTCQX: LOMLF) ("Lion One" or the "Company") is pleased to report preliminary quarterly gold production from the Tuvatu Gold Mine in Fiji for the quarter ending September 30th, 2025.

Preliminary Quarterly Production Results:

- 4,200 oz of gold recovered

- 5.1 g/t gold average head grade

- 83.9% gold recovery

- 29,850 tonnes milled

- 1,712 m underground mine development

Quarterly Production Results

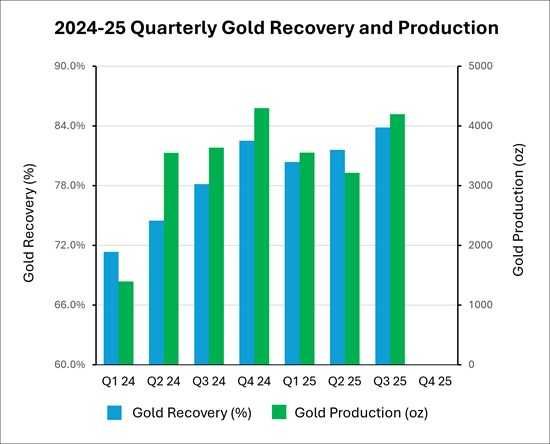

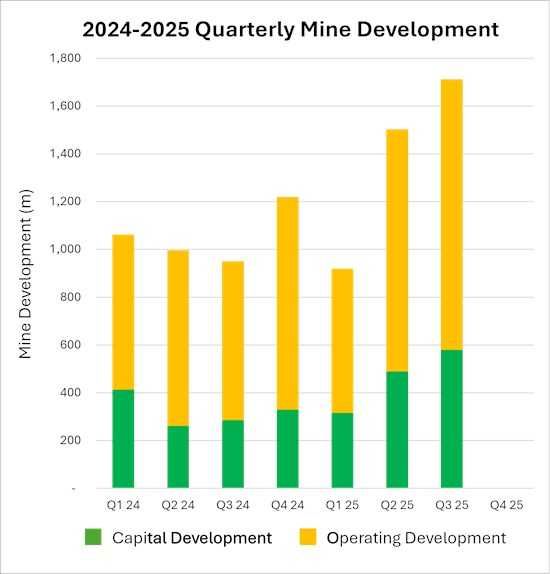

Lion One Metals produced approximately 4,200 oz of gold during the three-month period ending September 30th, 2025. This represents a 31% increase from the previous quarter. The average grade for the quarter was 5.1 g/t gold, which represents a 39% increase from the previous quarter. The Company also achieved record quarterly gold recovery of 83.9%, and record quarterly underground mine development of 1,712 m.

Lion One Metals' CEO Ian Berzins stated: "We're very pleased with the results from this quarter. Both the mine and the mill performed well, with record recoveries achieved at the mill and record development achieved at the mine. We also completed the production from our first shrinkage stope during the quarter, which was also a success and produced over 5,700 tonnes of material at 10.60 g/t gold. As we continue to increase the pace of development at the mine and as we continue to expand the processing facilities at Tuvatu we're very excited for the future and anticipate that production will continue to increase."

Lion One Metal's Chairman and President Walter Berukoff expressed his gratitude to Director of Operations Eric Setchell and the entire Fiji team for their key role in the company's recent turnaround. "This success is a direct result of the dedication and teamwork of our people in Fiji," said Berukoff. "Their hard work and commitment have set the stage for continued growth at Tuvatu."

Mill performance for the quarter was strong, achieving quarterly mill utilization of 91%, despite 4 days of planned downtime for maintenance. At total of 29,850 tonnes of mineralized material was processed through the mill, for an average throughput of approximately 328 tonnes per day for the quarter, which is above nameplate capacity of 300 TPD. Record quarterly gold recovery of 83.9% was achieved, including a record monthly recovery of 87.2% in July. Gold recoveries are anticipated to increase further once construction and commissioning of the flotation circuit is complete within the next few months.

Figure 1. Tuvatu Quarterly Gold Recovery and Production, 2024-2025.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2178/270666_e918b806b47698c2_001full.jpg

Mine performance for the quarter was also strong with 28,423 tonnes of mineralized material mined throughout the quarter, and a record 1,712 m of underground development completed during the quarter. The top three months of development at Tuvatu were all achieved during this quarter, surpassing the previous records set during the previous quarter. Mine development at Tuvatu has increased dramatically throughout 2025 as a result of the completion of the mine ventilation project, the addition of new mining equipment, and increasing the efficiency of mining methods and operations. With still additional equipment set to arrive on site, mine development is anticipated to increase further. The Company also completed production from the first ever shrinkage stope at Tuvatu, which was a major success and produced 5,704 tonnes of material at an average gold grade of 10.60 g/t. The company's second shrinkage stope is already in development and is anticipated to be twice as large as the first and will contribute to gold production in Q4 2025 and Q1 2026.

Figure 2. Tuvatu Quarterly Mine Development, 2024-2025.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2178/270666_e918b806b47698c2_002full.jpg

Board of Directors Update

The Company would also like to announce that Edward (Ned) Collery has stepped down from the Company's Board of Directors, and Todd Romaine has been appointed as an Independent Director of the Company.

Mr. Romaine is an Environmental, Social, and Governance (ESG) expert with over 25 years of professional experience. He has served in senior management positions in mining, oil and gas, non-profit, aboriginal, and public sector organizations, including Vice President Corporate Social Responsibility and Government Relations at Nevsun Resources for six years and Executive Vice President Sustainability at Galiano Gold for 4 years. Mr. Romaine holds professional designations with the Canadian Institute of Planners and the International Right of Way Association. He also has Masters Degrees in International Relations from the Fletcher School of Law, Tufts University and in Sustainability Leadership from the University of Cambridge.

Walter Berukoff, Chairman of Lion One's Board of Directors, commented, "On behalf of the Board and the Company's management team we wish to thank Mr. Collery for his service and contributions to the Company, and we wish him all the best in his future endeavours. We are also very pleased to welcome Todd Romaine to the Lion One Board of Directors. Todd is an expert in environmental sustainability, which is a core value for Lion One metals, and we are happy to have Todd join the team at Lion One."

Qualified Persons Statement

In accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43- 101"), Mark Horan, P.Eng., Chief Mining Engineer for the Company, is the Qualified Person for the Company and has reviewed and approved the technical and scientific content of this news release.

Lion One Laboratories / QAQC

Lion One adheres to rigorous QAQC procedures above and beyond basic regulatory guidelines in conducting its drilling, sampling, testing, and analyses. The Company operates its own geochemical assay laboratory and its own fleet of diamond drill rigs using PQ, HQ and NQ sized drill rods.

Diamond drill core samples are logged by Lion One personnel on site. Exploration diamond drill core is split by Lion One personnel on site, with half core samples sent for analysis and the other half core remaining on site. Grade control diamond drill core is whole core assayed. Core samples are delivered to the Lion One Laboratory for preparation and analysis. All samples are pulverized at the Lion One lab to 85% passing through 75 microns and gold analysis is carried out using fire assay with an AA finish. Samples that return grades greater than 10.00 g/t Au are re-analyzed by gravimetric method, which is considered more accurate for very high-grade samples.

Duplicates of 5% of samples with grades above 0.5 g/t Au are delivered to ALS Global Laboratories in Australia for check assay determinations using the same methods (Au-AA26 and Au-GRA22 where applicable). ALS also analyses 33 pathfinder elements by HF-HNO3-HClO4 acid digestion, HCl leach and ICP-AES (method ME-ICP61). The Lion One lab can test a range of up to 71 elements through Inductively Coupled Plasma Optical Emission Spectrometry (ICP-OES) but currently focuses on a suite of 26 important pathfinder elements with an aqua regia digest and ICP-OES finish.

About Lion One Metals Limited

Lion One Metals is an emerging Canadian gold producer headquartered in North Vancouver BC, with new operations established in late 2023 at its 100% owned Tuvatu Alkaline Gold Project in Fiji. The Tuvatu project comprises the high-grade Tuvatu Alkaline Gold Deposit, the Underground Gold Mine, the Pilot Plant, and the Assay Lab. The Company also has an extensive exploration license covering the entire Navilawa Caldera, which is host to multiple mineralized zones and highly prospective exploration targets.

On behalf of the Board of Directors,

Walter Berukoff, President, Chairman of the Board

Contact Information

Email: info@liononemetals.com

Phone: 1-855-805-1250 (toll free North America)

Website: www.liononemetals.com

Neither the TSX-V nor its Regulation Service Provider accepts responsibility or the adequacy or accuracy of this release

This press release may contain statements that may be deemed to be "forward-looking statements" within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein are forward-looking information. Generally, forward-looking information may be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "proposed", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases, or by the use of words or phrases which state that certain actions, events or results may, could, would, or might occur or be achieved. This forward-looking information reflects Lion One Metals Limited's current beliefs and is based on information currently available to Lion One Metals Limited and on assumptions Lion One Metals Limited believes are reasonable. These assumptions include, but are not limited to, the actual results of exploration projects being equivalent to or better than estimated results in technical reports, assessment reports, and other geological reports or prior exploration results. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance, or achievements of Lion One Metals Limited or its subsidiaries to be materially different from those expressed or implied by such forward-looking information. Such risks and other factors may include, but are not limited to: the stage development of Lion One Metals Limited, general business, economic, competitive, political and social uncertainties; the actual results of current research and development or operational activities; competition; uncertainty as to patent applications and intellectual property rights; product liability and lack of insurance; delay or failure to receive board or regulatory approvals; changes in legislation, including environmental legislation, affecting mining, timing and availability of external financing on acceptable terms; not realizing on the potential benefits of technology; conclusions of economic evaluations; and lack of qualified, skilled labor or loss of key individuals. Although Lion One Metals Limited has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. Accordingly, readers should not place undue reliance on forward-looking information. Lion One Metals Limited does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/270666