August 28, 2023

Legacy Minerals Holdings Limited (ASX: LGM) (Legacy Minerals or “the Company) is pleased to announce the results of the recently completed audio-magnetotelluric survey over completed on the Bauloora Project located in New South Wales (NSW), Australia.

Highlights

Compelling audio-frequency magnetotelluric (AMT) results returned from the initial survey phase at the Breccia Sinter Prospect at Bauloora:

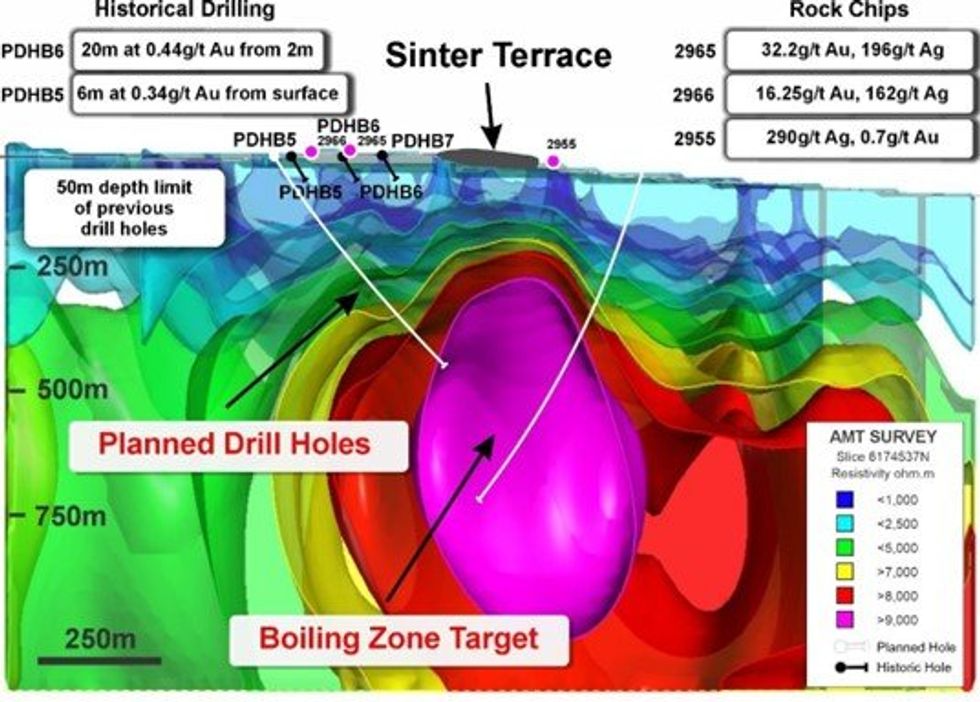

- A strongly resistive anomaly (~9,000 ohm*m) has been identified.

- The anomalous feature is depth extensive (>1,000m) and comes to within 300m of the surface.

- The anomaly is 500m x 500m and sits directly beneath mapped outcropping sinter.

The strongly resistive body supports the interpretation of a feeder structure at depth and the potential boiling zone which may host significant gold and silver mineralisation.

Sinter and high-grade gold on surface up to 32.2g/t Au above anomaly

- The AMT anomaly coincides with pathfinder elements associated with low-sulphidation systems.

- It is interpreted to be down dip of the recently announced 500m x 250m >20ppb Au soil anomaly where rock chips have graded up to 32.2g/t Au and 290g/t Agi, (see Endnotes Page 8).

- It shows indications of being structurally controlled by NS and NW-SE orientations, which reflects mapped vein orientations, and trends identified in ground magnetics and gradient array induced polarisation geophysical surveys.

Next Steps – Drilling this quarter

This high priority target will be drill tested immediately with a drill program planned for Q3 2023.

Figure 1: 3D Model Cross section showing resistive anomaly at the Breccia Sinter Prospect, drill intercept results, and highlight rock chip and (looking north).

Figure 1: 3D Model Cross section showing resistive anomaly at the Breccia Sinter Prospect, drill intercept results, and highlight rock chip and (looking north).Management comment - Legacy Minerals CEO & Managing Director, Christopher Byrne said:

“We are extremely pleased to report the positive initial results from the AMT survey conducted at Bauloora. The geophysical results highlight a large, undrilled, ‘bulls-eye’ resistivity anomaly at the Breccia Sinter Prospect.

AMT is a well-regarded survey technique used to identify zones of intense silicification and resistivity, and it has proved successful in guiding companies towards discoveries.

The AMT anomaly is compelling for a number of reasons. It sits 300m beneath a mapped sinter terrace which, according to Buchannans Model, is where you would expect the boiling zone and high-grade gold and silver mineralisation to increase. The anomaly is also adjacent to a gold soil anomaly and is below high-grade gold bearing low-sulphidation veins grading up to 32.2g/t Au and 290g/t Ag.

This is a textbook example of what we hope to see in a low-sulphidation target, and we’re excited to be drilling it imminently. “

Audio-frequency Magnetotelluric Geophysical Survey

The Company has completed Phase 1 of a large-scale, 80 line-km AMT survey over the Bauloora Vein Field. Geophysical contractors Quantec Geoscience and AGS were engaged to complete this work. The total survey area including Phase 2 will cover approximately 10km2 with approximately 200m spaced lines and infill to 100m spaced lines at the Breccia Sinter Prospect. The objective of the survey was to identify and target large, potentially deeper and strike extensive resistivity anomalies that may represent zones of silicification associated with epithermal veining. The survey provided very high- quality datasets to approximately 1,000m depth.

Magnetotelluric surveys such as AMT are a proven technique that has globally delivered success in the delineation of subsurface zones of silicification, even beneath areas of high-level silica and steam- heated clay alteration, which can be expected in the upper portions of a completely preserved epithermal system such as that interpreted at Bauloora.

Click here for the full ASX Release

This article includes content from Legacy Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

18h

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

09 February

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

09 February

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

09 February

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

09 February

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

09 February

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00