November 28, 2023

White Cliff Minerals Limited (White Cliff or the Company) is delighted to update shareholders on its 100% owned Lake Johnston South Lithium project.

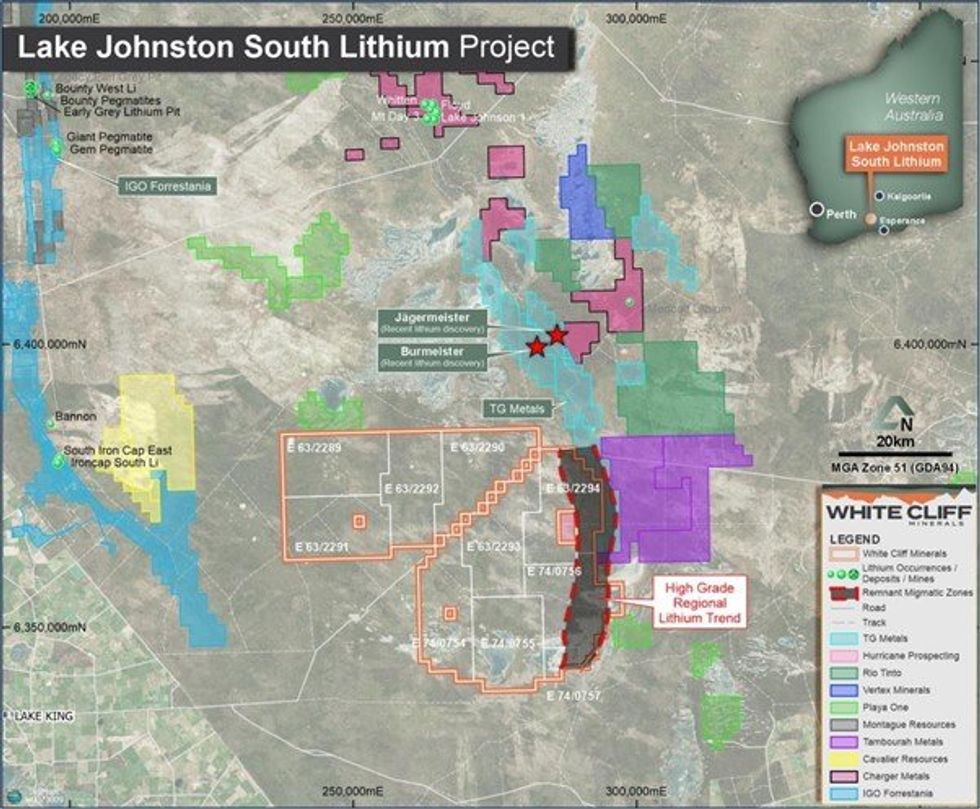

A review of the Lake Johnston South project (“Lake Johnston” or “the Project”), a license area of >1,870 square km (km2) west of Norseman in Western Australia, confirms the licenses cover a large portion of the Lake Johnston greenstone belt in the new shallow high-grade Lithium province. The project is adjacent to TG Metals recent spodumene discoveries and is approximately 20km from the Charger Metals and Rio Tinto Exploration joint venture project.

Highlights

- Lake Johnston review indicates the Project is highly prospective for spodumene bearing pegmatites.

- The licenses cover the southern half of the Lake Johnston structural corridor, where the Company has a dominant landholding.

- White Cliff Lake Johnston Project is immediately adjacent to pegged ground to be explored by Rio Tinto Exploration and Charger Metals JV and significant lithium discoveries by TG Metals.

- Government open file coarse magnetic data indicates the continuation of the Lake Johnston greenstone belt within White Cliff’s licenses.

- Further sampling and mapping will be conducted in the new high-grade Lithium province.

- The tenements were recently granted, and a Program of Work (PoW) for drilling will be submitted.

Commenting on the exploration results, White Cliff Chairman Roderick McIllree (FAusIMM) said:

“The Company has been working through a top-to-bottom strategic review of the existing portfolio while we deliver on our acquisition of large-scale high-grade copper projects in Canada.

I am delighted to inform existing and incoming shareholders that while we continue to deliver on our stated copper objectives in Canada, we have uncovered a stunning lithium prospect in our portfolio in what is now proven as a new shallow high grade lithium province. Given the several large discoveries by the adjacent TG Metals (TG6.ASX), and Rio Tinto Exploration and Charger Metals (CHR.ASX) commercially significant transactions, we have enormous confidence in the potential value of the Project.

We look forward to getting our exploration underway during December, intending to drill subsequent targets in early 2024.”

ABOUT THE PROJECT

The Lake Johnston Project (refer ASX News Release dated 24 October 2022) consists of 13 exploration licenses totalling 1,874.2km2. It is immediately adjacent to and along strike from recent large-scale discoveries of spodumene bearing pegmatites by Charger Metals and TG Metals. Based on high- resolution magnetics, these greenstone and magnetic trends continue for more than 30 linear kilometres into the project area. The broader region is located within the Phillips River Goldfield in the Southern Cross Domain of the Youanmi Terrane in the southern Yilgarn Craton.

The area is underlain by granites, gneisses and migmatite and hosts greenstone belts that daylight through the quaternary transported cover, all of which can be found at the Project.

Historical Exploration

Whilst numerous old, cleared grid exploration tracks exist in the project area, the only reported exploration within the area has been by Magnetic Resources NL and Uranex NL.

In 2006-2008, Magnetic Resources NL completed a shallow vertical air core drilling program of 34 holes for 1217m on several magnetic anomalies within the region. Samples were analysed for Au, Pt, As, Co, Cu, Ni, Cr, Zn, Mn and U in 4 metre downhole composites. A selected suite of 7 bottom hole samples was also analysed for Ba, Ca, Ce, Co, Cr, Cu, Dy, Er, Fe, K, La, Mg, Mn, Nb, Ni, P, Rb, Sr, Ti, Y and Zn. The targets were discrete magnetic anomalies within the basement.

Click here for the full ASX Release

This article includes content from White Cliff Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00