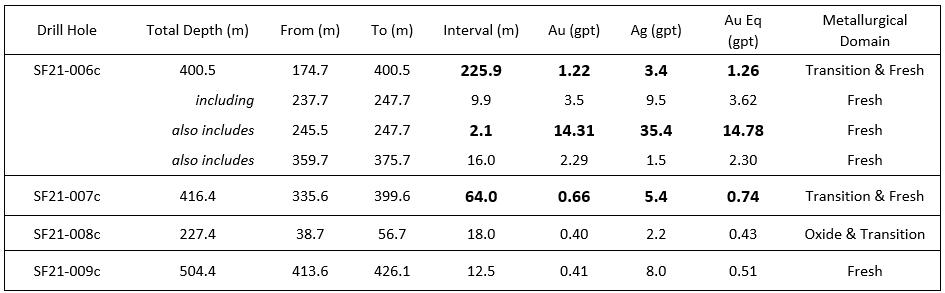

Lahontan Gold Corp. (TSX.V:LG) (formerly, 1246765 B.C. Ltd.) (the "Company" or "Lahontan") is pleased to announce drill results from four additional core drill holes exploring the Santa Fe pit area of the Company's 19 km2 Santa Fe Project in Nevada's Walker Lane. The four drill holes, totaling 1,549 metres, were completed in late 2021. These drill holes targeted down-dip step outs from known gold and silver mineralization along the Santa Fe fault, extensions of oxide and transition mineralization southeast of the Santa Fe pit, and an easterly trending structure that may tie Slab pit mineralization to the Santa Fe pit area. Highlights include

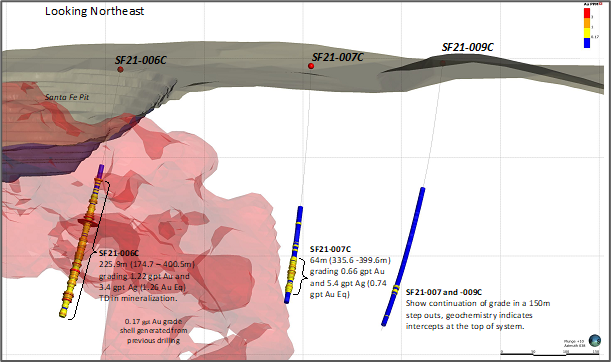

- SF21-006c: This core drill hole intercepted continuous gold and silver mineralization over 226 metres (1.22 gpt Au) and the drill hole bottoms in mineralized rock. Within this intercept, Lahontan has discovered a new high-grade zone (the "Bighorn Zone") with the highest Au assays in project history: up to 26.2 gpt Au and 61.0 gpt Ag (27.01 gpt Au Eq, 245.5 - 246.6m; please see table below). This high-grade zone is separate from the BH Zone and suggests that multiple high-grade feeder zones are present at the Santa Fe Project.

- SF21-008c: A step-out drill hole southeast of the Santa Fe pit, has successfully intercepted shallow oxidized gold and silver mineralization (75 metres south of previously reported drill hole SF21-004c). This drill hole demonstrates that additional oxide and transition mineralization is extensive south and southeast of the Santa Fe pit, and underscores the resource potential of this area.

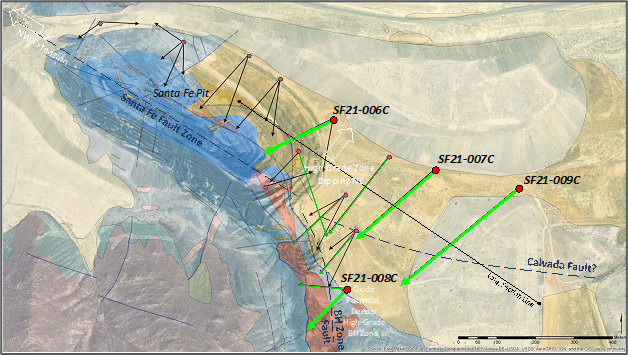

- SF21-007c and -009c: These two core drill holes targeted the projected extension of the Calvada fault, an east-west trending structure that may tie together mineralization seen at the Slab-Calvada area with the intensely gold and silver mineralized Santa Fe pit area. SF21-007c intercepted 64 metres grading 0.74 gpt Au Eq (please see table below) including up to 2.24 gpt Au Eq in transitional rocks (360.6 - 362.1m, 1.97 gpt Au and 19.7 gpt Ag). Although -009c appears to have drilled over the main structure, the two holes confirm the potential of the Calvada fault zone between the Santa Fe and Slab pits opening up over 1000 metres of potentially mineralized structure.

Kimberly Ann, CEO, President, Director, and Founder of Lahontan Gold Corp commented: "The discovery of a new high-grade zone northwest of the BH Zone suggests that there are multiple "feeder" structures at the Santa Fe Project, opening up additional high-grade targets along the entire strike length of the Santa Fe fault for hundreds of metres. The ubiquitous gold and silver mineralization seen in drill hole SF21-006c extends well below any previous drilling and is a testament to the strength of the Santa Fe hydrothermal system. Drilling results to date are validating our dual path exploration model at Santa Fe: Identify and expand shallow oxide gold and silver mineralization while simultaneously building the scope and scale of deeper, high-grade potential resources."

*Notes: Au Eq equals Au (gpt) + (Ag gpt/75). Metallurgical recovery has not been factored as insufficient test-work is available to determine potential Ag recoveries. True thickness of the intercepts shown above are estimated to be 80-90% of the drilled interval.

Drill hole location map, Santa Fe pit area, Santa Fe Project, Mineral County, Nevada. Bright green drill hole traces are those reported here, darker green traces were previously reported holes, and black drill traces are pending. Line of long section is shown.

The latest drill results emphasize the importance of both structural and stratigraphic controls to precious metal mineralization at Santa Fe. It is now apparent that structural intersections, e.g. the Santa Fe fault and easterly-tending faults and splays like the Calvada fault, help localize high grades along their raking intersections. Lahontan will apply this interpretation to further drilling northwest of SF21-006c (please see map above). The entire drilled interval of Triassic Luning Formation limestone was mineralized in SF21-006c and the hole bottomed in mineralized rock. Gold and silver mineralization occurs over tens of square kilometres at Santa Fe. The combined areal and vertical distribution of mineralization points to a very large system with multiple targets, both under cover and on the surface that remain to be tested.

Northwest-southeast (left to right, please see map above) long section through the newly discovered Bighorn high-grade zone, Santa Fe Project, Mineral County, Nevada. The grade shell adjacent to the Bighorn high-grade zone is based upon modeling historic drilling. Drill hole SF21-006c has intercepted new gold and silver mineralization in both the hanging-wall (above) and the footwall (below) the grade shell, greatly expanding the resource potential of this part of the Santa Fe Project.

QA/QC Protocols:

Lahontan conducts an industry standard QA/QC program for its core and RC drilling programs. The QA/QC program consisted of the insertion of coarse blanks and Certified Reference Materials (CRM) into the sample stream at random intervals. The targeted rate of insertion was one QA/QC sample for every 16 to 20 samples. Coarse blanks were inserted at a rate of one coarse blank for every 65 samples or approximately 1.5% of the total samples. CRM's were inserted at a rate of one CRM for every 20 samples or approximately 5% of the total samples.

The standards utilized include three gold CRM's and one blank CRM that were purchased from Shea Clark Smith Laboratories (MEG) of Reno, Nevada. Expected gold values are 0.188 gpt, 1.107 gpt, 10.188 gpt, and -0.005 gpt, respectively. The coarse blank material comprised of commercially available landscape gravel with an expected gold value of -0.005 gpt.

As part of the RC drilling QA/QC process, duplicate samples were collected of every 20th sample interval at the drill rig to evaluate sampling methodology. Samples were collected from the reject splitter on the drill rig cyclone splitter. Samples were collected at each 95- to 100-foot (28.96 - 30.48m) mark and labeled with a "D" suffix on the sample bag. No duplicates were submitted for core.

All drill samples were sent to American Assay Laboratories (AAL) in Sparks, Nevada, USA for analyses. Delivery to the lab was either by a Lahontan Gold employee or by an AAL driver. Analyses for all RC and core samples consisted of Au analysis using 30-gram fire assay with ICP finish, along with a 36-element geochemistry analysis performed on each sample utilizing two acid digestion ICP-AES method. Tellurium analyses were performed on select drill holes utilizing ICP-MS method. Cyanide leach analyses, using a tumble time of 2 hours and analyzed with ICP-AES method, were performed on select drill holes for Au and Ag recovery. AAL inserts their own blanks, standards and conducts duplicate analyses to ensure proper sample preparation and equipment calibration. We have all results reported in grams per tonne (gpt).

About Lahontan Gold Corp:

Lahontan Gold Corp. (TSX.V: LG) is a Canadian mineral exploration company that holds, through its US subsidiaries, three top-tier gold and silver exploration properties in the Walker Lane of mining friendly Nevada. Lahontan's flagship property, the 19 km2 Santa Fe Project, is a past producing gold and silver mine with excellent potential to host significant gold and silver resources (past production of 375,000 ounces of gold and 710,000 ounces of silver between 1988 and 1992; Nevada Bureau of Mines and Geology, 1996). Modeling of over 110,000 metres of historic drilling, geologic mapping, and geochemical sampling outline both shallow, oxidized gold and silver mineralization as well as deeper high grade potential resources. The Company is completing an aggressive 25,000 metre drilling program with the goal of publishing a National Instrument 43-101 ("NI 43-101") compliant mineral resource estimate in 2022. For more information, please visit our website: www.lahontangoldcorp.com

All scientific and technical information in this press release has been reviewed and approved by Quentin J. Browne, P.Geo., Consulting Geologist to Lahontan Gold Corp., who is a qualified person under the definitions established by National Instrument 43-101.

On behalf of the Board of Directors Kimberly Ann

Founder, Chief Executive Officer, President, and Director

FOR FURTHER INFORMATION, PLEASE CONTACT:

Lahontan Gold Corp.

Kimberly Ann

Founder, Chief Executive Officer, President, Director

Phone: 1-530-414-4400

Email: Kimberly.ann@lahontangoldcorp.com

Website: www.lahontangoldcorp.com

Cautionary Note Regarding Forward-Looking Statements:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Except for statements of historic fact, this news release contains certain "forward-looking information" within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking statements are based on the opinions and estimates at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to delays or uncertainties with regulatory approvals, including that of the TSXV. There are uncertainties inherent in forward-looking information, including factors beyond the Company's control. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by law. The reader is cautioned not to place undue reliance on forward-looking statements. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company's filings with Canadian securities regulators, which filings are available at www.sedar.com.

SOURCE: Lahontan Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/703916/Lahontan-Drills-Thick-Continuous-Gold-at-Santa-Fe-226M-Grading-122-Gpt-Au-and-New-High-Grade-Zone