Kestrel Gold Inc. ("Kestrel" or the "Corporation")(TSXV:KGC) is pleased to provide an update on work completed by Centerra Gold Inc. ("Centerra") on the QCM gold property ("QCM") located in the Manson-Germanson area of central British Columbia. Centerra is currently in the process of earning a 75% interest in QCM by making cash payments totaling $900,000 and completing $6,500,000 in exploration work, which must include a minimum of 13,500 metres of drilling, by May 7th, 2029

Centerra collected 1,245 soil samples from the area of the 14 Vein showing and the Main Zone during May and June. Follow-up soil sampling and prospecting as well as a trial induced polarization ("IP") geophysical survey over the 14 Vein showing are underway. Current plans are for a reverse circulation ("RC") drill test of showings and anomalies to commence in early October.

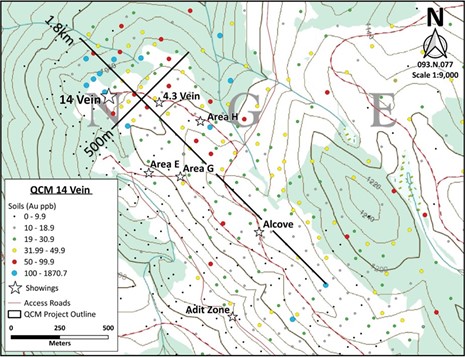

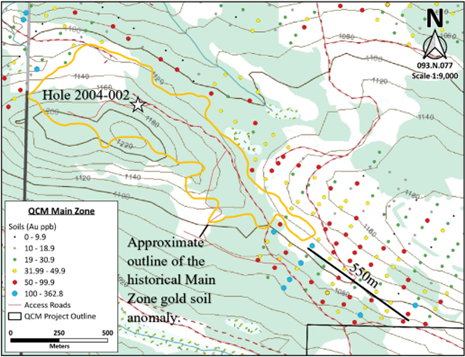

Highlights from Centerra's soil sampling program show that the 14 Vein showing, where RC drilling in 2022 returned 2.33 g/t Au over 44.19 metres, is located within the northwest portion of an approximate 1.8 kilometre long by up to 500-metre-wide southeast trending gold soil anomaly. Gold values from within this anomaly range from background to 1870.7 ppb with strongly anomalous gold typically associated with anomalous arsenic. The historically recognized gold in soil anomaly located over Main Zone, where hole 2004-002 returned 2.86 g/t Au over 110.95 metres, was extended approximately 550 metres to the southeast of previous limits. Gold values from the southeast extension range from background to 207 ppb.

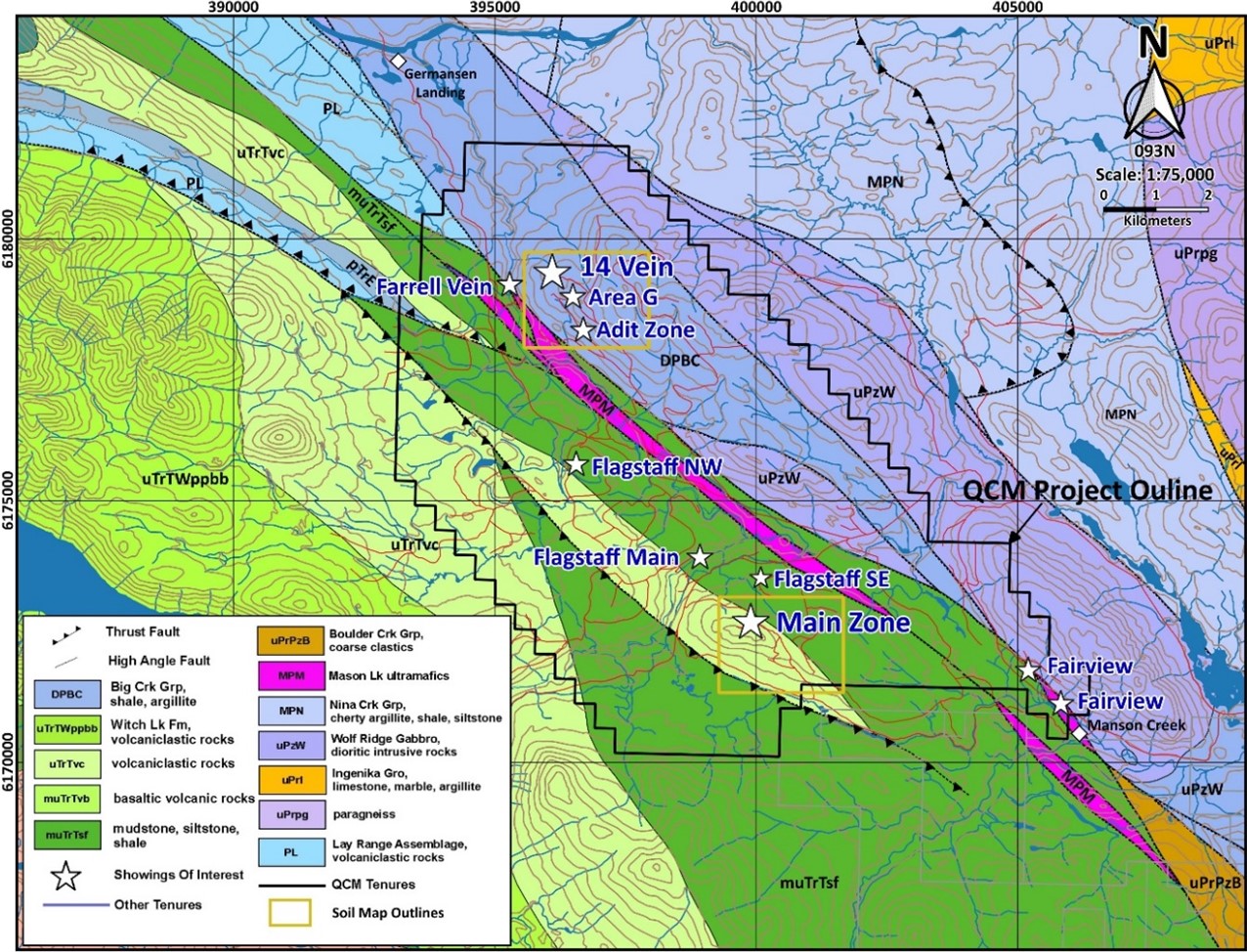

Showings on Geology (area of detail soil sample maps outlined in gold)

14 Vein Gold in Soil Map

Grid soil sampling in the 14 Vein area did not return significant gold anomalies over several showings including at Alcove (1.17 g/t Au from a 9.0m chip sample) and at Adit Zone where previous soil sampling returned up to 7,689 ppb Au. The loosely defined and sporadic nature of the 1.8 kilometre long by up to 500-metre-wide southeast trending gold soil anomaly and the lack of anomalies over several showings may be the result of glacial till dispersion and masking. Ice flow in this area is northwest to southeast.

Main Zone Gold in Soil Map

Pat Lynch, President and CEO of Kestrel, states: "We are pleased to see Centerra continue to make quality progress at QCM. The identification of a 1.8 kilometre long by up to 500-metre-wide gold in soil anomaly encompassing the 14 Vein showing suggests strong size potential for this target. We are also excited to see a 550-metre expansion of the gold in soil anomaly overlying Main Zone. Overall, work continues to support our belief that QCM is host to several large-scale gold targets and we look forward to results from the soon to commence drill test of these targets."

QCM Project Highlights:

QCM is comprised of 8,729 hectares covering an approximate 15-kilometre strike length of the Manson Fault Zone which is thought to be a controlling structure for much of the gold mineralization in the district.

Peak values from historical drilling completed within the Main Zone were found within hole 2004-002 which intersected an interval of 2.86 g/t Au over 110.95 metres, including a high-grade interval of 173 g/t Au over 1.5 metres, true widths unknown.

Prospecting during 2022 resulted in the discovery of the 14 Vein showing, drilling of which returned 2.33 g/t Au over 44.19 metres. Geology consists of silica-ankerite-pyrite altered greywacke cut by sheeted quartz veins. For further details see Kestrel's October 26, 2022 news release: https://www.kestrelgold.com/news/oct-25-2022-e7yzr.

Numerous historical showings occur throughout the project area, including Farrell where historical values of up to 1,777 g/t Au and 3,560 g/t Ag were returned from grab samples of a 3.0-metre-wide quartz vein and Flagstaff where historical values of up to 5.9 g/t Au and 1,153 g/t Ag were reported for grab samples of quartz veins and stockworks.

Kestrel owns a 100% interest in the QCM Property. For further details see Kestrel's March 22, 2024 news release: https://www.kestrelgold.com/news/march-22-2024. Kestrel subsequently granted Centerra the option to earn a 75% interest in QCM. For further details see Kestrel's May 8, 2024 news release: https://www.kestrelgold.com/news/may-8-2024.

Recently completed logging and associated road building has significantly improved access throughout the property which is proving of significant value to exploration efforts.

About Kestrel Gold

Kestrel Gold Inc. is an exploration company headquartered in western Canada and focused on the Canadian Cordillera. Kestrel has earned a 100% interest, subject to a 2% NSR royalty with buydown provisions, in the QCM Property which is an orogenic gold target located in the Manson-Germanson placer district. Kestrel has also earned a 100% interest, subject to a 2.5% NSR royalty with buydown provisions, in the KSD Property which is an orogenic gold target located in the Yukon portion of the Tintina Gold Belt. Kestrel is listed on the TSX Venture exchange under the symbol KGC. Readers are encouraged to refer to the Corporation's website "www.kestrelgold.com" for further information.

Qualified Person

Derek Torgerson P.Geo., a Qualified Person as defined by National Instrument 43-101, has reviewed and approved the technical information contained in this news release.

Forward-Looking Statements

The information and statements in this news release contain certain forward-looking information. This forward-looking information relates to future events or the Corporation's future performance including exploration activity that could take place on the Corporation's properties or projects. This forward-looking information is subject to certain risks and uncertainties and may be based on assumptions that could cause actual results to differ materially from those anticipated or implied in the forward-looking information. The Corporation's forward-looking information is expressly qualified in its entirety by this cautionary statement. Except as required by law, the Corporation undertakes no obligation to publicly update or revise any forward-looking information.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (as that term is defined in the policies of the TSX Venture Exchange) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

For further information contact:

Pat Lynch, President and CEO

Office: (403) 660-3329

Email: pat@kestrelgold.com

SOURCE: Kestrel Gold Inc.

View the original press release on accesswire.com