Investorideas.com, a global news source and expert investing resource covering mining stocks issues a snapshot looking at the recent breakouts in gold and silver and news from junior miners in the sector.

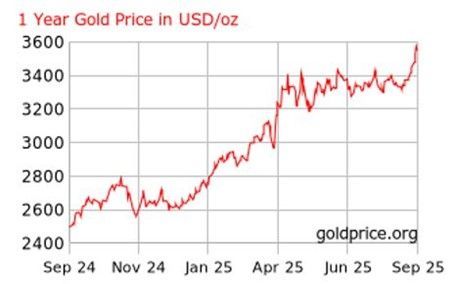

1 Year Gold Price in USD/oz

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6292/265535_image1.jpg

Miners are enjoying a big run as investors focus on gold and silver stocks, with ETF.com reporting that "Five of the 10 best-performing U.S.-listed ETFs in 2025 (excluding leveraged, inverse, and single-stock products) are tied to gold miners, and another three are tied to silver miners."

"The Sprott Gold Miners ETF (SGDM) leads with a 79% gain, followed closely by the iShares MSCI Global Gold Miners ETF (RING) and the iShares MSCI Global Silver and Metals Miners ETF (SLVP), both up 77%."

"Rounding out the group are the Global X Silver Miners ETF (SIL), the VanEck Gold Miners ETF (GDX), the Amplify Junior Silver Miners ETF (SILJ), the VanEck Junior Gold Miners ETF (GDXJ), and the Themes Gold Miners ETF (AUMI), all posting gains in the 69-72% range."

Recent news on PEA updates from miners making headlines include:

Fully permitted, pre-production gold and silver mining company ESGold Corp. (CSE: ESAU) (OTCQB: ESAUF) (FSE: Z7D), just announced the results of its updated Preliminary Economic Assessment ("PEA") for the Montauban Gold-Silver Project in Quebec1, underscoring the Company's position as a pre-production gold miner with near-term cash-flow and discovery upside.

From the news:

https://ca.finance.yahoo.com/news/ESGold-corp-releases-updated-preliminary-171000467.html

Updated PEA Highlights (All amounts CAD unless otherwise stated)

- After-Tax NPV (5%): C$24.27 million

- After-Tax IRR: 60.3%

- Payback Period: Less than two years

- Pre-Tax NPV (5%): C$44.53 million

- Pre-Tax IRR: 105.1%

- Total LOM Revenue: C$103.73 million

- CapEx: C$18.81 million (incl. contingency, owner & EPCM); Initial direct CapEx: C$17.44 million

- LOM Operating Cost: C$32.57 million

- Mine Life: 4 years

- Gold Recovery: 92% | Silver Recovery: 77%

- Gold Price Assumption: US$2,900/oz

- Silver Price Assumption: US$31.72/oz

- Exchange Rate: 1.45 CAD/USD

The PEA base case includes mica at US$300/t and related tonnage assumptions; implied mica revenue is derived within the model.

Download the Updated PEA Report https://esgold.com/wp-content/uploads/2025/09/ESGold_2025-09-03_Montauban_2025_PEA_Report.pdf.

The updated Preliminary Economic Assessment (PEA), prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects, replaces the Company's previous 2023 PEA, which reported a base-case after-tax NPV (5%) of C$6.99 million and an IRR of 23.4%, as disclosed in the technical report dated March 1, 2023, available on SEDAR+.

"This PEA is a milestone for ESGold and a validation of our strategy," said Gordon Robb, CEO of ESGold. "A 60% after-tax IRR, sub-two-year payback, and low initial capex are the hallmarks of a project built to generate cash flow quickly while limiting dilution and execution risk. Just as important, our fully permitted status and construction progress reduce the timeline from paper to pour. With commissioning preparations underway and a robust exploration pipeline, anchored by an upcoming 3D model and recent deep imaging to ~1,200 metres, we see a clear runway to first production by year-end and meaningful growth beyond it. We're excited, aligned, and focused on delivering."

ESGold is advancing a district-scale view of Montauban. A consolidated 3D geological model, integrating 2015 VTEM, historical work, and new ANT deep-imaging-is nearing completion. The previously conducted ambient noise tomography (ANT) survey has traced key structures to ~1,200 m depth, materially deeper than earlier scope, indicating potential for mineralized zones below and beyond historically worked areas.

VMS systems commonly occur in clusters, the emerging structural framework supports the potential for additional lenses outside the current footprint. Broken Hill-style characteristics observed at Montauban, including mineralogy and complex structural overprints, reinforce the interpretation of a broader, multi-lens system typical of high-grade VMS districts. This workstream complements ESGold's near-term production plan while opening blue-sky growth across the camp.

The updated PEA delivers an independent validation of Montauban's economics, reducing project risk by quantifying capital needs, margins, and payback while confirming a practical path from construction to operations. Coupled with full permits and late-stage site work, it strengthens ESGold's position to secure funding on more favourable terms.

Amex Exploration Inc. (TSXV: AMX) (FSE: MX0) (OTCQX: AMXEF) recently announced the results of an updated Preliminary Economic Assessment (the "PEA") for its wholly-owned Perron gold project (the "Project"), located near the towns of Normétal and Valcanton in the province of Quebec, Canada. The PEA was prepared in collaboration with independent engineering and geological firms Evomine, Bumigeme, P&E Mining Consultants, Norda Stelo, and Laurentia Exploration.

From the news:

Perron updated Preliminary Economic Assessment Highlights:

The Perron PEA has been updated to incorporate the latest Mineral Resource Estimate (MRE - released May 21st, 2025) and a new project development strategy. The following assumes a gold price of US$2,500/ounce ("oz") and a C$/US$ exchange rate of 1.38:1.

Staged production strategy derisk the project, simplifies the permitting process, accelerates time to revenue (targeting 2028) and minimizes shareholder dilution, with Phase 2 mine construction financed from free cash flow.

Phase 1:

4-year 1,000 tpd contract mining, toll-milling operation in the Abitibi region, where numerous processing plants are in operation;

Low initial capital cost estimate of $146.1M which is partially offset from pre-production revenues of $68.6M for a net Initial CAPEX of $77.5M;

Average annual gold production of 102,000 oz gold ("Au") at an All in Sustaining Cost ("AISC") of US$1,165/oz Au;

Average diluted head grade of 10.07 grams per tonne ("gpt") for 0.41 million oz Au.

Phase 2

13-year 2,000 tpd owner operated mine with on-site processing facility;

Growth capital of $191.6M;

Average annual production of 93,000 oz Au at an AISC of US$1,027/oz Au;

Average diluted head grade of 4.32 gpt for 1.25 million oz Au.

Life of Mine ("LOM") of 17.5 years;

Average annual production of 95,000 oz Au, or 1.66 million oz Au over LOM, including an average per year of 112,000 oz for the first 10 years.

LOM Average diluted grade of 5.07 gpt Au;

LOM AISC of US$1,061/oz Au;

LOM Sustaining Capex of $386.3M;

Pre-tax NPV of $1,885M and After-tax NPV of $1,085M;

Pre-tax IRR of 99.1% and After-tax IRR of 70.1%;

Cumulative Pre-tax Undiscounted Net Free Cash Flow of $3,010M and Cumulative After-tax Undiscounted Net Free Cash Flow of $1,768M;

Pre-tax payback period of 1.1 years and After-tax payback period of 1.4.

Another junior, Silver X Mining Corp. (TSXV: AGX) (OTCQB: AGXPF) (FSE: AGX) just announced the results of a new Preliminary Economic Assessment ("PEA") demonstrating a district-scale project with combined mining and processing capacity of 3,000 tonnes per day ("tpd") and annual metal production in excess of 6 Moz AgEq. The PEA was prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101").

From the news:

PEA Highlights (2025)

Life of Mine (LOM) of 14 years at 3,000 tpd combined mining and processing capacity.

Average annual production of approximately 6.2 million ounces of silver equivalent (AgEq)1.

After-Tax Net Present Value (NPV) of $440 million at a 5% discount rate.

LOM Cash Costs2 of $11.8/oz AgEq and LOM All-In Sustaining Costs ("AISC")2 of $15.8/oz AgEq.

Initial Capex of $82 million, including 13% contingency, for the new processing facility, dry-stacked tailings and mine development.

Robust project economics, confirming Silver X's potential to scale into a mid-tier silver producer.

Aggressive upcoming drill campaigns aimed at both upgrading resource categories and expanding tonnage and grades across the district.

In July that Augusta Gold Corp. (TSX: G) (OTCQB: AUGG) entered into a definitive merger agreement with AngloGold Ashanti to acquire all of the Company's issued and outstanding shares of common stock at a price of C$1.70 per share of common stock .

The Price represented a premium of approximately 28% to the closing price of the Company's common stock on the Toronto Stock Exchange ("TSX") on July 15, 2025, the last trading day prior to the announcement of the Transaction and approximately 37% to the volume-weighted average share price on the TSX over the 20 trading days prior to such date.

Research mining stocks at Investorideas.com

https://www.investorideas.com/Gold_Stocks/

About Investorideas.com - Big Investing Ideas

Investorideas.com is the go-to platform for big investing ideas. From breaking stock news to top-rated investing podcasts, we cover it all.

Disclaimer/Disclosure: ESGold Corp. (CSE: ESAU) (OTCQB: ESAUF) (FSE: Z7D) is a paid monthly featured mining stock on Investor ideas. More payment details and disclosure: This is not investment opinion. Our site does not make recommendations for purchases or sale of stocks, services or products. Nothing on our sites should be construed as an offer or solicitation to buy or sell products or securities. All investing involves risk and possible losses. This site is currently compensated for news publication and distribution, social media and marketing, content creation and more. Learn more about publishing your news release and our other news services on the Investorideas.com newswire https://www.investorideas.com/News-Upload/. More disclaimer: https://www.investorideas.com/About/Disclaimer.asp.

Global investors must adhere to regulations of each country. Please read Investorideas.com privacy policy: https://www.investorideas.com/About/Private_Policy.asp.

Follow us on X @investorideas

Follow us on Facebook https://www.facebook.com/Investorideas

Follow us on YouTube https://www.youtube.com/c/Investorideas

Contact Investorideas.

800 665 0411

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/265535