- WORLD EDITIONAustraliaNorth AmericaWorld

April 14, 2023

Jindalee Resources (ASX:JRL, OTCQX:JNDAF) is advancing North America’s largest lithium deposit. A pure-play lithium company focused exclusively on its promising 100-percent-owned McDermitt asset, Jindalee Resources recognizes the vast opportunity for lithium projects in the US as the country progresses towards its sustainable energy transition and developing a robust domestic supply chain for critical minerals.

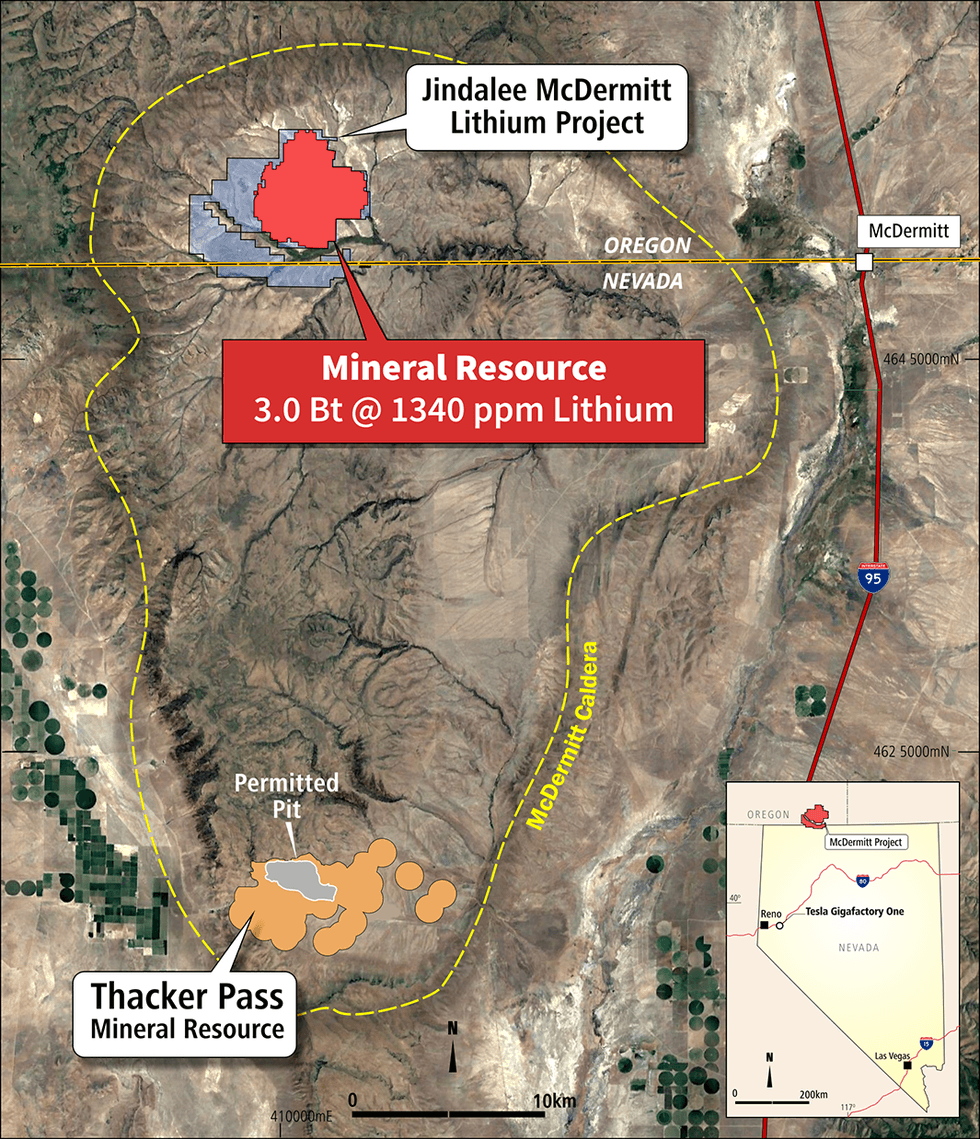

The McDermitt asset is located in southeast Oregon and contains a unique type of lithium deposit. The McDermitt project is an unconventional sediment-hosted lithium asset with an estimated and inferred resource totalling 3.0 billion tonnes at 1,340 parts per million (ppm) lithium for 21.5 million tonnes lithium carbonate equivalent (LCE), making it the largest lithium deposit in North America.

Sediment-hosted lithium deposits have a much more straightforward and efficient extraction process than lithium brines, completely sidestepping the extraction and metallurgical processes required for brine. Jindalee Resources can leverage this advantage over other lithium assets, both in terms of reaching production faster and reducing operating expenses.

Company Highlights

- Jindalee Resources is an exploration and development company with the largest lithium deposit in North America.

- The company is a pure-play lithium company focusing on its flagship McDermitt asset.

- The United States has ambitious electrification goals but lacks the critical minerals to reach them. Jindalee Resources aims to strengthen the North American supply chain to enable the country to reach net-zero emissions targets.

- North American lithium assets typically comprise pegmatite or lithium brine deposits, which involve a complex extraction and refinement process. However, the company’s McDermitt project is a sediment-hosted lithium deposit, allowing for more cost-effective operations.

- There are presently no sediment-hosted lithium assets in North America that have reached production. Jindalee Resources is ideally positioned to fill this void in the market.

- Other companies in North America are moving towards production, and their progress indicates Jindalee’s future trajectory.

- An experienced management team leads Jindalee Resource towards capitalizing on the potential of its assets.

This Jindalee Resources profile is part of a paid investor education campaign.*

JRL:AU

The Conversation (0)

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00