Overview

As the demand for clean technologies grows, so too does the demand for high-tech rechargeable batteries to power the green economy. However, the United States and the European Union’s current dependence on Japan, South Korea and China for 80 percent of the world’s battery production is threatening their auto industry. As the largest processor and producer of these battery materials, China alone can significantly influence pricing and supply chain flows.

The United States and the European Union are working to reduce dependence on these countries and restructure supply chains. Both regions have identified Canada as a secure and stable source of sustainable raw materials, such as lithium, which is critical to the growing electric vehicle market. As a result, mining companies with Canada-based projects that supply materials needed for high-tech rechargeable batteries such as lithium may be an interesting opportunity for investors to consider.

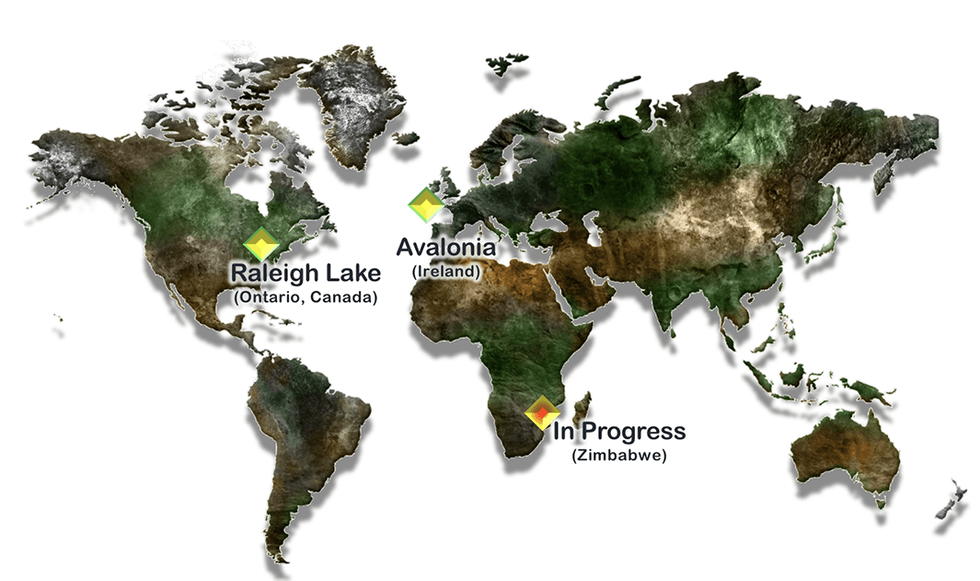

International Lithium (TSXV:ILC,OTC:ILHMF,FRA:IAH,OTCQB:ILHMF) is a mineral exploration company focused on developing a portfolio of lithium and rare metals projects and royalties in Canada and Ireland. The company is led by an experienced management team with a proven track record of advancing prospective projects with low technical risk in established mining jurisdictions.*Disclaimer: This profile is sponsored by International Lithium ( TSXV:ILC ). This profile provides information which was sourced by the Investing News Network (INN) and approved by International Lithium in order to help investors learn more about the company. International Lithium is a client of INN. The company's campaign fees pay for INN to create and update this profile.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with International Lithium and seek advice from a qualified investment advisor.