- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

July 18, 2023

Infinity Lithium Corporation Limited (‘Infinity’, or ‘the Company’), through wholly owned subsidiary Extremadura New Energies, is pleased to announce the acquisition of rights and access of land for the San José Lithium Project (‘San José’, or ‘the Project’).

HIGHLIGHTS

- Extremadura New Energies secures long term lease over land for the industrial development of the San José Lithium Project.

- The industrial zoned land is located within the granted Exploration Permit which also covers the San José lithium deposit.

- Acquisition structured in a multi-year option and minimum 35-year lease.

- Acquisition of ~36ha of land rights from largest landowner in the designated lithium chemical conversion plant area.

- Total acquisition cost €2.1m (~A$3.4m).

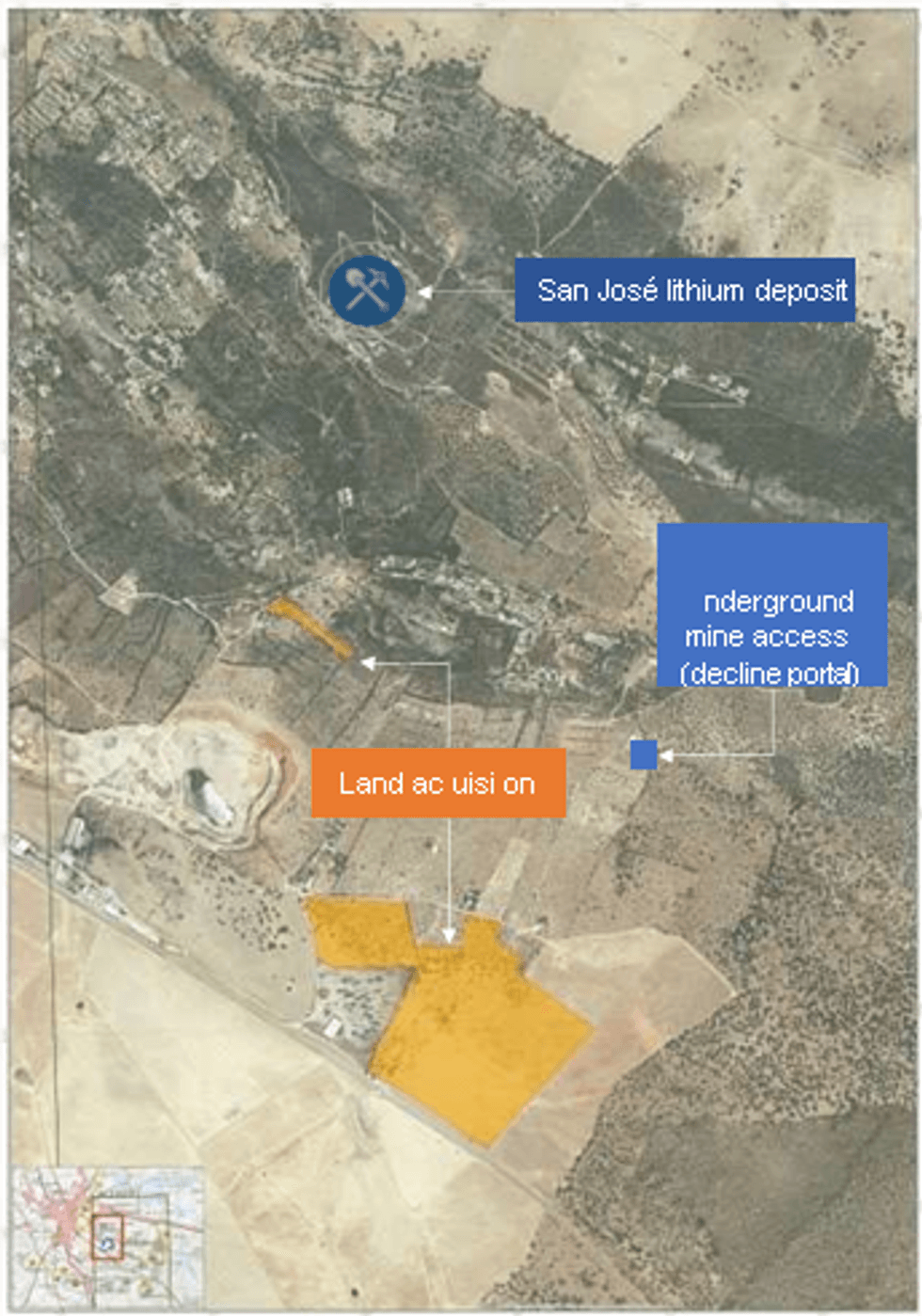

The Company has secured land rights and access through an agreement with landowners to enter into an option over a 35-year lease period covering the life of the Project. The lands included in this agreement are already zoned “Industrial” under local urban planning requirements, and are located within the granted Exploration Permit Extremadura S.E. (‘PESE’) which includes the San José lithium deposit. The rights that have been secured over the single largest landholding for the designated lithium chemical conversion plant and related processing activities comprises 36 hectares or more than one third of the total proposed development area. The industrial zoned land is located adjacent to the sealed road and other key infrastructure (refer to Figure 1). The total estimated cost for the life of the project is approximately €2.1 million. For further details refer to Appendix 1: Key Commercial Terms.

The acquisition of land rights is a significant milestone for the Company and the ongoing development of San José. Ramón Jiménez, CEO of Extremadura New Energies commented,

"The finalisation of the land agreement is another major milestone for San José and the ongoing momentum continues in collaboration with major local stakeholders. We are pleased to have finalised the agreement to secure rights to an essential land package for the project and provide visibility and precedent as we advance to the next stages of development.”

Other Project Developments

The Company has increased activities on multiple project specific fronts following the granting of PESE and the response from the Regional Government relating to the EIA Scoping Document. These include the advancement of documentation of updated economic studies on San José in compliance with requirements for an Exploitation Concession Application, increased stakeholder engagement to facilitate development, and land access.

Click here for the full ASX Release

This article includes content from Infinity Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

INF:AU

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00