February 06, 2022

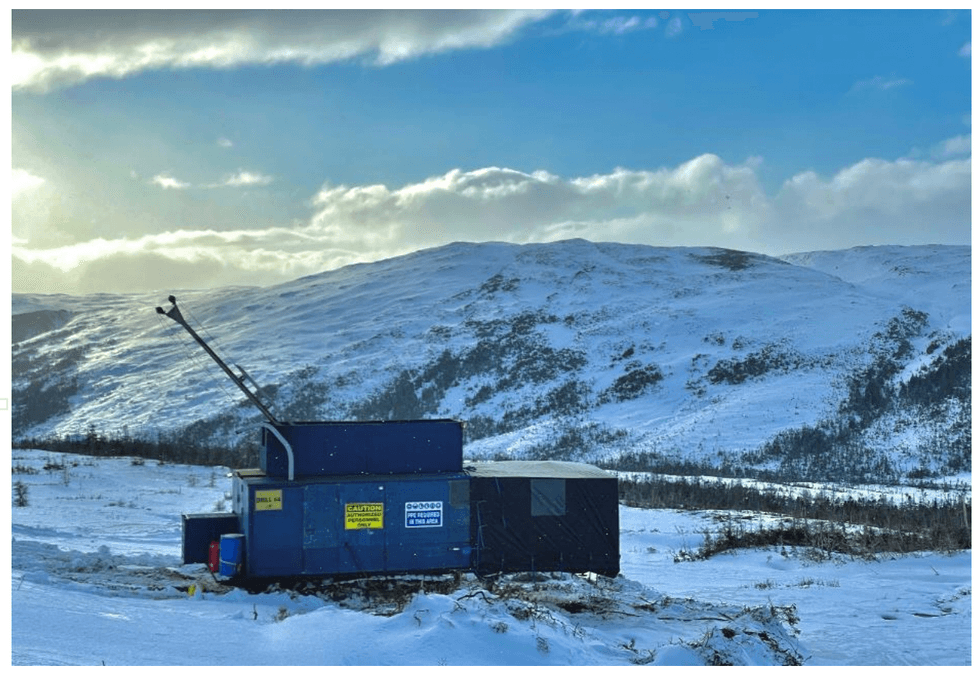

Matador Mining Limited (ASX: MZZ; OTCQX: MZZMF; FSE: MA3) (“Matador” or the “Company”) is pleased to announce the successful launch of its inaugural winter drill program at the Cape Ray Gold Project (the “Project”) in Newfoundland, Canada.

Highlights

- First ever winter drill programcommenced;

- 30 hole / 3,000-4,500 metre diamond drillprogram;

- Testing targets at PW East, Stag Hill, Isle aux Morts and Benton

Executive Chair Ian Murray commented:

“I would like to congratulate our exploration team and our service providers for the hard work they have put into the planning and preparation of this inaugural winter drill program. As with all exploration programs, safety and environment are front of mind. With a winter program, new potential challenges need to be planned for, which our team has done well during the preparation for this program.

In 2021, we commenced the largest ever drill program at the highly prospective Cape Ray Gold Project, with 20,681 metres of diamond drilling completed during the year. However, winter conditions in Newfoundland typically halt traditional drilling for a few months. To mitigate this, our inaugural winter drill program, which consists of around 30 diamond holes for 3,000 - 4,500 metres, will allow Matador to maintain the aggressive pace of exploration that we have established at Cape Ray, during what is typically a period of inactivity in the field.

As the winter program then segues into our 2022 summer program, Matador will prove itself as an exploration company that can successfully and efficiently execute exploration programs in all seasons, and provide investors with regular news flow throughout the year.

I look forward to updating the market of the results from this winter drill program in due course.”

Click here for the full ASX Release

This article includes content from Matador Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MZZ:AU

The Conversation (0)

15h

Mining’s New Reality: Strategic Nationalism, Gold Records and a Fractured Cost Curve

The era of “smooth globalization” is over, and mining is entering a more fragmented, politically charged phase defined by strategic nationalism, according to speakers at S&P Global’s latest webinar.Jason Holden, who opened the “State of the Market: Mining Q4 2025” session with a macro overview,... Keep Reading...

20h

Brazilian State Firm Seeks Injunction to Block Equinox Gold-CMOC Asset Sale

A Brazilian state-run mining company is seeking an emergency court injunction to block the sale of one of Equinox Gold's (TSX:EQX,NYSEAMERICAN:EQX) Brazilian assets. Bloomberg reported that Companhia Baiana de Produção Mineral (CBPM) has asked the Bahia State Court of Justice to immediately... Keep Reading...

22h

Silver Hammer Closes CDN$3,913,617 Non-Brokered Private Placement Pursuant to Listed Issuer Exemption

Silver Hammer Mining Corp. (CSE: HAMR,OTC:HAMRF) (the "Company" or "Silver Hammer") is pleased to announce that further to its news release dated February 2, 2026, it has closed its previously announced non-brokered private placement pursuant to the Listed Issuer Exemption ("LIFE") (the... Keep Reading...

22 February

High-Grade Near-Surface Graphite Intersected at Millennium

Metal Bank (MBK:AU) has announced High-Grade Near-Surface Graphite Intersected at MillenniumDownload the PDF here. Keep Reading...

22 February

Boundiali Resource Grows to 3Moz - Indicated Up 49%

Aurum Resources (AUE:AU) has announced Boundiali Resource Grows to 3Moz - Indicated Up 49%Download the PDF here. Keep Reading...

22 February

High-grade Assays incl 4m @ 26.7g/t Au in Sandstone Drilling

Brightstar Resources (BTR:AU) has announced High-grade assays incl 4m @ 26.7g/t Au in Sandstone drillingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00