Results underscore the high-grade resources, strong conversion potential, and significant growth upside across i-80 Gold's Nevada underground portfolio

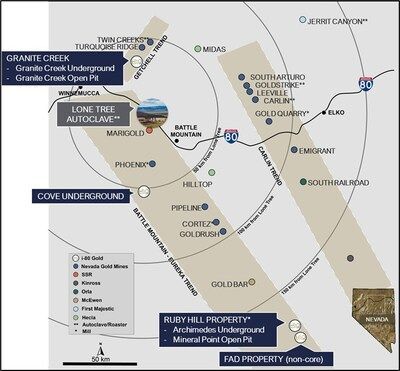

i-80 Gold Corp. (TSX: IAU) (NYSE American: IAUX) ("i-80", or the "Company") is pleased to announce initial assay results for the ongoing program at the Granite Creek Underground Project ("Granite Creek Underground"), and to provide an update on infill drilling activities at the Cove Underground Project ("Cove"), both located in Nevada United States (see Figure 1 in Appendix).

"At Granite Creek Underground, the first six holes from our infill drill program continue to show robust high-grade mineralization throughout the South Pacific Zone and suggest that the deposit has the potential to expand to the north and at depth," stated Tyler Hill , Vice President, Geology. "Similarly at Cove, the 2025 infill drill program successfully supported our geological model, confirmed the high-grade nature of the underground deposit, and demonstrated the potential for continued resource expansion at Cove. These findings were a key step in advancing the Cove feasibility study, which is expected in the first quarter of 2026, and reinforce our view that the resource conversion success which we anticipate at Cove could similarly be achieved at Granite Creek Underground, Archimedes Underground, and Mineral Point open pit given the comparable disseminated Carlin-style mineralization. Together, these outcomes from Granite Creek Underground and Cove highlight the consistency of high-grade resources and meaningful growth upside that exists across i-80's underground gold portfolio in Nevada ."

Granite Creek Underground High-Grade Assay Results

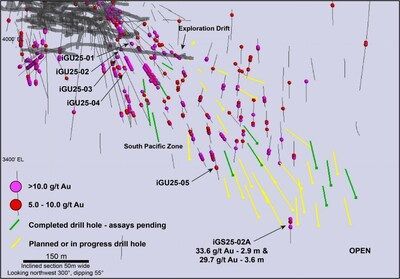

Granite Creek Underground, i-80's first underground gold operation, continues to progress ramp-up activities toward steady state gold output. An infill and step-out drilling campaign on the South Pacific Zone began in June from both surface and underground (see Figure 2 in Appendix). To date, 20 of the 40 holes planned over approximately 14,000 meters have been completed. New assay results from the first six holes are provided in the table below and continue to show robust high-grade mineralization throughout the South Pacific Zone and suggest potential to continue to expand the South Pacific Zone to the north and at depth.

Hole iGS25-02A represents the most northerly and deepest hole drilled to date in the South Pacific Zone, which intersected the primary fault structures where expected and returned grades of 33.6 g/t gold over 2.9 meters and 29.7 g/t gold over 3.6 meters.

This program aims to convert mineral resources from the inferred category to the indicated category and form the basis for the upcoming feasibility study for Granite Creek Underground, which is planned for completion in the first quarter of 2026. The feasibility study will incorporate an updated mineral resource estimate reflecting drill results over the past two years, including the current drill program.

Table 1: Summary Assay Results from South Pacific Zone Drilling

| Drillhole ID | Zone | Type | From (m) | To (m) | Length (m) | Au (g/t) |

| iGS25-02A | SPZ | Core | 616.6 | 619.5 | 2.9 | 33.6 |

| And | SPZ | Core | 622.7 | 625.4 | 2.7 | 7.5 |

| And | SPZ | Core | 634.1 | 637.7 | 3.6 | 29.7 |

| iGU25-01 | SPZ | Core | 116.6 | 122.2 | 5.7 | 20.8 |

| iGU25-02 | SPZ | Core | 53.1 | 54.8 | 1.7 | 12.4 |

| And | SPZ | Core | 95.1 | 100.1 | 5.0 | 12.2 |

| And | SPZ | Core | 106.1 | 109.3 | 3.3 | 16.2 |

| iGU25-03 | SPZ | Core | 52.5 | 59.7 | 7.2 | 7.2 |

| And | SPZ | Core | 113.5 | 117.0 | 3.4 | 11.4 |

| iGU25-04 | SPZ | Core | 63.7 | 69.2 | 5.5 | 10.4 |

| iGU25-05 | SPZ | Core | 244.8 | 247.8 | 3.0 | 11.4 |

| True widths estimated 80-95%. |

Table 1a: Collar Coordinates

| UTM | Drillhole ID | East m | North m | Elevation m | Azimuth | Dip |

| NAD83 | iGS25-02A | 478736 | 4554389 | 1541 | 309 | -75 |

| iGU25-01 | 478414 | 4554275 | 1258 | 293 | -13 | |

| iGU25-02 | 478414 | 4554274 | 1257 | 285 | -17 | |

| iGU25-03 | 478414 | 4554273 | 1257 | 277 | -24 | |

| iGU25-04 | 478415 | 4554274 | 1257 | 287 | -40 | |

| iGU25-05 | 478521 | 4554325 | 1259 | 341 | -71 |

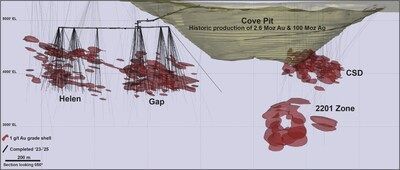

Cove Infill Drilling Update

At Cove, approximately 45,000 meters of infill drilling have been completed over the last two years. Drilling was conducted across the Gap and Helen zones on approximately 30 meter spacing (see Figure 3 in Appendix). The result of this work provides the Company with a more robust geological model, greater understanding of the gold mineralization at Cove, and increased confidence in future mineral resource delineation as the Company continues to work towards completing a feasibility study for Cove, planned for the first quarter of 2026 (the "2026 Cove FS"), which will replace the preliminary economic assessment for Cove filed in March 2025 (the "2025 Cove PEA" (1) ).

Approximately 15% of the known mineralization is oxidized in the upper portions of the Helen zone. This material is expected to be processed at the Company's Lone Tree central processing facility (2) bypassing the autoclave circuit of the plant. The remainder of the known mineralization is sulfide material that is planned to be processed by either autoclaving or roasting for optimal gold recovery. The Company has a third-party roasting agreement in place.

Based on this additional work, it is now anticipated that the forthcoming mineral resource estimate for Cove – to be included in the 2026 Cove FS – is expected to reflect a conversion of currently estimated inferred and indicated resources into higher confidence categories of resource classification. These results further validate the Company's understanding of Cove as representing a Carlin-style mineralized system with an anticipated high degree of mineral resource conversion through additional drilling. The Company has engaged SRK Consulting ("SRK") to complete the 2026 Cove FS.

Additional work required by the Company to release the 2026 Cove FS has not yet been completed and the results of work completed to date are subject to further confirmation and verification by the Company and SRK. i-80 and SRK are focused on advancing directly to the completion of the 2026 Cove FS by the first quarter of 2026, which will include the results of the infill drill program discussed herein.

Technical Disclosure and Qualified Persons

The technical information contained in this press release has been prepared under the supervision of, and has been reviewed and approved by Paul Chawrun P.Eng ., Chief Operating Officer, and Tyler Hill CPG., Vice President, Geology for the Company, each of whom are qualified persons within the meaning of National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") and Subpart 1300 of Regulation S-K ("S-K 1300").

For a description of the data verification, assay procedures and the quality assurance program and quality control measures applied by the Company, please see the Company's Form 10-K for the fiscal year ended December 31, 2024 . For further information about the 2025 Cove PEA referenced in this news release, including information in respect of key assumptions, parameters, risks and other factors, please see the 2025 Cove PEA. Both the Form 10-K and 2025 Cove PEA are available on EDGAR at www.sec.gov/edgar and SEDAR+ at www.sedarplus.ca . Mineral resources do not have demonstrated economic viability and are not mineral reserves.

Endnotes

| (1) | The 2025 Cove PEA was prepared in accordance with NI 43-101. An Initial Assessment for the Cove Project ("S-K 1300 Report") was also prepared in accordance with S-K 1300 and Item 601 of the Regulation S-K and the S-K 1300 Report will be filed on EDGAR at www.sec.gov . Both reports are filed under the Company's issuer profile on SEDAR+ at www.sedarplus.ca and on the Company's website at www.i80gold.com . The mineral estimates and project economics are the same under the 2025 PEA and the S-K 1300 Report. |

| (2) | Pending the completion of the Lone Tree processing facility refurbishment Class 3 engineering study (where a series of trade-off scenarios will be considered comparing full autoclave refurbishment to alternate toll milling and mineralized material purchase agreement options that could potentially be available), Board approval, and the successful funding, development, and commissioning of the Company's Lone Tree autoclave processing facility. |

About i-80 Gold Corp.

i-80 Gold Corp. is a Nevada -focused mining company committed to building a mid-tier gold producer through a new development plan to advance its high-quality asset portfolio. The Company is the fourth largest gold mineral resource holder in the state with a pipeline of high-grade development and production-stage projects strategically located in Nevada's most prolific gold-producing trends. Leveraging its central processing facility following an anticipated refurbishment, i-80 Gold is executing a hub-and-spoke regional mining and processing strategy to maximize efficiency and growth. i-80 Gold's shares are listed on the Toronto Stock Exchange (TSX: IAU) and the NYSE American (NYSE: IAUX). For more information, visit www.i80gold.com .

Cautionary Statement Regarding Forward Looking Information

Certain information set forth in this press release, including but not limited to management's assessment of the Company's future plans and operations, the perceived merit of projects or deposits, and the impact and anticipated timing of the Company's development plan, expectations regarding the timing, execution and results of the Company's drilling programs, outlook on gold output, the anticipated growth expenditures, the anticipated timing of production, project development or technical studies, including the anticipated 2026 Cove FS, constitutes forward looking statements or forward-looking information within the meaning of applicable securities laws. All statements other than statements of historical fact are forward-looking statements. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "continues", "forecasts", "projects", "predicts", "intends", "anticipates" or "believes", or variations of, or the negatives of, such words and phrases, or state that certain actions, events or results "may", "could", "would", "should", "might" or "will" be taken, occur or be achieved. Readers are cautioned that the assumptions used in the preparation of information, although considered reasonable at the time of preparation, may prove to be inaccurate and, as such, reliance should not be placed on forward-looking statements. The Company's actual results, performance or achievement could differ materially from those expressed in, or implied by, these forward-looking statements and, accordingly, no assurance can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what benefits, if any, that the Company will derive therefrom. By their nature, forward looking statements are subject to numerous risks and uncertainties, some of which are beyond the Company's control, including general economic and industry conditions, volatility of commodity prices, title risks and uncertainties, uncertainty in geological, metallurgical and geotechnical studies and opinions, and ability to access sufficient capital from internal and external sources such as selling assets, restructuring debt or obtaining additional equity capital on terms that may be onerous or highly dilutive. The Company's ability to refinance its indebtedness will depend on the capital markets and its financial condition at such time, currency fluctuations, construction and operational risks, licensing and permit requirements, environmental risks, competition from other industry participants, the lack of availability of qualified personnel or management, imprecision of mineral resource, or production estimates.

Please see "Risks Factors" in the Form 10-K for the fiscal year ended December 31, 2024 for more information regarding risks pertaining to the Company, which is available on EDGAR at www.sec.gov/edgar and SEDAR+ at www.sedarplus.ca . Readers are encouraged to carefully review these risk factors as well as the Company's other filings with the U.S. Securities and Exchange Commission and the Canadian Securities Administrators. All forward-looking statements contained in this press release speak only as of the date of this press release or as of the dates specified in such statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise except as required by applicable law.

Additional information relating to i-80 Gold can be found on i-80 Gold's website at www.i80gold.com , SEDAR+ at www.sedarplus.ca , and on EDGAR at www.sec.gov/edgar . The information included on, or accessible through, the Company's website is not incorporated by reference into this press release.

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/i-80-gold-reports-initial-assay-results-from-granite-creek-underground-and-provides-infill-drilling-update-at-high-grade-cove-project-302552319.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/i-80-gold-reports-initial-assay-results-from-granite-creek-underground-and-provides-infill-drilling-update-at-high-grade-cove-project-302552319.html

SOURCE i-80 Gold Corp

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2025/10/c5811.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2025/10/c5811.html