i-80 Gold Corp. (TSX: IAU) (NYSE American: IAUX) ("i-80 Gold", or the "Company") announces that it has received all required permits and commenced construction at the Archimedes project ("Archimedes" or the "Project") as planned.

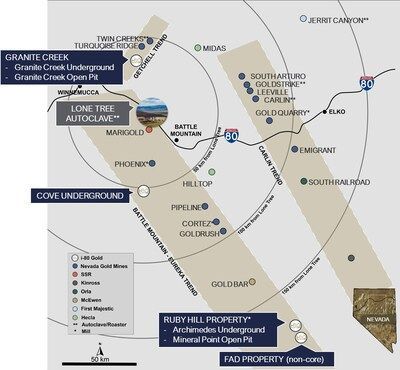

The environmental permits secured from both the Nevada Division of Environmental Protection and the Bureau of Land Management allow the Company to proceed with underground mining activities. Located on the Ruby Hill property (the "Property") in Nevada , U.S., Archimedes is the Company's second planned underground mine and lies approximately 180 kilometers from the Company's wholly owned Lone Tree autoclave and carbon-in-leach (CIL) processing facility (see Figure 1 in Appendix). Archimedes is expected to begin contributing to production in the fourth quarter of 2026 (see Figure 2 in Appendix).

"The receipt of permits and commencement of construction at Archimedes marks a major milestone for i-80 Gold as we advance Phase One of our growth strategy in Nevada ; Phase One is expected to increase annual gold output from less than 50,000 ounces to a target range of 150,000 to 200,000 ounces of gold by 2028 1 ," stated Richard Young , President & CEO. "We are excited about the exploration potential at Archimedes. The lower zone remains open to the north and south, offering substantial exploration potential that we believe can extend the current 10-year mine life. We have accelerated the infill drill program covering both the upper and lower zones to support a feasibility study anticipated in the first quarter of 2027, ahead of the original timeline included in the preliminary economic assessment."

The Company's three-phase development plan is expected to increase gold output to an annual target of 600,000 ounces in the early 2030s 1 . Phase One of the development plan includes the ramp up of Granite Creek underground, construction of Archimedes, as well as the refurbishment and commissioning of the Lone Tree autoclave and CIL processing facility. The Lone Tree refurbishment Class 3 engineering study remains on schedule for completion in the fourth quarter of 2025, followed by the feasibility study for Granite Creek Underground planned for completion in the first quarter of 2026.

| | Unless otherwise stated, all amounts referred to herein are in U.S. dollars. |

Permitting

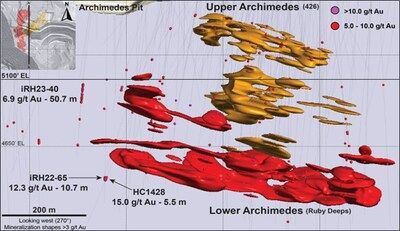

The current phase of permitting and development at Archimedes covers mining activities above the 5100-foot elevation, a threshold consistent with previously approved permits for open pit mining on the Property (see Figure 3 in Appendix). This phase of the Project is anticipated to provide development and production mining into the first half of 2028. Permitting activities below the 5100-foot elevation are underway with an estimated completion in the first half of 2027. This phased approach to permitting allows the Company to begin mining the Archimedes upper zone while simultaneously pursuing the remaining technical work and permits for the lower zone.

Development Work

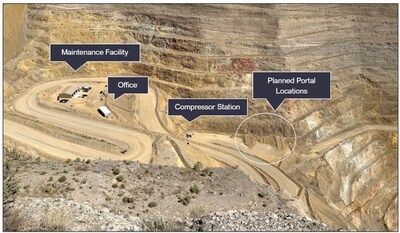

The construction of surface infrastructure, such as a maintenance shop and offices, to support the Archimedes underground portal is complete (see Figure 4 in Appendix). Utilities such as water, power and compressed air are in place, and the highwall around the portals has been secured. Small Mine Development, L.L.C. ("SMD") has been contracted to develop Archimedes to the 5100-foot elevation and is currently mobilized to advance the development drift. Underground development above the 5100-foot elevation is expected to be completed by mid-2027 and will include two underground portals, the main haulage decline, a series of raises for ventilation and secondary access, exploration bays and supporting infrastructure. The development contract with SMD is consistent with the cost estimates outlined in the Preliminary Economic Assessment of the Ruby Hull Project ("PEA") filed on March 31, 2025 .

Preliminary Economic Assessment Highlights

Based on the PEA, Archimedes is expected to have an after-tax net present value of $644 million 2 assuming a 5% discount rate, with an internal rate of return of 81% at a gold price of $3,000 per ounce. Archimedes anticipates an initial mine life of approximately 10 years, with an average annual gold output of approximately 100,000 ounces at an all-in-sustaining cost of $1,877 per ounce 3 following ramp-up to a steady state. Mine construction capital is estimated to be $47 million and life-of-mine development and closure costs are estimated to be $106 million .

Beginning in the fourth quarter of 2026, material mined at Archimedes is expected to be processed at a third-party autoclave processing facility in the region. Once Lone Tree is commissioned in early 2028 as anticipated, material mined at Archimedes will then be processed at Lone Tree. Additionally, operations at the Property are expected to be supplemented by on-site heap leaching during the initial years.

Archimedes hosts 436,000 ounces of gold in the Indicated mineral resource category at 7.6 grams per tonne and 988,000 ounces in the Inferred mineral resource category at 7.3 grams per tonne. Planned infill drilling and exploration are expected to further upgrade and expand resources providing potential to extend the current mine life. The lower zone (Ruby Deeps) at Archimedes is open to the north and south, offering substantial exploration potential (see Figure 3 in Appendix).

Next Steps to Feasibility Study

The timing of the infill drill program and Archimedes feasibility study has been accelerated by approximately 12 months compared to the timing outlined in the PEA. Accelerating the drill program and feasibility study is expected to increase the cost of drilling by a range of approximately $10 million to $25 million primarily due to drilling from higher elevations resulting in longer drill holes.

Initial infill drilling of the upper zone is scheduled to begin from underground in the fourth quarter of 2025, followed by underground infill drilling of the lower zone planned in the first quarter of 2026. Collectively, these infill programs are anticipated to include more than 175 holes for approximately 60,000 meters of core. Results from the infill drilling will be included in a feasibility study which is targeted for completion in the first quarter of 2027.

The next steps will focus on three areas: resource drilling, permitting, and metallurgical testing. Resource conversion drilling will commence as the underground decline advances with results incorporated into an updated resource model. On permitting, related actions to meet National Environmental Policy Act and Nevada Department of Environmental Protection requirements for mining below the 5100-foot elevation will be carried out. Metallurgical test work will target initial Ruby Hill production areas to confirm metallurgical recoveries with the anticipated Lone Tree process conditions, including comminution, pressure oxidation under both alkaline and acidic conditions, and CIL testing on oxide material.

This anticipated Archimedes feasibility study will be prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") and Subpart 1300 of Regulation S-K ("S-K 1300") with an updated mineral resource estimate.

Technical Disclosure and Qualified Persons

The technical information contained in this press release has been prepared under the supervision of, and has been reviewed and approved by Paul Chawrun P.Eng ( Ontario ), Chief Operating Officer, and Tyler Hill CPG., Vice President Geology for the Company, who are qualified persons within the meaning of NI 43-101 and S-K 1300.

For a description of the data verification, assay procedures and the quality assurance program and quality control measures applied by the Company, please see the Company's Form 10-K for the fiscal year ended December 31, 2024 . For further information about the PEA referenced in this news release, including information in respect of data verification, key assumptions, parameters, risks and other factors, please see the PEA. Both the Form 10-K and PEA are available on EDGAR at www.sec.gov/edgar and SEDAR+ at www.sedarplus.ca . Mineral resources do not have demonstrated economic viability and are not mineral reserves.

| Endnotes | |

| (1) | Consolidated production estimates and average annual production targets include the Cove Project, Archimedes Underground Project, Mineral Point Open Pit Project, Granite Creek Underground Project, and Granite Creek Open Pit Project and are based on the most recent life-of-mine production schedules disclosed in the latest technical studies filed for each respective project and related property. These anticipated production figures are preliminary in nature and are based on mineral resources, which do not have demonstrated economic viability, and which are not mineral reserves. In addition, each of the foregoing technical reports are preliminary economic assessments/initial assessment that are preliminary in nature and each include an economic analysis that is based, in part, on inferred mineral resources. Inferred mineral resources are considered too speculative geologically to have for the application of economic considerations applied to them that would enable them to be categorized as mineral reserves. As such, there is no certainty that the production targets will be realized. The production target is also pending the completion of the autoclave refurbishment Class 3 engineering study (where a series of trade-off scenarios will be considered comparing full autoclave refurbishment to alternate toll milling and ore purchase agreement options that could potentially be available), Board approval, and the successful funding, development, and commissioning of the Company's Lone Tree autoclave processing facility. The production target presented herein is a Company goal and not a projection of results and should not be taken as production guidance. |

| (2) | Cash flow and net present value are calculated as of the start of construction. After tax metrics assume the Company consumes existing net operating losses sufficient to offset all tax liabilities. |

| (3) | This all-in sustaining cost per ounce figure excludes the first and last year of the life of mine. The all-in sustaining cost of $1,893 per ounce of gold is as reported in the PEA over the life of mine. This is a non-IFRS/non-GAAP measure. Please refer to the press release titled, "i-80 Gold Announces Positive Preliminary Economic Assessment on the Archimedes Underground Project, Nevada" dated February 18, 2025, and refer to the section titled "Non-IFRS Performance Measures/Non-GAAP Financial Performance Measures" therein, for a detailed breakdown on how this measure was calculated for the life of mine, which is accessible on the Company's website at www.i80gold.com . |

About i-80 Gold Corp.

i-80 Gold Corp. is a Nevada -focused mining company committed to building a mid-tier gold producer through a new development plan to advance its high-quality asset portfolio. The Company is the fourth largest gold mineral resource holder in the state with a pipeline of high-grade development and production-stage projects strategically located in Nevada's most prolific gold-producing trends. Leveraging its central processing facility following an anticipated refurbishment, i-80 Gold is executing a hub-and-spoke regional mining and processing strategy to maximize efficiency and growth. i-80 Gold's shares are listed on the Toronto Stock Exchange (TSX: IAU) and the NYSE American (NYSE: IAUX). For more information, visit www.i80gold.com .

CAUTIONARY STATEMENT ON FORWARD LOOKING INFORMATION

Certain information set forth in this press release, including but not limited to management's assessment of the Company's future plans and operations, the perceived merit of projects or deposits, and the impact and anticipated timing of the Company's development plan and recapitalization plan, outlook on gold output, the anticipated growth expenditures, the anticipated timing of permitting, production, project development or technical studies constitutes forward looking statements or forward-looking information within the meaning of applicable securities laws. All statements other than statements of historical fact are forward-looking statements. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "continues", "forecasts", "projects", "predicts", "intends", "anticipates" or "believes", or variations of, or the negatives of, such words and phrases, or state that certain actions, events or results "may", "could", "would", "should", "might" or "will" be taken, occur or be achieved. Readers are cautioned that the assumptions used in the preparation of information, although considered reasonable at the time of preparation, may prove to be inaccurate and, as such, reliance should not be placed on forward-looking statements. The Company's actual results, performance or achievement could differ materially from those expressed in, or implied by, these forward-looking statements and, accordingly, no assurance can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what benefits, if any, that the Company will derive therefrom. By their nature, forward looking statements are subject to numerous risks and uncertainties, some of which are beyond the Company's control, including general economic and industry conditions, volatility of commodity prices, title risks and uncertainties, ability to access sufficient capital from internal and external sources such as selling assets, restructuring debt or obtaining additional equity capital on terms that may be onerous or highly dilutive. The Company's ability to refinance its indebtedness will depend on the capital markets and its financial condition at such time, currency fluctuations, construction and operational risks, licensing and permit requirements, environmental risks, competition from other industry participants, the lack of availability of qualified personnel or management, imprecision of mineral resource, or production estimates.

Please see "Risks Factors" in the Form 10-K for the fiscal year ended December 31, 2024 for more information regarding risks pertaining to the Company, which is available on EDGAR at www.sec.gov/edgar and SEDAR+ at www.sedarplus.ca . Readers are encouraged to carefully review these risk factors as well as the Company's other filings with the U.S. Securities and Exchange Commission and the Canadian Securities Administrators. All forward-looking statements contained in this press release speak only as of the date of this press release or as of the dates specified in such statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise except as required by applicable law.

Additional information relating to i-80 Gold can be found on i-80 Gold's website at www.i80gold.com , SEDAR+ at www.sedarplus.ca , and on EDGAR at www.sec.gov/edgar .

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/i-80-gold-receives-construction-permits-and-initiates-underground-development-at-archimedes-302547630.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/i-80-gold-receives-construction-permits-and-initiates-underground-development-at-archimedes-302547630.html

SOURCE i-80 Gold Corp

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2025/05/c4107.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2025/05/c4107.html