July 27, 2023

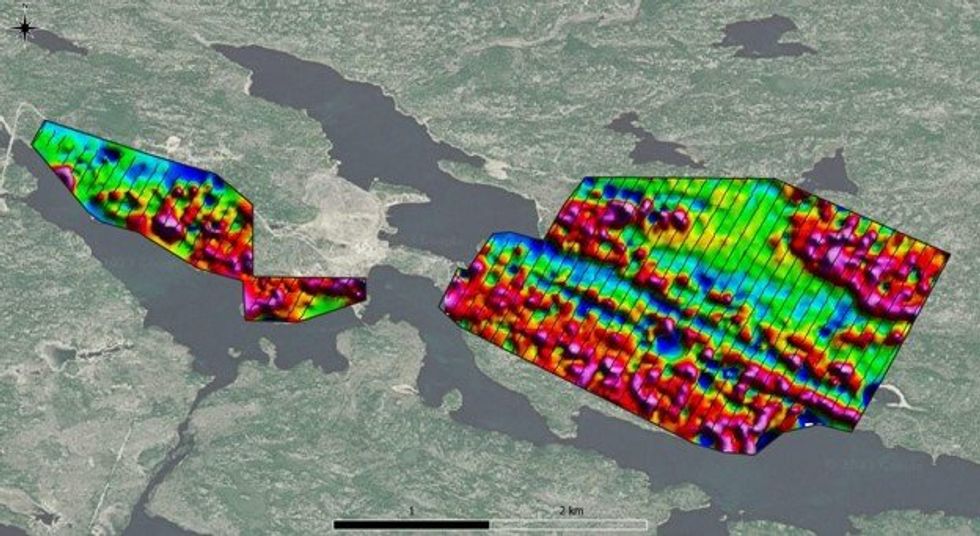

High-Tech Metals Limited (ASX: HTM) (High-Tech, or the Company) technical and geological consultants successfully progressed field work and sampling within the key target areas at its Werner Lake Cobalt Project located in north-western Ontario during the June quarter. This follows the successful orientation ground geophysical program, (Refer to ASX Release dated 20th April 2023 and 26th May 2023) which was pivotal in identifying potential mineral deposits and improving our understanding of the geological structure of the area.

HIGHLIGHTS

HTM successful completed ground magnetic and electromagnetic surveys at its Werner Lake Cobalt Project to identify high priority electrical conductors and/or magnetic anomalies for follow- up Drilling.

Results are being refined for Phase II exploration including mapping and sampling over geophysical targets.

The Company had received valid applications for 12,307,964 Loyalty Options, raising a total of $12,308.12 (before costs) under the Offer and a total of 4,112,041 Loyalty Options (Shortfall Options) were placed through a non-renounceable entitlement issue of Loyalty Options to eligible shareholders. The Company has the Loyalty Options listed on the ASX under the ASX code HTMO.

SUBSEQUENT EVENTS

The HTM field team collected approximately 209 rock samples over the course of June which will be used to delineate targets for potential additional sampling, detailed ground geophysics and drilling.

The Company has received several new project opportunities in the vicinity of Werner Lake and continues to conduct high-level internal assessments on projects that fit the Company’s objective of becoming a battery metal focused Company.

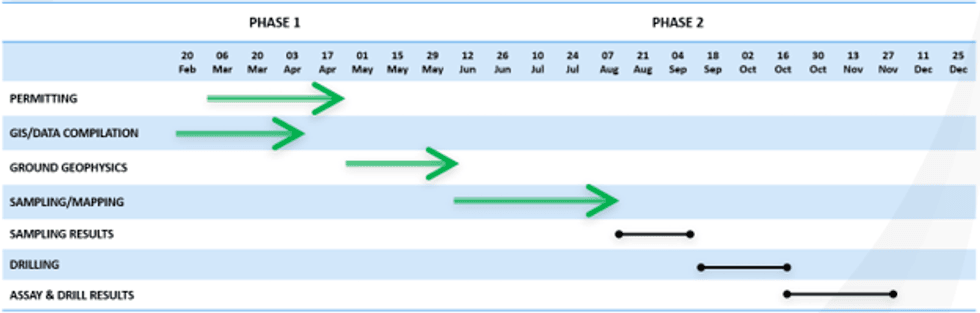

HTM EXPLORATION ROADMAP

Finalisation of targeting for Phase II has been completed with results from the sampling program providing additional data for HTM’s planned maiden drilling program.

The field program was conducted by APEX Geoscience’s team who collected 209 rock samples over the course of June which will be used to delineate targets for potential follow-up sampling and drilling testing. The field program was overseen by the Company’s professional geologist, Toby Hughes, P. Geo, who has extensive experience in the region.

Click here for the full ASX Release

This article includes content from High-Tech Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

HTM:AU

The Conversation (0)

08 November 2023

High-Tech Metals

Capitalizing on Exploration Upside Potential of a Historic Cobalt Project

Capitalizing on Exploration Upside Potential of a Historic Cobalt Project Keep Reading...

12 January 2025

Appointment of Chief Executive Officer

High-Tech Metals (HTM:AU) has announced Appointment of Chief Executive OfficerDownload the PDF here. Keep Reading...

20 January

Top 3 ASX Cobalt Stocks (Updated January 2026)

Cobalt is used in a wide variety of industrial applications, with lithium-ion batteries for electric vehicles (EVs) and energy storage systems as the largest demand segment. As an important battery metal, cobalt's fate is tied to demand for EVs. The EV market may be facing headwinds now, but the... Keep Reading...

19 January

Cobalt Market Forecast: Top Trends for Cobalt in 2026

Cobalt metal prices have trended steadily higher since September of last year, entering 2026 at US$56,414 per metric ton and touching highs unseen since July 2022. The cobalt market's dramatic reversal began in 2025, when it shifted from deep oversupply to structural tightness after a decisive... Keep Reading...

19 January

Top 5 Canadian Cobalt Stocks (Updated January 2026)

The cobalt market staged a dramatic turnaround in 2025, lifting sentiment across equity markets after years of oversupply and near-record price lows. Early in the year, the Democratic Republic of Congo’s (DRC) decision to suspend cobalt exports sparked a major price rebound, with benchmark metal... Keep Reading...

13 January

Cobalt Market 2025 Year-End Review

The cobalt market entered 2025 under pressure from a prolonged supply glut, but the balance shifted sharply as the year unfolded, due almost entirely to intervention from the Democratic Republic of Congo (DRC).After starting the year near nine year lows of US$24,343.40 per metric ton, cobalt... Keep Reading...

31 October 2025

Top 5 Canadian Cobalt Stocks (Updated October 2025)

Cobalt prices regained momentum in the third quarter of 2025 as tighter export controls from the Democratic Republic of Congo (DRC) fueled expectations of a market rebound. After languishing near multi-year lows early in the year, the metal surged to US$47,110 per metric ton in late October, its... Keep Reading...

27 October 2025

Top 3 ASX Cobalt Stocks (Updated October 2025)

Cobalt is used in a wide variety of industrial applications, with lithium-ion batteries for electric vehicles (EVs) and energy storage systems as the largest demand segment. As an important battery metal, cobalt's fate is tied to EVs. While EV demand may be facing headwinds now, the long-term... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00