- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

September 05, 2023

High-Tech Metals Limited (ASX: HTM) (High-Tech, HTM or the Company) is pleased to announce it has entered into an agreement to acquire the Norpax Deposit (Norpax) and acquired an option to purchase the Reynar Lake Project (Reynar Lake) (Together, the Projects) which are both located in Ontario, Canada. The Projects are directly west and adjoin the Company’s existing project, Werner Lake Project (Werner Lake, or the Project), located in northwestern Ontario.

HIGHLIGHTS

The Company has significantly increased its exposure to nickel sulphides and copper through the following acquisition and option agreement:

Norpax Nickel Sulphide Deposit:

- A historical non-JORC compliant resource of 1,010,000 tonnes 1.2% Ni and 0.5% Cu1.*

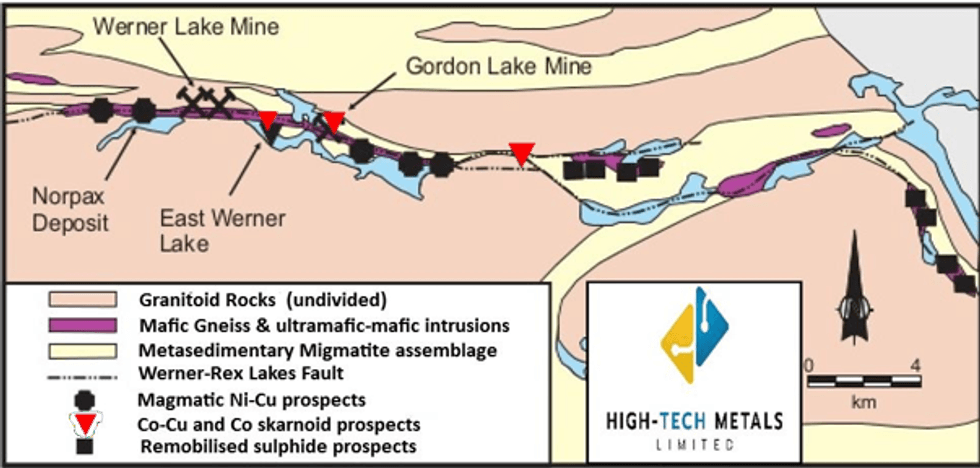

*The historical estimates are not reported in accordance with the JORC codes. A competent person has not done sufficient work to classify the historical estimates as a mineral resource in accordance with JORC Code. It is uncertain that following further exploration work that the historical estimates will be able to be reported as mineral resources within the JORC Code. - The deposit lies ~1 km west of HTM’s existing project, Werner Lake, and along the Werner Lake Belt.

- The Norpax nickel mineralisation sits on a known mineralised fault zone, the regional scale Werner-Gordon-Rex lake fault which extends from Rayner Lake in the west, passing under Almo Lake, east through the Werner Lake Co and Gordon Lake Cu-Ni deposits to Rex Lake.

- Mineralised peridotite is known to host many significant nickel deposits such as companies Mincor Resources Ltd in Kambalda and also Azure Minerals Ltd (ASX:AZS) Andover project’s ultramafic zone, which is in part peridotite.**

- The area has a rich history in nickel sulphide mines with the old Gordon Lake Mine located 3.5 km to the East of Werner Lake, which produced 1,370,285 tons averaging 0.92% Ni and 0.47% Cu and has existing reserves of 170,420 tonnes averaging 0.85% Ni and 0.35% Cu2.

Reynar Lake Ni-Cu-Co Project:

- Reynar Lake project immediately adjoins HTM’s Werner Lake Project.

- The ground is highly prospective for Ni, Cu and Co and should the option be exercised, it will provide HTM with additional landholding to potentially increase its cobalt resource and explore for additional nickel sulphide mineralisation.

The Company plans to build on the recent exploration success at Werner Lake by immediately begin planning exploration on the newly acquired Projects.

The acquisition of the Projects increases HTM’s landholding in the Werner Lake Area and the Company’s exposure to battery metals such as copper, cobalt, and nickel.

Sonu Cheema, Executive Director commented:

"We are excited by the acquisition of Norpax and the option over Reynar Lake with the potential for a nickel discovery in a historic nickel producing province of Canada. Not only do the acquisitions increase our exposure to nickel, but it also increases the Company’s land holding substantially making High-Tech one of the largest land holders in the area.

“As the Projects lay in the area of Werner Lake, the Company’s geological team are familiar with the geological setting. This has been recently proven by the Company’s discovery of high-grade samples of nickel sulphide (that exceeded assay detection limits) in the Werner Lake Project.

“The Company plans to utilise its expertise in the area by undertaking a review of all available geological data, performing a systematic geochemical sampling program of known mineral occurrences on the projects in conjunction with reconnaissance geological mapping and relog and assay all known and available core.”

Click here for the full ASX Release

This article includes content from High-Tech Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

HTM:AU

The Conversation (0)

08 November 2023

High-Tech Metals

Capitalizing on Exploration Upside Potential of a Historic Cobalt Project

Capitalizing on Exploration Upside Potential of a Historic Cobalt Project Keep Reading...

12 January 2025

Appointment of Chief Executive Officer

High-Tech Metals (HTM:AU) has announced Appointment of Chief Executive OfficerDownload the PDF here. Keep Reading...

20 January

Top 3 ASX Cobalt Stocks (Updated January 2026)

Cobalt is used in a wide variety of industrial applications, with lithium-ion batteries for electric vehicles (EVs) and energy storage systems as the largest demand segment. As an important battery metal, cobalt's fate is tied to demand for EVs. The EV market may be facing headwinds now, but the... Keep Reading...

19 January

Cobalt Market Forecast: Top Trends for Cobalt in 2026

Cobalt metal prices have trended steadily higher since September of last year, entering 2026 at US$56,414 per metric ton and touching highs unseen since July 2022. The cobalt market's dramatic reversal began in 2025, when it shifted from deep oversupply to structural tightness after a decisive... Keep Reading...

19 January

Top 5 Canadian Cobalt Stocks (Updated January 2026)

The cobalt market staged a dramatic turnaround in 2025, lifting sentiment across equity markets after years of oversupply and near-record price lows. Early in the year, the Democratic Republic of Congo’s (DRC) decision to suspend cobalt exports sparked a major price rebound, with benchmark metal... Keep Reading...

13 January

Cobalt Market 2025 Year-End Review

The cobalt market entered 2025 under pressure from a prolonged supply glut, but the balance shifted sharply as the year unfolded, due almost entirely to intervention from the Democratic Republic of Congo (DRC).After starting the year near nine year lows of US$24,343.40 per metric ton, cobalt... Keep Reading...

31 October 2025

Top 5 Canadian Cobalt Stocks (Updated October 2025)

Cobalt prices regained momentum in the third quarter of 2025 as tighter export controls from the Democratic Republic of Congo (DRC) fueled expectations of a market rebound. After languishing near multi-year lows early in the year, the metal surged to US$47,110 per metric ton in late October, its... Keep Reading...

27 October 2025

Top 3 ASX Cobalt Stocks (Updated October 2025)

Cobalt is used in a wide variety of industrial applications, with lithium-ion batteries for electric vehicles (EVs) and energy storage systems as the largest demand segment. As an important battery metal, cobalt's fate is tied to EVs. While EV demand may be facing headwinds now, the long-term... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00